XTB is one of the UK’s most popular FCA-regulated trading platforms, offering low fees, fast execution and a wide range of CFDs and forex markets.

This review explains its costs, tools, safety standards and overall trading experience so you can judge whether it suits your needs. All key details are written for UK traders comparing brokers side by side.

Is XTB good for beginners?

XTB is good for beginners thanks to its free ISA, low fees, strong education hub and easy-to-use mobile app. New investors benefit from courses, tutorials and a dedicated account manager.

However, beginners must be cautious because the platform mixes CFDs alongside real shares, which can be confusing for first-time traders. Keeping to the ISA or share-dealing section is the safest route.

Quick verdict: How do we rate XTB for UK traders in 2026?

XTB scores highly for UK traders thanks to its FCA regulation, commission-free share and ETF trading, and a free Stocks & Shares ISA with strong educational tools.

Its platform is powerful, but can feel complex for beginners, and the lack of a SIPP limits long-term planning. Overall, it offers excellent value for low-cost investors and active traders.

Overall rating: 4.4 / 5 (Good)

XTB is a balanced, low-fee platform that suits both active traders and UK investors wanting a cost-efficient ISA. Its tools and research are strong, but the mix of CFDs and shares creates complexity for first-timers.

Full score breakdown

| Category | Score | Reason |

|---|---|---|

| Security & trust | 5 | FCA-regulated, FSCS protection up to £85k, segregated accounts, strong track record. |

| Fees & pricing | 4 | £0 commission up to €100k monthly volume, no ISA fees, but 0.5% FX and inactivity fee. |

| Features | 4 | 6,600+ shares, 1,800+ ETFs, ISA, market tools, research, strong education; no SIPP. |

| Ease of use | 3 | App is simple, but web platform and CFD layout can overwhelm beginners. |

| Customer support | 4 | Fast responses, dedicated account managers, in-app support. |

| Reputation | 4 | Well-established global broker with strong UK growth; excellent education reputation. |

XTB at a glance

Key features

- £0 commission on shares/ETFs up to €100k/mo

- Free Stocks & Shares ISA

- FCA-regulated + FSCS up to £85k

- 4.25% interest on uninvested GBP

- 6,600+ shares & 1,800+ ETFs

- xStation 5 with advanced charting

- Large education hub (courses, ebooks, webinars)

- Instant card deposits, fast withdrawals

- Dedicated account manager for new users

Pros and cons

Pros

- Very low overall cost structure for active and long-term investors

- Free, tax-efficient ISA makes it attractive for UK savers

- Strong global market access with thousands of investable assets

- Exceptional educational support, ideal for building skills

- Smooth onboarding and a highly responsive mobile experience

- Competitive interest rate on idle GBP balances

Cons

- No SIPP option, limiting long-term pension planning

- Mixed CFD and share layout can increase the chance of mistakes for beginners

- FX conversion fees add up for frequent international trades

- Inactivity fee penalises hands-off investors

- Web platform has a steeper learning curve than simpler rivals

Who is IG best for?

- Beginners who want strong educational resources

- Low-cost share and ETF investors

- ISA investors wanting a free, tax-efficient account

- Active traders using xStation 5

- Investors wanting access to global markets

Who is IG not ideal for?

- Investors needing a SIPP

- Beginners who prefer a very simple app

- Long-term passive investors wanting funds

Is XTB a safe broker for UK Investors?

XTB is authorised and regulated by the Financial Conduct Authority (FCA), uses segregated client accounts, and offers FSCS protection up to £85,000 for eligible UK clients.

This makes it a secure option from a regulatory standpoint. However, investing still carries risk, and CFDs on XTB involve leverage, which is unsuitable for beginners.

XTB operates under FCA licence number 522157, meaning it must follow strict UK rules around capital requirements, reporting, and safeguarding customer money.

Client funds are kept separate from XTB’s own corporate accounts to protect users in the event of insolvency. Keep in mind that FSCS protection covers platform failure, not losses from market movements.

What are the fees on XTB in the UK?

XTB offers commission-free trading on stocks and ETFs for monthly volumes under €100,000, plus no platform fees for accounts under €250,000.

