Saxo is a well-established global trading platform offering UK investors access to shares, ETFs, CFDs, forex, and bonds through advanced web and mobile platforms.

In this Saxo Review UK 2026, we break down trading costs, platform features, FCA regulation, and key risks so you can quickly decide whether Saxo is right for your investing or trading style.

Is Saxo good for beginners?

Saxo is not ideal for beginners, despite having no minimum deposit and offering a demo account. Its platforms are designed for experienced investors, with advanced tools, complex layouts, and a fee structure that can feel expensive for small portfolios. Most first-time UK investors will find simpler, lower-cost platforms easier to start with. Beginners should consider looking at platforms like eToro or Trading 212 instead.

Quick verdict: How do we rate Saxo for UK traders in 2026?

Overall rating: 4.3 / 5

Saxo is a high-quality, FCA-regulated trading platform that excels in security, market access, and professional-grade tools. It scores particularly well for trust, features, and reputation, making it one of the strongest options for experienced UK traders and investors. However, higher fees for small portfolios and a steeper learning curve prevent it from achieving a perfect score.

Full score breakdown

| Category | Score (1–5) | Reason |

|---|---|---|

| Security & Trust | 5.0 | FCA-regulated, bank-backed, long track record, FSCS protection up to £85,000 |

| Fees & Pricing | 3.5 | Transparent but percentage-based fees and custody charges disadvantage small portfolios |

| Features | 5.0 | Exceptional asset range, global markets, advanced order types, strong research |

| Ease of Use | 3.5 | Powerful platforms but complex for beginners, learning curve required |

| Customer Support | 4.0 | Knowledgeable support, stronger service for Platinum and VIP clients |

| Reputation | 5.0 | Well-established global brand, consistently top-rated by industry reviewers |

Key features

- FCA regulated UK broker backed by Saxo Bank

- No minimum deposit for standard UK accounts

- Access to 23,500+ shares across 50 global exchanges

- Trade ETFs, bonds, mutual funds, forex, CFDs, futures, options, and crypto ETNs

- Stocks and Shares ISA and SIPP available for UK investors

- Advanced platforms: SaxoTraderGO, SaxoTraderPRO, and SaxoInvestor

- Tiered pricing model: Classic, Platinum (£200k+), VIP (£1m+)

- Strong research and education including Dow Jones news and in-house analysis

- FSCS protection up to £85,000 for eligible UK clients

- Demo account available for practice

What are the pros and cons of using Saxo?

Pros

- Excellent web and mobile trading platforms

- One of the widest investment ranges of any UK broker

- Strong FCA regulation and bank-level security

- Offers ISA and SIPP, unlike many global brokers

- High-quality research, webinars, and education

- Competitive pricing for large and active portfolios

Cons

- Higher fees for small or casual investors

- Percentage-based commissions can become expensive

- Platform complexity creates a steep learning curve

- FX conversion costs higher on smaller balances

- Account verification can be slow at busy times

Who is Saxo ideal for?

- Experienced traders who want advanced tools and execution

- High-net-worth investors who benefit from lower Platinum or VIP fees

- UK investors seeking global diversification beyond US and UK markets

- Active traders who value research, analytics, and customisation

- Long-term investors using ISAs or SIPPs with large balances

Who Saxo is not ideal for?

- Beginners looking for a simple, low-cost investing app

- Casual investors with small portfolios

- Users who prefer flat-fee pricing

- Investors wanting ready-made portfolios or copy trading

- Those prioritising simplicity over depth

How safe and trustworthy is Saxo?

Saxo is authorised and regulated by the FCA and operates as a licensed bank. Client funds are segregated, and eligible UK clients are protected by the FSCS up to £85,000.

The platform has a long operating history and is considered one of the most secure brokers available to UK investors.

