Interactive Investor is a UK investment platform known for its flat monthly fees and wide range of ISAs, funds, and shares.

This review explains who Interactive Investor is best for in 2026, covering costs, features, and suitability for different investing styles. If you want to know whether it offers good value for your needs, this guide breaks it down clearly.

Quick verdict: How do we rate Interactive Investor for UK traders in 2026?

Overall rating: 4.4 / 5

Interactive Investor is one of the strongest platforms in the UK for long-term, self-directed investors, especially those using ISAs and SIPPs with portfolios above £20,000. Its flat-fee pricing, wide investment range, and excellent customer support make it a great value for larger portfolios. However, beginners and small investors may find it less cost-effective and slightly complex compared to app-based, commission-free platforms.

Full score breakdown

| Category | Score (1–5) | Why |

|---|---|---|

| Security & Trust | 5.0 | FCA regulated, FSCS protection up to £85,000, segregated client assets, 25+ year UK track record |

| Fees & Pricing | 4.0 | Flat fees are excellent for larger portfolios but expensive for small balances |

| Features | 4.5 | Huge investment range, strong ISA and SIPP offering, ethical tools, ready-made portfolios |

| Ease of Use | 4.0 | Reliable and professional, but interface feels dated and less beginner-friendly |

| Customer Support | 5.0 | UK-based phone support, consistently strong reviews, rare among UK platforms |

| Reputation | 4.7 | Very strong customer reviews, industry awards, backed by Aberdeen Group plc |

Interactive Investor at a glance

Key features

- Customers: 450,000+ UK investors

- Assets under administration: £70bn+

- Pricing model: Flat monthly subscription

- Regulation: FCA authorised

- Protection: FSCS up to £85,000

- Accounts: ISA, SIPP, Junior ISA, Trading Account

- Investments: 40,000+ shares, ETFs, funds, bonds

What are the pros and cons of using Interactive Investor?

Pros

- Flat fees that become cheaper as portfolios grow

- One of the widest investment selections in the UK

- Excellent Stocks & Shares ISA and SIPP options

- FCA regulated and FSCS protected

- Strong UK-based phone support

- Free regular investing from £25 per month

- Junior ISA included on higher plans

Cons

- Not cost-effective for small portfolios

- No Lifetime ISA or Cash ISA

- No fractional shares

- App and platform feel less modern than app-first rivals

- Limited appeal for beginners wanting simplicity

Who is Interactive Investor best for and who is it not ideal for?

Interactive Investor is best suited to confident, long-term investors with growing portfolios, but it is not ideal for beginners or casual traders with small balances.

Best for

- Long-term UK investors

- ISA and SIPP holders

- Portfolios above £20,000–£30,000

- Investors who value fee transparency

- Parents using Junior ISAs

- Ethical investors using ACE 40 lists

Not ideal for

- Beginners with small balances

- Investors who want commission-free trading

- Mobile-first traders

- Anyone needing a Lifetime ISA

Is Interactive Investor good for beginners?

Interactive Investor can work for beginners who plan to invest regularly and build a larger portfolio, but it is not the easiest or cheapest option to start with. The platform is FCA-regulated and reliable, but its flat monthly fee and more complex interface mean most beginners with small balances are usually better suited to simpler, commission-free investment apps.

How regulated and trustworthy is Interactive Investor in the UK?

Interactive Investor is fully FCA authorised and covered by the Financial Services Compensation Scheme (FSCS), making it one of the safest UK investment platforms. Client assets are held in segregated custodian accounts and protected up to £85,000 per person.

If Interactive Investor failed, your investments would be returned or compensated under FSCS rules. You can also escalate disputes to the Financial Ombudsman Service.

What assets can you trade on Interactive Investor?

Interactive Investor offers one of the broadest investment ranges of any UK platform, making it suitable for diversified, long-term portfolios.

| Asset type | Available on Interactive Investor | Notes |

|---|---|---|

| UK shares | Yes | Trade shares listed on the London Stock Exchange |

| International shares | Yes | Access to major global markets |

| ETFs | Yes | Wide range of passive and thematic ETFs |

| Mutual funds | Yes | Thousands of UK and global funds available |

| Investment trusts | Yes | Strong coverage of UK investment trusts |

| Bonds | Yes | Includes corporate bonds |

| Gilts | Yes | UK government bonds supported |

| Ready-made portfolios | Yes | Managed and risk-rated options available |

| Cryptocurrency | No | Crypto trading not supported |

| CFDs | No | No leveraged CFD products |

| Forex | No | No spot FX trading |

| Options | No | Derivatives not available |

| Futures | No | Futures trading not supported |

How much does Interactive Investor cost?