FX fees are 0.5%, and withdrawals over £50 are free. The main charge to watch out for is the £10 inactivity fee after one year.

For most long-term UK investors, XTB is cost-efficient because share dealing and ISAs have no trading or custody charges. A

ctive traders surpassing €100,000 per month will pay a 0.2% commission (minimum €10), which can add up quickly.

XTB fees table

| Fee type | Cost |

|---|---|

| Share/ETF Trades (<€100k/mo) | £0 commission |

| Share/ETF Trades (>€100k/mo) | 0.2% (min €10) |

| FX Conversion Fee | 0.5% |

| Platform / Custody Fee | £0 (under €250k) |

| Withdrawal Fee | £0 (over £50), £5 if below |

| Inactivity Fee | £10 per month after 12 months |

| ISA Fee | £0 |

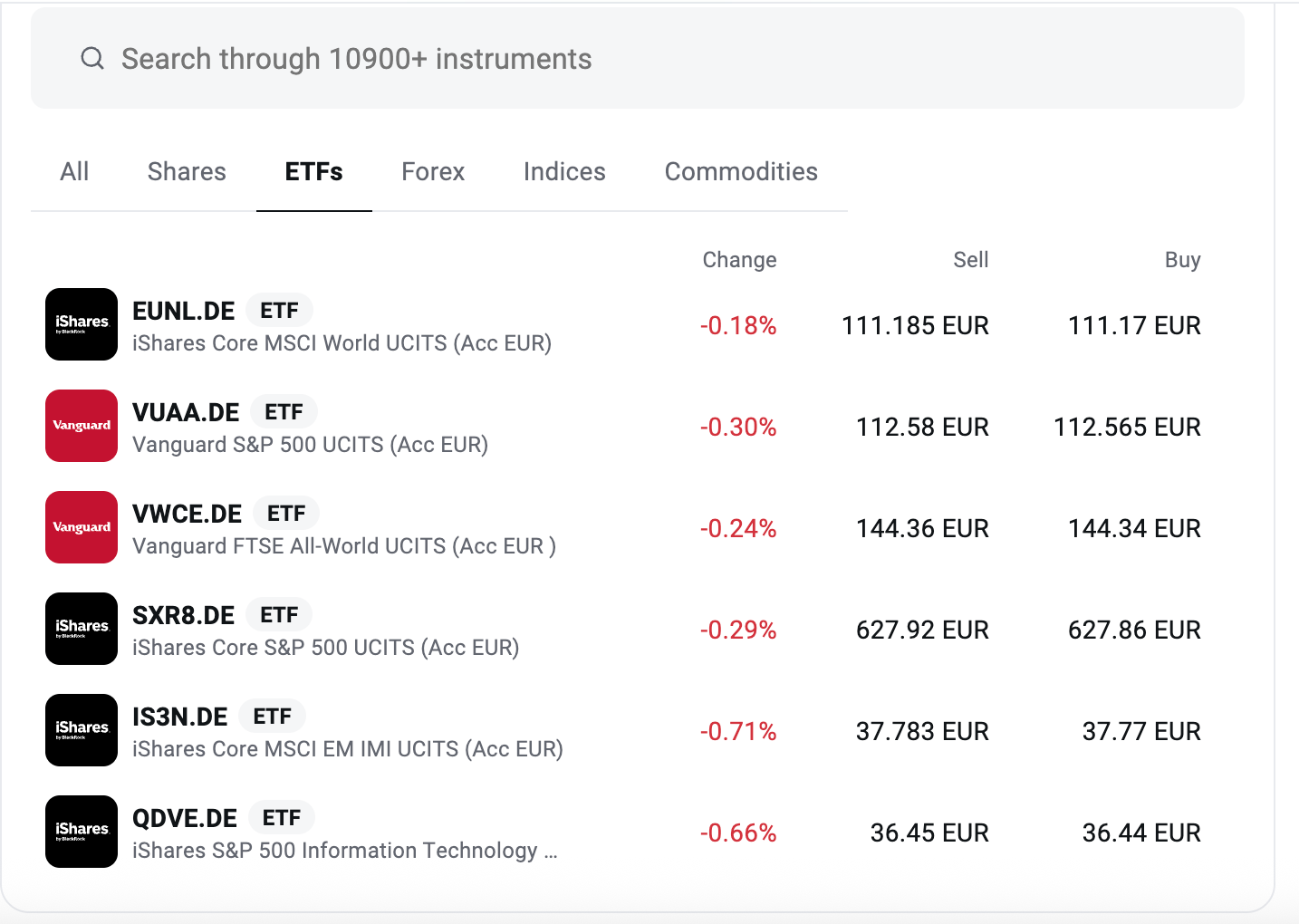

What can you invest in with XTB?

