Forex trading in the UK means buying and selling currency pairs through FCA-regulated brokers, usually via CFDs, with strict leverage and risk rules in place.

This beginner’s step-by-step guide explains how forex trading works, how to get started safely, and what UK traders need to know about costs, regulation, and risks in 2026.

What is forex trading?

Forex trading is the process of buying one currency and selling another to profit from changes in exchange rates, usually through CFDs or spread betting on an online platform.

In the UK, retail traders do not exchange physical currency. They speculate on price movements in currency pairs like GBP/USD or EUR/USD using FCA-regulated forex brokers.

Forex, short for foreign exchange or FX, is the largest financial market in the world. According to the Bank for International Settlements, average daily global forex trading volume reached $7.5 trillion in April 2022, far exceeding stock and bond markets.

This size makes forex highly liquid, meaning prices move constantly and trades can usually be opened and closed quickly.

Who trades in the forex market?

The forex market includes a wide range of participants:

- Central banks such as the Bank of England and the US Federal Reserve

- Commercial banks and financial institutions

- Multinational companies managing currency risk

- Retail traders using online platforms

Estimates from central bank surveys suggest 90–95% of forex trading volume is speculative, meaning most activity comes from traders seeking short-term price movements rather than currency exchange for trade or travel.

Key characteristics of forex trading

| Feature | Forex market |

|---|---|

| Market size | ~$7.5 trillion traded daily |

| Trading hours | 24 hours a day, 5 days a week |

| Market structure | Decentralised (over-the-counter) |

| Directional trading | Profit from rising or falling prices |

| Access method (UK) | CFDs and spread betting |

Is forex trading legal and regulated in the UK?

Yes, forex trading is legal in the UK and tightly regulated when you use authorised firms. UK traders can legally trade forex through brokers that meet strict regulatory standards covering leverage limits, client fund protection, transparency, and risk disclosures. These rules are designed to reduce harm from high-risk leveraged products such as forex CFDs and spread betting.

In practice, this means UK residents should only trade forex with brokers that are formally authorised to operate in the UK and appear on the official regulator’s register.

Who regulates forex trading in the UK?

Forex trading in the UK is regulated by the Financial Conduct Authority (FCA). The FCA authorises and supervises firms offering forex trading to retail clients, primarily via CFDs and spread betting.

Key FCA rules that apply to UK forex trading include:

- Leverage limits

- 30:1 on major currency pairs such as GBP/USD and EUR/USD

- 20:1 on non-major currency pairs

- Negative balance protection, so retail traders cannot lose more than their deposited funds

- Mandatory risk warnings, including disclosure that around 70–80% of retail CFD accounts lose money

- Client money segregation, requiring brokers to hold customer funds separately from company funds

Are forex trades protected by the FSCS?

No, losses from forex trading are not protected by the FSCS. The Financial Services Compensation Scheme (FSCS) does not cover trading losses from forex, CFDs, or spread betting.

FSCS protection may apply only in specific circumstances related to broker failure:

| Scenario | FSCS protection |

|---|---|

| Losses from forex trading | No |

| Broker insolvency with missing client funds | Yes, up to £85,000 |

| Poor trading performance | No |

| Market losses due to leverage | No |

How does forex trading work for UK beginners?

Forex trading works by speculating on whether one currency will rise or fall against another using regulated trading platforms, usually through CFDs or spread betting. UK beginners open an account with an FCA-regulated broker, choose a currency pair, decide whether to buy or sell, and manage risk using position sizing and stop-loss orders. Trades are based on price movements, not physical currency exchange.

For retail traders in the UK, forex trading is almost always leveraged, meaning you only put down a small deposit called margin while gaining exposure to a much larger position. This increases both potential profits and potential losses.

What is a currency pair?

A currency pair is a quotation showing the value of one currency compared to another. Forex trades are always placed on pairs because you are buying one currency while selling another at the same time.

Currency pairs are usually grouped into three categories:

| Pair type | Description | Examples |

|---|---|---|

| Major pairs | Include the US dollar and have high liquidity | EUR/USD, GBP/USD |

| Minor pairs | Do not include the US dollar | EUR/GBP, AUD/JPY |

| Exotic pairs | Include emerging market currencies | USD/TRY, GBP/MXN |

For beginners, major currency pairs are usually recommended because they have tighter spreads, higher liquidity, and more stable price movements.

