Trading 212 is a popular UK trading app known for commission-free investing in shares, ETFs, and ISAs.

In this Trading 212 review UK 2026, we break down fees, FCA regulation, safety, and who the platform is best for.

You will quickly see whether Trading 212 is worth using for beginners and long-term investors in the UK.

Quick verdict: How do we rate Trading 212 for UK traders in 2026?

Overall rating: 4.3 out of 5

Trading 212 scores highly for UK traders thanks to zero-commission investing, strong FCA regulation, and an easy-to-use mobile app. It is especially well-suited to beginners and long-term investors using an ISA, though advanced traders may find tools and support more limited compared with premium brokers.

Full score breakdown

| Category | Score | Summary |

|---|---|---|

| Security & Trust | 4.5 | FCA-authorised broker with segregated client funds. No FSCS protection on investments. |

| Fees & Pricing | 5.0 | Commission-free trading on shares and ETFs. FX fees apply on conversions. |

| Features | 4.0 | Invest and ISA accounts, fractional shares, ETFs. Limited advanced tools. |

| Ease of Use | 4.5 | Clean, intuitive app ideal for beginners and casual investors. |

| Customer Support | 3.5 | Email and in-app support only. No phone support. |

| Reputation | 4.0 | Strong UK user base and brand trust, occasional complaints during volatility. |

Best for: Beginners, ISA investors, and low-cost long-term investing.

Is Trading 212 good for beginners?

Yes, Trading 212 is good for beginners, especially UK users who want a simple, low-cost way to start investing. The platform focuses on ease of use, commission-free trading, and small minimum investments, but it does not offer deep education or advanced support, so beginners must still be willing to learn independently.

Beginner friendliness

Trading 212 is clearly beginner-friendly. The app is clean, intuitive, and mobile-first, with plain-English labels and minimal clutter.

You can start investing from £1, open a free Stocks and Shares ISA, and avoid confusing fee structures, which removes many early barriers for new investors.

Compared with beginner-first platforms like Freetrade or InvestEngine, Trading 212 is stronger on features such as AutoInvest, Pies, and a free ISA with no monthly fee.

However, platforms like InvestEngine offer clearer ETF-focused guidance, while some robo-advisors provide more hand-holding through ready-made portfolios and risk profiling.

What are the pros and cons of using Trading 212?

Trading 212 offers excellent value for UK investors who want commission-free investing and a simple app-based experience, but it has clear limitations for advanced traders. Its strengths lie in low costs and ease of use, while its weaknesses show up in research depth, support options, and advanced trading tools.

| Category | Pros | Cons |

|---|---|---|

| Fees | £0 commission on shares and ETFs in Invest and ISA accounts | 0.15% FX conversion fee on non-GBP trades |

| Account costs | Free Stocks and Shares ISA with no platform or custody fees | No alternative tax wrappers such as a SIPP |

| Accessibility | Very low £1 minimum investment, suitable for beginners | Limited suitability for advanced or professional traders |

| Investing features | Fractional shares and AutoInvest Pies support hands-off investing | No access to bonds, mutual funds, or options |

| Platform | Clean, intuitive mobile and web platforms | Basic charting compared with professional platforms |

| Research & tools | Simple, uncluttered interface | No in-depth research, analysis, or analyst reports |

| Customer support | In-app chat and email support available | No phone support |

| Regulation & safety | FCA regulated with client money segregation and FSCS protection for eligible claims | CFD trading involves high risk and wider spreads than specialist brokers |

How regulated and trustworthy is Trading 212 in the UK?

Trading 212 is regulated and generally trustworthy for UK investors because it is authorised by the Financial Conduct Authority and must follow strict client protection rules. UK users benefit from regulatory oversight, segregated client funds, and FSCS protection, although investment losses from the market are not covered.

Is Trading 212 FCA-regulated in the UK?

Yes. Trading 212 UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA). FCA regulation requires the platform to meet capital requirements, follow strict conduct rules, and undergo regular compliance checks, which significantly reduces counterparty and operational risk for UK investors.

How is your money protected at Trading 212?

