Trading CFDs in the UK is straightforward once you understand how leverage, margin, and FCA rules work.

This guide shows you how to open an account, manage risk, and place your first CFD trade using UK-regulated platforms.

You’ll learn the key steps, costs, and risks so you can trade CFDs safely and confidently in 2025.

What is CFD trading in the UK?

CFD trading is a way to speculate on price movements of assets like forex, indices, shares, and commodities without owning them.

You trade a Contract for Difference, which pays the difference between the price when you open the trade and when you close it. UK traders use CFDs for flexible long and short trading, but they carry high risk due to leverage.

CFD stands for Contract for Difference, a financial derivative where you agree to exchange the price difference of an asset from open to close. You never take ownership of the asset; you only speculate on direction.

CFDs are widely used in the UK for:

- Short-term trading

- Hedging

- Leveraged speculation

- Multi-market access

CFDs are regulated by the FCA, and all UK CFD brokers must implement negative balance protection and risk warnings for retail traders.

How does CFD trading work?

CFD trading works by opening a buy (long) or sell (short) contract based on whether you expect prices to rise or fall. Your profit or loss is calculated by multiplying the price movement by your position size and leverage.

All trades require margin, and your position stays open until you manually close it.

Here’s the simple version:

- Choose an asset (e.g., GBP/USD, FTSE 100, gold).

- Decide if the price will rise (go long) or fall (go short).

- Your profit or loss equals the distance between entry and exit.

- Trades are leveraged, so you control a larger exposure with a small deposit.

- Losses can exceed your deposit in volatile markets, but UK rules include negative balance protection.

What is a contract for difference?

A CFD is an agreement with your broker where you exchange the difference in price between when the trade opens and closes.

If the market moves in your favour, you profit. If it moves against you, you lose. The underlying asset never transfers ownership.

What assets can you trade with CFDs?

Most FCA-regulated brokers offer CFDs on:

- Forex (GBP/USD, EUR/USD, GBP/JPY)

- Indices (FTSE 100, S&P 500, DAX 40)

- Shares (UK, US, EU stocks)

- Commodities (gold, oil, natural gas)

- Crypto (restricted; UK retail cannot trade crypto CFDs since 2021)

CFD trade example

If you buy GBP/USD expecting it to rise:

- Entry: 1.2500

- Exit: 1.2550

- Price moves +50 pips

With £5 per point exposure, your profit is £250.

Reverse the direction and it becomes a £250 loss.

CFDs vs owning the underlying Asset: what’s the difference?

CFD trading speculates on price changes only, while owning an asset gives you direct ownership.

CFDs allow leverage, short selling, and low capital entry, but they also carry significantly higher risk.

Asset ownership is slower, safer, and free of leverage.

Key differences

| Feature | CFD trading | Owning the ssset |

|---|---|---|

| Ownership | No | Yes |

| Leverage | Yes (up to 30:1 for retail) | No |

| Short Selling | Yes | Limited |

| Overnight Fees | Yes | No |

| Risk Level | High | Lower |

| Capital Needed | Low | Medium/High |

| Regulation | FCA derivative rules | Standard investment rules |

CFDs are designed for traders. Owning assets is designed for investors.

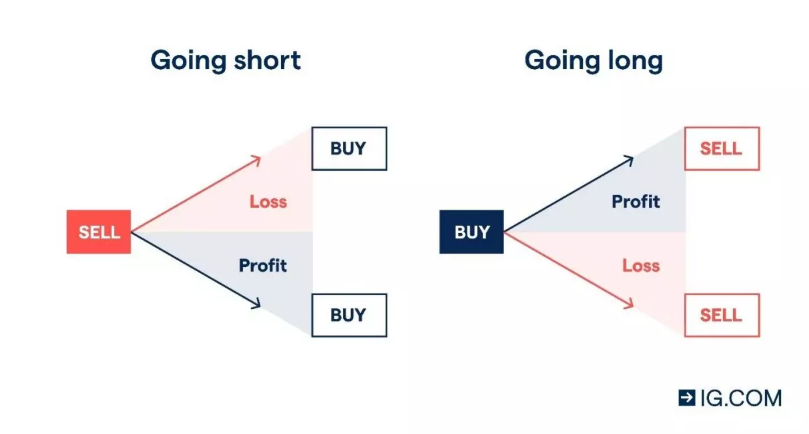

What is the difference between going long and going short?

