Starting trading in the UK begins with understanding the risks involved, choosing a secure FCA regulated platform and learning how different markets work.

This guide explains the essentials in clear, practical steps so beginners know how to set up an account, manage risk and place their first trades responsibly.

It is written to provide unbiased, people first guidance that helps new traders build skills safely and confidently.

Quick answer: How do I start trading in the UK?

Start by choosing an FCA regulated broker, opening an account, learning the basics with a practice account and placing your first live trades using small positions and clear risk controls.

What beginners need to know

What is trading and how does it work in the UK?

Trading is the process of buying and selling financial instruments with the aim of profiting from price movements.

In the UK, most new traders access the markets through FCA regulated brokers that provide online trading platforms for trading shares, indices, forex, commodities and other assets.

Prices move based on supply and demand, and traders open positions when they believe an asset will rise or fall.

Trading works by speculating on short term price changes rather than holding assets for the long term.

UK brokers offer different account types, including share dealing for traditional ownership and leveraged products like CFDs and spread betting that allow traders to speculate on rising or falling markets.

Each trade is executed at the live market price, and the outcome depends on how far the price moves relative to the entry.

Beginner traders should focus on understanding risks, platform tools and regulation before placing any live trades.

Why do people start trading?

People start trading for different reasons, but most begin because they want a flexible way to engage with the financial markets and potentially grow their money over time.

Trading gives individuals direct access to global markets, allowing them to act on news, company updates or economic events without relying on traditional investment products.

For some, it is an active alternative to long term investing, offering the chance to take advantage of shorter term opportunities.

Others are drawn to the educational aspect of trading, using practice accounts and beginner tools to learn how markets move and how different strategies work.

Many new traders also value the convenience of modern UK platforms, which provide low cost access, clear pricing and risk management features.

Whatever the motivation, successful beginners typically focus on learning the basics, understanding risk and choosing regulated platforms that support responsible decision making.

What markets can beginners trade in the UK?

Beginners can access several core markets through FCA regulated trading platforms. Each market has different risks, volatility levels and learning curves.

| Market | What it is | Why beginners trade it | Key risks to know |

|---|---|---|---|

| Shares | Ownership of individual companies listed on UK or global exchanges. | Easy to understand, wide choice of companies, transparent pricing. | Company specific risk, earnings volatility, gaps around news. |

| Indices | Baskets of shares such as the FTSE 100, S&P 500 or NASDAQ. | Smooth price movement, broad market exposure, popular for beginners. | Can move sharply on economic data and global news. |

| Forex | Trading currency pairs like GBP USD or EUR USD. | High liquidity, tight spreads, available 24 hours on weekdays. | Fast price moves, leverage can amplify losses. |

| Commodities | Markets such as gold, oil and natural gas. | Clear drivers like supply, demand and global events. | High volatility, sensitive to geopolitical and economic shifts. |

| Cryptocurrencies | Digital assets such as Bitcoin and Ethereum (through CFD or spread betting accounts). | High interest and strong price trends. | Extreme volatility, not FCA regulated when traded directly. |

| ETFs | Funds that track markets, sectors or themes. | Simple diversification and lower risk than single stocks. | Can still fall in value with the broader market. |

What is share trading?

Share trading involves buying and selling individual company shares on UK or global stock exchanges.

When someone buys a share, they own a small part of that company and their profit or loss depends on how the share price moves over time.

Beginners often start here because the concept is simple and there is no leverage by default, which keeps risk clearer and easier to manage.

Share trading is available through FCA regulated share dealing accounts on most UK platforms.

What is CFD trading?

