Day trading in the UK is simple to get started once you understand how FCA rules, strategy selection, and market costs work.

This beginner guide shows you how to choose a platform, analyse charts, and place your first day trade safely.

You’ll also learn the key risks, tools, taxes, and steps needed to trade confidently in 2026.

Key takeaway: How to day trade in the UK?

To day trade in the UK, use an FCA authorised platform, choose liquid markets, understand leverage and costs, manage risk carefully, and treat day trading as a high risk activity rather than a long term investment strategy.

What is day trading?

Day trading is the practice of buying and selling financial assets within the same trading day to profit from short term price movements.

You close all positions before the market ends to avoid overnight funding costs and unpredictable price gaps.

UK day traders typically trade CFDs or spread bets because these products allow control over position size, use of leverage, and long and short setups.

Day trading relies on analysing price charts, tracking market news, and reacting quickly to intraday volatility.

Unlike long term investing, which focuses on multi year growth, day traders aim to take many smaller trades and close them within minutes or hours.

The focus is not on company fundamentals but on price movement, trends, liquidity, and market sentiment. This style is suitable for people who enjoy active decision making and are comfortable with high risk.

Characteristics of day trading

- High frequency of trades

- Use of charts, indicators, and patterns

- Reliance on speed and discipline

- No overnight exposure

- Use of leverage on most platforms

How UK regulation applies

- All brokers must be authorised by the Financial Conduct Authority (FCA)

- CFDs and spread bets are high risk and not FSCS protected

- Retail traders have negative balance protection

- Leverage is capped at 1:30 under UK rules

How do you start day trading in the UK?

You start day trading in the UK by choosing an FCA regulated broker, opening an account, completing identity verification, depositing funds, selecting a strategy, and practising your execution on a demo platform.

While setting up an account is quick, building consistency takes time and requires learning risk management, chart patterns, and market structure.

Step by step process

- Choose an FCA regulated day trading platform

- Complete KYC identity checks

- Fund your account with GBP

- Learn how to use charts and indicators

- Build a written trading plan

- Test strategies on a demo account

- Start with small positions on live markets

- Record trades in a journal for review

What you need to open an account

- Driving licence or passport

- Proof of address such as a bank statement

- UK debit card or bank account

- Experience questionnaire to determine risk classification

What markets can you day trade in the UK?

You can day trade indices, forex pairs, shares, commodities, and some cryptocurrencies depending on the platform.

Most beginners choose indices or forex due to high liquidity, tight spreads, and predictable trading sessions.

Market selection depends on your capital, strategy type, and preferred volatility level.

Indices

Indices such as the FTSE 100, NASDAQ 100, DAX 40, and S&P 500 are popular because they move consistently during market opens.

The FTSE 100 is especially active at 8am UK time and reacts to economic announcements.

Forex

Forex pairs like GBP USD, EUR GBP, and GBP JPY move around the clock during weekdays.

They offer tight spreads, deep liquidity, and predictable reaction patterns to economic news such as interest rate decisions.

Shares

Share day trading focuses on individual companies listed on the London Stock Exchange.

Popular choices include Glencore, Tesco, BP, Shell, and Vodafone.

UK shares may experience price gaps at the open due to overnight news.

Commodities

Gold, Brent Crude Oil, and natural gas are active during major economic announcements and global energy news.

These markets suit strategies based on momentum and trend continuation.

What are the best day trading strategies for beginners?

The best beginner day trading strategies include trend trading, intraday swing trading, scalping, mean reversion, and the use of money flow indicators.

These strategies help traders identify short term opportunities using technical analysis.

Beginners should choose one strategy and master it before adding others.

Trend trading

Trend trading identifies the dominant direction of the market and trades in line with it.

Traders use higher highs and higher lows to confirm uptrends and lower highs and lower lows to confirm downtrends.

Intraday swing trading

Swing traders look for reversals, pullbacks, and breakouts within the intraday trend.

They often use indicators like moving averages or stochastic oscillators. It is slower and easier for beginners than scalping.

Scalping

Scalping uses very small time frames and aims to earn a few pips or points repeatedly.

Although profitable for experienced traders, it demands fast execution and emotional discipline.

A small mistake can erase a series of wins quickly.

