InvestEngine has become one of the UK’s most popular low-cost ETF platforms, offering commission-free investing and simple portfolio tools for beginners and long-term investors.

This review explains its fees, safety standards, FCA status, account options, and core features so you can decide whether it’s the right fit for your investing style.

All insights follow UK regulations and focus on clear, people-first guidance.

Is InvestEngine good for beginners?

InvestEngine is well suited for beginners due to its zero fees, ETF-only focus and simple interface. The lack of complex charts and frequent trading tools reduces overwhelm. Beginners needing instant execution, phone support or individual stocks might prefer broader platforms, but for low-cost passive investing, InvestEngine is a strong option.

Quick verdict: How do we rate InvestEngine for UK traders in 2026?

Overall rating: 4.3 out of 5

InvestEngine scores highly for UK investors thanks to its ultra-low fees, strong FCA regulation and simple ETF-focused platform.

It is not the most feature-rich broker, but for long-term ETF investing it remains one of the best-value options in the UK market.

Its main drawbacks are limited customer support, no instant execution and no individual shares, but overall it delivers exceptional value for beginners and passive investors.

Full score breakdown

| Category | Score (1-5) | Reasoning |

|---|---|---|

| Security and Trust | 4 | FCA authorised and FSCS protected up to £85,000. Transparent structure and over £1bn assets under management. Slightly lower score due to being a newer platform. |

| Fees and Pricing | 5 | Among the lowest costs in the UK. Zero-fee DIY ETF investing and low-cost managed options. Extremely competitive compared with rivals. |

| Features | 3 | Strong ETF filtering, rebalancing and reporting tools, but lacks shares, instant trading, advanced charts and broader asset classes. |

| Ease of Use | 4 | Clean and simple interface perfect for beginners. A few extra steps when buying ETFs prevents a perfect score. |

| Customer Support | 3 | Helpful and responsive but limited. Email and form support only. No live chat and phone support only on request. |

| Reputation | 4 | Excellent Which? ratings, strong Trustpilot reviews and a growing user base. Slight deduction due to being younger than major competitors. |

InvestEngine at a glance

Key features

- Commission-free ETF investing on DIY portfolios.

- 760 to 830+ ETFs available, covering global shares, bonds, commodities and themes.

- FCA authorised and FSCS protected up to £85,000.

- ISA, GIA and SIPP accounts available, including a flexible Stocks and Shares ISA.

- Managed portfolios available for a low 0.25 percent fee.

- Daily batch investing at 2pm, helping keep structural costs low.

- Simple, uncluttered interface designed for long-term investing.

- Beginner-friendly educational content, webinars and YouTube lessons.

What are the pros and cons of using InvestEngine?

Pros

- Commission-free ETF investing.

- Very low ongoing costs for DIY portfolios.

- Large choice of global ETFs.

- FCA regulated with FSCS protection.

- Clean, simple interface that avoids information overload.

- Strong customer satisfaction scores for value and ease of use.

- Flexible ISA and low-cost SIPP options.

- Good selection of ESG and sustainable ETFs.

Cons

- No individual shares or mutual funds.

- Customer support is mainly by email, not phone or live chat.

- Minimum £100 deposit to start.

- Daily batch investing only, not instant execution.

- Managed portfolios are temporarily unavailable during improvements.

- The platform is newer and still scaling up.

InvestEngine – who’s it best for?

- Beginners who want simple, low-cost ETF investing.

- Long-term investors who prefer buy-and-hold strategies.

- Cost-conscious investors seeking zero commission and low fund fees.

- ETF-focused investors who do not need individual stocks.

- Passive investors who want automated rebalancing.

- Self-directed DIY investors who like building portfolios from global ETFs.

How regulated and trustworthy is InvestEngine in the UK?

InvestEngine is considered trustworthy because it is authorised and regulated by the Financial Conduct Authority (FCA) and client funds are held in segregated accounts.

Investors are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, which covers platform failure.

InvestEngine has grown rapidly, manages over £1 billion in client assets and has achieved strong customer satisfaction scores from Which?, Boring Money and Trustpilot.

Although it is a newer platform, its regulatory status and transparent business model significantly support its reliability.

Is InvestEngine any good for UK investors?

InvestEngine is a strong option for UK investors looking for low-cost ETF investing, offering zero platform fees on DIY portfolios and an intuitive interface.

Its focus on simplicity, global ETF choice and long-term investing makes it ideal for beginners and passive investors. Customer satisfaction scores show high marks for value, ease of use and overall service.

InvestEngine stands out from trading-focused platforms by discouraging frequent trades and promoting a long-term mindset. Its structure and tools are built for steady portfolio management rather than day trading.

What do customers say about InvestEngine?

- Customers praise InvestEngine for its low fees, simple interface, and supportive service.

- Which? awarded the platform a 78 percent customer satisfaction score, including five stars for value for money and five stars for ease of use.

- Users report quick email responses, reliable day-to-day performance, and an easy-to-navigate investment app.

- The community forum provides an extra channel for guidance, tips, and support.

What are InvestEngine’s fees in the UK?