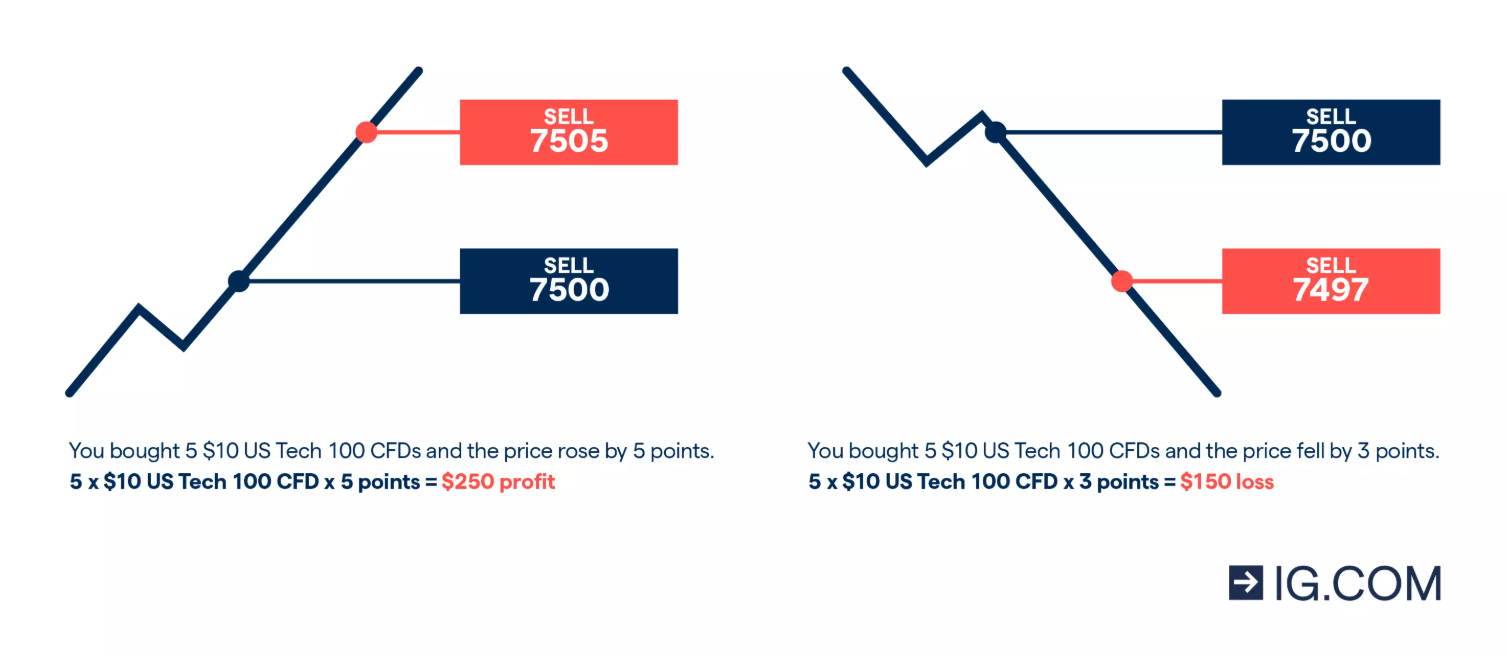

CFD trading lets traders speculate on price movements without owning the underlying asset.

A CFD, or contract for difference, tracks the live market price of shares, indices, forex, commodities and other assets.

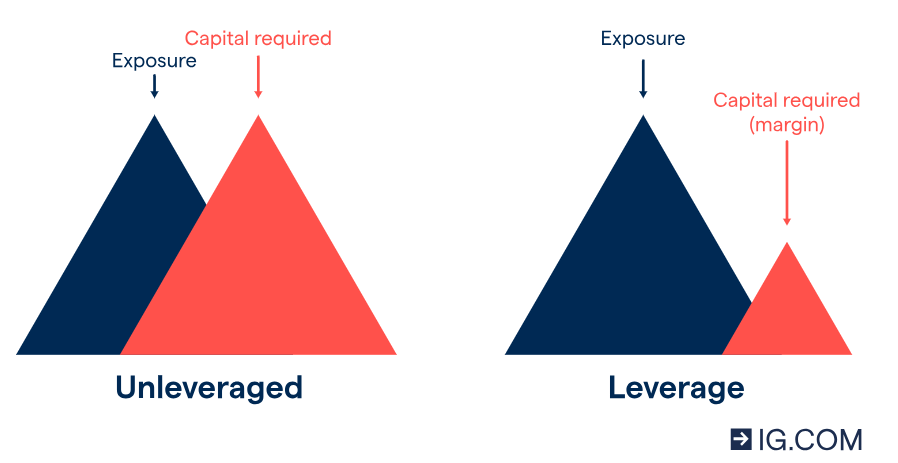

Traders can go long if they expect prices to rise or go short if they expect prices to fall. CFDs use leverage, which means only a fraction of the trade value is deposited, magnifying both profits and losses.

