Looking for the best MT5 broker in the UK for 2026?

This guide compares FCA-regulated MT5 platforms based on fees, spreads, execution, and trading tools to help UK traders choose with confidence.

All platforms support MetaTrader 5, UK payment methods, and operate under UK regulatory standards.

Key takeaway: Which is the best MT5 broker in the UK in 2026?

Pepperstone is the best MT5 broker in 2026 thanks to ultra-low spreads, fast execution, and full FCA regulation. It is ideal for active, cost-focused trading. CMC Markets is best for advanced tools and market depth, while IG suits traders who want MT5 alongside long-term investing options like ISAs.

Top 5 MT5 brokers in the UK

- Pepperstone – Best for: Ultra-low spreads, fast execution, and scalping or algorithmic MT5 trading.

- CMC Markets – Best for: Advanced traders who want deep market coverage, powerful tools, and strong FCA protection.

- IG – Best for: Traders who want MT5 access plus long-term investing options like ISAs, shares, and ETFs.

- Forex.com – Best for: Active forex traders who prioritise execution quality, tight spreads, and FCA regulation.

- AvaTrade – Best for: MT5 users who value platform choice and education over UK-specific regulation and tax wrappers.

MT5 UK brokers comparison

| Broker | Regulation & Safety | MT5 Trading Costs | Markets & Assets | Best For |

|---|---|---|---|---|

| Pepperstone | FCA regulated, FSCS up to £85,000, segregated funds | From 0.0 pips on Razor + commission. No inactivity fees | Forex, indices, commodities, shares CFDs | Low-cost MT5 trading, scalping, algo traders |

| CMC Markets | FCA regulated, FSCS up to £85,000, LSE-listed | From 0.7 pips, £10 inactivity fee after 12 months | 12,000+ markets including forex, indices, shares CFDs | Advanced tools, market depth, precision trading |

| IG | FCA regulated, FSCS up to £85,000, FTSE 250 | From ~0.8 pips, £24 quarterly custody if inactive | 13,000+ assets, CFDs, spread betting, investing | MT5 + investing, all-round UK traders |

| Forex.com | FCA regulated, FSCS firm protection | From 0.8 pips or 0.0 pips + commission, inactivity fee after 12 months | Forex-focused, indices, commodities, share CFDs | Active forex traders, execution quality |

| AvaTrade | Not FCA regulated, no FSCS protection | Spread-only pricing, inactivity & admin fees apply | Forex & CFD markets only | MT5 access, education, global CFD trading |

1. Pepperstone – Best for ultra-low spreads and fast MT5 execution

Pepperstone is one of the strongest MT5 brokers for UK traders who value low costs, fast execution, and professional-grade tools. It combines FCA regulation, tight spreads, and reliable MT5 performance, making it especially well-suited to active trading styles such as scalping, day trading, and algorithmic trading.

Key information

| Feature | Pepperstone |

|---|---|

| UK regulation | FCA regulated |

| FSCS protection | Up to £85,000 |

| MT5 supported | Yes |

| Minimum deposit | £0 |

| Account types | Standard, Razor, Spread Betting |

| UK payments | Debit card, PayPal, bank transfer |

| Inactivity fees | None |

Is this MT5 broker FCA-regulated and safe for UK traders?

Yes. Pepperstone is authorised and regulated by the FCA, with client money held in segregated Tier-1 bank accounts. Eligible UK retail clients receive FSCS protection up to £85,000 and negative balance protection, meeting key UK safety standards.

How good is the MT5 platform experience with this broker?

Pepperstone delivers a high-quality MT5 experience with fast execution, stable performance, and full support for Expert Advisors, custom indicators, and depth of market. MT5 is available on desktop, web, and mobile, and integrates smoothly with Pepperstone’s pricing and liquidity.

What are the spreads, commissions, and total trading costs?

Pepperstone is among the lowest-cost MT5 brokers in the UK. Standard and spread betting accounts are commission-free, while Razor accounts offer raw spreads with a small per-lot commission.

