Webull is a US-based trading platform that launched in the UK in 2023, offering low-cost access to US stocks and a limited range of UK shares and ETFs through a tiered subscription model.

During our hands-on testing, we used both the Webull mobile app and desktop platform to assess charting depth, execution flow, and account usability for UK users.

In this Webull review UK, we break down what UK users can actually trade, how FCA regulation applies, and whether Webull is genuinely suitable for UK traders after hands-on testing.

Quick verdict: How do we rate Webull for UK traders in 2026?

Overall rating: 3.9 / 5

Webull is a strong specialist platform for UK traders focused on actively trading US stocks at low cost with advanced charting tools. It is not designed for long-term UK investors, as it lacks ISAs and SIPPs, and only offers UK shares and ETFs through its paid subscription model. Overall, Webull scores well on fees, tools, and ease of use, but loses points for limited product range and tax inefficiency.

Score breakdown (UK)

| Category | Score (1–5) | Reason |

|---|---|---|

| Security & Trust | 4.5 | FCA-regulated UK entity, segregated client funds, FSCS protection up to £85,000 on cash. No major UK regulatory concerns. |

| Fees & Pricing | 4.5 | Very low trading fees (0.025%), no platform or inactivity fees. FX fee applies on every trade, which slightly reduces the score. |

| Features | 3.5 | Excellent charting, paper trading, and desktop tools, but extremely limited asset coverage for UK users. |

| Ease of Use | 4.0 | Account opening is fast and fully online. Platform is powerful but can feel cluttered for beginners. |

| Customer Support | 4.0 | Phone, email, and in-app chat available in the UK with generally responsive support. |

| Reputation | 3.0 | Well-known globally, but still new in the UK with mixed user reviews and a limited local track record. |

Webull at a glance

Key features

- Minimum deposit: £0

- Assets: US stocks + limited UK shares & ETFs (subscription-based)

- Fractional shares: Yes

- ISA/SIPP: No

- Trading fee: 0.025% per trade

- FX fee: 0.35% GBP to USD

- Platform fee: £0

- Demo account: Yes

- Extended hours trading: Yes

What are the pros and cons of using Webull?

Pros

- Very low trading fees for US stocks

- No platform or inactivity fees

- Advanced charting on mobile and desktop

- Fractional shares improve affordability

- Paper trading for strategy testing

Cons

- Limited UK shares and ETFs available via subscription

- No ISAs, SIPPs, or pensions

- FX fee applies to every trade

- Interface can overwhelm beginners

- Limited UK-specific education

Who is Webull best for?

- Active traders focused on US equities

- Users who want advanced charting tools

- Short-term traders avoiding UK taxes via allowances

- Investors trading smaller amounts using fractional shares

Who is Webull not ideal for?

- Long-term UK investors

- ISA or SIPP savers

- Investors wanting large range of UK, EU, or ETF exposure

- Simplicity-first beginners

Is Webull good for beginners?

Webull is partly suitable for beginners, but not ideal for complete first-time investors. The app is easy to open and use, offers demo trading and educational content, and supports fractional shares. However, the interface can feel crowded and there are no tax-efficient ISA options, which may confuse new UK investors.

Why beginners may like Webull

- £0 minimum deposit

- Paper trading with $1 million virtual funds

- Fractional US shares from $1

- Strong in-app education and news

- Minimum value for placing a trade on any UK share or ETF is £5.

Where beginners may struggle

- Busy interface with advanced tools

- Limited UK shares and ETFs unless subscribed to Webull Meridian

- No Stocks and Shares ISA or SIPP

Is Webull good for day traders and active traders?

Webull is well-suited to active traders and short-term investors who focus on US equities. It offers extended-hours trading, advanced charting, low percentage-based fees, and a robust desktop platform designed for analysis-heavy trading styles.

Trading style suitability

Day trading: Best suited due to low percentage-based fees, extended-hours trading, fast execution, and advanced charting on desktop and mobile.

Swing trading: Strong tools for technical analysis and research, but limited asset coverage and unavoidable FX fees reduce flexibility.