Client money is held in segregated accounts, meaning it is kept separate from Trading 212’s own funds. If the firm fails, eligible UK clients are covered by the Financial Services Compensation Scheme (FSCS) up to £120,000, but this does not protect against losses caused by market movements.

Does Trading 212 have a strong track record?

Trading 212 has been operating since 2004 and has grown into one of the largest retail investment platforms in the UK and Europe. It serves millions of funded accounts and manages substantial client assets, with no history of major FCA enforcement actions or systemic security breaches.

What markets and assets can you trade on Trading 212?

Trading 212 offers a focused range of markets aimed at UK beginners and long-term investors, covering shares, ETFs, and CFD-based trading across major global markets. The platform prioritises simplicity and low costs over complex instruments, making it best suited to straightforward, self-directed investing.

Shares and ETFs (UK and global markets)

UK users can invest in thousands of real shares and ETFs across the UK, US, and Europe.

- UK markets: London Stock Exchange main market and AIM

- Global access: US and European exchanges

- Fractional shares: Invest from £1 on eligible stocks and ETFs

- ETF coverage: Broad range of equity, bond, and thematic ETFs

This makes Trading 212 well suited to beginners building diversified, low-cost portfolios.

CFDs and leveraged trading products

Trading 212 also offers CFDs, which are higher-risk and designed for experienced traders.

- CFDs available on: Shares, indices, forex, commodities, and crypto

- Leverage: Available within FCA retail limits

- Risk note: Most retail investors lose money trading CFDs, and these products are not suitable for beginners.

CFD spreads are wider than specialist trading platforms, reducing their appeal for active traders.

Crypto exposure availability and limitations

Trading 212 provides crypto exposure via CFDs only, not direct ownership.

- No crypto wallets or withdrawals

- Positions track price movements only

- Crypto trading is not FSCS-protected and carries high volatility risk

This keeps crypto access simple but limits flexibility compared with dedicated crypto exchanges.

Assets not available on Trading 212

Trading 212 does not support several common investment products.

- No options or futures

- No bonds or gilts

- No mutual funds or OEICs

- No SIPP or pension accounts

This narrower range helps reduce complexity but may limit more advanced portfolio strategies.

How much does Trading 212 cost to use?

Trading 212 is largely free to use for UK investors, with £0 commission on shares and ETFs and no platform, custody, or inactivity fees. For most long-term investors using an ISA or Invest account, costs are minimal and easy to understand.

Main costs to be aware of:

- Trading commission: £0 on UK and international shares and ETFs

- ISA fee: £0

- Platform and custody fees: £0

- FX conversion fee: 0.15% on non-GBP trades, charged on buy and sell

- CFDs: Spread-based pricing plus overnight financing

How good is Trading 212’s trading platform and mobile app?

| Area | Rating | Summary |

|---|---|---|

| Overall usability | Excellent | Clean, intuitive design that is easy to navigate for beginners and long-term investors |

| Mobile app | Excellent | Fast, reliable app with biometric login, price alerts, fractional shares, and full Pie and AutoInvest support |

| Web platform | Good | Mirrors the mobile app well but offers limited customisation and no desktop software |

| Charting tools | Basic | Standard indicators and timeframes only, not suitable for technical or active traders |

| Order types | Basic | Market, limit, and stop orders available, no advanced or algorithmic orders |

| Speed & reliability | Good | Generally stable, with occasional slowdowns during extreme market volatility |

| Comparison to rivals | Strong for beginners | More feature-rich than Freetrade, but far less advanced than IG or Interactive Brokers |

| Best suited for | Beginners | Ideal for UK beginners and long-term, low-cost investing rather than active trading |

How easy is it to open an account and start trading?