InvestEngine’s fees are among the most competitive in the UK. DIY investing costs £0, including:

- £0 platform fee

- £0 trading fee

- £0 dealing costs

- £0 ISA or SIPP account fee

The only cost is the ETF’s own fund fee, typically 0.10 to 0.50 percent.

Managed portfolios cost:

- 0.25 percent platform fee

- 0.12 percent average ETF fee

0.37 percent total cost - This is lower than many competitors like Nutmeg or Moneyfarm.

What can you invest in with InvestEngine?

InvestEngine offers only Exchange Traded Funds (ETFs), which reduces complexity and encourages diversified, long-term investing.

Choice includes:

- 760 to 830+ ETFs

- Global equity ETFs

- Bond ETFs

- Commodities

- Sector ETFs

- ESG and sustainability-focused ETFs

- Smart beta and factor ETFs

Available accounts:

| Account type | Available |

|---|---|

| Stocks and Shares ISA | ✔ |

| General Investment Account | ✔ |

| SIPP | ✔ |

| Lifetime ISA | ✘ |

| Junior ISA | ✘ |

How good is InvestEngine’s trading platform and mobile app?

The InvestEngine platform is clean, straightforward and intentionally minimal.

Strengths:

- Simple navigation

- Clear ETF information pages

- Fast funding via bank transfer

- Same interface on mobile and desktop

- Strong reporting tools

Limitations:

- No live chat

- No instant execution (only daily batching at 2pm)

- Fewer advanced charts or deep research tools

It is built for long-term investing, not high-frequency trading.

Does InvestEngine provide real crypto or derivatives?

No. InvestEngine does not offer:

- Cryptocurrency

CFDs - Spread betting

- Options

- Futures

- Leveraged derivatives

It focuses entirely on low-cost ETFs, making it a long-term investing platform rather than a trading app.

What unique features does InvestEngine offer UK users?

- Commission-free ETF investing

- Automatic portfolio rebalancing

- Flexible ISA (withdraw and replace within same tax year)

- 830+ ETF choices

- Daily batch execution to reduce costs

- Free SIPP account

- Useful analytics for each ETF

- Regular investing plans

- Extensive ETF filtering (sector, region, ESG, strategy)

- Clear performance and tax reporting tools

How do deposits and withdrawals work on InvestEngine?

Deposits:

- Bank transfer

- Instant bank payments supported

- Minimum deposit £100

Withdrawals:

- Made back to your linked bank account

- Typically 1 to 3 business days

- Must move cash out of portfolios before withdrawing

- No withdrawal fees

Delays generally occur only when funds must settle or when verification is required.

Is InvestEngine good for ethical investors?

InvestEngine works well for ethical investors due to its strong ESG filters. You can sort ETFs by sustainability labels, Morningstar ESG ratings and view each ETF’s top holdings. This transparency helps investors align their portfolio with personal values.

Is your money safe with InvestEngine?

InvestEngine is FCA authorised and client assets are held in segregated accounts. If the company fails, investors are protected by the FSCS up to £85,000 per person. Market losses are not covered, which applies to all investing platforms. Security features include PIN or biometric login and optional two-factor authentication.

How good is InvestEngine’s customer service?

Customer service is primarily offered through email, web form and social media. Response times aim to be within two business hours, which is strong for a low-cost broker. There is no live chat, though phone support is available on request. The community forum offers additional help for common questions.

