Lightyear is a UK investing app focused on low-cost stock and ETF investing with a clean, beginner-friendly design.

This Lightyear review UK 2026 explains the platform’s fees, features, FCA regulation, and safety so you can decide if it suits your investing goals. We also cover ISAs, costs, and key limitations for UK investors.

Is Lightyear good for beginners?

Yes. Lightyear is well suited to beginners because it combines a simple, intuitive app, low fees, and straightforward access to UK and US stocks and ETFs. New investors can get started quickly with no minimum deposit, while long-term savers benefit from clear pricing and an ISA. However, it is a self-directed platform, so beginners still need to choose their own investments.

Quick verdict: How do we rate Lightyear for UK traders in 2026?

Overall rating: 4.5 / 5

Lightyear is an excellent choice for UK beginners and cost-conscious investors who want a simple, transparent way to invest in stocks and ETFs. Its low fees, FCA regulation, fee-free ISA, and interest on uninvested cash make it stand out against many competitors. However, it is not ideal for advanced traders who need complex tools, derivatives, or pension products like SIPPs. Overall, Lightyear delivers strong value with clarity and ease of use.

Full score breakdown

| Category | Score (1–5) | Summary |

|---|---|---|

| Security & Trust | 4.5 | FCA regulated, segregated client funds, FSCS protection up to £85,000 for eligible cash. Strong safeguards, but still a relatively young platform. |

| Fees & Pricing | 5.0 | Zero platform fees, commission-free ETFs and stocks, low 0.35% FX fee. Among the cheapest UK investing platforms. |

| Features | 4.0 | Solid core features including ISA, multi-currency accounts, fractional shares, and interest-paying Vaults. Lacks SIPPs, crypto, and advanced trading tools. |

| Ease of Use | 5.0 | One of the best-designed investing apps in the UK. Fast onboarding, clean interface, and very beginner-friendly. |

| Customer Support | 4.0 | Helpful and well-reviewed support via email and in-app contact, but no phone or live chat. |

| Reputation | 4.5 | Excellent user reviews, strong industry recognition, and growing trust among UK investors, though still newer than legacy brokers. |

Lightyear at a glance

Key features

- FCA regulated in the UK

- Stocks & Shares ISA and Cash ISA available for UK users

- Zero commission on ETFs and stocks

- Low FX fee of 0.35% with multi-currency accounts

- Interest on uninvested cash via Vaults and money market funds

- Access to 3,500+ stocks and ETFs including fractional shares

- No platform, custody, inactivity, or withdrawal fees

- App-first experience with a clean, beginner-friendly design

What are the pros and cons of using Lightyear?

Pros

- Among the lowest-cost investing platforms in the UK

- Zero commission on ETFs and stocks

- Stocks & Shares ISA with no platform fee

- High-interest Vaults backed by BlackRock money market funds

- Multi-currency accounts reduce repeated FX charges

- Excellent mobile and web app usability

- Pays interest on idle cash

Cons

- Relatively new platform compared with incumbents

- Fewer assets than legacy brokers like Hargreaves Lansdown

- No SIPP or derivatives trading

- Limited advanced charting and trading tools

- Customer support is digital-only

Who is Lightyear best for?

- Beginners starting with stocks and ETFs

- Long-term, self-directed investors

- Cost-conscious UK investors using an ISA

- Investors buying US and international stocks regularly

- Those who want interest paid on uninvested cash

Who is Lightyear not ideal for?

- Active day traders needing advanced tools

- Investors wanting crypto, CFDs, or options

- Those seeking managed portfolios or robo-advice

- Pension investors looking for a SIPP

How regulated and trustworthy is Lightyear in the UK?

Lightyear is authorised and regulated by the FCA as an appointed representative of RiskSave Technologies Ltd. Client money is held in segregated accounts, meaning it is kept separate from company funds.