This makes CFDs flexible but higher risk, so beginners should use small position sizes and understand margin requirements before trading.

*New to CFDs? Read our How to Trade CFDs UK for Beginners guide for a simple, step by step introduction before you start trading.

What is spread betting?

Spread betting is another way to trade rising or falling markets without owning the asset. Instead of buying or selling units, traders stake a certain amount of money per point of price movement.

If the market moves in the chosen direction, profits rise by the number of points gained multiplied by the stake. If it moves against them, losses increase in the same way.

Spread betting is tax free in the UK, but it is a leveraged product, which means losses can exceed the initial deposit.

It is therefore essential for beginners to use risk controls such as stop losses and to learn how margin works before trading.

What is the difference between trading and investing?

Trading focuses on short term price movements, where positions are opened and closed over minutes, hours or days based on market trends, news or technical signals.

The goal is to profit from frequent changes in price, and traders typically use tools like charts, leverage and risk controls to manage each position.

Because the time horizon is short, trading requires more active decision making and a clear understanding of volatility and risk.

Investing aims to grow wealth over the long term by buying assets such as shares, funds or ETFs and holding them for months or years.

Investors focus on company fundamentals, earnings growth and broader market trends rather than short term price swings.

Returns come from long term appreciation and sometimes dividends. The overall approach is slower, less reactive and usually more suitable for beginners who prefer a lower risk, long term strategy.

What accounts do you need to start trading?

Beginner traders in the UK can choose from three main account types, depending on whether they want to trade short term price movements or invest for the long term.

These accounts include spread betting accounts, CFD trading accounts and traditional share dealing accounts.

Each option has different features, risks and tax rules, so new traders should choose the account that matches their goals, risk tolerance and experience level.

What is a spread betting account?

A spread betting account allows traders to speculate on rising or falling prices by placing a stake per point of movement.

Instead of owning the underlying asset, traders profit or lose money based on how far the market moves in either direction.

Spread betting is popular in the UK because profits are tax free, although losses are also not tax deductible. Since it uses leverage, traders only put down a margin deposit, which increases both potential gains and losses.

Beginners should start with small stakes and learn how margin and stop losses work before opening live positions.

What is a CFD trading account?

A CFD trading account is used to trade contracts for difference, which mirror the price of real world assets without requiring ownership.

CFD traders can go long or short, use leverage and access markets like shares, indices, forex, commodities and crypto linked instruments.

Only a portion of the trade value is deposited, so risk can increase quickly if prices move against the position.

UK traders must use an FCA regulated CFD trading platform, and beginners should prioritise risk controls, clear pricing and simple position sizing when learning how CFDs work.

How do share dealing accounts work?

A share dealing account lets individuals buy and sell real shares on UK and global stock exchanges.

Unlike CFDs or spread bets, this account type gives traders ownership of the asset, which means no leverage is involved unless the platform offers optional margin trading.

These accounts suit beginners who prefer a straightforward way to invest in companies, hold assets for the long term and access dividends.

Costs usually include dealing fees, FX charges for overseas shares and custody fees, depending on the broker.

For new investors, a share dealing account is often the simplest and lowest risk entry point into the markets.

How do you choose a trading platform in the UK?

Choosing a trading platform starts with identifying what you want to trade, how actively you plan to trade and the level of support you need as a beginner.

A suitable UK platform should offer clear pricing, simple navigation, strong educational resources and risk management tools that help new traders make informed decisions.

Independent reviews, hands on testing and transparent fees are essential when comparing providers, since each broker offers different products, markets and account types.

Why is FCA regulation important?

FCA regulation is the most important factor when choosing a UK trading platform because it ensures the broker follows strict rules on client protection, segregation of funds, financial stability and fair conduct.

Regulated brokers must be transparent about fees, risks and how they handle customer money.

FCA oversight also gives access to dispute resolution and, in many cases, FSCS protection if the firm fails.

For beginners, using an FCA regulated platform is the safest way to trade online.