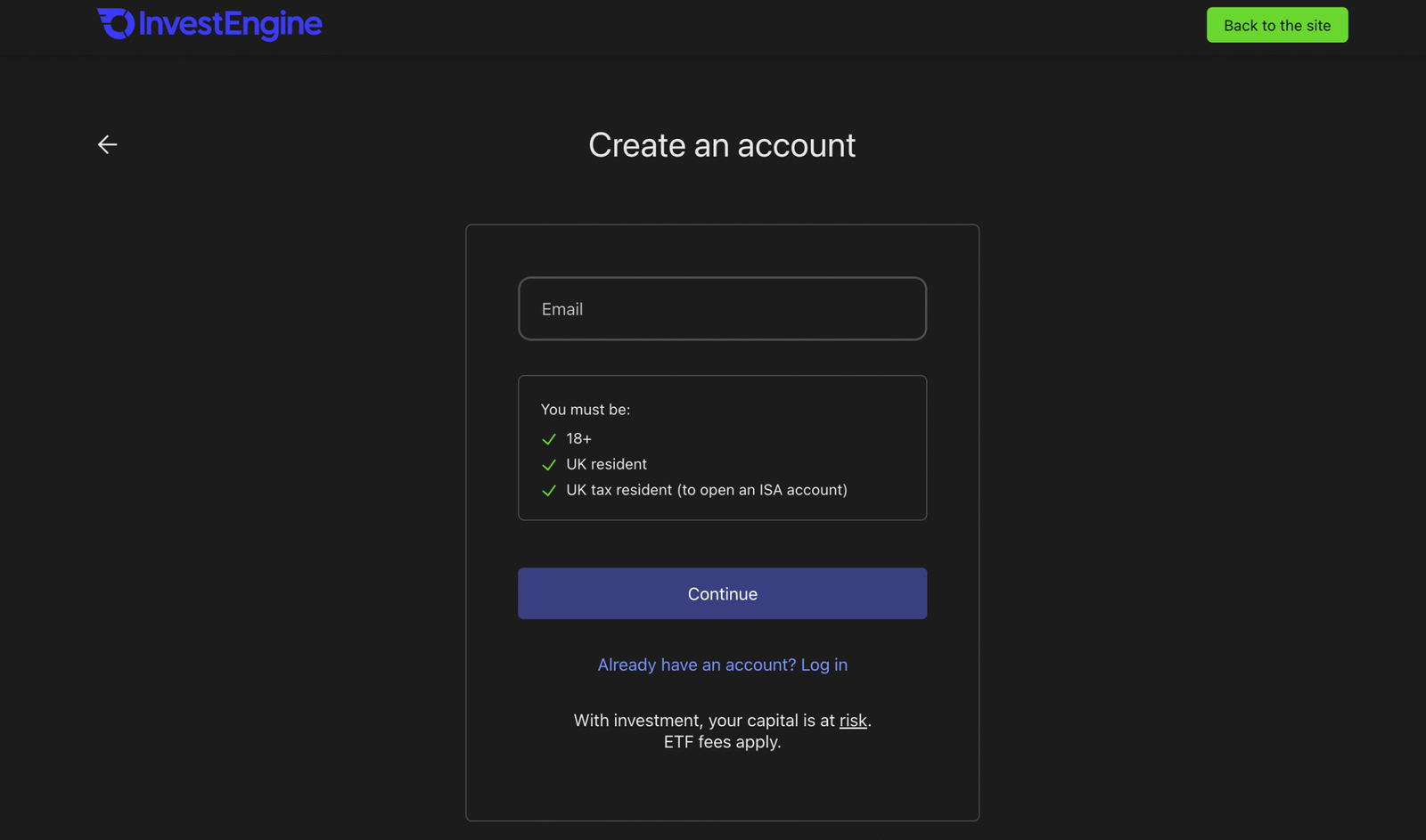

How easy is it to open an account and start investing on InvestEngine?

Opening an account is straightforward and takes a few minutes.

You need:

- NI number

- Photo ID (in some cases)

- Bank details

Steps:

- Sign up online or via the app.

- Choose ISA, GIA or SIPP.

- Deposit £100 minimum.

- Create or select a portfolio.

- Choose ETFs.

- Invest (orders placed before 2pm are executed the same day).

Is InvestEngine right for your investing style?

InvestEngine is best for:

- Long-term investors

- ETF-focused portfolios

- Passive investing strategies

- Low-cost investing needs

- Investors who do not require instant execution

It is not ideal for:

- Active intraday traders

- Stock pickers

- Crypto investors

- Investors who want phone-based support

- Those wanting mutual funds or broad asset classes beyond ETFs

InvestEngine vs competitors (quick comparison)

| Platform | Best for | Fees | Assets offered | Support | Key difference |

|---|---|---|---|---|---|

| InvestEngine | Low-cost ETFs | £0 DIY | ETFs only | Ultra-low fees | |

| Trading 212 | Stocks + ETFs | £0 | Stocks, ETFs | Live chat | Instant execution |

| Vanguard | Passive portfolios | 0.15 percent | Funds + ETFs | Phone | Fewer ETFs |

| Freetrade | Simple investing | £0–£11.99 | Stocks, ETFs | In-app chat | No SIPP free |

| eToro | Social + crypto | Variable | Stocks, ETFs, crypto | Chat | Social trading |

| Nutmeg | Managed portfolios | 0.75 percent | Ready-made | Strong guidance |

InvestEngine wins on cost, ETF choice and simplicity, but loses on customer support speed and asset variety.

InvestEngine UK limitations

- ETF-only platform

- No instant trade execution

- No crypto or derivatives

- Limited customer support channels

- Newer platform with shorter track record

- £100 minimum deposit

- No Lifetime or Junior ISA

- No mutual funds or direct bonds

Conclusion

InvestEngine is one of the UK’s strongest low-cost ETF investing platforms, offering zero trading fees, a wide ETF selection and clear, beginner-friendly tools.

Its FCA regulation, FSCS protection and strong customer satisfaction scores give it credibility despite being a younger platform.

It is ideal for long-term, low-cost, passive investing but less suited to active traders or investors needing instant execution or broader asset choices.

FAQs

Can InvestEngine be trusted?

Yes. It is FCA regulated, FSCS protected up to £85,000 and manages over £1 billion in client assets.

Why can’t I withdraw from InvestEngine?

Withdrawals may be delayed if funds are unsettled, still inside portfolios or if ID checks are required. Most withdrawals complete in 1 to 3 business days.

Is InvestEngine better than Vanguard?

InvestEngine is cheaper for ETF investing and offers more ETFs. Vanguard offers stronger guidance and more diversified funds. Best choice depends on your preferences.

How is InvestEngine so cheap?

It earns revenue from interest on client cash, low-cost managed portfolio fees and operational efficiencies like daily batch trades.