Long-term investing: Not well suited due to the lack of ISAs or SIPPs, a strong US focus, limited UK assets via subscription, and ongoing FX costs that compound over time.

How regulated and trustworthy is Webull in the UK?

Webull is authorised and regulated by the Financial Conduct Authority (FCA) through Webull Securities (UK) Limited. Client funds are held in segregated accounts and are protected by the FSCS up to £85,000 if the firm fails.

Important: FSCS protection does not cover investment losses. Your capital is always at risk when trading shares.

What assets can you trade on Webull?

| Asset type | Webull Go (free) | Webull Meridian (paid) | Notes |

|---|---|---|---|

| UK stocks | Limited | Full range | Go includes FTSE 100 stocks only. Meridian unlocks wider UK share coverage. |

| UK-listed ETFs | Limited | Wider access | Go includes a curated list of ~20 popular UK ETFs. Meridian expands ETF access. |

| US stocks | Yes | Yes | Fractional shares supported on both tiers. |

| US ETFs | No | No | Not available to UK retail users. |

| Options | No | No | Options trading not enabled in the UK. |

| CFDs | No | No | Not offered by Webull UK. |

| Forex | No | No | FX only applies to currency conversion. |

| Crypto | No | No | Not supported in the UK. |

| ISA / SIPP | No | No | No tax-efficient accounts on any tier. |

Webull now offers access to some UK-listed ETFs, but the range remains limited and the platform does not support ISAs or long-term ETF investing features. It is still better suited to active trading than passive ETF portfolios.

What fees does Webull charge UK users?

Webull’s fees are low but not zero.

Trading fees

- Share trading: 0.025% per trade

- Example: $6,000 trade ≈ $1.50 fee

FX fees

- GBP to USD: 0.35%

- Lower than many UK brokers but unavoidable

Other fees

- Platform fee: £0

- Inactivity fee: £0

- Withdrawal fee: £0

What account types does Webull offer UK users?

Webull only offers one account type in the UK.

| Account type | Available |

|---|---|

| General Investment Account (GIA) | Yes |

| Stocks and Shares ISA | No |

| SIPP | No |

| Junior accounts | No |

This means capital gains and dividends may be taxable.