XTB supports more than 6,600 shares, over 1,800 ETFs, and thousands of CFDs across forex, indices, commodities and stocks.

It does not offer mutual funds, bonds, investment trusts, SIPPs or spread betting, which may limit long-term retirement planners.

Investment coverage table

| Asset type | Available on XTB? |

|---|---|

| UK Shares | ✔ |

| US Shares | ✔ |

| European Shares | ✔ |

| ETFs | ✔ (1,800+) |

| Investment Plans (ETF baskets) | ✔ |

| CFDs (forex, indices, commodities) | ✔ |

| Bonds | ✘ |

| Mutual Funds | ✘ |

| Crypto (real) | ✘ (CFDs only, not for UK retail) |

| SIPP | ✘ |

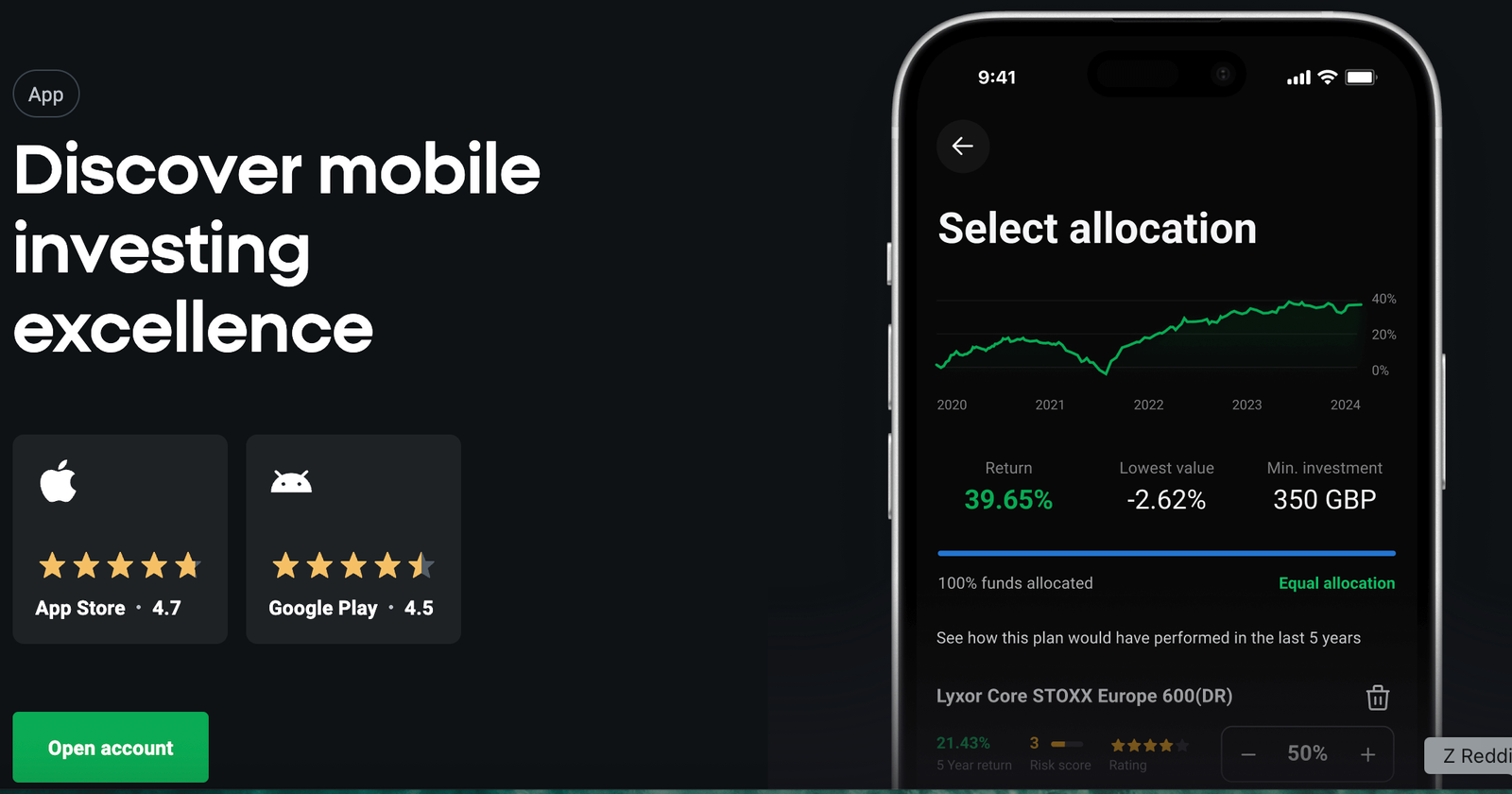

XTB’s Investment Plans allow users to build ETF portfolios automatically, offering a simplified, low-cost solution for passive investors.