Going long means buying a CFD because you expect the price to rise.

Going short means selling a CFD because you expect the price to fall. CFDs allow both directions, making them useful in volatile or falling markets.

Going long example

You buy gold CFDs at $2,300 expecting a rise. It increases to $2,320. You gain the £ value of the 20-point move multiplied by your position size.

Going short example

You sell FTSE 100 at 7,900 expecting a drop. It falls to 7,850. You profit from the 50-point decline.

Short selling is one of the defining features of CFD trading, but it increases risk in fast-moving markets.

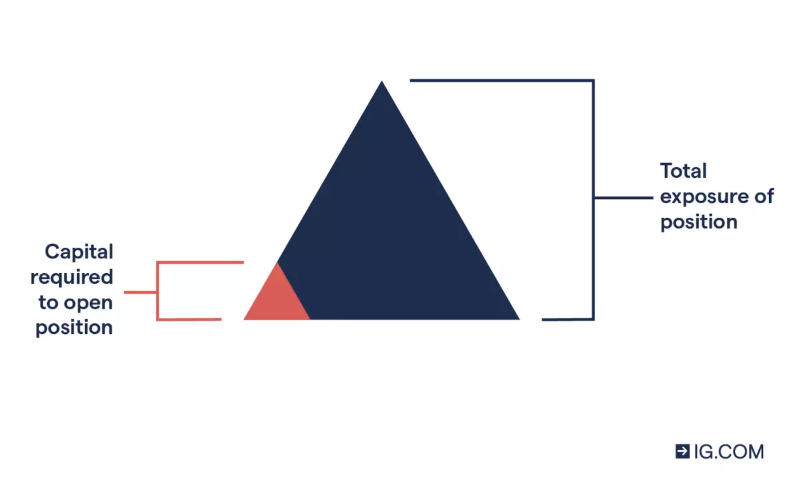

Margin and leverage explained

Leverage allows you to control a larger market position with a small deposit. Margin is the amount you must put down to open the trade.

UK brokers follow strict FCA leverage caps, such as 30:1 for major forex pairs and 5:1 for shares.

Understanding leverage

Leverage multiplies both profits and losses.

Example: With 10:1 leverage, a £100 margin controls a £1,000 position.

Understanding margin

Margin is your required deposit. If your trade moves against you, you may face a margin call, requiring more funds to keep the trade open.

Key FCA leverage limits (retail traders)

| Asset | Max leverage |

|---|---|

| Major Forex | 30:1 |

| Minor Forex | 20:1 |

| Indices | 20:1 |

| Gold | 20:1 |

| Commodities | 10:1 |

| Shares | 5:1 |

What are the costs of CFD trading in the UK?

CFD trading costs include the spread, overnight financing charges, and any commissions your broker charges. These costs apply to every trade you open and close, and they directly affect profitability.

UK traders should compare spreads, swap rates, and share CFD commissions before choosing a platform.

CFD costs are usually made up of four main elements:

Spread (the primary cost)

The spread is the difference between the buy and sell price. Tighter spreads reduce trading costs.

Example: If the FTSE 100 spread is 1 point and you trade £5 per point, the cost to enter equals £5.

Commission fees

Most forex and index CFDs are commission-free, but share CFDs often include a small commission such as 0.1 percent or a flat rate depending on the broker.

Overnight financing (swap fees)

Positions held past market close incur daily financing charges. Long positions cost more, while short positions may receive small credits.

Other possible fees

- Inactivity fees

- Guaranteed stop-loss fees

- Currency conversion fees

- Withdrawal fees (depending on broker)

CFD cost types overview

| Cost type | Description | Applies to |

|---|---|---|

| Spread | Difference between buy and sell price | All CFD trades |

| Commission | Fee per share CFD trade | Share CFDs |

| Overnight Financing | Swap fees for keeping trades open | All overnight trades |

| Guaranteed Stop Fee | Fee for GSLO protection | Optional |

| Currency Conversion Fee | Fee for non-GBP trades | Some brokers |

| Inactivity Fee | Fee for dormant accounts | Selected brokers |

What are the risks of CFD trading in the UK?

CFD trading carries high risk due to leverage, volatility, and the speed of market movements.