What tools and features should beginners look for?

Beginners should look for platforms that offer an intuitive interface, real time pricing, simple order tickets and built in risk controls such as stop losses and limit orders.

A good platform will also provide market research, educational guides, practice accounts and charting tools that explain price movements clearly.

Clear fee information, fast customer support and a well designed mobile trading app help new traders learn confidently and avoid unnecessary mistakes.

How do you trade rising and falling prices?

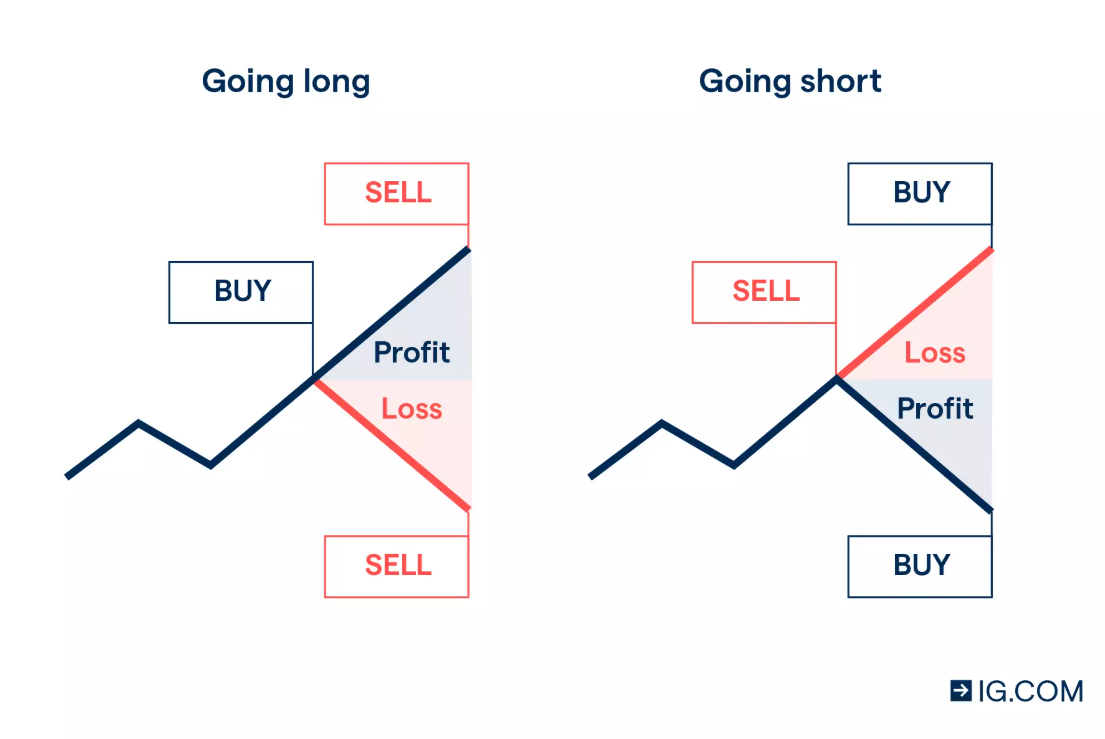

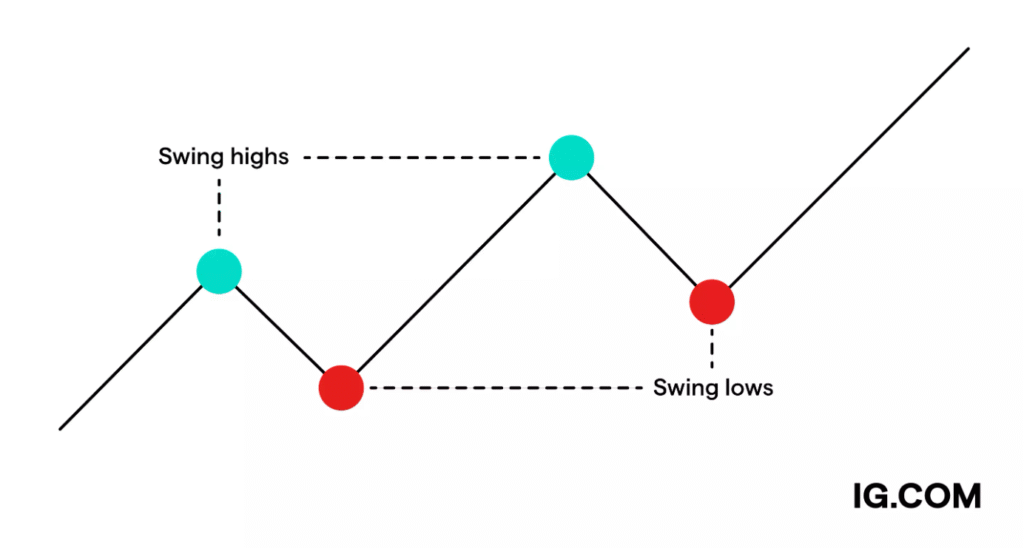

Traders can profit from both rising and falling markets by choosing whether to go long or short on an asset.

Going long means opening a position because you expect the price to rise, while going short means you expect the price to fall.

Products like CFDs and spread bets allow both types of trades without owning the underlying asset, making them popular for short term trading in the UK.

To trade either direction responsibly, beginners should understand how position size, leverage and stop loss orders affect potential outcomes.

A long or short trade only becomes profitable if the market moves in the chosen direction, and losses can increase quickly if it moves the opposite way.

Focusing on small trades, clear entry and exit plans and strong risk controls helps new traders manage volatility and make more informed decisions.

What is leverage and margin for beginners?

Traders can open long positions when they think a market will rise or short positions when they think it will fall.

Products like CFDs and spread bets let you trade in either direction without owning the asset.

Example of a long trade: If GBP USD trades at 1.2500 and you expect it to rise, you open a long position. If it climbs to 1.2550 and you close the trade, the profit comes from the 50 point move.

Example of a short trade: If you think Tesla shares will fall from 220 to 210, you can open a short position. If the price drops as expected, the profit reflects the 10 point decline.

Beginners should use clear entries, small trade sizes and stop losses, as leverage can increase gains and losses quickly.

What is the bid ask spread and why does it matter?

The bid ask spread is the difference between the price buyers are willing to pay for a market (the bid) and the price sellers are willing to accept (the ask).