Interactive Investor charges a monthly subscription fee instead of a percentage-based platform fee. This makes it cheaper for larger portfolios but less attractive for small balances.

Subscription plans

| Plan | Monthly fee | Best for |

|---|---|---|

| Investor Essentials | £4.99 (up to £50k) | Small DIY investors |

| Investor | £11.99 | ISA and GIA users |

| Super Investor | £19.99 | Active, multi-account investors |

| Pension Essentials | £5.99 (up to £50k) | Small SIPP holders |

| Pension Builder | £12.99 | Larger SIPPs |

Trading fees

- UK & US shares and funds: £3.99 per trade

- International shares: £9.99 (£5.99 on Super Investor)

- Dividend reinvestment: £0.99

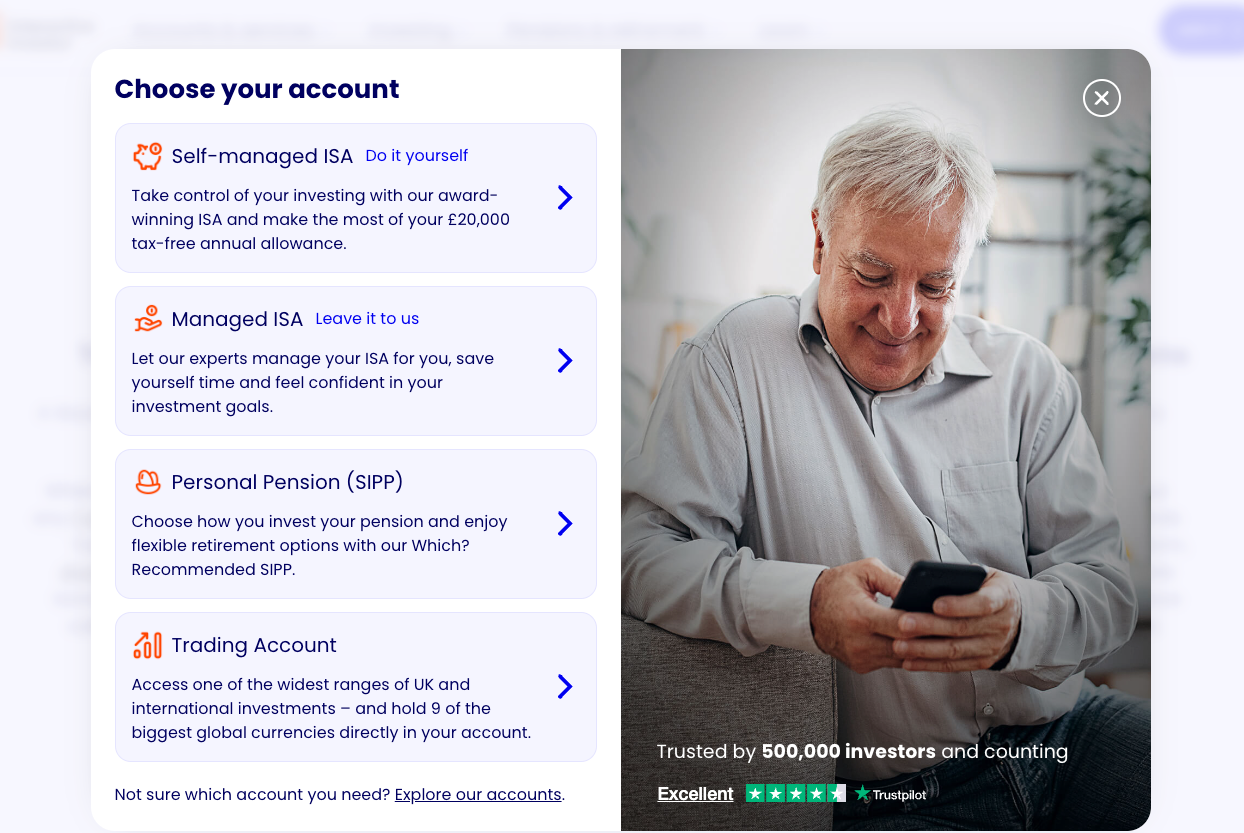

What account types does Interactive Investor offer UK users?

Interactive Investor covers all major UK investing needs except LISAs.

Account types

- Stocks & Shares ISA

- Self-Invested Personal Pension (SIPP)

- Trading Account (GIA)

- Junior ISA

- Joint and company accounts

No Lifetime ISA or Cash ISA available

Does Interactive Investor pay interest on cash?