Typical MT5 costs

- EUR/USD from 0.60 pips on spread betting

- From 0.0 pips on Razor MT5 accounts

- £0 deposit, withdrawal, or inactivity fees

- Overnight financing applies to open positions

What markets and assets can you trade on MT5 with this broker?

Pepperstone’s MT5 offering is strongest for forex and indices, with additional access to commodities and share CFDs. Crypto derivatives are not available to UK retail traders due to FCA restrictions.

MT5 asset coverage

- Forex: 90+ pairs

- Indices: FTSE 100, NAS100, DAX

- Commodities: metals and energies

- Shares: 1,000+ CFDs

- Crypto: not available for UK retail clients

How strong is execution quality, liquidity, and order reliability?

Execution quality is a core strength. Pepperstone uses deep institutional liquidity and market execution with no dealing desk, supporting fast and reliable MT5 order fills.

Execution highlights

- Sub-100ms execution in testing

- No requotes on MT5

- Suitable for scalping and automated strategies

Who is this MT5 broker best for?

Pepperstone is best for UK traders who prioritise low spreads, fast execution, and advanced MT5 functionality. It suits scalpers, day traders, algorithmic traders, and spread bettors. Traders who need guaranteed stop losses.

Read the complete Pepperstone review here.

Pros and cons of using Pepperstone

| Pros | Cons |

|---|---|

| Ultra-low MT5 spreads | No guaranteed stop loss orders |

| FCA regulated with FSCS protection | No crypto trading for UK retail clients |

| Fast execution and deep liquidity | Demo account limited to 60 days |

| MT4, MT5, cTrader and TradingView support | Smaller share range than IG or CMC |

| No deposit, withdrawal, or inactivity fees | Limited long-term investing tools |

2. CMC Markets – Best for advanced tools and deep market coverage

CMC Markets is a highly established FCA-regulated broker offering MT5 alongside its proprietary Next Generation platform. It is best known for strong regulation, deep market coverage, advanced risk tools, and reliable execution, making it a solid MT5 option for UK traders who prioritise safety and platform depth over ultra-low spreads.

Key information

| Feature | CMC Markets |

|---|---|

| UK regulation | FCA regulated |

| FSCS protection | Up to £85,000 |

| MT5 supported | Yes |

| Minimum deposit | £0 |

| Account types | CFD, Spread Betting, Professional |

| UK payments | Debit card, PayPal, bank transfer |

| Inactivity fee | £10 after 12 months |

Is this MT5 broker FCA-regulated and safe for UK traders?

Yes. CMC Markets is authorised and regulated by the FCA, is publicly listed on the London Stock Exchange, and holds client funds in segregated accounts. Eligible UK retail traders benefit from FSCS protection up to £85,000 and negative balance protection, placing CMC among the safest UK trading platforms.

How good is the MT5 platform experience with this broker?

CMC Markets offers a stable and reliable MT5 experience, suitable for traders who prefer MetaTrader’s environment while benefiting from CMC’s pricing and infrastructure. MT5 supports Expert Advisors, advanced order types, and multi-asset trading, though CMC’s most advanced features remain exclusive to its proprietary platform.

What are the spreads, commissions, and total trading costs?

CMC Markets offers competitive but not ultra-low MT5 pricing. Costs are transparent, with spreads built into pricing and no deposit or withdrawal fees.

Typical MT5 trading costs

- FX spreads from 0.7 pips

- No deposit or withdrawal fees

- £10 inactivity fee after 12 months

- Overnight financing applies to leveraged positions

What markets and assets can you trade on MT5 with this broker?

CMC Markets provides one of the largest market selections available on MT5 in the UK, making it suitable for traders who want broad diversification.

MT5 asset coverage

- Forex: 300+ currency pairs

- Indices: FTSE 100, S&P 500, Germany 40

- Shares: 9,000+ global CFDs

- Commodities: metals, energy, agriculture

- Crypto CFDs: available for eligible clients only

- Bonds and treasuries

How strong is execution quality, liquidity, and order reliability?