What are base and quote currencies?

Every currency pair consists of a base currency and a quote currency.

- The base currency is the first currency listed

- The quote currency is the second currency listed

If GBP/USD is trading at 1.2800, it means £1 = $1.28.

- You buy GBP/USD if you believe the pound will strengthen

- You sell GBP/USD if you believe the pound will weaken

When you trade forex through CFDs or spread betting, you are not buying the currencies themselves. You are speculating on whether the exchange rate will rise or fall.

What is a pip in forex trading?

A pip is the standard unit used to measure price movements in forex trading. For most currency pairs, a pip is the fourth decimal place, or 0.0001.

Examples:

- EUR/USD moving from 1.1000 to 1.1001 = 1 pip

- GBP/USD moving from 1.2500 to 1.2550 = 50 pips

For pairs involving the Japanese yen, a pip is usually the second decimal place:

| Pair | Pip size |

|---|---|

| EUR/USD | 0.0001 |

| GBP/USD | 0.0001 |

| USD/JPY | 0.01 |

Pips are used to calculate:

- Profit and loss

- Trading costs, such as the spread

- Risk and reward ratios

For example, if you risk 20 pips to target 60 pips, your risk-to-reward ratio is 1:3, a common benchmark used in forex risk management.

Understanding currency pairs, base and quote currencies, and pips gives UK beginners the foundation needed to place trades and manage risk effectively before moving on to leverage, costs, and trading strategies.

How do you start trading forex in the UK step-by-step?

To start trading forex in the UK, beginners must choose an FCA-regulated broker, open and verify an account, fund it using UK payment methods, and practise before trading real money. UK regulation focuses on consumer protection, leverage limits, and transparency, which means following the correct steps is essential before placing your first trade.

How to choose an FCA-regulated forex broker?

UK beginners should only trade forex with brokers authorised by the Financial Conduct Authority (FCA). FCA authorisation ensures the broker meets strict standards on client money protection, leverage limits, and risk disclosures.

When comparing FCA-regulated forex brokers, check:

- FCA authorisation status on the FCA Register

- Products offered: such as forex CFDs and spread betting

- Leverage limits: capped at 30:1 on major currency pairs for retail traders

- Negative balance protection, so losses cannot exceed deposits

- Trading platforms, such as web platforms or MetaTrader 4/5

- Fees and spreads, especially on major pairs like GBP/USD

Avoid offshore or unregulated brokers. Trading with non-FCA firms removes UK consumer protections and significantly increases risk.

How to open and verify a forex trading account?

Opening a forex trading account in the UK is a regulated process that usually takes 10–30 minutes online.

Brokers must comply with anti-money laundering (AML) and Know Your Customer (KYC) rules.

You will typically need to provide:

- Proof of identity, such as a passport or driving licence

- Proof of address, such as a utility bill or bank statement

- Basic financial information and trading experience

UK brokers also require you to complete a risk assessment, confirming you understand that leveraged forex trading carries a high risk of loss. Once approved, you can access the trading platform but may need to fund the account before placing trades.

How to fund a forex account using UK payment methods?

UK forex accounts can be funded using local, FCA-approved payment methods, usually in pounds sterling. Funding times and fees vary by broker.

Common UK payment methods include:

| Payment method | Typical processing time | Notes |

|---|---|---|

| Debit card | Instant | Often capped per transaction |

| Bank transfer (Faster Payments) | Same day | Usually fee-free |

| Credit card | Instant | Not always accepted |

| E-wallets | Instant | Availability varies |

Many FCA-regulated brokers have no minimum deposit, but beginners often start with £100–£500 to manage risk while learning. Funds are held in segregated client accounts, separate from the broker’s own money.

Should beginners use a demo account first?

Yes, beginners should always use a demo account before trading real money. A demo account allows you to trade forex using virtual funds while experiencing real market prices and conditions.

Benefits of using a demo account include:

- Learning how a trading platform works

- Understanding spreads, pips, and leverage in practice

- Testing strategies without risking capital

- Building confidence before trading live

Most UK brokers provide demo accounts with £10,000–£100,000 in virtual funds. However, demo trading does not fully replicate the emotional pressure of real money trading, so it should be used as a learning tool, not proof of profitability.