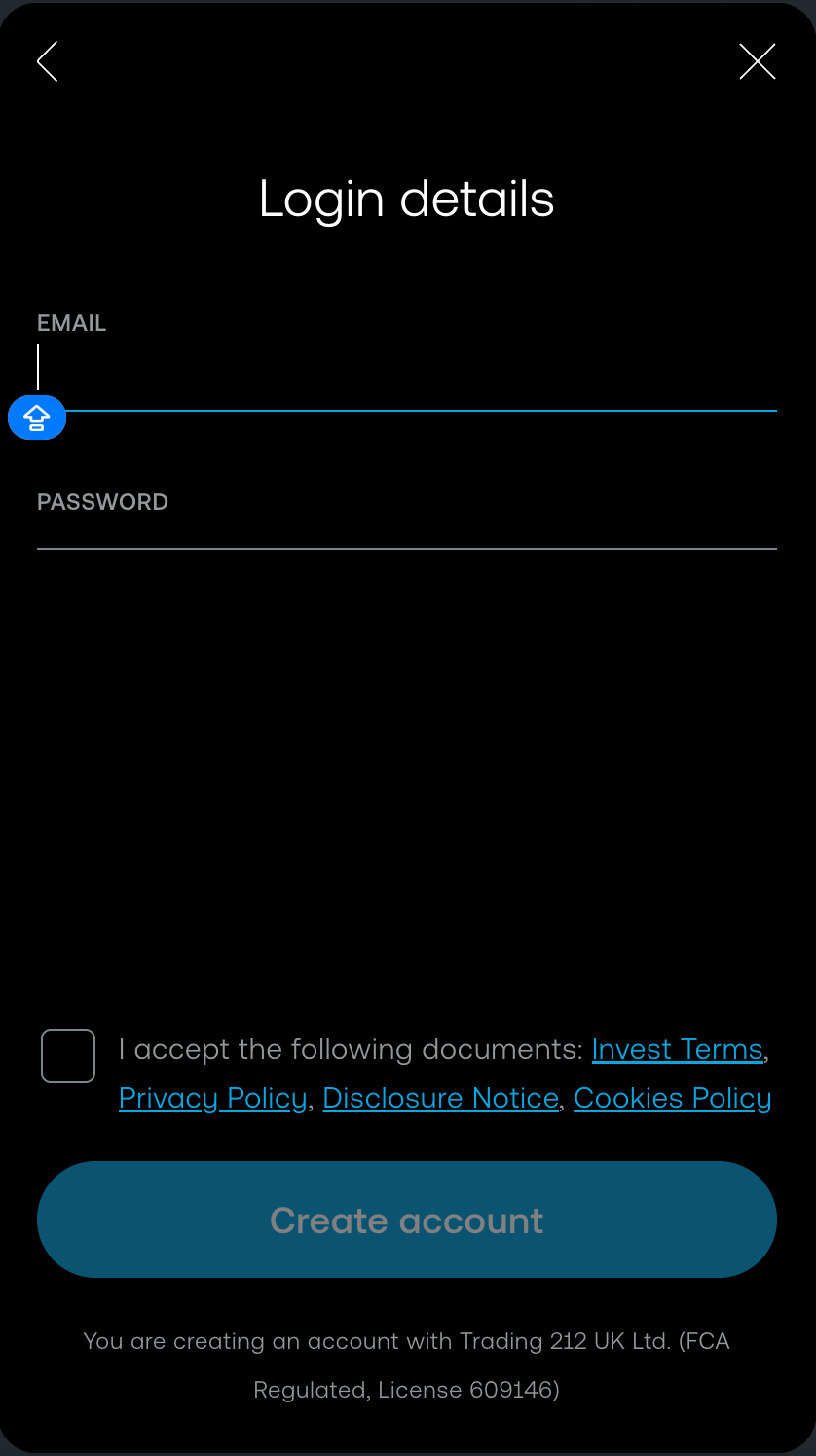

Opening an account with Trading 212 is quick and beginner-friendly, with a fully online process that most UK users can complete in under 10 minutes. There is no paperwork, low minimum funding, and many accounts are approved almost instantly.

How long does it take to open an account?

- Sign-up usually takes 5–10 minutes via the mobile app or web platform

- Many UK accounts are approved instantly

- Some applications require manual checks and are approved within 24 hours

What KYC checks are required?

- Proof of identity: passport or UK driving licence

- Identity verification: selfie or live facial check via the app

- Tax information: UK tax residency and National Insurance number

These checks are required under UK anti-money laundering rules.

What is the minimum deposit and are there approval delays?