Execution quality is a major strength. CMC Markets reports median execution latency of ~0.004 seconds, supporting fast and consistent MT5 order fills even during volatile markets. Pricing transparency and published execution reports add an extra layer of trust.

Execution highlights

- Very low latency execution

- Deep liquidity and stable pricing

- Minimal slippage during normal market conditions

- Reliable fills for active FX and index traders

Who is this MT5 broker best for?

CMC Markets is best for UK MT5 traders who value regulation, market depth, and execution reliability. It suits intermediate and advanced traders, strategy-driven traders, and those trading multiple asset classes. Beginners may find the platform powerful but complex.

Read the complete CMC Markets review here.

Pros and cons of using CMC Markets

| Pros | Cons |

|---|---|

| FCA regulated and LSE-listed | Inactivity fee after 12 months |

| FSCS protection up to £85,000 | Learning curve for beginners |

| Large MT5 market range | MT5 not as feature-rich as CMC’s own platform |

| Fast, reliable execution | Overnight financing costs apply |

| No deposit or withdrawal fees | Crypto limited to CFDs only |

3. IG – Best for MT5 trading plus long-term investing options

IG is one of the most established FCA-regulated brokers in the UK, offering MT5 alongside its proprietary trading platforms. It stands out for strong regulation, very broad market access, and robust risk controls, making it a reliable MT5 option for UK traders who prioritise trust, stability, and long-term platform support.

Key information

| Feature | IG |

|---|---|

| UK regulation | FCA regulated |

| FSCS protection | Up to £85,000 |

| MT5 supported | Yes |

| Minimum deposit | £0 (bank transfer) |

| Account types | CFD, Spread Betting, ISA, GIA, SIPP |

| UK payments | Debit card, PayPal, bank transfer |

| Inactivity / custody fee | £24 per quarter unless active |

Is this MT5 broker FCA-regulated and safe for UK traders?

Yes. IG is authorised and regulated by the FCA, with client funds held in segregated accounts and FSCS protection up to £85,000 on eligible assets. It is a FTSE 250–listed company with over 50 years of operating history, placing it among the safest and most transparent brokers in the UK.

How good is the MT5 platform experience with this broker?

IG offers a solid and stable MT5 experience, suitable for traders who prefer MetaTrader’s layout and automation tools. MT5 supports Expert Advisors, advanced indicators, and multi-asset trading. However, many of IG’s most advanced tools are found on its proprietary platforms rather than MT5.

What are the spreads, commissions, and total trading costs?

IG’s MT5 pricing is competitive but not the cheapest in the UK. Costs are transparent, though inactivity and FX conversion fees can impact lower-volume traders.

Typical MT5 trading costs

- FX spreads from around 0.8 pips on major pairs

- £24 quarterly custody fee unless trading activity thresholds are met

- 0.7% FX conversion fee on non-GBP assets

- Overnight financing applies to leveraged positions

What markets and assets can you trade on MT5 with this broker?

IG provides one of the widest MT5 market selections in the UK, making it suitable for traders who want maximum flexibility across asset classes.

MT5 asset coverage

- Forex: major, minor and exotic pairs

- Indices: FTSE 100, S&P 500, DAX

- Shares: global CFDs

- Commodities: metals, energies, agriculture

- Crypto: available via CFDs for eligible clients

- Options and futures

How strong is execution quality, liquidity, and order reliability?

Execution quality is a core strength. IG delivers fast and reliable order execution, supported by deep liquidity and robust infrastructure. Pricing is stable during normal market conditions, and IG publishes transparency data to support trust.

Who is this MT5 broker best for?

IG is best for UK traders who value regulation, market breadth, and platform reliability over the lowest possible spreads. It suits active traders, multi-asset traders, and those combining MT5 trading with long-term investing through ISAs or Smart Portfolios.