How do you place your first forex trade?

Placing your first forex trade in the UK involves four steps: choosing a suitable currency pair, deciding whether to buy or sell, setting the correct position and lot size, and applying stop-loss and take-profit orders. UK beginners usually trade via CFDs or spread betting on FCA-regulated platforms, where risk management is essential because leverage magnifies both gains and losses.

How to choose a currency pair?

Beginners should start with major currency pairs because they are the most liquid, have tighter spreads, and move more predictably. Liquidity matters because it reduces trading costs and slippage.

Common beginner-friendly pairs include:

| Currency pair | Why it’s popular with beginners |

|---|---|

| EUR/USD | Highest liquidity and tight spreads |

| GBP/USD | Strong UK relevance and high volume |

| USD/JPY | Stable trends and good liquidity |

Avoid exotic pairs early on. They often have wider spreads, lower liquidity, and sharper price swings, which increase risk for new traders.

How to decide whether to buy or sell

You buy a currency pair if you expect the base currency to strengthen and sell if you expect it to weaken. This decision is based on analysis rather than guesswork.

Two common approaches used by beginners:

- Fundamental analysis: looking at interest rates, inflation, and economic data. Example: If UK interest rates are rising faster than US rates, GBP/USD may strengthen.

- Technical analysis: using charts, trends, and indicators such as support and resistance.

Example decision:

- GBP/USD at 1.2800

- You expect the pound to rise → Buy

- You expect the pound to fall → Sell

Forex trading allows you to profit in both rising and falling markets, unlike traditional investing.

How to set position size and lot size?

Position size determines how much money you risk on a trade, while lot size determines how large the trade is. Managing this correctly is one of the most important skills for UK beginners.

Standard forex lot sizes:

| Lot type | Units of base currency |

|---|---|

| Standard lot | 100,000 |

| Mini lot | 10,000 |

| Micro lot | 1,000 |

Most beginners use micro or mini lots to keep risk low.

A common risk rule is to risk no more than 1–2% of your account per trade.

Example:

- Account balance: £1,000

- Risk per trade (1%): £10

- Stop-loss distance: 20 pips

- Position size adjusted so each pip equals £0.50

This approach helps prevent a small number of losing trades from wiping out your account.

How to place a stop-loss and take-profit order

A stop-loss limits how much you can lose, while a take-profit locks in gains automatically. Both are essential tools for UK forex traders using leveraged products.

- Stop-loss: closes the trade if the market moves against you

- Take-profit: closes the trade when your target is reached

Example setup:

- Entry: GBP/USD at 1.2800

- Stop-loss: 1.2780 (20 pips risk)

- Take-profit: 1.2860 (60 pips reward)

This creates a 1:3 risk-to-reward ratio, a commonly recommended benchmark in forex trading.

UK-regulated platforms also offer guaranteed stop-loss orders on some accounts. These close trades at the exact price you set, even during extreme volatility, but usually include a small fee.

How does leverage work in UK forex trading?