Yes, Interactive Investor pays interest on uninvested cash held in ISAs, SIPPs, Junior ISAs, and Trading Accounts, though rates are not market-leading. Interest is tiered by balance and account type, making it useful for idle cash but less competitive than specialist platforms.

Key points

- Interest applies to uninvested cash only

- Rates vary by balance and account type

- SIPP cash typically earns more than ISA or GIA cash

- Cash is FSCS protected up to £85,000

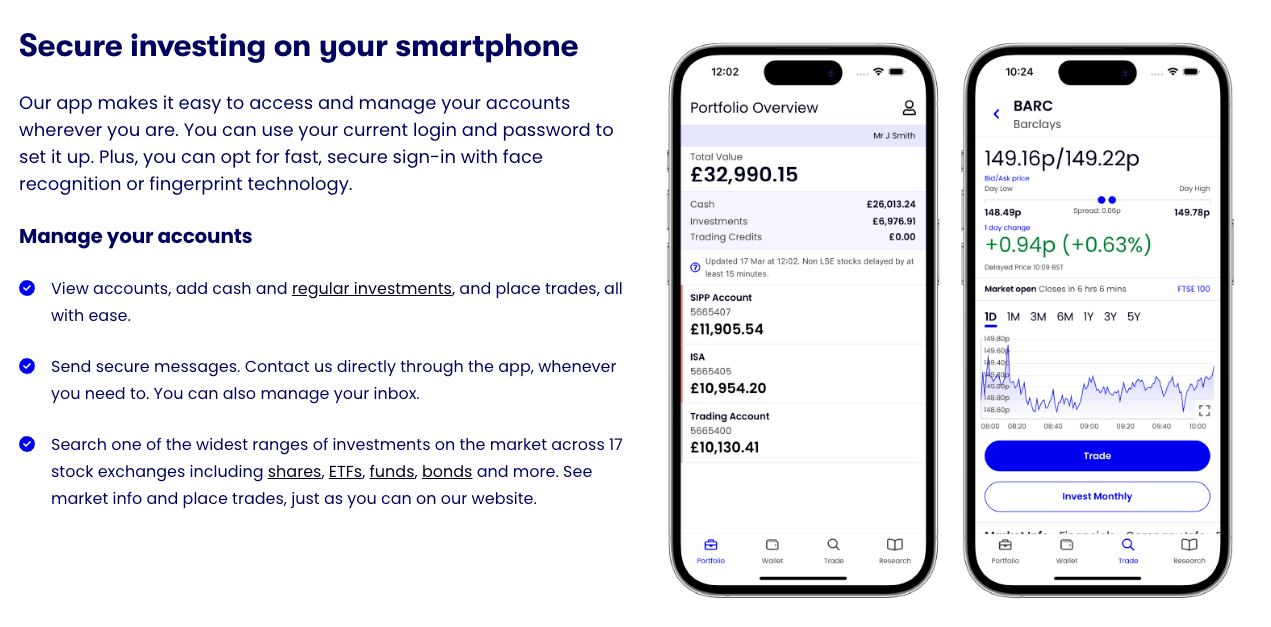

How good is Interactive Investor’s trading platform and mobile app?

Interactive Investor’s platform prioritises reliability and depth over modern design. It works best for experienced investors rather than beginners.

Platform strengths

- Detailed portfolio reporting

- Strong research and filters

- Price alerts on web platform

- Stable execution

Platform weaknesses

- Interface feels dated

- App is functional but not sleek

- Limited charting tools

How easy is it to open an account and start trading?

Opening an Interactive Investor account is fully online and usually takes under 10 minutes. There is no minimum deposit, though you must cover the monthly subscription fee.

Verification is digital for most UK users. In rare cases, ID documents may be required.

Steps to open an Interactive Investor account

- Choose your plan and account type such as ISA, SIPP, or Trading Account

- Complete the online application with your personal details

- Verify your identity digitally

- Fund your account by bank transfer or debit card

- Start investing once your funds arrive

What security features protect an Interactive Investor account?

Interactive Investor uses multiple layers of security alongside FCA regulation to protect client accounts and data. These measures reduce the risk of unauthorised access while keeping investments segregated and protected under UK rules.

Security features

- Two-factor authentication (2FA)

- Encrypted data transmission

- Biometric login on mobile devices

- Segregated client money accounts

- FCA regulation and FSCS protection

How do deposits and withdrawals work?

Interactive Investor supports simple UK funding with no hidden fees.