You always buy at the ask and sell at the bid, so the spread acts as an immediate cost every time you open a trade. Tight spreads mean lower costs and smoother execution, while wider spreads make it harder for a trade to move into profit.

Example of how a spread works: If GBP USD shows a bid of 1.2500 and an ask of 1.2503, the spread is 0.0003 (three points). A long trade must rise by at least three points before you break even.

Another example: If a stock index displays 7,600 / 7,604, the four point spread means a new long trade will start four points in the red. The market must rise by four points just to reach breakeven.

Spreads can widen during volatility or low liquidity, so beginners should prioritise well known markets, check pricing during peak hours and choose FCA regulated platforms with clear, consistent spread information.

What moves market prices?

Market prices move because of changes in supply and demand.

When more traders want to buy an asset than sell it, the price rises, and when more want to sell, the price falls.

This balance shifts constantly as new information enters the market.

Company news, economic data, political events, interest rate decisions and broader market sentiment all influence how traders react.

Beginners who understand these drivers can interpret price moves more confidently and avoid reacting emotionally to short term volatility.

How do earnings reports affect markets?

Earnings reports are among the most important price movers for individual shares.

Companies release them quarterly, providing updates on revenue, profit, guidance and future expectations.

Prices often move quickly if the results are better or worse than analysts expected.

Example:

If a UK listed retailer reports stronger than expected Christmas sales, its share price may jump at the market open as traders anticipate higher future profits.

If results disappoint, the opposite can happen, with the stock gapping down.

Earnings reports can also move indices that include the company. For example, a large FTSE 100 bank missing earnings expectations can pull the wider index lower.

Beginners should check the earnings calendar before trading specific shares and be aware that spreads may widen around release times due to higher volatility.

How do economic events move prices?

Economic events affect entire markets because they signal how strong or weak the economy is.

Traders look at data such as inflation, employment, GDP, interest rates and consumer confidence.

These reports influence expectations about growth, central bank policy and corporate performance.