Read the complete IG review here.

Pros and cons of using IG

| Pros | Cons |

|---|---|

| FCA regulated with FSCS protection | £24 quarterly custody fee if inactive |

| Very wide MT5 market coverage | Not the cheapest MT5 spreads |

| Long operating history and FTSE listing | MT5 less feature-rich than IG’s own platform |

| Strong execution and risk controls | 0.7% FX conversion fee |

| Supports trading and investing accounts | Platform can feel complex for beginners |

4. AvaTrade – Best for MT5 platform choice and trader education

AvaTrade is a global CFD broker offering MT5, along with several proprietary platforms and strong educational tools. For UK traders, the key consideration is that AvaTrade is not FCA-authorised, meaning there is no FSCS protection, despite the broker being regulated in other major jurisdictions.

Key information

| Feature | AvaTrade |

|---|---|

| UK regulation | Not FCA authorised |

| FSCS protection | No |

| MT5 supported | Yes |

| Minimum deposit | £100 (or currency equivalent) |

| Account types | Retail, Professional, Demo, Islamic, Copy trading |

| UK payments | Debit card and bank transfer |

| Inactivity / admin fees | Yes, inactivity and admin fees apply |

Is this MT5 broker FCA-regulated and safe for UK traders?

No. AvaTrade accepts UK clients but is not authorised by the FCA, so UK-specific protections such as FSCS cover do not apply. The broker is regulated internationally and uses segregated client funds with negative balance protection for retail clients, but this does not replace UK regulatory safeguards.

How good is the MT5 platform experience with this broker?

AvaTrade provides a strong MT5 experience, supporting Expert Advisors, custom indicators, and advanced charting. Platform choice is one of AvaTrade’s biggest strengths, with MT4, MT5, AvaTradeGO, WebTrader, and specialist tools like AvaOptions available to eligible users.

What are the spreads, commissions, and total trading costs?

AvaTrade uses a spread-only pricing model, with no separate trading commissions on most CFDs. While spreads are competitive on forex and indices, non-trading fees are a key drawback for UK users.

Cost considerations

- No deposit or withdrawal fees

- Inactivity fee after 3 months

- Annual administration fee after 12 months

- Overnight financing applies to leveraged positions

What markets and assets can you trade on MT5 with this broker?

AvaTrade focuses on CFD trading, not long-term investing. The MT5 platform covers core global markets, but UK retail crypto access is restricted under UK rules.

MT5 asset coverage

- Forex CFDs: 50+ pairs

- Index CFDs: FTSE 100, S&P 500, DAX

- Share CFDs: 600+ global stocks

- Commodity CFDs: metals and energy

- Crypto CFDs: restricted for UK retail traders

How strong is execution quality, liquidity, and order reliability?

AvaTrade operates a market maker execution model, setting prices internally based on underlying markets. This provides predictable pricing and fast execution for most retail traders, but slippage can occur during volatile periods. High-frequency traders may prefer FCA-regulated brokers with direct market access.

Who is this MT5 broker best for?

AvaTrade is best for UK traders who want MT5 or MT4 access, trade forex or CFDs actively, and value education and platform variety over UK-specific regulation. It is less suitable for UK traders who want FCA oversight, FSCS protection, or tax-efficient accounts.

Read the complete AvaTrade review here.

Pros and cons of using AvaTrade

| Pros | Cons |

|---|---|

| Supports MT4 and MT5 | Not FCA authorised |

| Long operating history and global regulation | No FSCS protection for UK users |

| Strong platform range and mobile app | Inactivity and admin fees apply |

| Good education and demo account | CFDs only, no real shares or ISAs |

| Spread-only pricing with free withdrawals | Crypto CFDs restricted for UK retail traders |

5. Forex.com – Best for active forex trading with FCA regulation

Forex.com is an FCA-regulated UK broker focused on forex and CFD trading, with a strong reputation for execution quality, pricing transparency, and professional-grade platforms. It is designed for active traders rather than casual investors, prioritising trading performance over simplicity or long-term investing features.