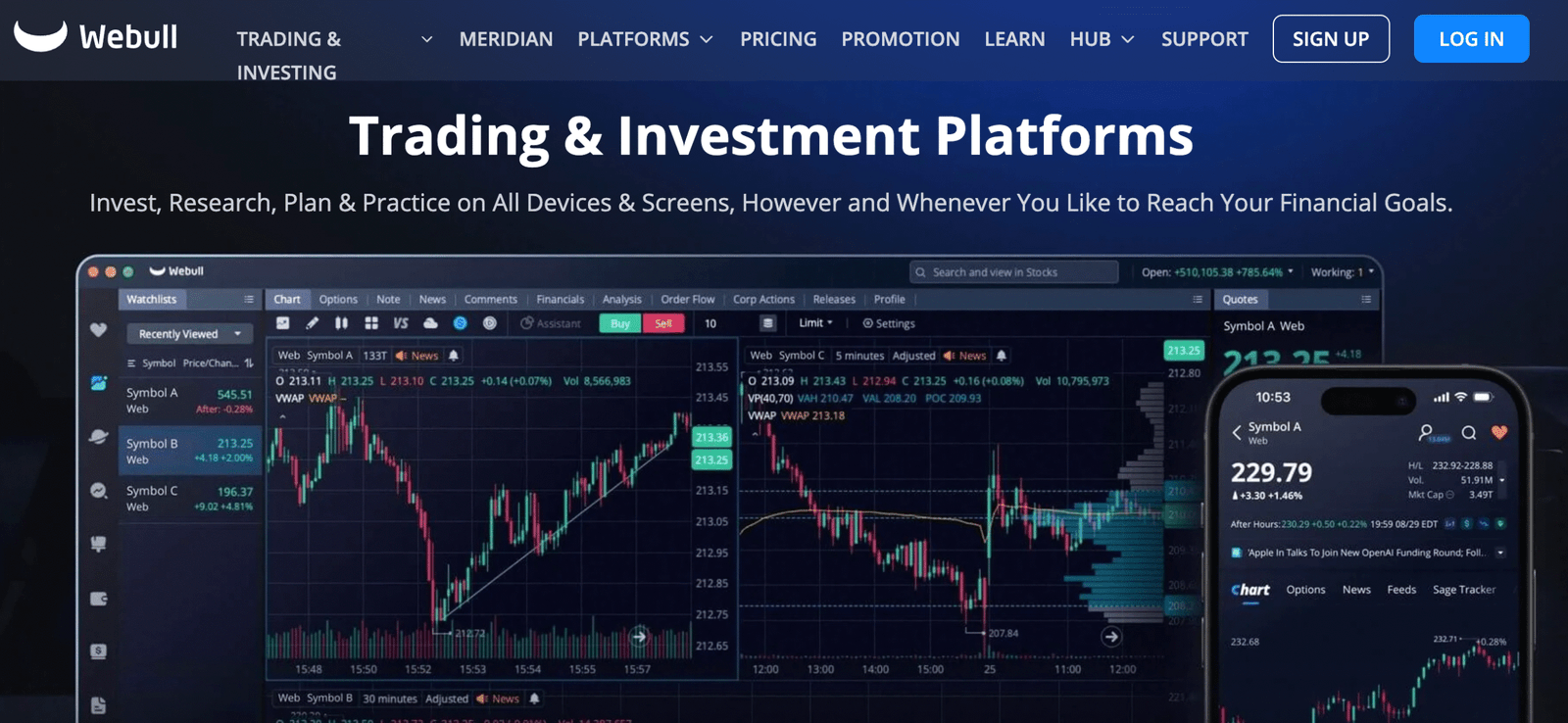

How good is Webull’s trading platform and mobile app?

During our testing, Webull’s platform stood out for its depth of charting tools, particularly on desktop, where multi-chart layouts and technical indicators are more advanced than many UK investing apps.

Mobile app highlights

- Live US pricing

- Sector heatmaps

- Up to 3 stocks per comparison chart

- News and educational feeds

- Landscape chart mode

Desktop platform

- Multi-chart layouts up to 4 charts

- 12 indicators and 17 drawing tools

- Analyst ratings and financials

- Demo trading supported

Downside: Web platform search and chart comparison tools feel limited.