Example:

If UK inflation comes in much higher than expected, traders may assume the Bank of England could raise interest rates. This often strengthens GBP while pressuring stock indices like the FTSE 100, which can fall as borrowing costs rise.

Another example:

A stronger than expected US jobs report can lift global stock markets by signalling a healthy economy, while weaker data may push investors toward safer assets such as gold.

Beginners should check the economic calendar and avoid opening new trades right before a major announcement unless they understand how volatility may affect spreads and stop losses.

How do political events influence trading?

Political developments can create uncertainty, which often leads to sharp price movements.

Elections, government policy changes, trade negotiations and unexpected geopolitical events all influence market sentiment by changing expectations about future economic conditions.

Example:

If a government announces a large tax cut or spending plan, stock markets may rise as traders anticipate stronger corporate earnings.

If a political crisis emerges or an unexpected resignation occurs, markets may fall as investors shift to safer assets.

Brexit negotiations provide a clear past example: GBP USD regularly experienced large swings when new information emerged, even if the final outcome was still unclear.

Traders should monitor reliable news sources and understand that political events can raise volatility across multiple markets at once. Beginners may prefer to trade smaller sizes or avoid high risk periods until they gain more experience reading market reactions.

What are the risks of trading and how do you manage them?

Trading involves the possibility of losing money, especially when using leveraged products such as CFDs and spread bets.

Prices can move quickly, markets can gap around news events and small losses can turn into large ones if positions are not managed carefully.

Managing risk means controlling how much of your account is exposed on each trade, setting clear exit points and avoiding emotional decisions.

Beginners who understand risk early on are more likely to trade responsibly and build long term consistency.

Effective risk management starts with simple habits: using small position sizes, only trading money you can afford to lose and avoiding markets you do not fully understand.

It also involves learning how volatility, spreads, overnight financing costs and leverage affect the real cost of a trade.

A clear plan helps prevent common mistakes such as overtrading, chasing losses or reacting impulsively to short term price swings.

What are the main risks for beginners?

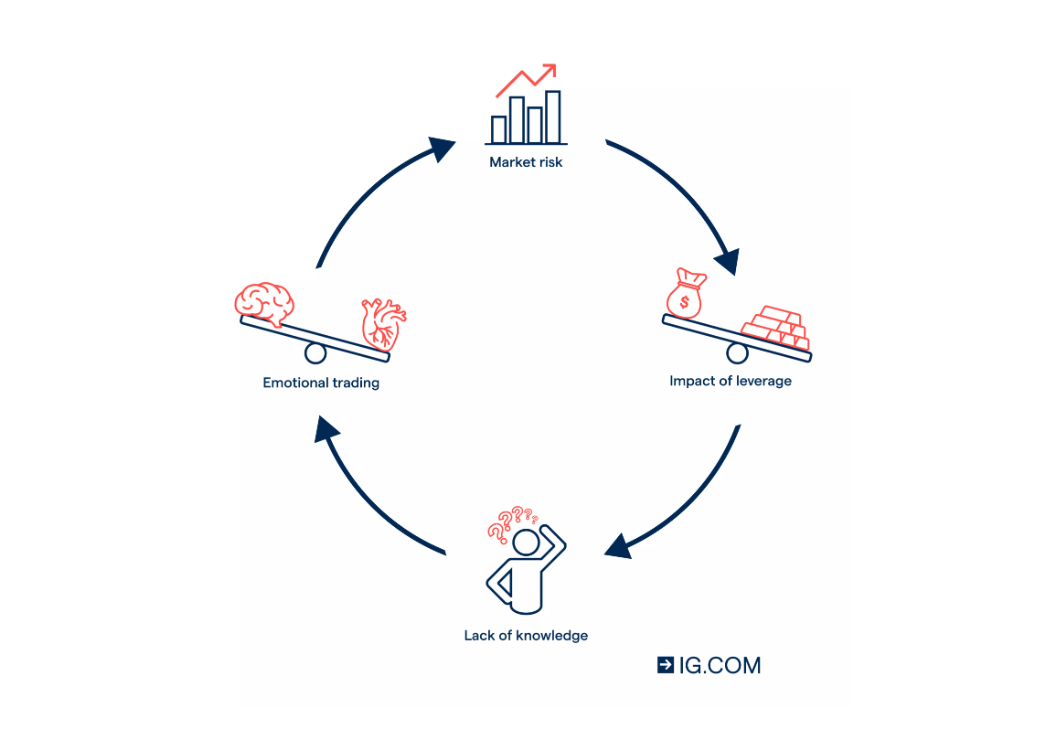

Beginners typically face three main categories of risk:

1. Market risk

This is the risk that prices move against your position.