UK users benefit from FSCS protection up to £85,000 for eligible cash, while EU investments fall under Estonian investor protection up to €20,000. Crypto assets are not supported and therefore not relevant to FSCS crypto exclusions.

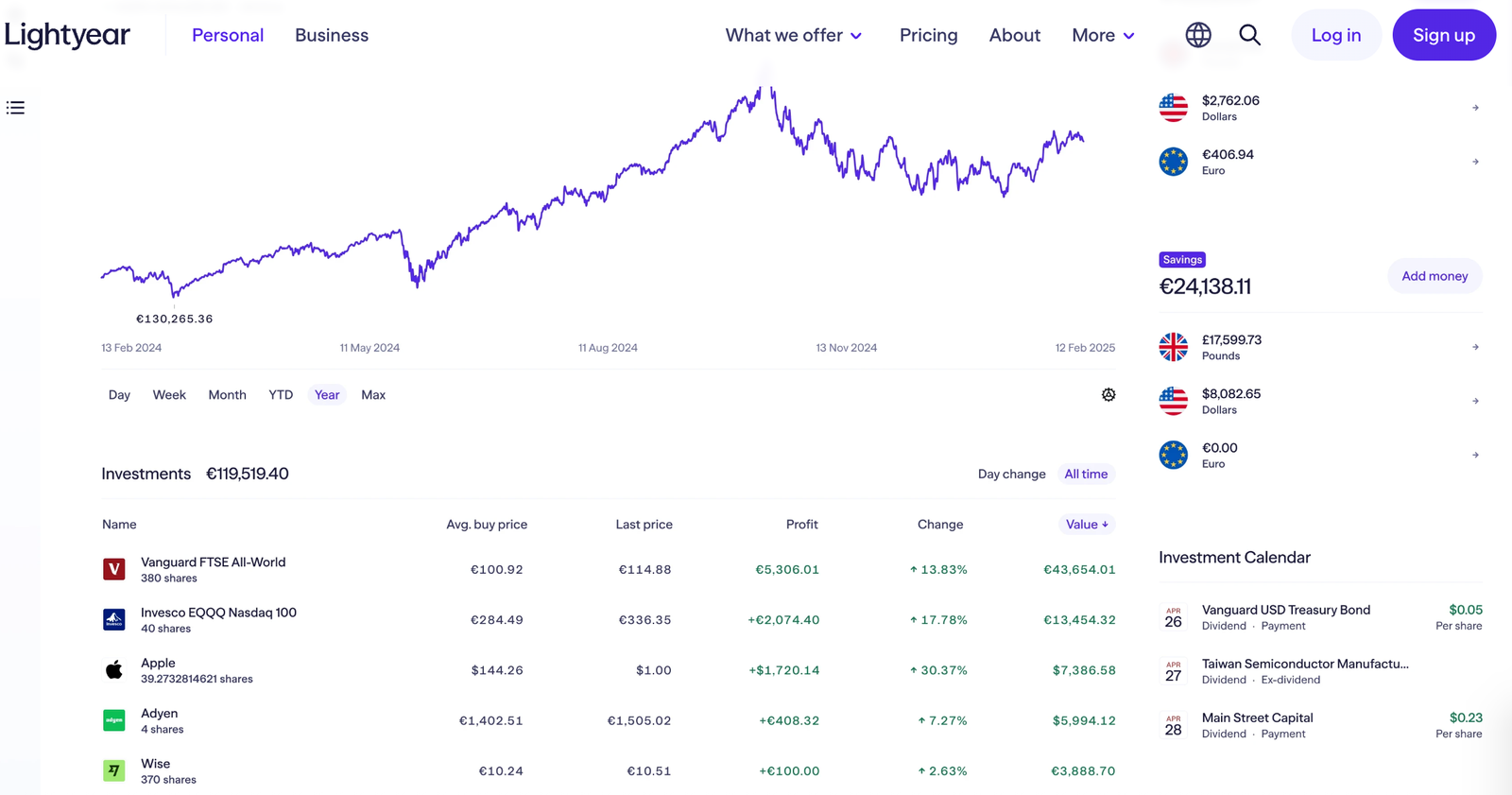

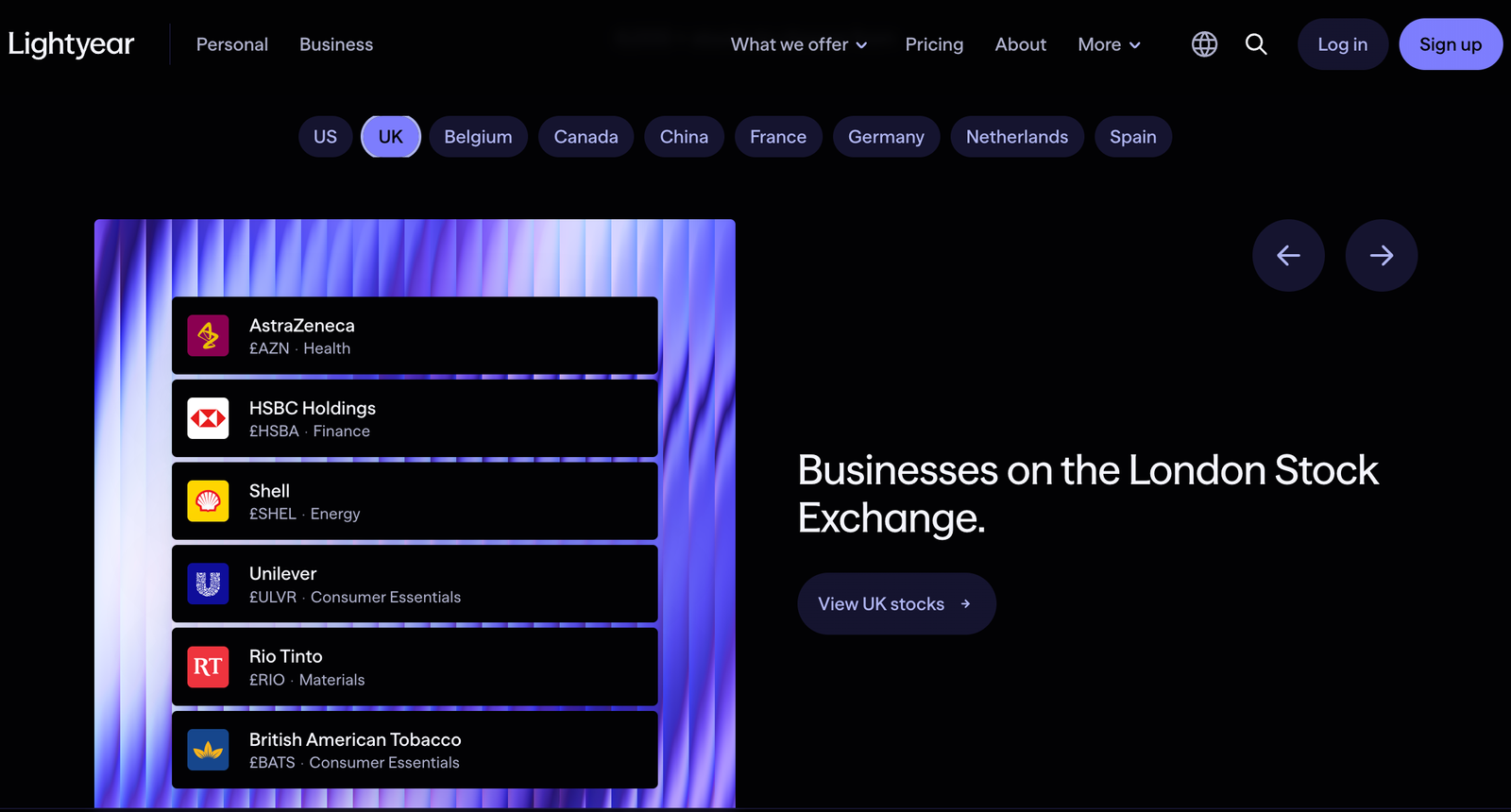

What assets can you trade on Lightyear?