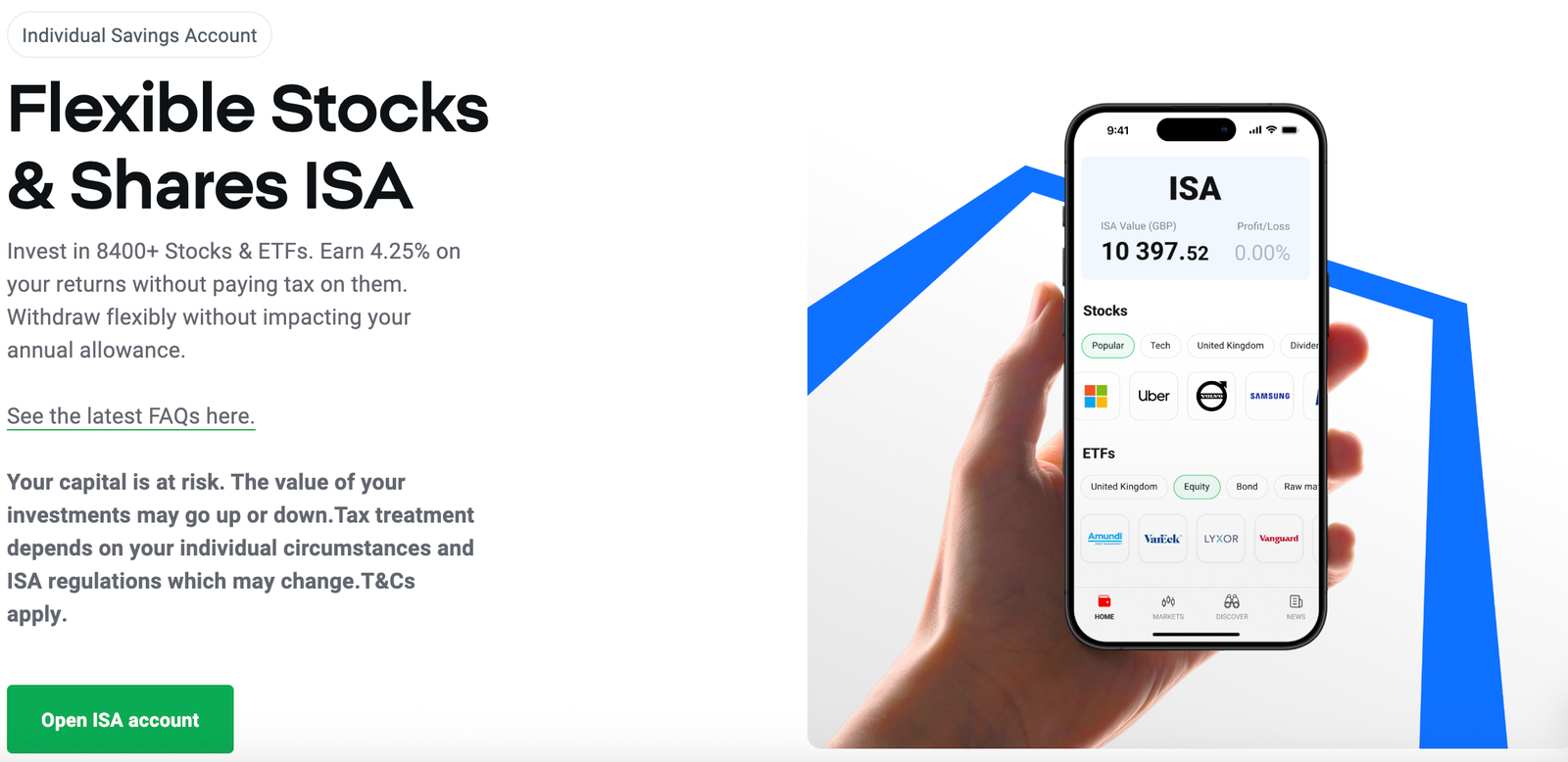

How does XTB’s ISA work for UK investors?

XTB’s Stocks and Shares ISA is free to open and maintain, with no trading fees, no platform fees, and no custody charges.

You can invest in thousands of global shares and ETFs with full UK tax efficiency. The only charges are FX fees and ETF fund provider fees.

| ISA pros | ISA cons |

|---|---|

| £0 fees on trades and account maintenance | Must be opened via the mobile app |

| Access to 6,600+ shares and 1,800+ ETFs | Interface mixes CFDs and shares, which may confuse beginners |

| 4.25% interest on uninvested GBP cash | No Lifetime ISA or Junior ISA |

| Eligible for £20,000 yearly ISA allowance | |

For UK savers seeking a low-cost, tax-efficient investing account, XTB’s ISA is one of the best value options on the market.

Is XTB easy for beginners to use?

XTB offers an easy-to-use app, strong educational content, and account managers for guidance, making it suitable for beginners. However, the platform integrates CFDs alongside shares, which can be confusing, and its web platform is more complex than competitors like Trading 212.

For new investors, sticking to the mobile trading app and using the Investment Plans feature is the most beginner-friendly route.

How good is the XTB mobile app?

The XTB app is well-designed, fast, and easy to navigate. It offers real-time prices, thematic stock filters, in-app news, and charting tools.

Beginners can invest quickly using debit card deposits, while traders can monitor markets via watchlists, indicators and sentiment data.

| Mobile app highlights | Mobile app limitations |

|---|---|

| Real-time prices and charts | CFD products appear alongside stocks |

| Instant GBP deposits | Watchlist sync from desktop can lag |