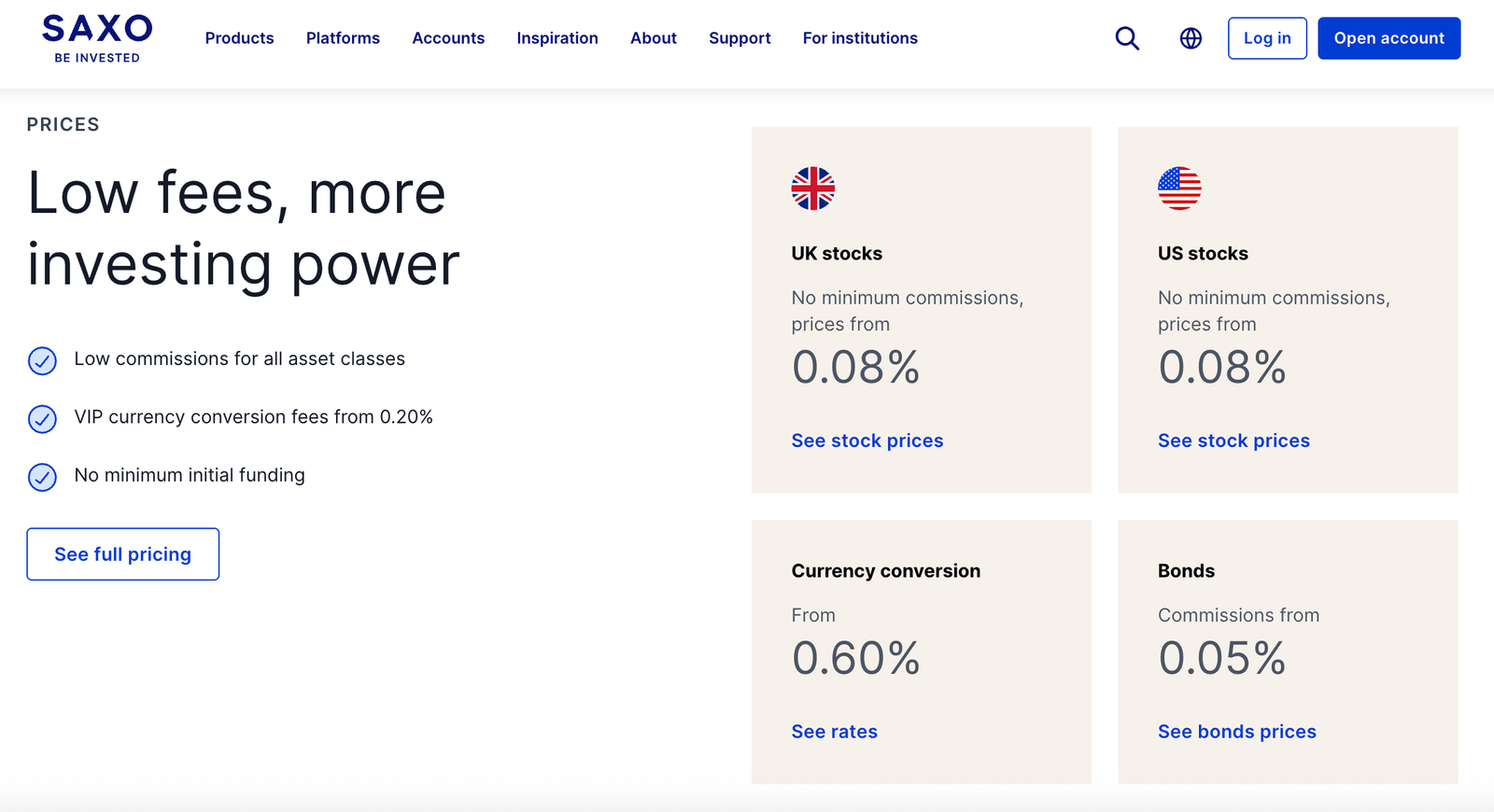

What are the fees and trading costs on Saxo?

Saxo uses a tiered, percentage-based pricing model that rewards larger portfolios and higher activity levels. Costs are transparent but can be more expensive for smaller investors compared with flat-fee UK trading platforms. There are no inactivity fees, but custody and FX charges are important to understand.

Share and ETF trading fees

Saxo removed minimum commission charges for shares and ETFs, so you only pay a percentage of the trade value.

- Classic account: 0.08% per trade

- Platinum account: 0.05% per trade

- VIP account: 0.03% per trade

Example:

- £10,000 share trade on Classic: £8 commission

- £100,000 share trade on Classic: £80 commission

This model is competitive for small trades but becomes costly on larger transactions compared with flat-fee brokers.

Custody and platform fees

Saxo charges an annual custody fee for holding shares, ETFs, and bonds.

- Classic and Platinum: 0.12% per year

- VIP: 0.08% per year

Example:

- £50,000 portfolio on Classic: £60 per year

- £1,000,000 portfolio on VIP: £800 per year

This makes Saxo more expensive than platforms with no custody fee, but competitive for very large portfolios.

Mutual fund fees

Holding mutual funds comes with an additional service charge.

- Classic: up to 0.40% annually

- Platinum: around 0.20%

- VIP: around 0.10%

Fund trades are free, but ongoing fund manager charges still apply on top.