- UK, US, and EU stocks

- ETFs across equities, bonds, and themes

- Fractional shares for US stocks

- Money Market Funds via Vaults

- Limited bond exposure via select markets

Not available: crypto, CFDs, options, futures, mutual funds.

What are the fees on Lightyear?

Lightyear uses simple, transparent pricing with no hidden charges.

| Fee type | Cost |

|---|---|

| Platform fee | Free |

| UK stock trades | £1 per order |

| US stock trades | 0.10% (min $0.10, max $1) |

| EU stock trades | €1 per order |

| ETF trades | Free |

| FX conversion | 0.35% |

| Withdrawals | Free |

| Inactivity | None |

Small trades can be expensive in percentage terms, but larger trades are very competitive.

How do Lightyear’s FX fees affect long-term investors?

Lightyear’s 0.35% FX fee is among the lowest in the UK and can significantly reduce costs for long-term investors buying US or EU stocks. Because Lightyear supports multi-currency accounts, you only pay FX once when converting, not on every trade. Over many years, this can save hundreds or even thousands of pounds compared with platforms that charge FX on each transaction.

What does investing small amounts on Lightyear really cost?

Lightyear is cheapest for medium to large trades, but very small trades can be expensive in percentage terms. For example, a £20 UK share trade costs £1, which is a 5% fee, while a £500 trade costs just 0.2%. Investors making frequent small trades may want to batch investments to keep costs low.

What account types does Lightyear offer UK users?

- Stocks & Shares ISA

- Cash ISA

- General Investment Account (GIA)

- Business investment account

There is no SIPP, LISA, or Junior ISA currently available.