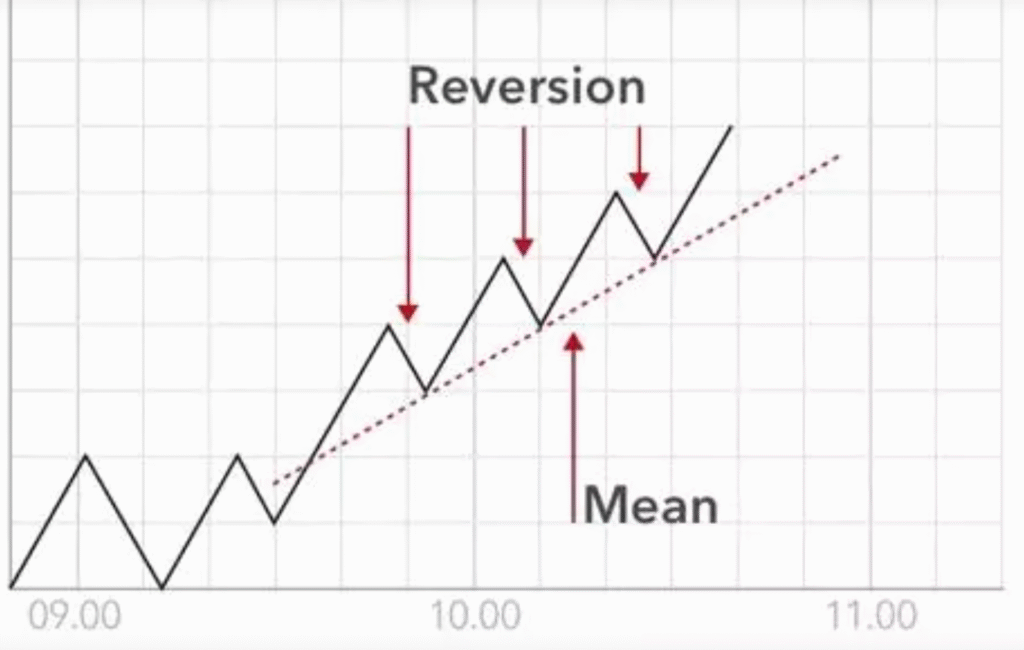

Mean reversion

Mean reversion assumes that prices eventually return to their average after extreme moves.

Traders use indicators like RSI, Bollinger Bands, and moving averages to identify overbought and oversold conditions.

Money flow analysis

The money flow index combines price and volume to evaluate whether buyers or sellers dominate the market.

A reading above 80 signals an overbought environment while a reading below 20 signals an oversold environment.

What should you know before you start day trading?

Before you begin day trading, you must understand liquidity, volatility, trading volume, and how economic news affects intraday price movements.

These factors determine trade quality, speed of execution, and overall profitability.

Day trading requires strong discipline, emotional control, and awareness of market conditions.

Liquidity

High liquidity allows fast order execution without major slippage.

Markets such as GBP USD and FTSE 100 are ideal for beginners because they offer deep liquidity.

Volatility

Volatility allows traders to capture price movement.

A market with low volatility may not move enough to hit profit targets. Days with high volatility can create opportunities but increase risk.

Trading volume

Volume shows how many participants are active and whether price movements are reliable.

High volume is common during the London open, US open, and major economic announcements.

News trading

Day traders often react to news such as UK inflation reports, interest rate decisions, employment figures, and GDP updates.

These events cause sharp price moves that can be profitable with the right strategy.

How do you choose a day trading platform in the UK?

Choose an FCA regulated platform that offers low spreads, fast execution, strong charting tools, negative balance protection, and GBP accounts.

A suitable day trading platform must be reliable, fast, and mobile friendly while offering access to key markets like the FTSE 100 and major forex pairs.

Features to look for

- FCA regulation for safety

- Low spreads and low commissions

- Stable mobile and desktop platforms

- Fast withdrawals to UK bank accounts

- GBP base currency to avoid conversion fees

- A demo account for practice

How do you manage risk when day trading?

You manage risk by setting stop losses, limiting leverage, using small position sizes, avoiding emotional decisions, and following a consistent trading plan.

Successful traders focus on protecting capital rather than chasing profits.

Practical rules

- Risk no more than 1 percent of your account on each trade

- Maintain a minimum risk to reward ratio of 1 to 2

- Avoid averaging down on losing trades

- Use stop losses on every position

- Take breaks after consecutive losses

- Keep records to review performance

Common risks to avoid

- Trading during illiquid periods

- Overtrading after losses

- Increasing size to chase profits

- Ignoring economic calendars

How do you place your first day trade in the UK?