Key information

| Feature | Forex.com |

|---|---|

| UK regulation | FCA regulated |

| FSCS protection | Up to £85,000 |

| MT5 supported | Yes |

| Minimum deposit | £0 (practical minimum £100+) |

| Account types | Standard, Raw Pricing, Demo, Professional |

| UK payments | Debit card, bank transfer, Faster Payments |

| Inactivity fee | ~£12 per month after 12 months |

Is this MT5 broker FCA-regulated and safe for UK traders?

Yes. Forex.com operates in the UK under FCA authorisation, with client funds held in segregated accounts and strict compliance with UK conduct and capital rules. Eligible UK clients may be covered by the FSCS up to £85,000 if the firm fails, although trading losses are not FSCS protected, which is standard for CFDs.

How good is the MT5 platform experience with this broker?

Forex.com provides a robust and professional MT5 experience, supporting Expert Advisors, advanced indicators, and fast order execution. MT5 integrates well with Forex.com’s pricing and liquidity, making it suitable for technical, systematic, and short-term trading strategies rather than casual use.

What are the spreads, commissions, and total trading costs?

Forex.com offers competitive pricing, with two main cost structures depending on account type.

Typical MT5 costs

- Standard account: spreads from ~0.8 pips, no commission

- Raw Pricing account: spreads from 0.0 pips + commission

- No deposit or withdrawal fees

- Inactivity fee after 12 months of no trading activity

- Overnight financing applies to leveraged positions

Costs are well suited to frequent traders but less attractive for inactive accounts.

What markets and assets can you trade on MT5 with this broker?

Forex.com is focused on forex and leveraged trading, not long-term investing.

MT5 asset coverage

- Forex: 80+ currency pairs

- Indices: FTSE 100, DAX, S&P 500

- Commodities: gold, oil, silver

- Share CFDs: selected UK and global stocks

- Spread betting: available to eligible UK traders

- Crypto: not available to UK retail clients

How strong is execution quality, liquidity, and order reliability?

Execution quality is a major strength. Forex.com delivers fast, reliable fills supported by deep liquidity and professional infrastructure. It is well suited to day trading and short-term strategies, with stable pricing during normal market conditions and transparent execution standards.

Execution highlights

- Consistent MT5 execution

- Suitable for scalping and day trading

- Advanced order types available

- FCA leverage limits apply to UK retail traders

Who is this MT5 broker best for?

Forex.com is best for active UK traders who want tight spreads, advanced MT5 tools, and FCA regulation. It suits forex specialists, day traders, and technically driven traders. It is less suitable for beginners wanting a simple app or investors looking for ISAs, ETFs, or buy-and-hold portfolios.

Read the complete Forex.com review here.

Pros and cons of using Forex.com

| Pros | Cons |

|---|---|

| FCA regulated with segregated client funds | Not beginner-first. Steeper learning curve |

| Competitive MT5 pricing options | No physical shares or ETFs |

| Strong execution and platform stability | No Stocks & Shares ISA |

| Supports MT5, MT4, proprietary platform, TradingView | Inactivity fee after 12 months |

| Well suited to active forex and CFD trading | Trading losses not FSCS protected |