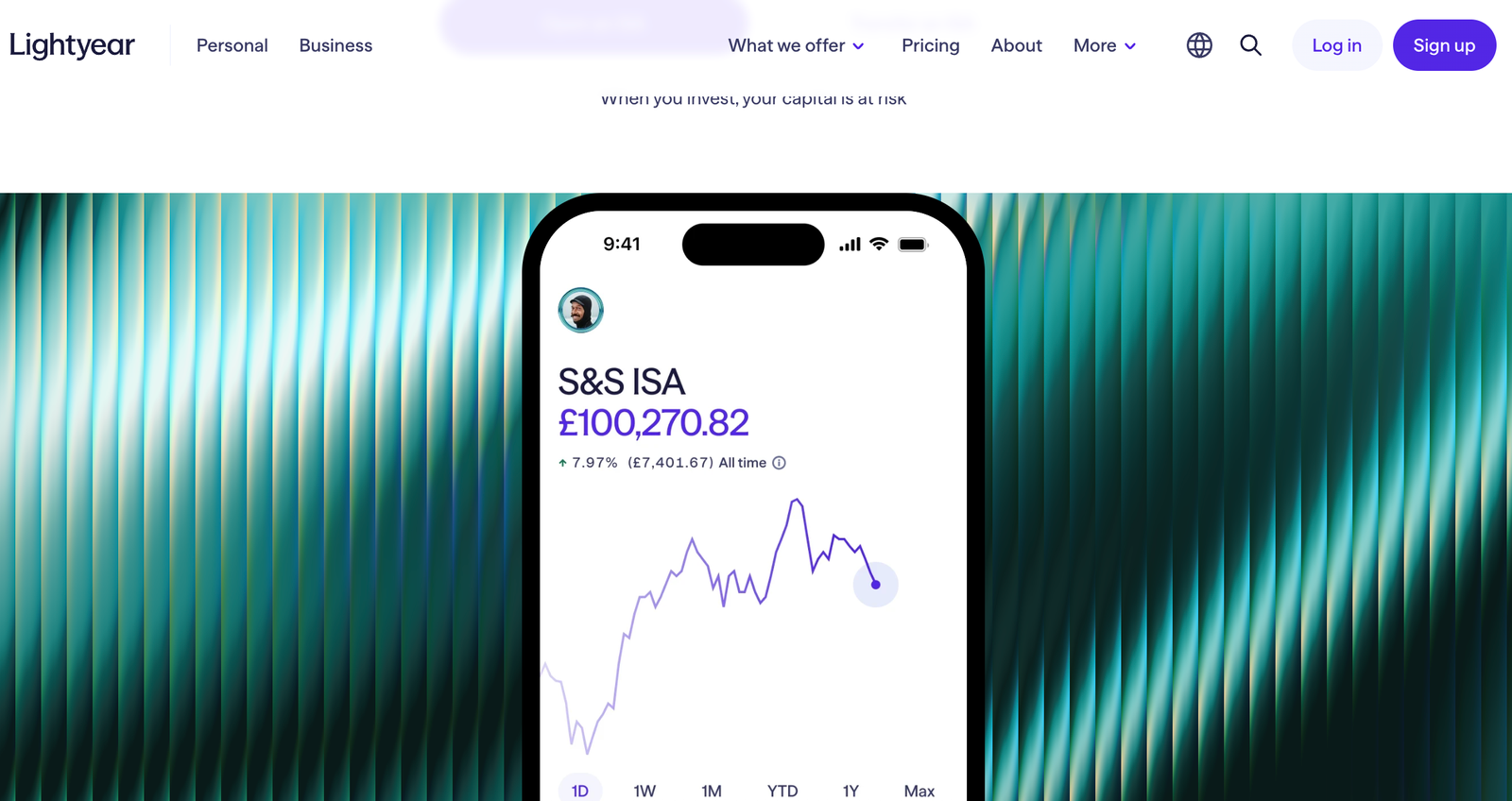

How good is Lightyear’s trading platform and mobile app?

Lightyear offers one of the cleanest and easiest-to-use investing apps in the UK, designed with beginners and long-term investors in mind. The platform is mobile-first, with a matching web version that mirrors most core features, making it easy to manage investments on the go or from a desktop.

Platform features

- Intuitive navigation with fast order placement

- Analyst ratings and key company fundamentals displayed clearly

- Simple portfolio, performance, and cash balance views

- Fractional share investing for US stocks

- Recurring and scheduled investments for long-term strategies

Limitations

- No advanced charting or technical indicators

- No algorithmic, options, or professional trading tools

Overall, Lightyear’s platform is excellent for clarity, speed, and everyday investing, but it is not designed for active traders who rely on complex analysis or advanced order types.