| Watchlists and market sentiment | Charting tools are weaker than the web version |

| Built-in education | |

| Clear trade tickets |

What tools does the XTB web platform (xStation 5) offer?

XTB’s xStation 5 platform is powerful, feature-rich, and designed for active traders. It includes advanced charting, sentiment analysis, alerts, heat maps, and economic calendars.

However, it’s less beginner-friendly than other UK share dealing platforms.

Trading tools overview

| Tool | Available? | Notes |

|---|---|---|

| Advanced charting | ✔ | 39 indicators, drawing tools |

| Stock screener | ✔ | Filter by sector, fundamentals |

| Economic calendar | ✔ | Integrated with charts |

| Heat maps | ✔ | Colour-coded market moves |

| News & research | ✔ | Daily analysis and signals |

| Copy trading | ✘ | Not supported |

| MetaTrader | ✘ | Not supported |

XTB stands out for allowing up to 16 charts simultaneously, ideal for multi-asset traders.

How good are XTB’s education and research tools?

XTB offers one of the strongest education hubs in the UK, including tutorials, ebooks, trading courses, video lessons, and quick-start guides on how to start trading.

New account holders are assigned a dedicated account manager, which is rare among low-cost brokers.

Education features

- 200+ lessons in the Trading Academy

- Videos, webinars, ebooks

- Beginner, intermediate and advanced levels

- Premium research for active traders

- Daily market news and sentiment tools

This makes XTB a strong option for users wanting structured learning with practical guidance.

How easy is it to deposit and withdraw money on XTB?

Deposits and withdrawals on XTB are fast, simple and mostly free. Debit card deposits are instant, and bank transfers usually arrive the same day. Withdrawals above £50 are free, while smaller amounts incur a £5 fee.