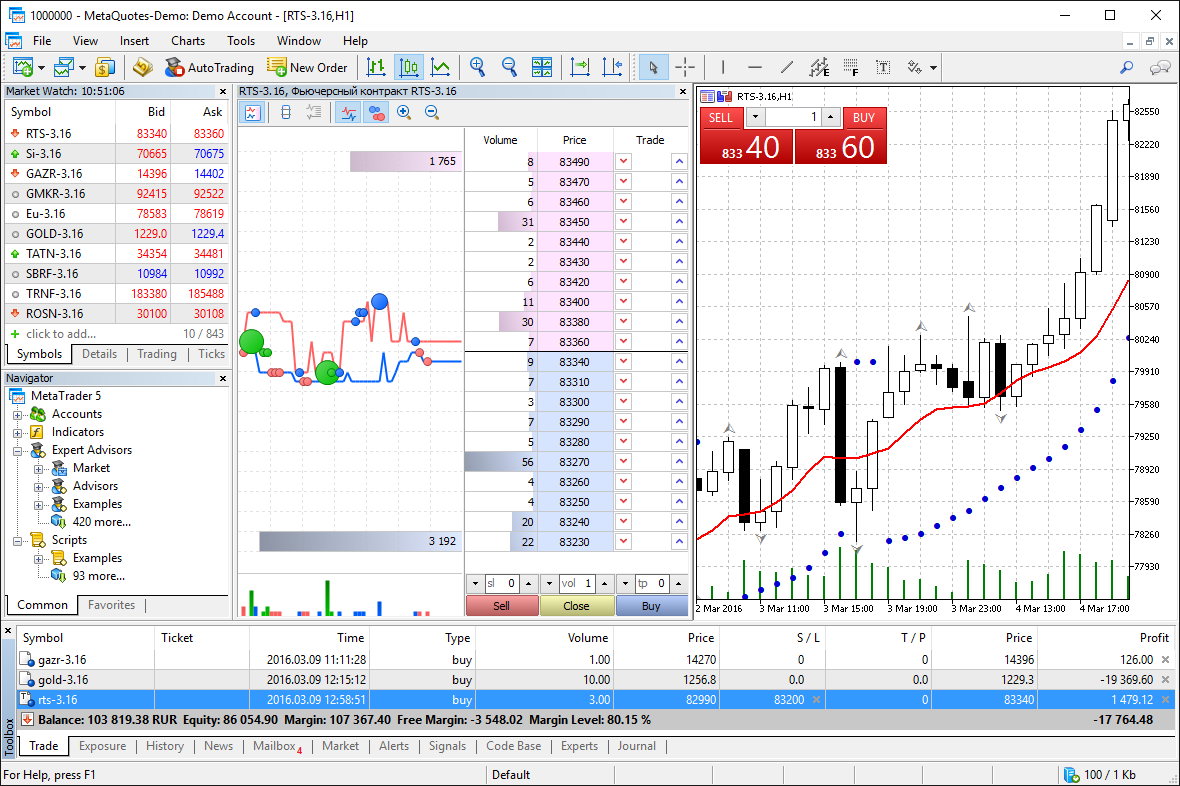

What is MT5 exactly?

MetaTrader 5, or MT5, is a multi-asset trading platform used to trade forex, CFDs, indices, commodities, and shares through supported brokers.

It offers advanced charting, faster processing, more order types, and built-in tools for analysis and automation, making it suitable for active and professional traders.

MT5 is software, not a broker. You access it through an FCA-regulated broker in the UK.

Trade multiple markets from one platform

MT5 allows you to manage all supported assets in one place, including forex, indices, commodities, and share CFDs. It supports both hedging and netting, so you can open multiple positions on the same market or use exchange-style position accounting, depending on the asset and broker.

Use advanced order types and risk tools

MT5 supports market orders, pending orders, stop orders, and trailing stops, with multiple execution modes. This flexibility lets traders apply scalping, day trading, swing trading, and longer-term strategies with precise risk control.

Analyse markets with professional tools

MT5 includes dozens of built-in indicators, drawing tools, and timeframes, plus an integrated economic calendar and news feed. Charts are fully customisable, and you can monitor many markets at once for technical and fundamental analysis.

Automate and copy trades

You can use Expert Advisors (EAs) to automate strategies, backtest them in the Strategy Tester, or subscribe to copy trading signals directly from the platform. MT5 also supports VPS hosting, allowing automated strategies to run 24/7 without your computer switched on.

Trade on desktop, web, and mobile

MT5 works across desktop, web browser, and mobile trading apps on iOS and Android. Accounts sync across devices, and you can receive alerts and notifications in real time, making it easy to manage trades anywhere.