FX conversion fees

Saxo charges FX conversion fees when trading assets in non-GBP currencies.

- FX costs are higher for Classic accounts

- Fees reduce significantly once balances exceed £1 million

- Frequent international traders should factor FX costs into returns

This is a key cost difference versus brokers like Interactive Brokers, which offer cheaper FX conversion.

Other charges to be aware of

- No inactivity fees

- No deposit or withdrawal fees

- Live market data may require paid exchange subscriptions

- Bond trades carry minimum ticket charges, often higher than shares

For portfolios under £25,000, Saxo is usually more expensive than Trading 212, Freetrade, and Interactive Brokers.

What can you trade on Saxo?

- UK and international shares

- ETFs and investment trusts

- Bonds and gilts

- Mutual funds

- Forex and CFDs

- Futures and options

- Crypto ETNs only

What accounts are available to UK users?

- General investment and trading account

- Stocks and Shares ISA

- SIPP

- Joint and corporate accounts

- Professional client accounts

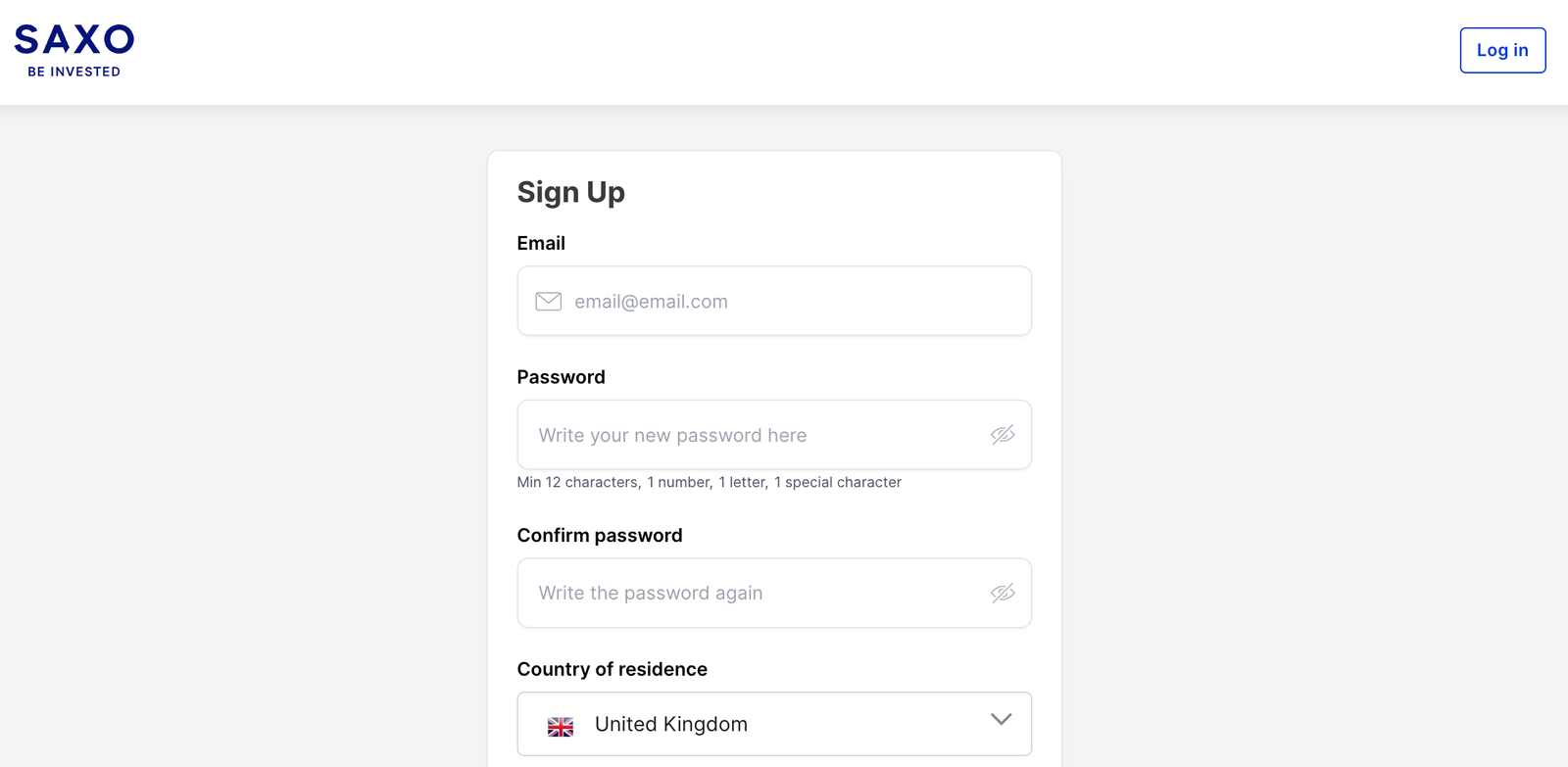

How easy is it to open an account and start trading?