Deposit and withdrawal options

| Method | Deposit | Withdrawal |

|---|---|---|

| Bank transfer | Free | Free |

| Debit card | Free | N/A |

| PayPal | Supported | Supported |

| E-wallets | Some regions only | Some regions |

There are no FX or transfer fees when adding or withdrawing GBP to/from the GBP wallet.

How good is XTB’s customer support?

XTB offers reliable customer support with fast response times, knowledgeable staff and multiple ways to get help. UK users can access in-app chat, email and phone support, and new customers benefit from a dedicated account manager. Support is strong overall, though not fully 24/7 and phone availability is limited outside market hours.

Key points:

- Fast responses through in-app chat

- Email and phone support available

- Dedicated account managers for onboarding

- Helpful education reduces support needs

- Not 24/7; phone support limited at off-peak times

What unique features does XTB offer UK users?

- Free ISA

- Investment Plans (automated ETF baskets)

- 4.25% interest on uninvested GBP

- Dedicated account manager

- Advanced research hub

- Multi-chart views

Is XTB good for UK traders overall?

XTB is an excellent option for UK investors wanting low fees, a free ISA, high interest on cash, and access to thousands of global shares and ETFs.

Its powerful trading tools and research also make it a top choice for active traders. However, the interface can be overwhelming for beginners, and the lack of a SIPP will deter retirement-focused investors.

XTB vs competitors (quick comparison)

XTB is one of the strongest all-round brokers for UK investors, offering low fees, a free ISA and powerful tools. It competes closely with Trading 212, Freetrade, IG and AJ Bell, but its mix of advanced features and low costs gives it an edge for serious investors and active traders.

Quick comparison table:

| Platform | Best for | Fees | ISA | Tools | Downsides |

|---|---|---|---|---|---|

| XTB | Low-cost global investors | £0 up to €100k | Free | Advanced charts/tools | No SIPP, complex UI |

| Trading 212 | Beginners | £0 | Free | Easy-to-use | Lighter research |

| Freetrade | Simple long-term investors | £0–£11.99 | £5.99/mo | Very easy | Limited global access |

| IG | Experienced traders | Low | Yes | Professional-grade | Higher learning curve |

| AJ Bell | Pension/long-term | 0.25% | Yes | Good for SIPPs | More expensive |

What are the limitations of XTB for UK users?

XTB offers excellent value, but it has limitations that may affect some UK investors. The lack of a SIPP and absence of mutual funds or bonds limit long-term diversification. The platform is also more complex than beginner-focused rivals, and placing CFDs alongside real shares can create confusion for new users.

Main limitations:

- No SIPP for retirement investing

- No mutual funds, bonds or investment trusts

- No real crypto and crypto CFDs not available to UK retail users

- Interface can overwhelm beginners

- ISA available only via mobile app

- £5 withdrawal fee under £50

- £10 inactivity fee after 12 months

Conclusion

XTB is a strong, low-cost option for UK investors who want access to global shares, ETFs and a free Stocks and Shares ISA.

Its FCA regulation, competitive pricing and advanced tools make it suitable for both active traders and long-term investors who value low fees and solid research.

While the platform can feel complex for beginners and lacks a SIPP or mutual funds, XTB’s combination of cost efficiency, investor protection and market coverage makes it one of the most compelling all-round brokers available in the UK today.

FAQs

Is XTB safe to use in the UK?

Yes, XTB is FCA-regulated and offers FSCS protection up to £85,000 per person. Client funds are segregated and handled under strict regulatory rules.

Does XTB charge trading fees?

Share and ETF trades are free up to €100,000 per month. Beyond that, XTB charges a 0.2% commission (min €10). FX fees, ETF provider fees, and stamp duty may apply.

What is the minimum deposit on XTB?

You can open an account with £0, but the minimum trade size for shares is £10.

Is XTB good for beginners?

Yes, if you stick to the app and ISA. The education hub is excellent, but beginners must avoid confusing CFDs with real shares.

Does XTB have a SIPP?

No. XTB offers a Stocks and Shares ISA and a General Investment Account, but not a SIPP.