How does MT5 differ from MT4?

MT5 is a newer and more advanced platform than MT4, designed to support more markets and features. While MT4 focuses mainly on forex, MT5 supports a wider range of assets and more sophisticated trading tools.

MT5 is the future-facing platform, while MT4 is legacy software that some traders still use for specific strategies.

Key differences

- MT5 supports forex, CFDs, and shares, while MT4 is mainly forex-focused

- MT5 has more timeframes, indicators, and order types

- MT5 uses a faster 64-bit architecture

- MT5 includes built-in economic calendar and depth of market

- MT4 has broader legacy EA support, but MT5 is catching up

Is MT5 better than MT4?

Yes for most UK traders, MT5 is generally better than MT4, especially if you trade multiple asset classes or use advanced tools. It offers better performance, more features, and long-term support.

However, MT4 may still suit traders who:

- Only trade forex

- Use older Expert Advisors built for MT4

- Prefer a simpler, lightweight platform

How do you choose an MT5 broker?

Choosing the right MT5 broker comes down to regulation, costs, execution quality, and market access, not the platform alone.

In the UK, you should prioritise FCA regulation, competitive spreads, reliable execution, and support for the assets you want to trade, such as forex, indices, or shares.

What UK traders should look for in an MT5 broker

- FCA regulation and safety: Always check the broker is FCA authorised. This ensures client money segregation and FSCS protection up to £85,000 if the firm fails. Trading losses are not FSCS protected.

- Spreads, commissions, and non-trading fees: Compare typical spreads on major pairs like EUR/USD. Check whether commissions apply and watch for inactivity or custody fees.

- Execution quality and liquidity: Fast execution, low slippage, and no requotes matter more than features for active traders.

- Markets and account types: Ensure the broker supports the markets you want on MT5, such as spread betting, CFDs, or professional accounts.

- UK payment methods and support: Look for GBP accounts, Faster Payments, and responsive UK customer support.

Is MT5 the same on all brokers?

No. While the MT5 software looks similar, the trading experience varies significantly by broker. Spreads, execution speed, order handling, available markets, and even MT5 features can differ depending on how the broker configures the platform.

What changes between MT5 brokers

- Pricing and spreads are set by the broker, not MT5

- Execution model differs, such as market maker vs agency-style execution

- Available assets vary widely across brokers

- Add-ons and tools like indicators, plugins, and analytics differ

- Order types and risk tools may be limited or expanded by the broker

MT5 is the engine, but the broker controls the driving experience. Choosing the right MT5 broker matters just as much as choosing MT5 itself.

Conclusion: What’s the best MT5 broker in the UK?

The best MT5 broker for you depends on costs, regulation, and how you trade.

Pepperstone stands out for ultra-low spreads and fast execution, making it ideal for scalpers and algorithmic traders. CMC Markets is a top choice for advanced tools, deep market coverage, and strong FCA protection. IG suits traders who want MT5 access alongside long-term investing options like ISAs and a broad asset range.

All three are FCA regulated, support GBP funding, and offer reliable MT5 performance. Choose based on whether you prioritise lowest costs, platform depth, or all-round investing flexibility.

FAQs

Does MT5 work on my phone?

Yes. MT5 works on iOS and Android via the MetaTrader 5 app. You can trade, manage positions, view charts, and receive alerts. Desktop is better for advanced analysis.

Is MT5 beginner-friendly?

Somewhat. MT5 is powerful but not beginner-first. It suits beginners willing to learn using a demo account, but simpler investing apps are easier at the start.

Can I use MetaTrader 5 in the UK?

Yes. MT5 is available in the UK through FCA-regulated brokers. It supports forex, CFDs, and spread betting. Trading losses are not FSCS protected.

What is the best broker for MetaTrader 5 for beginners?

IG and CMC Markets are best for beginners due to FCA regulation, demos, and strong education.