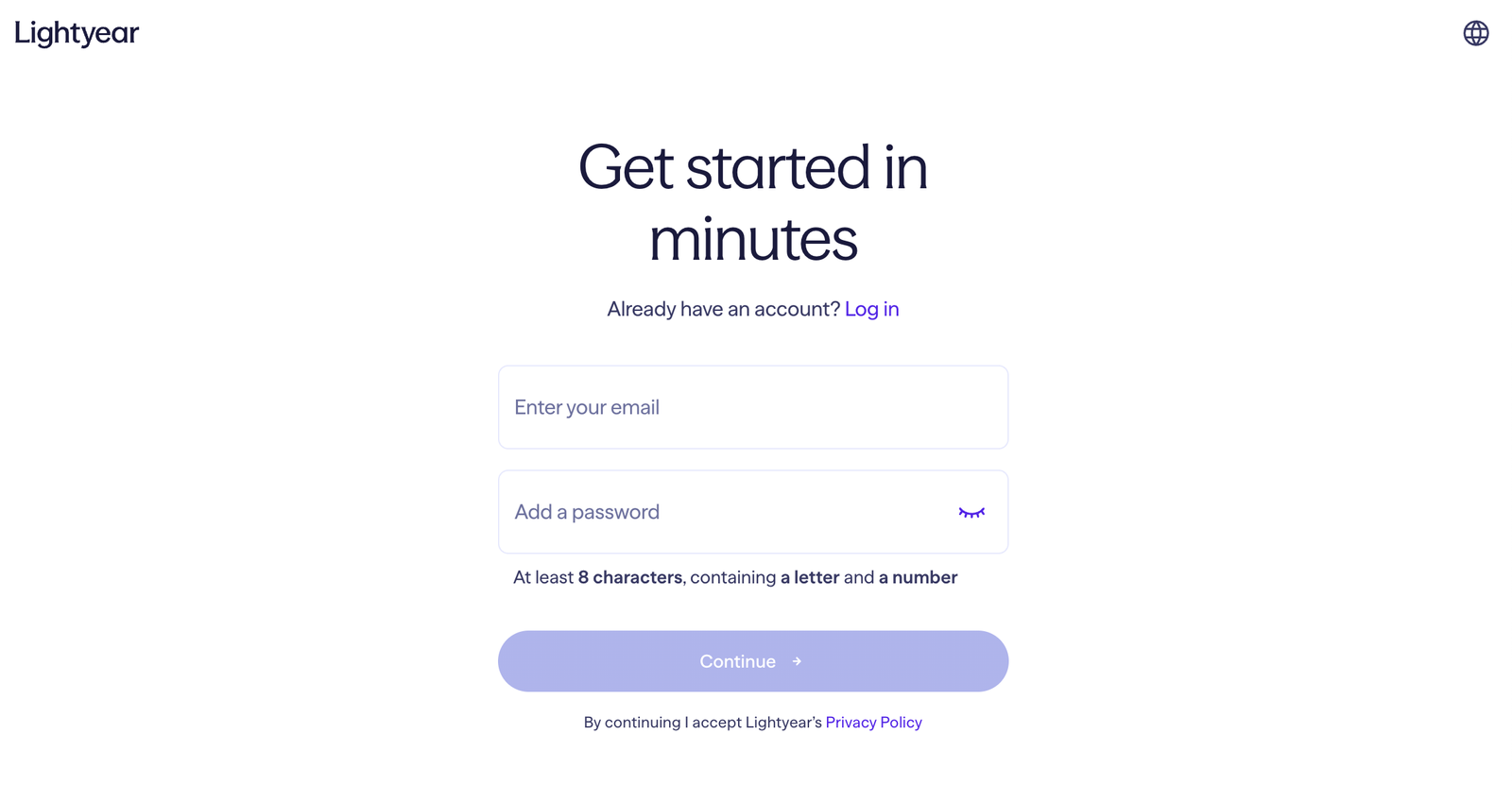

How easy is it to open an account and start trading?

Opening a Lightyear account is fully digital and usually takes under 10 minutes for UK users. The process is completed through the mobile app or web platform, with no paperwork or minimum deposit required. Most users are verified and able to start investing the same day.

What you need to sign up

- A valid photo ID such as a passport or driving licence

- Proof of address, for example a utility bill or bank statement

- Basic tax information, including your National Insurance number

Account setup steps

- Create an account using your email and phone number

- Enter personal and address details

- Complete tax residency and regulatory questions

- Upload ID and complete identity verification

- Link a bank account and fund your account

Once approved, you can deposit funds via bank transfer or debit card and begin trading immediately. There is no minimum deposit, making Lightyear accessible for beginners starting with small amounts.

How do deposits and withdrawals work?

Lightyear supports simple, UK-friendly payment methods and does not charge fees for withdrawals. Deposits can be made in GBP, USD, or EUR, and funds are typically available quickly once received.