Losses can happen quickly, especially for beginners, but UK rules require negative balance protection to stop losses exceeding deposits. You must fully understand leverage and margin before trading.

The FCA requires all CFD brokers to display a risk warning stating the percentage of retail accounts that lose money. This is typically between 70 and 80 percent.

Key CFD risks

- Leverage risk: A small move can trigger large losses.

- Volatility risk: Fast markets can cause slippage.

- Margin calls: Running out of funds can close positions automatically.

- Overnight funding: Fees add up for long-term trades.

- Emotional trading: Fear and greed cause poor decisions.

UK protections

- Negative balance protection (cannot lose more than you deposit)

- FCA leverage caps

- Segregated client funds

- Mandatory risk warnings

What can you trade with CFDs in the UK?

UK traders can trade CFDs on forex, indices, shares, commodities, and some cryptos (though crypto CFDs are banned for retail).

Market variety helps spread risk and build diversified trading strategies.

Forex CFDs

Major pairs like GBP/USD, EUR/USD, USD/JPY offer tight spreads and high liquidity.

Index CFDs

Trade global indices such as:

- FTSE 100

- S&P 500

- DAX 40

- Dow Jones

Share CFDs

Thousands of UK, US, and EU stocks available with leverage up to 5:1.

Commodity CFDs

Includes gold, silver, oil, and natural gas.

Crypto CFDs (Not Allowed for UK Retail)

Since 2021, the FCA prohibits crypto CFD trading for retail traders.

How do you trade CFDs in the UK? (step-by-step guide)

You trade CFDs in the UK by choosing an FCA-regulated broker, opening an account, verifying your identity, depositing funds, and placing your first long or short trade.

Beginners should start with a demo account before trading with real money.

- Choose an FCA-regulated broker: Look for UK protection, low spreads, and strong trading tools.

- Open your trading account: Fill in your details, answer experience questions, and complete risk warnings.

- Verify ID (KYC): Upload a passport or driving licence plus a proof of address.

- Deposit funds: Use debit card, bank transfer, or Faster Payments.

- Choose your market: Forex, indices, shares, or commodities.

- Decide long or short: Buy if you expect a rise, sell if you expect a fall.

- Select position size: Choose exposure carefully based on risk per trade.

- Add stop-loss and take-profit: These protect your capital and lock in gains.

- Place the trade: Monitor market conditions and adjust risk if needed.

- Close your trade manually: Or let take-profit/stop-loss close it automatically.

What is a good CFD strategy for beginners?

Beginner CFD strategies focus on risk control, simple trading setups, and market selection.

New traders should avoid high leverage, trade liquid markets like forex or indices, and stick to a clear plan with predefined rules.

Beginner-friendly strategies

- Trend following: Trade in the direction of major trends.

- Breakout trading: Enter when price breaks a clear level.

- Support and resistance: Buy low, sell high within ranges.

- News trading (only for experienced traders).

Core principles for beginner traders

- Risk no more than 1–2 percent of your account per trade.

- Always use stop-loss orders.

- Do not trade during high-impact volatility until experienced.

- Backtest strategies before using real money.

Hedging with CFDs

CFDs can also be used for hedging by opening positions that offset risk in your main portfolio.

For example, a trader holding UK shares may short the FTSE 100 to reduce market exposure during volatility.

Hedging reduces risk but still carries leverage and financing costs.

What risk management tools do CFD traders use?

CFD trading requires strong risk control tools, including stop-losses, take-profit levels, and position sizing.

These tools help you limit losses and protect your account when markets move quickly.

FCA rules require brokers to offer negative balance protection, but traders must still manage their own risk.

Core CFD risk tools

- Stop-loss orders: Automatically close your trade if the market hits a specified loss.

- Take-profit orders: Lock in profits when your target price is reached.

- Trailing stops: Move with price to protect gains while letting trades run.

- Limit orders: Control your entry price to avoid slippage.

- Position sizing calculators: Ensure you risk only a small portion of your account.

Risk management principles

- Never risk more than 1–2 percent of your account per trade.

- Avoid holding large leveraged trades overnight.

- Reduce risk during major news events.

- Stick to predefined entry and exit rules.

FCA-mandated safety features

- Negative balance protection

- Leverage caps

- Margin-stop outs

- Clear risk disclosures

These features aim to stop catastrophic losses but do not eliminate trading risk.