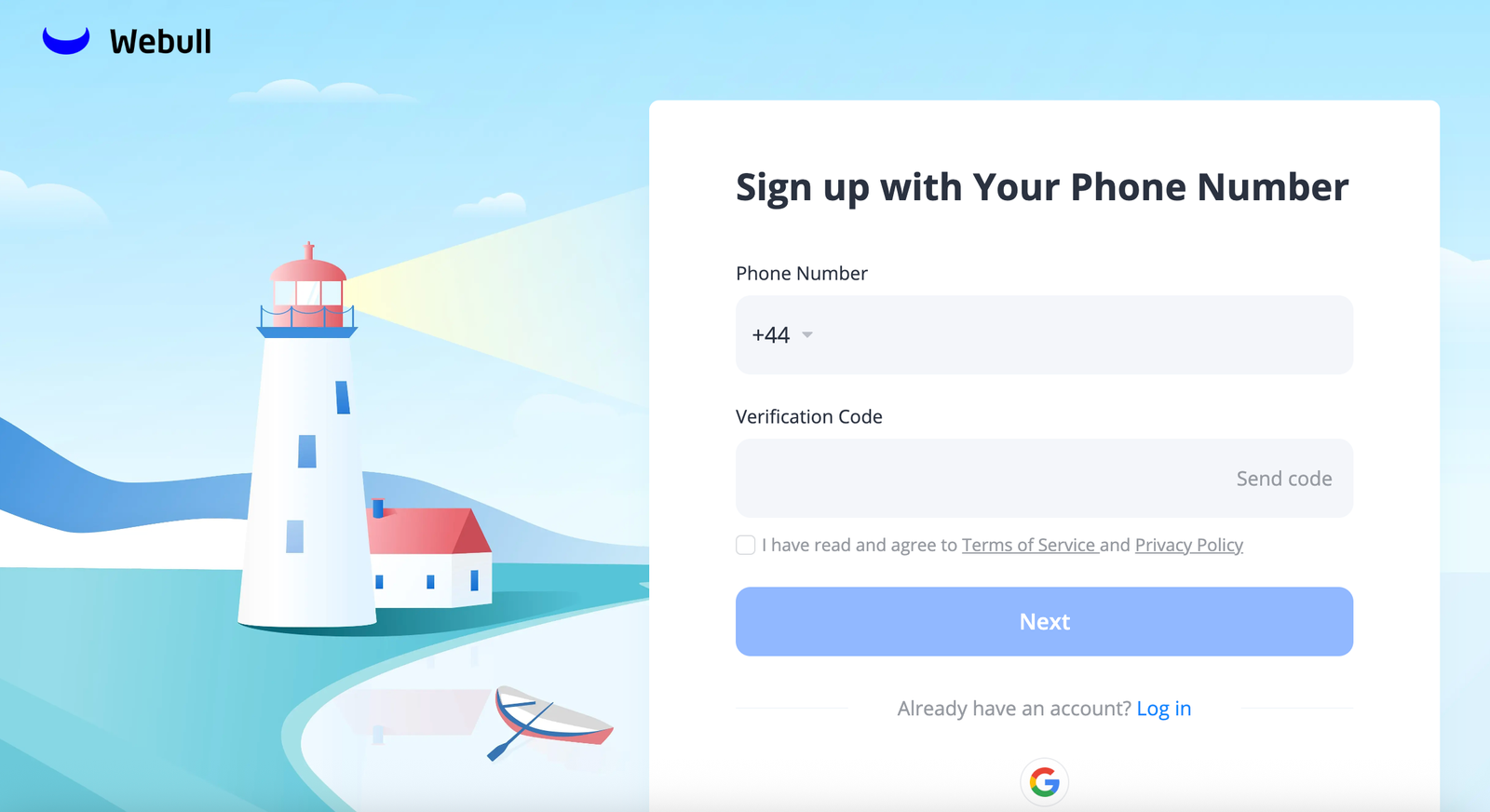

How easy is it to open an account and start trading?

Opening a Webull account is fully online and usually completed within one day. The process includes identity verification and a W-8BEN tax form for US shares.

Account opening steps

- Register via app or website

- Upload ID and proof of address

- Complete tax declaration

- Set trading password

- Deposit funds and trade

How do deposits and withdrawals work?

Webull supports UK bank transfers with no fees.

| Feature | Details |

|---|---|

| Minimum deposit | £0 |

| Deposit fee | £0 |

| Withdrawal fee | £0 |

| Processing time | 1–3 working days |

| Currency | GBP |

Deposits and withdrawals are made in GBP only. Withdrawals can be requested once trades have settled, typically on the morning of settlement

Note: GBP deposits are automatically converted to USD with a 0.35% FX fee.

What unique features does Webull offer to UK users?

Paper trading

Practice with $1 million virtual funds before risking real money.

Advanced charting

Better technical tools than Robinhood, Revolut, or XTB for US stocks.

Webull Savings

Access FSCS-protected savings accounts from UK banks via the app.

How good is Webull customer support?

Webull offers solid UK-based support with multiple channels.

| Channel | Available |

|---|---|

| Phone | Yes |

| Yes | |

| In-app chat | Yes |

Response times are generally fast, though user reviews are mixed.

Webull vs competitors (UK comparison)

| Feature | Webull | Trading 212 | Interactive Brokers |

|---|---|---|---|

| Minimum deposit | £0 | £0 | £0 |

| Stocks & Shares ISA | No | Yes | No |

| US stocks | Yes | Yes | Yes |

| UK shares | Limited (subscription-based) | Yes | Yes |

| Trading fees | Low (0.025% per trade) | £0 commission | Low, tiered |

| FX fee | 0.35% | ~0.15% | ~0.002%–0.03% |

| Platform depth | High | Medium | Very high |

| Best for | US stock traders | ISA investors | Advanced traders |

How is Webull taxed in the UK?