UK deposit methods

- Bank transfer (Faster Payments)

- Debit card

- Apple Pay and Google Pay

Deposit fees and speed

- Bank transfers are free and usually arrive the same day via Faster Payments

- Card, Apple Pay, and Google Pay deposits are free up to £500, then charged at 0.5% above this amount

- Card-based deposits are typically instant

Withdrawals

- Withdrawals are free

- Funds are sent back to your linked bank account

- Withdrawals usually take 1–2 working days to process

You can only deposit from and withdraw to accounts in your own name, in line with UK anti-money laundering rules. There are no minimum deposit or withdrawal amounts, which keeps Lightyear flexible for both new and experienced investors.

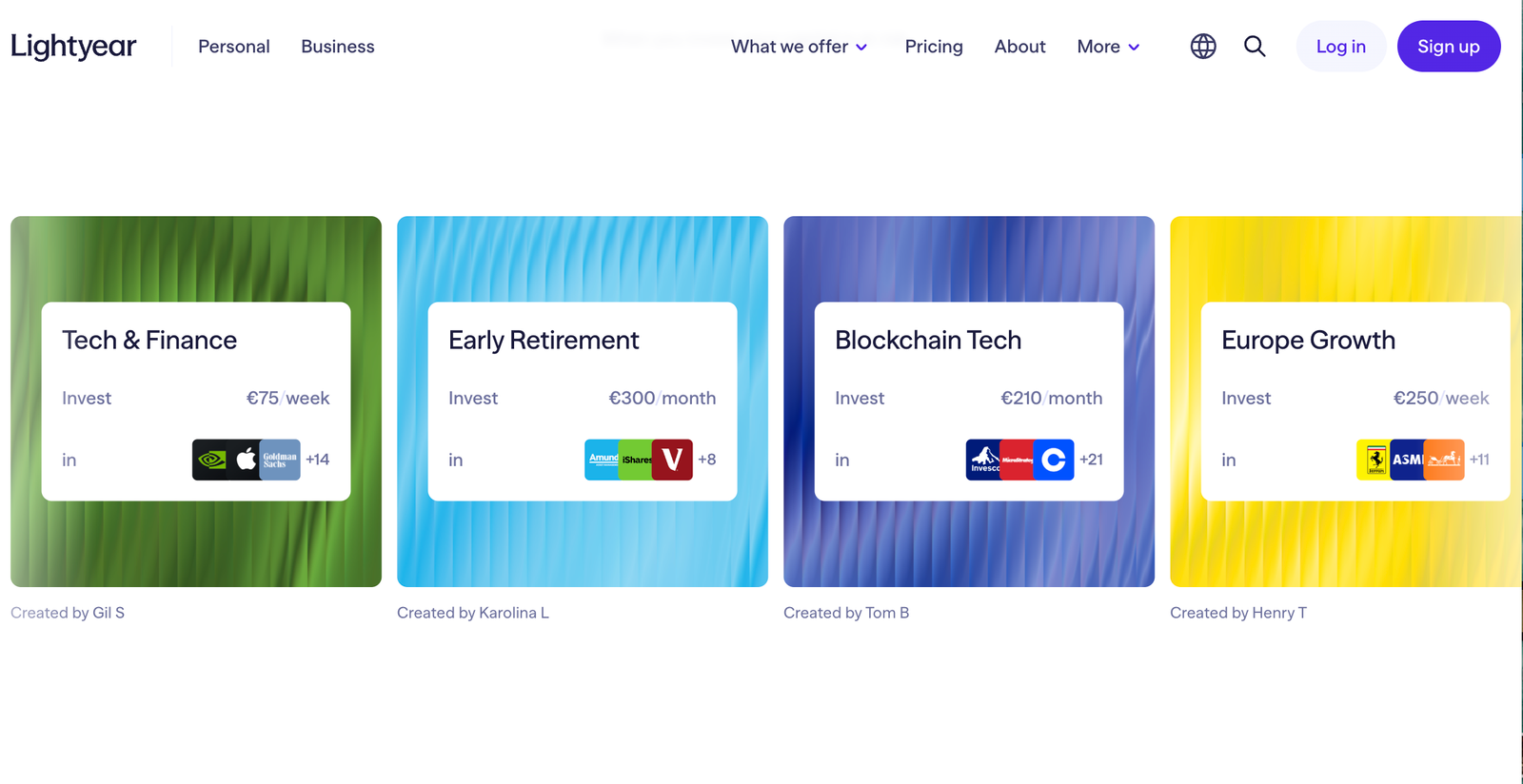

What unique features does Lightyear offer to UK users?