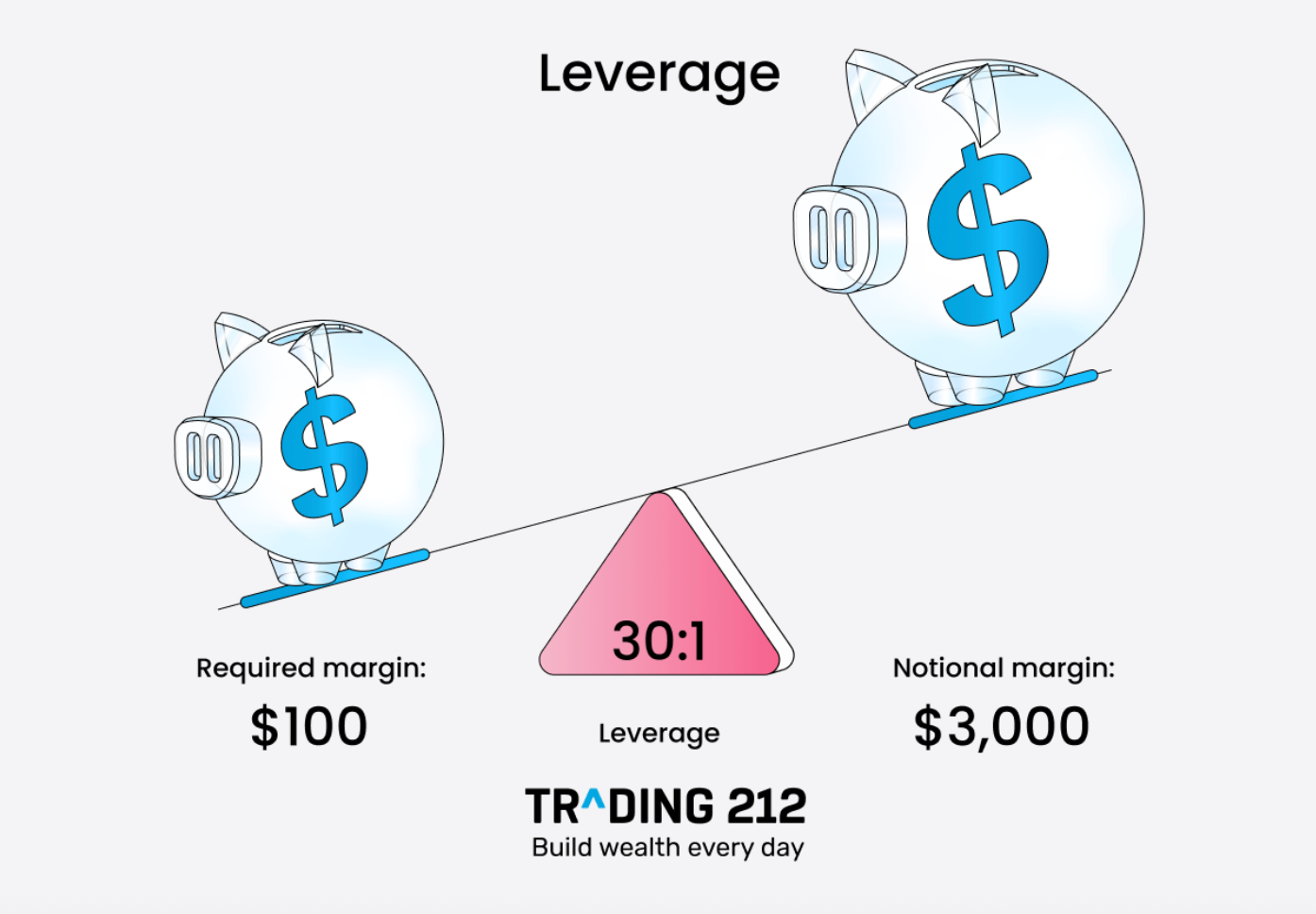

Leverage in UK forex trading lets you control a large position with a relatively small deposit, known as margin.

While this increases potential profits, it also magnifies losses, which is why leverage is tightly restricted for retail traders under UK regulation and is one of the main reasons most beginners lose money.

In the UK, leverage is mainly used when trading forex via CFDs or spread betting with brokers authorised by the Financial Conduct Authority.

What is margin in forex trading?

Margin is the amount of money you must deposit to open and maintain a leveraged forex trade.

It is not a fee. It is a portion of your own capital set aside by the broker while the trade remains open.

Example:

- Trade size: £30,000 on GBP/USD

- Leverage: 30:1

- Required margin: £1,000

If the market moves in your favour, profits are calculated on the full £30,000 position, not just the £1,000 margin.

If the market moves against you, losses are also calculated on the full position.

If losses reduce your available funds below the required margin level, the broker may issue a margin call or automatically close your position to prevent further losses.

What are FCA leverage limits for retail traders?

The FCA caps leverage for UK retail forex traders to reduce the risk of catastrophic losses. These limits apply to all FCA-regulated brokers offering forex CFDs and spread betting.

| Asset type | Maximum leverage | Margin required |

|---|---|---|

| Major currency pairs | 30:1 | 3.33% |

| Non-major currency pairs | 20:1 | 5% |

| Gold | 20:1 | 5% |

| Other commodities | 10:1 | 10% |

Professional traders who meet strict criteria may access higher leverage, but most UK beginners are classified as retail traders and are subject to these limits.