- Minimum deposit: £1 for Invest and ISA accounts, £10 for CFD accounts

- Approval delays: Rare, but may occur if documents are unclear or details do not match

- Most delays are resolved within one business day

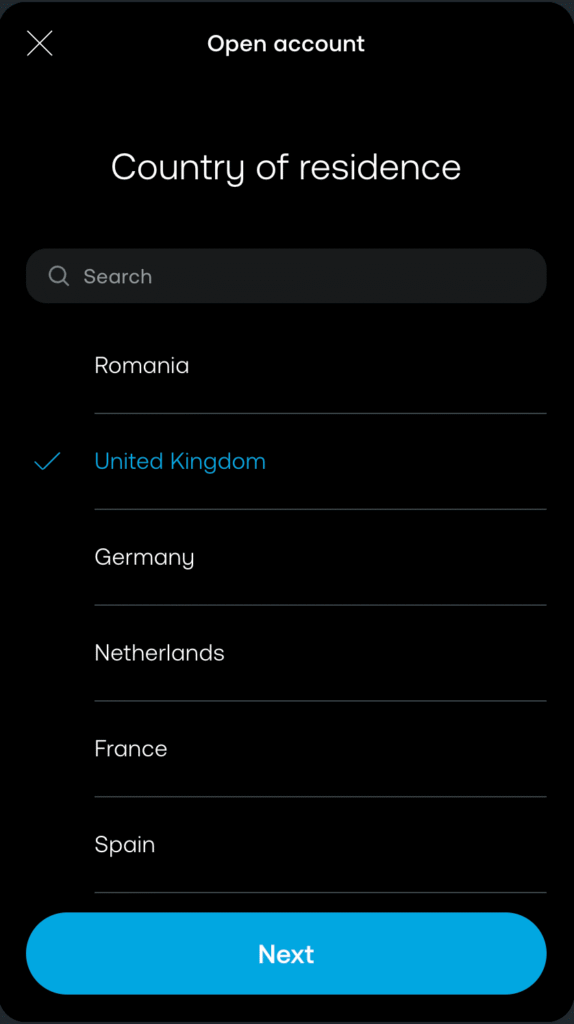

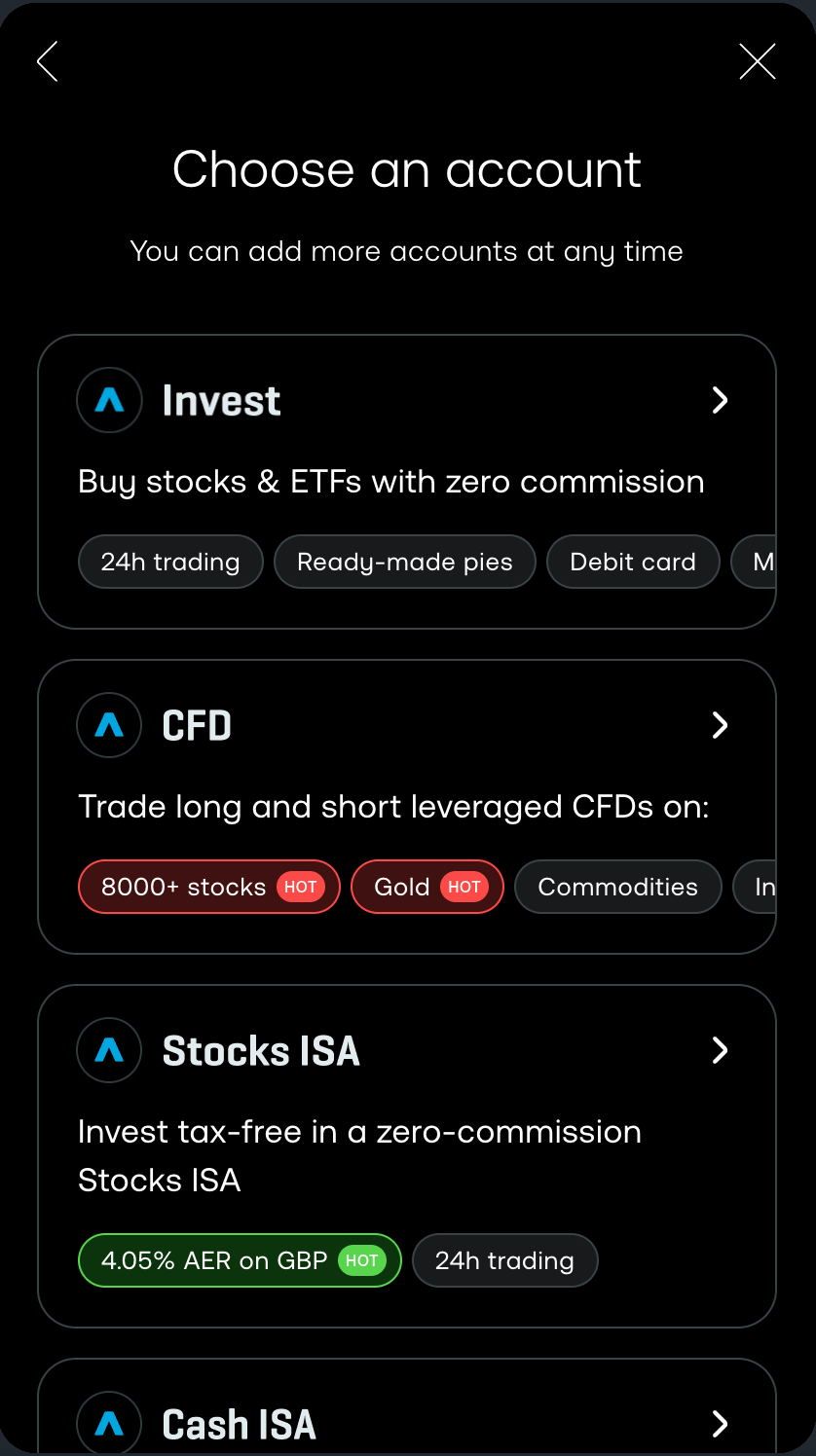

Account opening steps

- Register: Create an account using your email address and confirm your UK residency.

- Verify ID: Upload a passport or driving licence and complete a quick selfie check for KYC.

- Choose account: Select Invest, Stocks and Shares ISA, or CFD (ISA or Invest is best for most users).

- Deposit: Fund your account via bank transfer, debit card, Apple Pay, or Google Pay.

- Start trading: Search for shares or ETFs, place your first trade, or set up an AutoInvest Pie.

How do deposits and withdrawals work?

| Feature | Deposits | Withdrawls |

|---|---|---|

| Supported methods | Bank transfer, debit card, Apple Pay, Google Pay | Bank transfer or original funding method |

| Processing time | Instant for cards and wallets, 1–2 business days for bank transfer | Usually 1–2 business days |

| Fees | Free (card deposits free up to £2,000, then 0.7%) | Free |

| Minimum amount | No minimum | No minimum |

| Currency support | GBP and multiple foreign currencies | Same currency as deposit |

| Account name rule | Must be in your own name | Must be to an account in your own name |

| Availability | 24/7 deposits via app | Requests processed on business days |

| Notes | Faster Payments supported for UK users | Withdrawals returned to original method first |

Is Trading 212 right for your trading style?

| Trading style | Suitability | Reason |

|---|---|---|

| Scalping | ★★☆☆☆ | Fast execution is possible, but basic charting, limited order types, and wider CFD spreads make Trading 212 less suitable for frequent, short-term trades. |

| Day trading | ★★★☆☆ | Works for simple day trading, but lacks advanced tools, direct market access, and professional charting needed by active traders. |

| Long-term investing | ★★★★★ | Excellent choice for buy-and-hold investors thanks to £0 commission, a free Stocks and Shares ISA, fractional shares, and AutoInvest Pies. |

| Passive investing | ★★★★★ | AutoInvest and Pies make regular, hands-off investing easy with no platform or management fees. |

| Beginners | ★★★★★ | Very low £1 minimum, intuitive app, demo account, and simple fee structure make it ideal for first-time investors. |

What unique features does Trading 212 offer?