Example: You go long on a stock at 250, but unexpected earnings come in weak and the price drops to 230.

2. Leverage risk

CFDs and spread bets amplify both gains and losses.

Example: A £5 per point stake on a volatile index can lose £50 in a ten point move, even though the trader only deposited a small margin.

3. Emotional and behavioural risk

New traders often rush into trades, trade too frequently or widen stop losses when a trade moves against them.

Example: After two losses in a row, a beginner doubles their stake to “win back” losses, often creating even larger losses.

Beginners should also be aware of risks like slippage (getting a worse price during fast markets), overnight financing costs, platform outages and widening spreads during volatility.

What risk management tools can you use?

Most FCA regulated platforms offer built in tools that help beginners control losses and protect their account balance.

Key tools include:

Stop loss orders

Automatically close a trade at a chosen price if the market moves against you.

Example: Placing a stop loss £20 below your entry on a share trade helps limit potential loss.

Limit orders

Close a trade at a profit target when the market reaches your desired price.

Example: If you buy at 200 and want to take profit at 210, a limit order locks that in.

Guaranteed stop losses

These close your trade at the exact level you set, even during gaps or high volatility. They usually include a small premium but offer strong downside protection.

Position sizing tools

These help traders calculate how much to risk per trade.

A common beginner rule is to risk no more than 1 to 2 percent of the account on any single position.

Practice accounts

Demo accounts allow beginners to learn without risking real money. They are useful for testing strategies, learning order types and understanding how leverage works.

Risk warnings and margin alerts

These notify you when your open trades approach margin levels or when volatility increases.

Using these tools together helps beginners protect capital, avoid large losses and build disciplined trading habits that support long term success.

What trading styles and strategies can beginners learn?

Beginners can choose from several trading styles based on how active they want to be and how long they plan to hold each position.

The three most common approaches are day trading, swing trading and position trading. Each style has different timeframes, risk levels and skill requirements, so beginners should experiment using a practice account before committing real money.

Understanding the strengths and limitations of each approach helps new traders avoid strategies that do not match their schedule, personality or risk tolerance.

What is day trading?

Day trading involves opening and closing trades within the same trading day, aiming to profit from small, short term price movements.

Traders rely heavily on charts, real time data and clear entry and exit rules.

Example:

A day trader might buy the FTSE 100 when it pulls back to a support level and close the trade minutes later after a quick ten point bounce.

Day trading requires fast decision making, strict discipline and the ability to handle volatility. It is not suitable for beginners who cannot commit regular time during market hours.

*Read our guide to the best UK day trading platforms.

What is swing trading?

Swing trading focuses on capturing medium term moves that play out over several days or weeks.

Traders look for patterns, trends or momentum shifts and enter when they believe a market is about to move in a new direction.

Example:

If a stock breaks above a long term resistance level and holds that level for a day or two, a swing trader might buy and aim to hold the position for a multi day upward move.

Swing trading is often the most beginner friendly style because it provides time to think, uses wider stop losses and does not require constant screen time.

What is position trading?

Position trading is a long term strategy where trades are held for weeks, months or sometimes longer. Traders rely on broader trends, fundamental analysis and macroeconomic themes rather than short term fluctuations.

Example:

If the Bank of England signals a cycle of interest rate cuts, a position trader might buy UK equities expecting a longer term rise supported by improving economic conditions.

This style requires patience and the ability to tolerate fluctuations without reacting emotionally. It is often the lowest maintenance strategy and can suit beginners who prefer a slower, research based approach.

How do you create a trading plan that suits your goals?

A trading plan sets out how you choose trades, manage risk and measure progress. It helps beginners avoid emotional decisions and ensures each trade aligns with their goals, time commitment and risk tolerance.