UK regulation also requires:

- Negative balance protection, so you cannot lose more than your deposit

- Automatic margin close-out, typically when equity falls to 50% of required margin

Why does leveraging increase risk for beginners?

Leverage increases risk because even small price movements can cause large losses relative to your deposit. This effect is often underestimated by new traders.

Example:

- Account balance: £1,000

- Trade size: £30,000 (30:1 leverage)

- Market moves against you by 1%

- Loss: £300 (30% of your account)

A 3.3% adverse move on a fully leveraged position could wipe out the entire £1,000 margin.

Beginners often combine high leverage with poor risk management, such as oversized positions or missing stop-loss orders.

What are the main forex trading strategies for beginners?

Beginner forex traders typically use simple, time-based strategies that focus on risk control rather than frequent trading. The most common beginner strategies are day trading, swing trading, and position trading, while scalping is usually discouraged due to its speed, costs, and higher risk. Choosing the right strategy depends on time commitment, risk tolerance, and experience level.

What is day trading in forex?

Day trading in forex involves opening and closing trades within the same trading day to avoid overnight risk. Positions are never held past market close, which helps traders avoid overnight swap fees and unexpected price gaps.

Key characteristics:

- Trades last from minutes to several hours

- Focuses on intraday price movements

- Uses technical analysis such as support, resistance, and trendlines

- Commonly traded during high-liquidity sessions like London and New York

Example:

A trader buys EUR/USD in the morning based on a breakout and closes the position before the end of the trading day, regardless of profit or loss.

Day trading suits beginners who can actively monitor markets but still requires discipline, clear stop-loss rules, and controlled position sizing.

What is swing trading in forex?

Swing trading involves holding trades for several days or weeks to capture medium-term price trends. It is one of the most popular strategies for UK beginners because it requires less screen time and allows for more considered decision-making.

Key characteristics:

- Trades held for days or weeks

- Combines technical and fundamental analysis

- Tolerates short-term market noise

- Requires overnight holding and swap fees

Example:

A trader buys GBP/USD after a pullback in an uptrend and holds the position for several days as the trend resumes.

Swing trading is often recommended for beginners because it reduces emotional pressure and overtrading compared to faster strategies.

What is position trading?

Position trading is a long-term forex strategy where trades are held for weeks, months, or even longer.

Decisions are driven primarily by economic data, interest rate trends, and central bank policy rather than short-term price movements.

Key characteristics:

- Very low trade frequency

- Focus on macroeconomic trends

- Larger stop-loss distances

- Minimal screen time required

Example:

A trader buys GBP/USD based on expectations of sustained UK interest rate rises relative to the US and holds the trade for several months.

Position trading requires patience and a strong understanding of economic fundamentals, but it avoids the stress of frequent trading and intraday noise.

What is scalping, and why is it risky for beginners?

Scalping is a very short-term strategy that aims to profit from small price movements over seconds or minutes. Traders may place dozens or even hundreds of trades per day.

Why scalping is risky for beginners:

- Extremely sensitive to spreads and transaction costs

- Requires fast execution and constant monitoring

- High emotional and psychological pressure

- Small mistakes can quickly compound losses

Example:

A scalper may target 2–5 pips per trade on EUR/USD, but spreads and slippage can erase profits.

Under FCA-regulated conditions, where leverage is capped and spreads matter more, scalping is particularly difficult for beginners to execute profitably.

Beginner-friendly strategy comparison

| Strategy | Time commitment | Risk level | Suitable for beginners |

|---|---|---|---|

| Day trading | High | Medium–high | Yes, with discipline |

| Swing trading | Medium | Medium | Yes, highly suitable |

| Position trading | Low | Medium | Yes, with patience |

| Scalping | Very high | High | No |

How do you manage risk when trading forex?

Managing risk in forex trading means limiting losses before they happen by using stop-loss orders, controlling position size, and avoiding excessive leverage. Because forex is a leveraged market, risk management is not optional. It is the single most important factor determining whether a UK trader can survive long enough to improve.

Why are stop-loss orders essential?

A stop-loss order automatically closes a trade when the market reaches a predefined loss level. It protects your account from large, unexpected moves and removes emotional decision-making.