Profits made on Webull are taxable for UK users because the platform does not offer ISAs or SIPPs. Capital gains tax may apply once you exceed your annual CGT allowance, and dividends from US stocks are subject to a 15% US withholding tax after completing a W-8BEN form, with UK dividend tax potentially due as well.

What changed recently on Webull UK?

Since launching in the UK in 2023, Webull has expanded beyond US stocks to include limited UK shares and ETFs through a tiered subscription model. The free Webull Go plan includes FTSE 100 stocks and a small ETF selection, while the paid Webull Meridian plan unlocks broader UK market access, though ISAs and SIPPs are still not available.

How good are Webull’s education tools?

Webull’s education tools are above average but not UK-focused. The platform offers guides, tutorials, and in-platform lessons that explain trading concepts and how to use Webull’s tools. However, much of the content is adapted from the US site, which limits relevance for UK investors.

What Webull does well

- In-platform Learning Centre explaining platform features

- Educational articles and market news inside the app

- Strong stock research data, including analyst ratings and financials

- Paper trading (demo account) with $1 million virtual funds for practice

Where Webull falls short

- Education is not tailored to UK rules or tax treatment

- Limited beginner walkthroughs for first-time investors

- No live webinars or structured courses for UK users

What are Webull’s main limitations?

Webull’s main limitations for UK users are the absence of ISAs and SIPPs, subscription-gated access to UK shares and ETFs, and a strong focus on US stocks over long-term investing. FX fees also apply when trading US shares.

Key limitations

- No Stocks & Shares ISA or SIPP

- UK shares and ETFs limited by subscription tier

- 0.35% FX fee on US trades

- Platform geared toward active traders, not beginners

- No options, CFDs, forex, or crypto for UK users

Is Webull worth using in the UK in 2026?

Webull is a legitimate, FCA-regulated trading platform that offers UK users low-cost access to US stocks with strong charting tools and a powerful desktop platform. It stands out for active and short-term traders who value analysis, fractional shares, and extended-hours trading over simplicity or tax efficiency.

However, Webull’s US-focused asset range, mandatory FX fees, and lack of ISAs or SIPPs make it a poor fit for long-term UK investors or anyone building a tax-efficient portfolio. Profits and dividends are taxable, and investors looking for ETFs, UK shares, or retirement accounts will find the platform restrictive.

As always, your capital is at risk, and Webull is best used as a specialist US-equities trading platform, not an all-in-one UK investing solution.

FAQs

Is Webull available in the UK?

Yes, Webull is available in the UK through Webull Securities (UK) Limited, which launched in 2023. UK residents can open an account online and trade using the mobile app or desktop platform, subject to UK regulatory rules.

Is Webull regulated and safe to use in the UK?

Yes, Webull is authorised and regulated by the Financial Conduct Authority (FCA). Client cash is held in segregated accounts and protected by the FSCS up to £85,000, although investment losses are not covered.

Does Webull offer a Stocks and Shares ISA or SIPP?

No, Webull does not offer a Stocks and Shares ISA or SIPP. All UK users trade through a General Investment Account, meaning capital gains and dividends may be taxable.

What can UK users trade on Webull?

UK users can trade US stocks and a limited range of UK shares and ETFs, with broader access available through the paid Webull Meridian subscription. Webull does not offer options, CFDs, forex, or crypto in the UK.

Is Webull commission-free in the UK?

No, Webull is not commission-free for UK users. It charges 0.025% per trade on shares, plus a 0.35% FX fee when converting GBP to USD for US stock trades.

Do you actually own the shares you buy on Webull?

Yes, when you buy shares on Webull UK, you own the underlying shares, not derivatives. Shares are held in custody on your behalf, and you are entitled to dividends and corporate actions.

What is Webull Meridian?

Webull Meridian is Webull’s paid UK subscription that unlocks broader access to UK shares and ETFs compared to the free Webull Go plan, which only includes FTSE 100 stocks and a small ETF selection.