Opening a Saxo account in the UK is fully online, secure, and FCA-compliant, but it is slower and more detailed than trading app-based platforms like Trading 212 or Freetrade.

Most UK users can expect the process to take 1 to 3 working days, depending on verification checks.

Step-by-step: How to open a Saxo account in the UK

- Create an account online: Visit Saxo’s UK website and choose your account type. Options include a general trading account, Stocks and Shares ISA, or SIPP. You can open more than one account type under the same login.

- Complete personal and tax details: You will be asked for your personal information, UK tax residency status, and basic financial details. This is required under FCA anti-money laundering rules.

- Verify your identity: Upload a valid photo ID such as a passport or driving licence, plus proof of address. Verification is thorough and can take longer than newer app-only platforms.

- Choose your platform: Once approved, you can access SaxoTraderGO, SaxoTraderPRO, or SaxoInvestor. Beginners are usually better starting with SaxoInvestor before moving to the more advanced platforms.

- Fund your account: Deposit funds via bank transfer or Faster Payments in GBP. There is no minimum deposit, and Saxo does not charge deposit fees.

- Start trading: After funds arrive, you can trade immediately across shares, ETFs, bonds, funds, forex, CFDs, and other supported assets. A demo account is also available if you want to practise first.

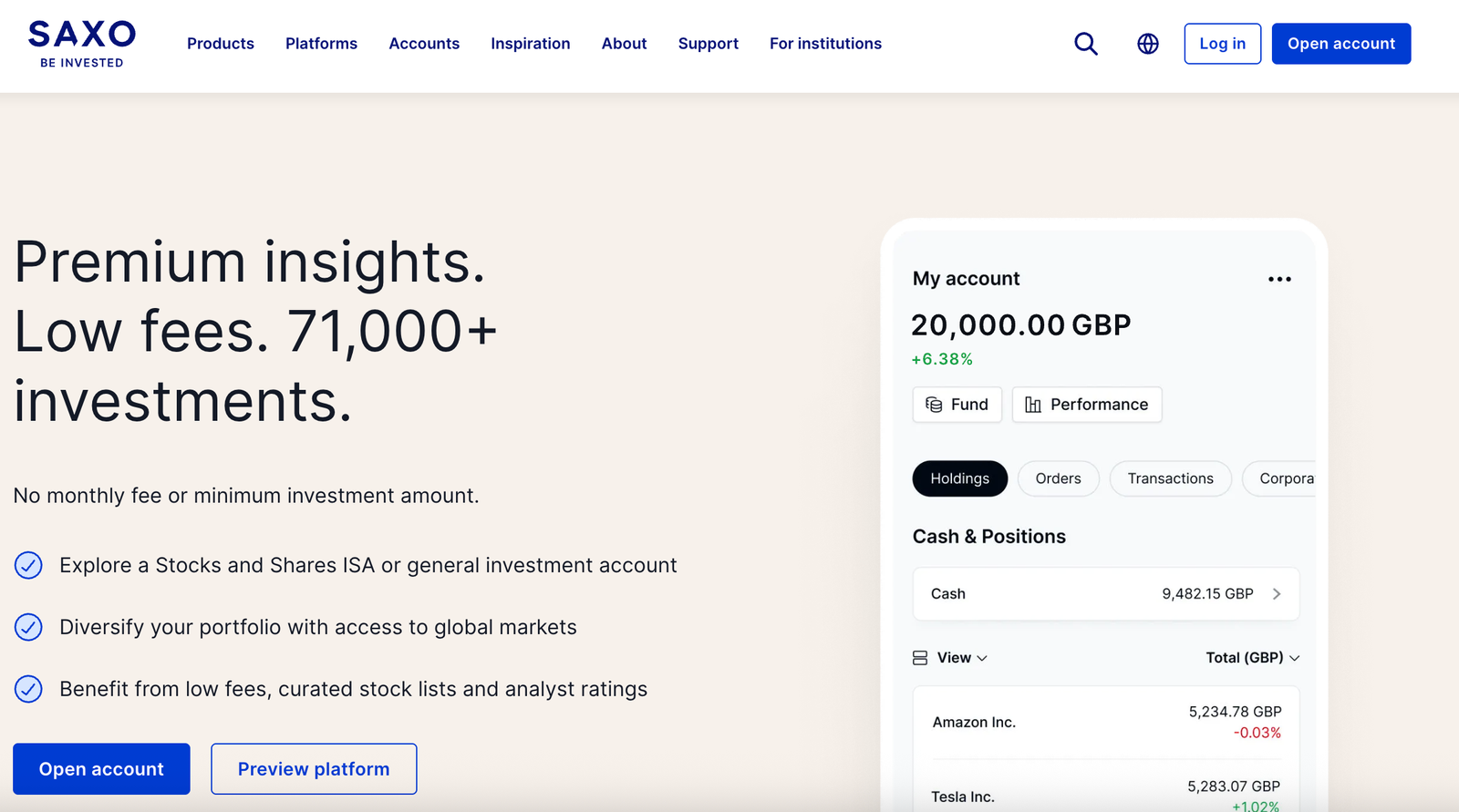

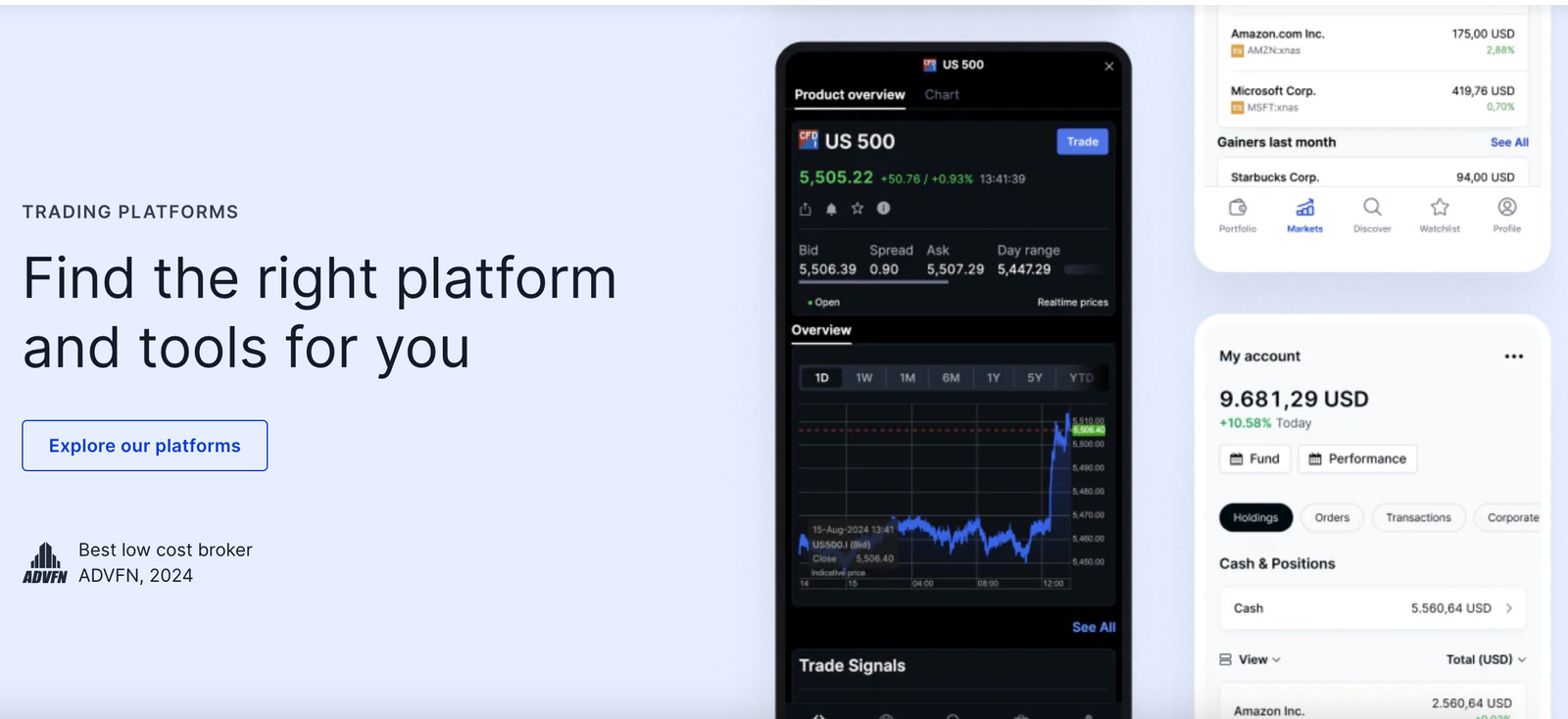

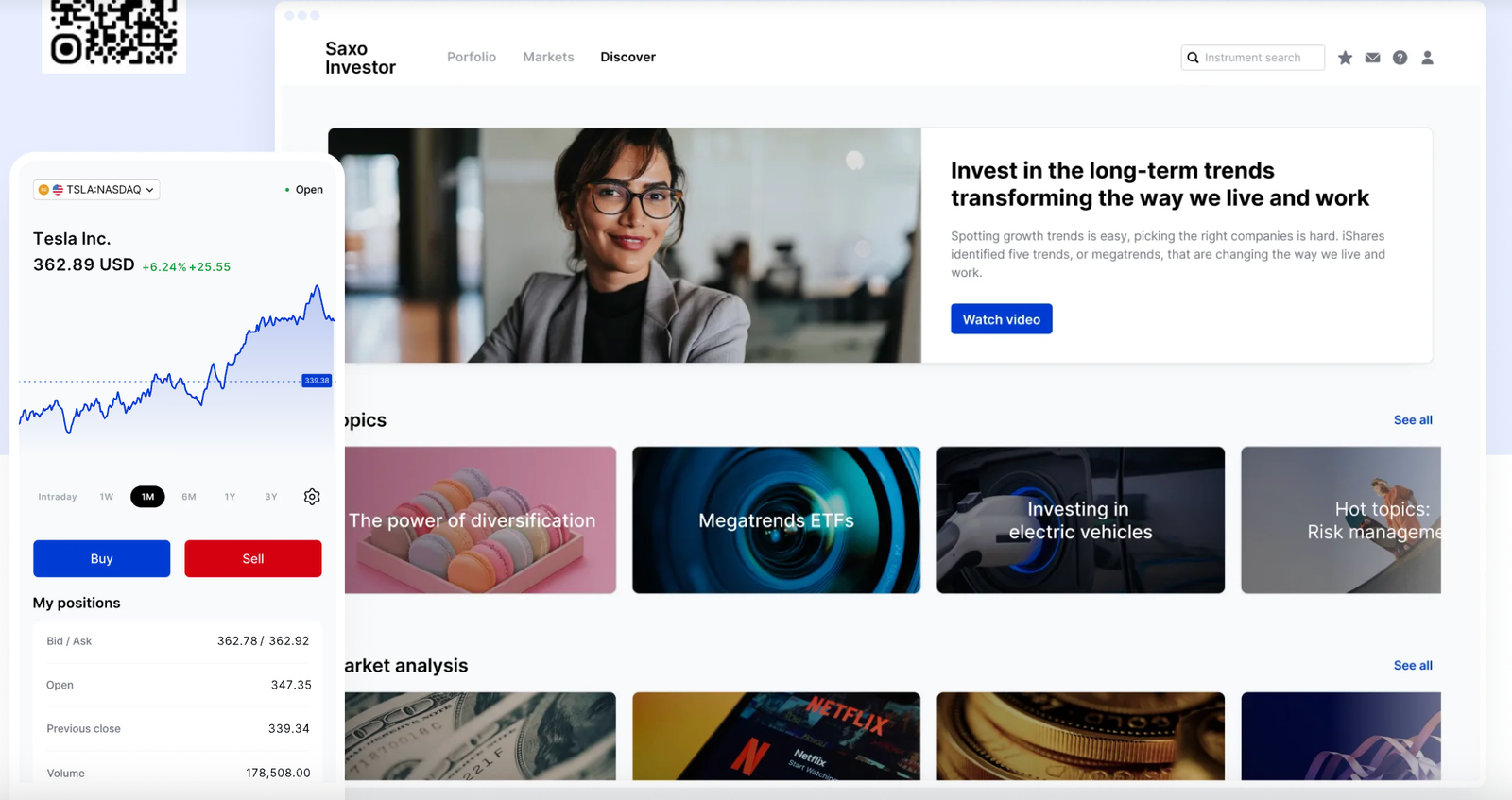

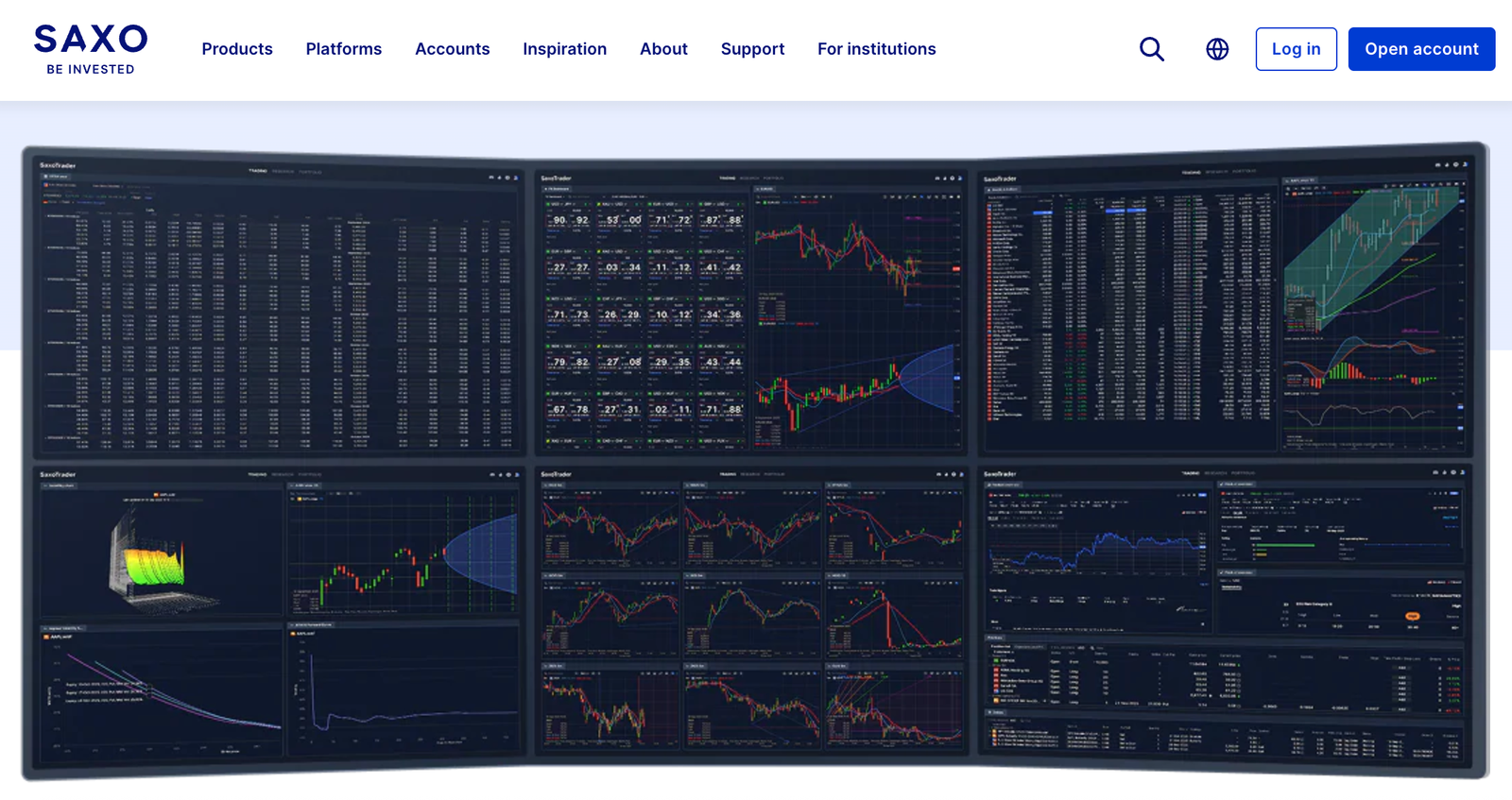

How good is Saxo’s trading platform and mobile app?

Saxo offers one of the most powerful trading platform suites available to UK investors, designed for serious traders who value data, speed, and flexibility. Its platforms deliver professional-grade tools across web, desktop, and mobile, though the depth can feel overwhelming for beginners.

Platforms available

- SaxoTraderGO: Main web and mobile platform for most users

- SaxoTraderPRO: Advanced desktop platform for professionals

- SaxoInvestor: Simplified interface for long-term investors

Key platform strengths

- Advanced charting with 60+ indicators

- Customisable layouts and synced watchlists

- Integrated research, news, and analyst insights

- Stable execution across global markets

Mobile app experience

- Clean, modern design

- Strong order management and portfolio tracking

- Slightly limited chart customisation compared to desktop

- Market data delayed unless live pricing is subscribed

How do deposits and withdrawals work on Saxo?