You place your first day trade by selecting a market, analysing the trend, identifying an entry signal, choosing buy or sell, setting stop and target levels, and confirming the order.

Monitoring your trade is essential because intraday movements can change quickly.

Example trade process

- Open your trading platform

- Select FTSE 100 or GBP USD

- Identify trend direction using highs and lows

- Draw support and resistance

- Wait for a breakout or pullback

- Set a stop loss based on volatility

- Confirm order size

- Close the trade before markets end

- Log the trade in your journal

Pros and cons of day trading

| Pros | Cons |

|---|---|

| Flexible schedule | Very high risk |

| No overnight charges | Steep learning curve |

| Small capital needed | Requires discipline and emotional control |

| Tax free spread betting | Majority of beginners lose money |

| Access to global markets | Potential for rapid losses |

How is day trading taxed in the UK?

Day trading taxation in the UK depends on the instrument you trade. Spread betting profits are tax free because they are treated as gambling rather than investment.

CFD trading profits may be subject to Capital Gains Tax at 10 percent or 20 percent depending on your income. If you trade frequently enough to be considered a professional, HMRC may classify profits as income tax.

Summary of taxes

- Spread betting: Tax free

- CFDs: Capital Gains Tax may apply

- High frequency traders: Potential income tax classification

- Keep records of all trades for HMRC

Is day trading worth it in the UK?

Day trading can be worth it for disciplined individuals who enjoy active markets and are able to manage risk.

However most beginners lose money due to poor planning, emotional trading, or the misuse of leverage.

The key is to focus on skill development, not quick profits.

Who day trading suits

- People comfortable with fast decisions

- Individuals who enjoy charts and analysis

- Traders who follow routines and rules

- Those with the discipline to limit risk

What are the best day trading platforms in the UK?

The best day trading platforms in the UK are eToro, IG, XTB, AJ Bell, and InvestEngine, each offering FCA regulated accounts, fast execution, and strong market access.

Your choice depends on fees, tools, and the markets you want to trade.

Below is a quick overview of what each platform offers.

| Platform | Best for | Key features |

|---|---|---|

| eToro | Beginners who want a simple interface and social trading | Easy to use platform, low minimum deposits, social and copy trading tools, access to stocks, ETFs, forex, indices, and crypto CFDs |

| IG | Experienced traders needing advanced tools | Advanced charting, fast execution, deep market coverage, spread betting and CFD trading, professional analysis tools |

| XTB | Low cost forex and CFD trading | Tight spreads, strong mobile and desktop platforms, very fast execution, wide range of CFD markets |

| AJ Bell | Share investors who trade frequently | Low share dealing fees, strong reputation, solid research tools, suitable for active investors |

| InvestEngine | Low cost ETF focused traders | Commission free ETF investing, simple portfolio tools, FCA regulated, designed for long term ETF investing rather than short term CFDs |

FAQs

How to day trade in the UK online?

You day trade online by opening an account with an FCA regulated broker such as eToro or IG, verifying your identity, depositing funds, choosing a market, and placing trades through a web or mobile platform.

How to day trade in the UK for free?

You can practise day trading free using demo accounts. Live trading always involves costs such as spreads, commissions, or swaps.

How to day trade in the UK for beginners?

Beginners should start with a demo account, learn simple strategies like trend trading, use low leverage, and focus on risk management instead of speed.

What is day trading?

Day trading is buying and selling assets within the same day to profit from short term price movements.

Is day trading for beginners?

Beginners need to learn chart patterns, technical indicators, risk management, and trading psychology before using real money.

How is day trading taxed in the UK?

Spread betting is tax free. CFD profits may incur Capital Gains Tax. If trading becomes your main income, HMRC may classify your profits as income tax.

Can you do day trading in the UK?

Yes. Day trading is legal and regulated in the UK.

How much money do you need to day trade in the UK?

You can start with 200 to 500 GBP although more capital provides better flexibility and risk control.

What is the 3 5 7 rule in trading?

The 3 5 7 rule suggests planning trades around risk to reward ratios such as 1 to 3, 1 to 5, or 1 to 7 depending on volatility.

References

- https://commonslibrary.parliament.uk/the-rise-of-armchair-retail-trading-risks-and-regulation

- https://www.fca.org.uk/firms/contract-for-differences

- https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim56820

- https://www.ig.com/uk/trading-strategies/beginners-guide-to-day-trading-39692-170905