Trading 212 stands out in the UK market by combining genuinely commission-free investing with automation tools that are still uncommon among UK brokers. Its unique appeal lies in making long-term, hands-off investing accessible without adding extra fees or complexity.

| Feature | What makes it unique in the UK |

|---|---|

| AutoInvest and Pies | Automated portfolios with custom allocations and one-tap rebalancing, offered with no management or platform fees, which is rare among UK brokers |

| Fractional shares from £1 | Allows investment in high-priced UK and US stocks with very small amounts, lowering the barrier to diversification |

| Free Stocks and Shares ISA | No dealing fees, custody charges, or monthly ISA fees, unlike many UK competitors |

| Interest on uninvested cash | Pays interest on idle cash in Invest and ISA accounts, helping reduce cash drag, a feature only a few UK platforms offer |

| Multi-currency accounts | Lets users hold and manage multiple currencies to reduce repeated FX conversions when investing overseas |

| Demo account | Built-in practice account using virtual funds, allowing beginners to learn without risking real money |

How good is Trading 212 customer support?

Trading 212’s customer support is adequate but not a standout, offering reliable help through digital channels while lacking phone-based support for urgent issues.

| Support channel | Availability | Typical response time | Notes |

|---|---|---|---|

| In-app chat | Yes | 2–24 hours | Primary support method, generally helpful but slower during high volatility |

| Email support | Yes | 24 hours | Suitable for non-urgent queries and account issues |

| Phone support | No | N/A | Not available, which may frustrate some users |

| Help centre / FAQs | Yes | Instant | Covers common issues but limited depth for advanced topics |

Trading 212 vs competitors (UK comparison)

| Feature | Trading 212 | Freetrade | InvestEngine |

|---|---|---|---|

| FCA regulated | Yes | Yes | Yes |

| Commission on shares & ETFs | £0 | £0 | £0 |

| Stocks and Shares ISA | Yes, free | Yes, £4.99 per month (Standard) | Yes, free |

| Minimum investment | £1 | £2 | £1 |

| Fractional shares | Yes | Yes (limited) | No |

| Automated investing | Yes (AutoInvest & Pies) | No | Yes (ETF portfolios only) |

| Interest on uninvested cash | Yes | No | No |

| FX fee on overseas trades | 0.15% | 0.45% | 0% (ETFs only) |

| Asset range | Shares, ETFs, CFDs | Shares, ETFs | ETFs only |

| Mobile app quality | Excellent | Good | Good |

| Best for | Beginners and long-term investors | Simple investing with curated stocks | Hands-off ETF investing |

What are the main limitations of Trading 212?

- Limited research tools with no in-depth market analysis or analyst reports.

- Basic charting and technical indicators compared with professional trading platforms.

- No phone support, only in-app chat and email.

- Narrow asset range with no options, bonds, mutual funds, or futures.

- FX conversion fee of 0.15% on non-GBP trades, charged on buy and sell.

- CFD trading carries high risk, with wider spreads than specialist brokers.

- Not suitable for active day traders or advanced technical traders.

Conclusion: Is Trading 212 the right choice for UK investors?

Trading 212 is one of the best trading platforms in the UK for beginners and long-term investors who want £0 commission investing, a free Stocks and Shares ISA, and an app that is genuinely easy to use.

Its AutoInvest Pies, fractional shares, and low minimums make it especially strong for hands-off, cost-conscious investing.

That said, it is not for everyone. If you need advanced tools, options, or professional-grade execution, Interactive Brokers is a better choice for active and international traders.

If you want simple ETF-only portfolios with no stock picking, InvestEngine is a strong alternative. For users who value curated stock lists and simplicity over automation, Freetrade can also make sense.

FAQs

Is Trading 212 suitable for beginners?

Yes. Trading 212 is ideal for beginners due to its simple app, £1 minimum investment, £0 commission, and free Stocks and Shares ISA.

How does Trading 212 compare with eToro?

Trading 212 is cheaper for UK investors and better for ISA investing, while eToro is stronger for social trading and CFDs but has higher FX fees.

Can you trade forex and CFDs on Trading 212?

Yes. Trading 212 offers forex and CFDs, but these are high risk and not suitable for most beginners.

Does Trading 212 pay interest on cash?

Yes. Trading 212 pays interest on uninvested cash in Invest and ISA accounts, excluding CFD balances.