Deposits

- Bank transfer

- Debit card

- No deposit fees

Withdrawals

- Bank transfer only

- Standard GBP withdrawals are free

- Urgent or foreign currency withdrawals may cost £15

What unique features does Interactive Investor offer UK users?

Interactive Investor stands out for features rarely offered by competitors.

Unique UK features

- Flat-fee pricing that scales well

- ACE 40 ethical investment lists

- Friends & Family account linking

- Ready-made portfolios for beginners

- Award-winning UK phone support

How good is Interactive Investor customer support?

Interactive Investor has some of the best customer support among UK investment platforms, particularly for phone access.

| Channel | Availability |

|---|---|

| Phone support | UK-based, Mon–Fri |

| Secure messages | Yes |

| Live chat | No |

| Help centre | Extensive |

Interactive Investor vs competitors: How does it compare in the UK?

| Platform | Pricing model | Best for |

|---|---|---|

| Interactive Investor | Flat monthly fee | Large portfolios, ISAs, SIPPs |

| Hargreaves Lansdown | Percentage-based | Beginners, brand trust |

| AJ Bell | Percentage-based | Balanced DIY investing |

| Trading 212 | Commission-free | Small investors, beginners |

| Vanguard | Fund-only, low cost | Passive investors |

How does Interactive Investor SIPP drawdown and tax relief work?

Interactive Investor supports flexible SIPP drawdown from the UK minimum pension age, letting you take up to 25% tax-free cash, draw a regular income, take lump sums, or combine both, with no additional platform charges for drawdown, though normal income tax rules apply.

You can also use Pension Wise, the free UK government guidance service. Contributions to an Interactive Investor SIPP benefit from UK pension tax relief, with 20% added automatically, meaning a £100 contribution costs £80 for basic-rate taxpayers, while higher and additional-rate taxpayers can reclaim extra relief via Self Assessment, subject to the £60,000 annual allowance and individual tax circumstances.

What awards, reviews, and third-party ratings does Interactive Investor have?

Interactive Investor is consistently recognised by independent reviewers and customers for value, service, and long-term investing. These third-party validations support its reputation as one of the UK’s most trusted investment platforms.

Independent recognition

- Praised for UK-based phone customer support

- Trustpilot rating: Excellent

- Strong App Store ratings on iOS and Android

- Multiple UK investment awards for ISAs and SIPPs

- Regularly ranked among the best UK investment platforms

What are the main limitations of Interactive Investor?

Key limitations

- Flat fees penalise small balances

- No Lifetime ISA

- No fractional shares

- Platform feels complex for beginners

- Not designed for frequent trading

Our verdict

Interactive Investor is one of the best investment platforms in the UK for serious, long-term investors. Its flat-fee structure, huge investment range, and excellent ISA and SIPP offerings make it especially strong for portfolios above £20,000.

If you value predictable fees, FCA regulation, and strong customer support, Interactive Investor is an excellent choice. Beginners or small investors may prefer commission-free alternatives, but for long-term UK investing, ii remains a top-tier platform.

FAQs

Who owns Interactive Investor UK?

Interactive Investor UK is owned by Aberdeen Group plc, a major UK asset manager, which acquired the platform in 2022. The business remains UK-based and operates under FCA regulation.

Is Interactive Investor safe?

Yes, Interactive Investor is considered very safe. It is authorised by the FCA, covered by FSCS protection, and has over 25 years of operating history in the UK.

What fees does Interactive Investor charge?

Interactive Investor charges a flat monthly subscription, starting from £4.99 per month, plus trading fees from £3.99 per trade. Fees do not increase as your portfolio grows.

Is Interactive Investor FCA regulated?

Yes, Interactive Investor is authorised and regulated by the Financial Conduct Authority (FCA) in the UK.

Is Interactive Investor covered by the FSCS?

Yes, eligible client assets are protected by the FSCS up to £85,000 per person, if Interactive Investor were to fail.

Can I lose money on Interactive Investor?

Yes, the value of investments can fall as well as rise. FSCS protection does not cover investment losses, only platform failure.

Is Interactive Investor good for beginners?

Interactive Investor can suit beginners who plan to invest regularly, but its flat fees are better value for larger portfolios. Many beginners prefer lower-cost, commission-free platforms at first.

Does Interactive Investor offer an ISA and SIPP?

Yes, Interactive Investor offers both a Stocks & Shares ISA and a Self-Invested Personal Pension (SIPP), which are among its most popular accounts.

Does Interactive Investor offer a Lifetime ISA?

No, Interactive Investor does not currently offer a Lifetime ISA (LISA).