Key benefits of stop-loss orders:

- Caps the maximum loss on a trade

- Protects against sudden volatility and news events

- Prevents small losses from turning into account-ending losses

Example:

- Buy GBP/USD at 1.2800

- Stop-loss at 1.2770

- Risk = 30 pips

If the market moves against you, the trade closes automatically. Without a stop-loss, losses can escalate rapidly, especially when leverage is involved.

Some FCA-regulated brokers offer guaranteed stop-loss orders, which close at the exact price you set even during extreme volatility. These usually involve a small additional cost but offer stronger protection.

What is position sizing and the 1–2% rule?

Position sizing determines how much of your account you risk on a single trade. The widely used 1–2% rule limits risk to a small portion of your capital on each trade.

How the 1–2% rule works:

- Account balance: £1,000

- Maximum risk per trade (1%): £10

- Stop-loss distance: 20 pips

- Position size adjusted so each pip = £0.50

This ensures that even a string of losing trades does not wipe out your account.

| Account balance | 1% risk per trade | 2% risk per trade |

|---|---|---|

| £500 | £5 | £10 |

| £1,000 | £10 | £20 |

| £5,000 | £50 | £100 |

Professional traders focus on risk per trade, not profit per trade. Consistent position sizing keeps drawdowns manageable and reduces emotional pressure.

How to avoid overleveraging?

Overleveraging occurs when you use too much leverage relative to your account size, making small price moves extremely dangerous. Even though UK regulators cap leverage at 30:1 on major currency pairs, beginners can still overexpose themselves.

Example of overleveraging:

- Account balance: £1,000

- Trade size: £30,000

- Market moves against you by 1%

- Loss: £300 (30% of account)

A 3.3% adverse move on a fully leveraged trade can wipe out the entire account.

Ways to avoid overleveraging:

- Use lower effective leverage than the maximum allowed

- Trade micro or mini lots instead of standard lots

- Always set a stop-loss before entering a trade

- Risk a fixed percentage of your account per trade

UK regulation enforced by the Financial Conduct Authority also requires negative balance protection, meaning you cannot lose more than your deposit. However, this does not prevent rapid account losses from poor risk management.

What factors move the forex market?

The forex market is driven mainly by interest rates, economic data, central bank policy, and the global role of the US dollar. Exchange rates move because currencies reflect the relative strength, stability, and outlook of national economies.

For UK traders, understanding these drivers is essential because forex prices react quickly to news and policy changes.

The majority of daily forex trading is speculative. Data cited in central bank surveys shows that around 90–95% of global forex volume is driven by trading activity rather than trade or tourism, which is why sentiment and expectations matter as much as hard data.

How do interest rates and central banks affect currencies?

Interest rates are the single most important driver of currency values. Higher interest rates tend to attract foreign capital, increasing demand for that currency, while lower rates often weaken it.

Central banks control interest rates and monetary policy, including:

- The Bank of England (BoE) for the British pound

- The Federal Reserve for the US dollar

- The European Central Bank for the euro

Example:

If the Bank of England signals future rate hikes while the US Federal Reserve pauses or cuts rates, GBP/USD often rises as investors move capital towards higher-yielding sterling assets.

Central banks also influence currencies through:

- Forward guidance (signals about future policy)

- Quantitative easing or tightening

- Emergency interventions during financial stress

Forex traders closely monitor central bank meetings, speeches, and policy statements because prices often move before rates actually change.

How does economic news impact forex prices?

Economic data releases move forex markets when results differ from expectations. Prices often react within seconds of major announcements.

High-impact economic indicators include:

- Inflation data such as CPI

- Employment data such as unemployment rates and US Non-Farm Payrolls

- GDP growth figures

- Retail sales and business activity surveys

Example:

If UK inflation prints higher than expected, traders may anticipate future BoE rate hikes, which can cause the pound to strengthen immediately.

Because expectations are priced in, surprise matters more than the headline number. Even positive data can weaken a currency if it underperforms forecasts.

Many traders track releases using economic calendars published by brokers and financial institutions.

Why the US dollar matters in forex trading?

The US dollar is the most important currency in the forex market. It appears in around 85–90% of all forex trades, according to global market surveys, and acts as the world’s primary reserve currency.

Reasons the dollar dominates forex trading:

- Most global trade and commodities such as oil and gold are priced in USD

- Central banks hold a large share of reserves in dollars

- US financial markets are deep, liquid, and globally trusted

Even if you trade pairs that do not include the dollar, USD strength or weakness often affects the entire market.