- Interest-paying Vaults inside an ISA

- Multi-currency balances in GBP, USD, and EUR

- Very low FX fees compared with UK rivals

- Community-driven asset requests

- Transparent, flat pricing

Few UK platforms combine ISAs, FX efficiency, and interest on idle cash.

How good is Lightyear customer support?

Lightyear provides email and in-app support rather than phone or live chat. While support options are limited compared with traditional brokers, response times are generally fast and helpful, particularly for account, payments, and platform queries.

Support channels

- In-app contact form

- Email support

Availability and quality

- No phone or live chat support

- Most queries are answered within one business day

- Strong help centre and FAQs reduce the need to contact support

User feedback

Lightyear scores around 4.8 out of 5 on Trustpilot, one of the highest ratings among UK investment apps. Users frequently highlight quick responses, clear explanations, and a smooth app experience, although some note the lack of real-time support as a drawback.

Lightyear vs competitors (UK comparison)

| Feature | Lightyear | Trading 212 | Hargreaves Lansdown |

|---|---|---|---|

| Platform fee | Free | Free | Up to 0.45% |

| ISA available | Yes | Yes | Yes |

| FX fee | 0.35% | 0.5% | 0.75% |

| ETF trading | Free | Free | Dealing fees apply |

| Interest on cash | Yes | Limited | No |

| App usability | Excellent | Good | Average |

What are the main limitations?

- No SIPP or pension accounts

- Limited advanced research tools

- Smaller asset range than legacy brokers

- Newer platform with shorter track record

- No crypto or derivatives

Conclusion: Is Lightyear worth it for UK investors in 2026?

Lightyear is one of the best low-cost investing platforms in the UK in 2026, combining transparent fees, a fee-free Stocks & Shares ISA, and interest on uninvested cash.

Its FCA regulation, simple pricing, and beginner-friendly app make it especially well suited to long-term, self-directed investors who want to build a global portfolio without overpaying.

That said, Lightyear is not designed for advanced traders. The lack of a SIPP, limited asset range, and basic trading tools mean experienced investors may prefer more complex platforms.

For beginners and cost-conscious UK investors focused on stocks and ETFs, Lightyear remains a strong, trustworthy choice.

FAQs

Is Lightyear regulated in the UK?

Yes. Lightyear is authorised and regulated by the FCA as an appointed representative. Client money is held in segregated accounts, meaning it is kept separate from Lightyear’s own funds.

Is my money safe with Lightyear?

Lightyear uses fund segregation and strong security controls. Eligible cash may be protected by the FSCS up to £85,000, US assets are protected by SIPC up to $500,000, and EU investments fall under Estonian investor protection. Investments can fall in value and are not guaranteed.

Does Lightyear offer a Stocks & Shares ISA?

Yes. Lightyear offers a Stocks & Shares ISA and a Cash ISA for UK users, allowing you to invest up to £20,000 per tax year with no tax on gains or dividends inside the ISA.

How much does Lightyear cost to use?

There is no platform or inactivity fee. UK shares cost £1 per trade, ETFs are commission-free, and FX conversion is 0.35%. Withdrawals are free.

What can you invest in on Lightyear?

You can invest in UK, US, and EU stocks, ETFs, fractional shares, and money market funds via Vaults. Lightyear does not offer crypto, CFDs, options, or a SIPP.

Does Lightyear pay interest on uninvested cash?

Yes. Lightyear pays interest on uninvested cash, including through Vaults backed by money market funds. Rates vary and are not guaranteed.