Deposits and withdrawals with Saxo are straightforward and transparent for UK users, with strong support for GBP funding and no hidden charges. However, processing times are slower than app-only platforms.

Deposits

- Bank transfer and Faster Payments supported

- GBP base accounts available

- No minimum deposit

- No deposit fees

Withdrawals

- Withdrawals are free

- Typically processed within 1–3 working days

- Must be sent to a verified bank account

How good is Saxo’s customer support?

Saxo provides reliable, knowledgeable customer support that suits experienced investors, though it is not the fastest or most accessible in the UK market. Support quality is strong, but availability is more limited than app-first competitors.

Support channels

- Secure in-platform messaging

- Phone support during UK business hours

- Help centre with detailed guides

What to know

- No 24/7 live chat for all users

- Priority support for Platinum and VIP clients

- Responses are accurate but not always instant

What unique features does Saxo offer UK users?

Saxo stands out by offering a bank-backed trading environment with institutional-grade tools rarely available to retail investors. Its feature set is designed for depth rather than simplicity.

Standout features

- Access to 50 global exchanges

- Professional order types and risk tools

- In-depth research from Saxo analysts and Dow Jones

- Flexible ISA allowing withdrawals and replacements

- Tiered pricing that rewards larger portfolios

How does Saxo compare to other UK brokers?

| Broker | Best for | Fees | Platforms | ISA | FCA Regulated |

|---|---|---|---|---|---|

| Saxo | Advanced & high-value investors | Higher for small balances | Excellent | Yes | Yes |

| Interactive Brokers | Lowest global fees | Very low | Powerful but complex | Yes | Yes |

| IG | Active trading & CFDs | Competitive | Excellent | Yes | Yes |

| Trading 212 | Beginners & low costs | Very low | Simple | Yes | Yes |

| Freetrade | Long-term beginners | Low | Basic | Yes | Yes |

What are Saxo’s limitations?

- Higher costs for smaller balances

- No spread betting

- No copy trading or robo-portfolios

- Complex interface for first-time investors

- Some live market data requires paid subscriptions

Conclusion: Is Saxo right for UK investors in 2026?

Saxo is a high-quality, FCA-regulated trading platform that stands out for its global market access, advanced tools, and strong security. It is best suited to experienced traders and investors with larger portfolios, where its tiered pricing becomes more competitive and its platforms can be fully utilised.

However, fees and complexity mean Saxo is not the best choice for beginners or small, cost-sensitive investors. If you want a premium, professional-grade investing experience and are comfortable with a learning curve, Saxo remains one of the strongest options available to UK investors in 2026

FAQs

Is Saxo trustworthy?

Yes. Saxo is a well-established global investment bank founded in 1992 with a long, clean regulatory track record. Client funds are held in segregated accounts, and eligible UK clients are protected by the Financial Services Compensation Scheme up to £85,000.

Is Saxo regulated in the UK?

Yes. Saxo is authorised and regulated by the Financial Conduct Authority. This requires Saxo to meet strict UK standards for client money protection, transparency, and risk disclosure.

What is the minimum deposit to open a Saxo account?

For UK retail users, there is no minimum deposit on standard accounts. Higher tiers require £200,000 for Platinum status and £1,000,000 for VIP status.

Does Saxo offer commission-free trading?

Not fully. Saxo has removed minimum commission charges on shares and ETFs, but trades are priced as a percentage of the trade value rather than being truly commission-free.

Can I trade cryptocurrency with Saxo?

Only indirectly. UK users can trade crypto exchange-traded notes. Saxo does not offer direct crypto ownership, and crypto assets are not protected by the FSCS.

What platforms does Saxo provide?

Saxo offers SaxoTraderGO for web and mobile trading, SaxoTraderPRO for advanced desktop trading, and SaxoInvestor for long-term investors seeking a simpler interface.

Is Saxo good for beginners?

Generally no. While there is no minimum deposit and a demo account is available, Saxo’s platforms are complex and its fee structure can be expensive for small portfolios. Beginners may prefer simpler UK platforms.

Does Saxo offer an ISA or SIPP?

Yes. Saxo offers both a Stocks and Shares ISA and a SIPP. These allow UK investors to invest tax-efficiently, though leveraged products are not permitted within ISAs.

Are there inactivity or withdrawal fees on Saxo?

No. Saxo does not charge inactivity fees or withdrawal fees. FX conversion fees apply when trading assets in non-GBP currencies.