Traders frequently monitor the US Dollar Index (DXY), which measures the dollar’s value against a basket of major currencies including the euro, pound, and yen. A rising DXY usually signals broad dollar strength, while a falling index suggests weakening demand for USD.

How are forex profits taxed in the UK?

Forex profits in the UK may be taxable, depending on how you trade and which product you use. Forex CFDs are usually subject to Capital Gains Tax, while forex spread betting profits are typically tax-free. Tax treatment depends on your personal circumstances, trading frequency, and whether HMRC classifies your activity as investing or trading.

UK tax rules are set and enforced by HM Revenue & Customs, and they can change, so traders should keep records and seek professional advice if unsure.

Is forex trading subject to Capital Gains Tax?

Yes, forex trading via CFDs is usually subject to Capital Gains Tax (CGT). When you trade forex CFDs, any profit you make may be taxed if it exceeds your annual CGT allowance. Key CGT points for UK forex traders:

- Applies to forex CFDs, not spread betting

- Taxed only on profits above the annual CGT allowance

- CGT rates depend on your income tax band

Current CGT rules for individuals:

- Basic-rate taxpayers: 10% on gains above the allowance

- Higher- and additional-rate taxpayers: 20% on gains above the allowance

Losses from forex CFD trading can usually be offset against other capital gains, which may reduce your overall tax bill. This is one reason some active traders prefer CFDs over spread betting, despite the tax-free nature of spread betting.

When is spread betting tax-free?

Forex spread betting profits are usually tax-free in the UK. This is because spread betting is legally classified as gambling rather than investing.

Key points:

- No Capital Gains Tax on profits

- No Income Tax on winnings

- Losses are not tax-deductible

Spread betting is regulated by the Financial Conduct Authority, despite its gambling classification for tax purposes. This makes the UK one of the few countries where leveraged forex trading can be legally tax-free for retail traders.

However, if spread betting becomes your primary source of income and resembles a business activity, HMRC may review your tax status, although this is rare in practice.

Do you need to report forex profits to HMRC?

Yes, you must report taxable forex profits to HMRC if they exceed your allowances or generate a tax liability.

What you typically need to report:

- Forex CFD profits above the CGT allowance

- Any capital gains where losses or gains need to be declared

- Trading activity classified as income, in exceptional cases

What usually does not need reporting:

- Spread betting profits, if genuinely tax-free

- CFD profits below the annual CGT allowance

| Trading method | Usually taxable? | Needs reporting? |

|---|---|---|

| Forex CFDs | Yes (CGT) | Yes, if above allowance |

| Spread betting | No | Usually no |

| Spot forex (rare retail use) | Yes | Yes |

What are the pros and cons of forex trading?

Forex trading offers high liquidity, flexible trading hours, and the ability to profit in rising or falling markets, but it also carries significant risks due to leverage and volatility. For UK traders, understanding both sides is essential before committing capital, especially when trading leveraged products like CFDs or spread betting.

Advantages of forex trading

Forex trading has several features that make it attractive to UK retail traders, particularly beginners.

- High liquidity: The forex market is the largest financial market in the world, with over $7.5 trillion traded daily according to global central bank surveys. High liquidity means tighter spreads and easier trade execution, especially on major pairs like EUR/USD and GBP/USD.

- Ability to trade rising and falling markets: Forex allows you to buy or sell a currency pair, meaning you can potentially profit whether prices go up or down.

- 24-hour market access: Forex trades 24 hours a day, five days a week, following global trading sessions in London, New York, and Asia. This suits UK traders who cannot trade during standard market hours.

- Low barriers to entry: Many FCA-regulated brokers allow accounts to be opened with £100–£500, making forex more accessible than some other markets.

- Tax efficiency for UK spread bettors: Forex spread betting profits are usually tax-free, unlike CFDs which are subject to Capital Gains Tax.

- Strong regulation in the UK: Brokers regulated by the Financial Conduct Authority must follow strict rules on leverage limits, client fund segregation, and negative balance protection.

Risks and disadvantages UK traders should know

Despite its advantages, forex trading is high-risk and not suitable for everyone.