What are the best CFD trading tips for beginners?

Beginner CFD traders should start small, focus on liquid markets, and use simple strategies.

Understanding leverage, avoiding emotional trading, and practising on demo accounts are the biggest success factors for new UK traders.

Top beginner tips

- Trade only major markets with tight spreads.

- Keep leverage low until you gain experience.

- Never add to losing trades.

- Journal every trade for performance review.

- Use demo accounts to master charting tools.

- Learn price action and basic market structure.

- Focus on one or two markets (e.g., FTSE 100 or GBP/USD).

What are the FCA rules for CFD trading in the UK?

The FCA regulates CFD trading in the UK to protect retail traders. Rules include leverage limits, negative balance protection, banned bonuses, and mandatory risk disclosures.

FCA-regulated brokers must hold client funds in segregated accounts and provide fair pricing.

Key FCA CFD rules (retail traders)

- Leverage limits:

- 30:1 major forex

- 20:1 indices and minors

- 10:1 commodities

- 5:1 shares

- No crypto CFDs for retail clients

- Negative balance protection

- Mandatory 70–80 percent loss-rate warning

- No trading bonuses or incentives

- Segregated client accounts

Why FCA rules matter

They reduce the likelihood of large, unmanageable losses and ensure transparency.

FCA supervision also ensures that brokers hold adequate capital and follow strict reporting standards.

FSCS Protection Note

CFD trading is not protected by the Financial Services Compensation Scheme (FSCS).

FSCS covers firm failure for certain investment products, but it does not cover trading losses on CFDs.

Conclusion

Trading CFDs in the UK is achievable for beginners who understand leverage, margin, and risk.

By learning how CFDs work, choosing an FCA-regulated broker, using stop-loss tools, and following a structured plan, you can trade markets like forex, indices, shares, and commodities safely and confidently.

Use a demo account first, keep leverage low, and treat risk management as the foundation of every trade.

FAQs

What is CFD trading and how is it defined?

CFD trading is the practice of speculating on price movements using Contracts for Difference. You trade the price change of an asset rather than owning it, allowing you to go long or short using leverage.

Is there a difference between CFDs and investing?

Yes. CFD trading uses leverage and does not involve owning the asset, making it suitable for short-term trading. Investing involves buying the asset outright with no leverage and lower risk.

Who can trade CFDs in the UK?

Any UK resident aged 18 or over can trade CFDs if they pass the broker’s appropriateness assessment. Beginners must demonstrate basic understanding of leverage and risk.

Where can I open a CFD trading account?

You can open a CFD account with any FCA-regulated broker. The process includes registering online, completing a short trading experience questionnaire, verifying your identity, and depositing funds.

How do you define a CFD account?

A CFD account is a trading account that allows you to buy and sell Contracts for Difference. It supports leveraged trading, long and short positions, and includes tools like margin management and risk controls.

How much does it cost to trade CFDs?

Costs include the spread, overnight financing (swap fees), and sometimes commission on share CFDs. Additional fees may include currency conversion or guaranteed stop-loss fees, depending on the broker.

What markets can I trade with CFDs?

You can trade forex, indices, shares, commodities, and some cryptocurrencies (crypto CFDs banned for UK retail). Popular markets include GBP/USD, FTSE 100, gold, oil, and major US stocks.

How do I place a CFD trade?

Choose a market, decide whether to go long or short, set your position size, add stop-loss and take-profit orders, and click buy or sell. You can close the trade manually or using automated exit orders.

Which CFD trading platform is the best?

The best platform depends on your needs. Look for FCA regulation, tight spreads, strong charting tools, and fast execution. The ideal choice varies by trader experience and markets traded.

What platforms can I use to trade CFDs?

Most UK brokers offer one or more o proprietary web/mobile platforms, metaTrader ⅘ and advanced charting platforms. Choose a platform with clear pricing and strong risk tools.

References

- https://www.fca.org.uk/firms/contract-for-differences

- https://www.london.ac.uk/study/courses/short-courses/financial-markets

- https://research-information.bris.ac.uk/en/publications/trading-is-a-losing-game-an-audit-of-deceptive-choice-architectur/

- https://www.jbs.cam.ac.uk/wp-content/uploads/2025/06/eprg-2025-newbery-reforming-two-sided-cfds.pdf