A clear plan also supports consistent behaviour, which is essential for long term learning.

To build a plan, start by defining what you want to achieve and how much time you can realistically spend trading.

Choose a trading style that fits your schedule, such as swing trading for part time traders or position trading for those who prefer a slower approach.

Set rules for risk, including maximum position size and how much of your account you are willing to risk per trade.

Example:

A beginner might decide to risk no more than 1 percent of their account per trade, use stop losses on every position and only enter trades that match a simple trend continuation setup.

Tracking results is equally important. Reviewing past trades helps identify patterns, strengths and mistakes that can be adjusted over time.

A well structured trading plan grows with you, becoming more refined as your experience and confidence increase.

Should beginners use a practice account?

A practice account is one of the safest ways for beginners to learn how trading works before risking real money.

It allows new traders to test strategies, understand order types, explore platform features and see how markets move in real time.

Because there is no financial risk, it helps build confidence and reduces the chance of early mistakes that can affect long term progress.

A beginner can place a simulated long and short trade on the FTSE 100, set stop losses and limit orders, then review how the position behaves when the market moves. This hands on experience makes it easier to transition to a live account later.

While practice accounts are useful, beginners should remember that emotions feel different when real money is on the line.

The goal is to use a demo account to build skills, then apply those skills gradually with small, well managed live trades.

How do you open a live trading account in the UK?

Opening a live trading account is simple, but beginners should follow a clear step by step process to stay safe and compliant.

1. Choose an FCA regulated broker

Pick a platform that offers the markets you want, transparent fees and strong beginner tools.

2. Complete the online application

Provide your personal details, trading experience and financial information so the broker can assess suitability under FCA rules.

3. Verify your identity

Upload proof of identity and address, such as a passport and recent utility bill. This is required for all real money accounts.

4. Fund your account

Deposit money using a supported method like a debit card or bank transfer. Many brokers have low minimum deposits.

5. Set up platform tools

Familiarise yourself with charts, order types, stop losses and account settings before opening your first trade.

6. Start with small positions

Begin with low risk trades to adjust from practice trading to real market conditions and avoid early large losses.

Example trades: how does a real trade work?

Understanding a real trade from start to finish helps beginners see how prices, spreads and order types affect the outcome.

Here are two simple examples using common UK markets.

Example 1: A long trade on the FTSE 100

You believe the FTSE 100 will rise from its current ask price of 7,600.

- You open a long CFD position.

- The spread is 7,598 / 7,600, so the trade opens slightly in the red.

- The market climbs to 7,620, and you close the trade.

- Your profit comes from the 20 point move, minus any spread or financing costs. If the index had fallen instead, the loss would reflect how many points it moved against you.

Example 2: A short trade on a UK share

You expect a company trading at 250 / 251 to fall after weak earnings.

- You open a short spread bet at 250.

- The stock drops to 238, and you close the position.

- Your gain is based on the 12 point move in your favour multiplied by your stake per point. If the price had risen above your entry, the same calculation would apply to the loss.

These examples show how direction, spread, position size and market movement all determine the final result.

Beginners should practise these steps on a demo account first to understand how real market conditions affect each part of the trade.

FAQs

How can I trade in the UK?

You can trade in the UK by opening an account with an FCA regulated broker, choosing the markets you want to trade and placing orders through a trading platform. Beginners typically start with shares, CFDs or spread betting and should use risk controls on every trade.

What is the 90% rule in trading?

The 90 percent rule refers to the idea that 90 percent of traders lose 90 percent of their money within 90 days, usually due to poor risk management, overleveraging and emotional decisions. It is a cautionary guideline that highlights the importance of discipline and risk control.

Why do 90% of day traders lose money?

Most day traders lose money because they trade too frequently, use high leverage, take impulsive risks and struggle to manage losses. Fast price movements and tight timeframes make it difficult for beginners to stay consistent, and emotional decision making often leads to larger losses.

How to trade UK for beginners?

Beginners should start by learning how markets work, choosing an FCA regulated platform and practising on a demo account. When moving to live trading, use small position sizes, set stop losses and focus on simple strategies in liquid markets like major indices or large cap shares.