- High risk due to leverage: Even with FCA leverage caps of 30:1 on major pairs, small price movements can cause large losses. FCA disclosures show around 70–80% of retail forex and CFD accounts lose money.

- Volatility and sudden market moves: Economic news, central bank decisions, and geopolitical events can cause rapid price swings that may trigger stop-losses or slippage.

- Complexity for beginners: Forex prices are influenced by interest rates, inflation, central bank policy, and global sentiment, making the market difficult to master quickly.

- Emotional and psychological pressure: The speed of the forex market can lead to overtrading, revenge trading, and poor decision-making, especially for inexperienced traders.

- No FSCS protection for trading losses: Losses from forex trading are not protected by the FSCS, even when using an FCA-regulated broker.

Summary comparison

| Aspect | Benefit | Risk |

|---|---|---|

| Market access | 24/5 global trading | Constant exposure |

| Leverage | Smaller capital required | Losses magnified |

| Liquidity | Tight spreads | Fast losses |

| Tax | Spread betting often tax-free | CFD profits taxable |

| Regulation | FCA protections | No profit guarantees |

Is forex trading suitable for beginners in the UK?

Forex trading can be suitable for beginners in the UK, but only with strong risk control and realistic expectations. FCA regulation provides protections like leverage caps and negative balance protection, but most beginners still lose money if they trade too aggressively.

Forex may suit beginners who start small, use demo accounts, risk 1–2% per trade, and accept losses as part of learning. It is not suitable for those expecting quick profits or using maximum leverage.

What mistakes should new forex traders avoid?

New forex traders often lose money by overleveraging, trading without a plan, and ignoring risk management. Even with UK regulation, most beginner losses come from avoidable mistakes rather than market unpredictability.

The most common mistakes to avoid include:

- Using too much leverage: FCA rules cap leverage at 30:1 on major currency pairs, but beginners often use the maximum available. This magnifies small market moves into large losses and is a key reason 70–80% of retail accounts lose money.

- Trading without a stop-loss: Failing to use stop-loss orders exposes your account to unlimited downside. In fast-moving forex markets, losses can escalate within seconds.

- Risking too much per trade: Risking more than 1–2% of your account per trade makes it statistically likely that a short losing streak will wipe out your capital.

- Overtrading and revenge trading: Placing too many trades or trying to recover losses quickly often leads to emotional decisions and bigger losses.

- Starting with complex strategies: Scalping, news trading, and high-frequency strategies are unsuitable for beginners due to costs, speed, and execution risk.

- Ignoring regulation: Trading with brokers not authorised by the Financial Conduct Authority removes key protections such as negative balance protection and segregated client funds.

- Expecting fast or guaranteed profits: Forex is not a shortcut to income. Consistent profitability takes time, discipline, and acceptance of losses.

Conclusion

Forex trading in the UK is legal, accessible, and well regulated, but it remains a high-risk activity that requires discipline and realistic expectations. Beginners who use FCA-regulated brokers, start with demo accounts, manage risk carefully, and avoid overleveraging give themselves the best chance to learn safely.

Forex is not a shortcut to income, but with patience, education, and strict risk control, it can be approached responsibly.

FAQs

How much money do I need to start forex trading in the UK?

You can start forex trading in the UK with £100–£500 at most FCA-regulated brokers. Starting small allows beginners to trade micro or mini positions, manage risk properly, and learn without risking large losses.

Can you make money trading forex in the UK?

Yes, it is possible to make money trading forex in the UK, but most beginners lose money. FCA risk disclosures show that around 70–80% of retail traders lose money, mainly due to leverage and poor risk management rather than market conditions.

Is forex trading gambling?

Forex trading is not gambling, but it can resemble gambling if done without a plan or risk control. In the UK, forex trading is regulated by the Financial Conduct Authority, and successful trading relies on analysis, discipline, and risk management rather than chance.

What is the best time to trade forex in the UK?

The best time to trade forex in the UK is during the London session (8am–4pm) and the London–New York overlap (1pm–4pm UK time). These periods offer the highest liquidity, tighter spreads, and the most consistent price movement.

Do I need experience to start trading forex?

No formal experience is required to start, but education is essential. Beginners should use demo accounts, learn basic risk management, and trade small amounts before risking real money. Trading forex without preparation greatly increases the chance of losses.