Interactive Brokers is a global trading platform known for low fees, advanced tools, and access to international markets.

In this Interactive Brokers Review UK 2026, we explain whether it is a good choice for UK traders by assessing fees, FCA regulation, platform features, and who it is best for.

This guide helps you decide if Interactive Brokers matches your trading experience and goals.

Quick verdict: How do we rate Interactive Brokers for UK traders in 2026?

Interactive Brokers rates as an excellent platform for experienced UK traders who want low fees, deep market access, and professional-grade tools, but it is not ideal for beginners.

Its strengths are pricing, asset coverage, and reputation, while usability and support are weaker for casual investors.

Overall, it suits active, self-directed traders rather than those wanting simplicity.

Overall rating: 4.2 / 5

Full score breakdown

| Category | Score (1-5) | Explanation |

|---|---|---|

| Security & Trust | 5 | FCA-regulated in the UK, long operating history, strong financial controls, and segregation of client funds. |

| Fees & Pricing | 5 | Among the lowest trading fees in the UK market, with tight spreads and transparent commissions. |

| Features | 5 | Exceptional range of global markets, advanced order types, research tools, and professional trading platforms. |

| Ease of Use | 3 | Powerful but complex platform that can feel overwhelming for beginners and casual investors. |

| Customer Support | 3 | Reliable but not best-in-class, with limited hand-holding compared to beginner-focused platforms. |

| Reputation | 4 | Highly respected globally among professional traders, though often seen as too advanced for retail beginners. |

Best for: Advanced and active UK traders focused on low costs, global access, and professional tools.

Not ideal for: Beginners or investors who want a simple, app-first experience.

Is Interactive Brokers good for UK traders?

Yes. Interactive Brokers is a strong choice for experienced and active UK traders who want very low fees, global market access, and professional-grade tools, but it is less suitable for beginners. FCA regulation, FSCS protection, and advanced execution make it reliable, while platform complexity is the main trade-off.

Key strengths for UK-based investors

Interactive Brokers offers several clear advantages for UK traders who are comfortable managing their own investments.

- Low fees and tight execution: UK shares typically cost £3 per trade or 0.05% on larger orders. FX conversion fees are around 0.03%, among the lowest available to UK investors.

- Global market access: Trade across 90+ stock markets worldwide, including the LSE, NYSE, Nasdaq, and major Asian exchanges. This is rare among UK platforms.

- Strong regulation and safety: FCA regulated, client funds held in segregated accounts, and FSCS protection up to £85,000. Additional insurance applies above this limit.

- Advanced platforms and tools: Access to IBKR Desktop, Trader Workstation, IBKR Mobile, and IBKR GlobalTrader, plus advanced order types, options tools, and portfolio analytics.

- Flexible investing options: Fractional shares from $1, multi-currency accounts, and interest paid on uninvested cash above thresholds.

Where Interactive Brokers may not suit UK users

Despite its strengths, Interactive Brokers is not designed for every type of UK investor.

- Steep learning curve: The platform is powerful but complex. Beginners may find the interface overwhelming compared with app-first UK brokers.

- No ready-made portfolios: UK users must build and manage their own portfolios. There are no simple “set-and-forget” investment options.

- ISA fees for inactive investors: The Stocks and Shares ISA carries a £3 monthly fee, waived only if you trade at least £3 per month. This can be costly for small or inactive portfolios.

- Limited funding methods: Deposits and withdrawals are bank transfer only, with one free withdrawal per month.

- Crypto risk: Crypto trading is available, but crypto assets are not FSCS protected and carry higher risk.

Overall verdict for UK traders in 2026

Interactive Brokers is an excellent platform for experienced UK traders who prioritise low costs, global access, and advanced tools over simplicity. If you are confident investing independently and trade regularly, it offers outstanding value. Beginners or hands-off investors may be better served by simpler UK platforms with lower complexity.

What are the pros and cons of using Interactive Brokers?

Interactive Brokers offers very low fees, global market access, and professional-grade tools, making it ideal for experienced UK traders. However, the platform is complex, less beginner-friendly, and lacks ready-made portfolios. The main trade-off is power and pricing versus simplicity and hand-holding found on UK-focused platforms.

| Pros | Cons |

|---|---|

| Very low trading fees on UK and international shares | Complex platform that can overwhelm beginners |

| Ultra-low FX fees around 0.03%, ideal for overseas investing | No ready-made portfolios for hands-off investors |

| Access to 90+ global stock markets, including Asia | £3 monthly ISA fee if you do not trade regularly |

| FCA regulated with FSCS protection up to £85,000 | Bank transfer only for deposits and withdrawals |

| Advanced platforms and tools for active and professional traders | Learning curve compared with UK app-first platforms |

| Fractional shares from $1 for flexible investing | Crypto is available but not FSCS protected |

| Strong execution and liquidity using SMART routing | Account opening process can feel slow and detailed |

What markets and assets can you trade on Interactive Brokers?

Interactive Brokers offers one of the widest market and asset selections available to UK traders, covering shares, ETFs, derivatives, bonds, forex, and crypto exposure across dozens of global exchanges. This breadth suits active and international investors who want deep diversification from a single FCA-regulated platform.

Shares and ETFs (UK and global markets)

UK traders can invest in thousands of shares and ETFs across the UK and overseas, including major and emerging markets.

- UK markets: London Stock Exchange main market and AIM

- Global access: US, Europe, Asia-Pacific, and emerging markets

- Fractional shares: Invest from $1 on eligible stocks and ETFs

- ETF coverage: 13,000+ ETFs across equities, bonds, commodities, and themes

This makes IBKR particularly strong for long-term investors building diversified, multi-region portfolios.

CFDs, options, futures, and leveraged products

Interactive Brokers supports advanced trading strategies through a broad derivatives offering, best suited to experienced traders.

- Options: Equity, index, and ETF options across major global exchanges

- Futures: Index, commodity, interest rate, and currency futures

- CFDs: Mainly stock and index CFDs for UK clients

- Leverage: Available via margin accounts, subject to FCA rules

Bonds, funds, and fixed income access

Interactive Brokers is unusually strong for fixed income compared with most UK retail platforms.

- Bonds: UK gilts, US Treasuries, and global government and corporate bonds

- Bond inventory: Tens of thousands of individual bonds

- Funds: 55,000+ mutual funds, including 20,000+ with no transaction fee

- ETFs: Fixed income ETFs across regions and maturities

This depth appeals to income-focused and portfolio-balancing investors.

Forex trading and currency pairs

IBKR offers direct forex trading alongside investing, with very low conversion costs.

- Currency pairs: Around 100 FX pairs

- FX fees: Typically around 0.03%, among the lowest in the UK

- Multi-currency accounts: Hold and trade in 25+ currencies

Crypto exposure availability and limitations

Interactive Brokers provides limited but regulated crypto exposure for UK users.

- Available exposure:

- Crypto ETNs listed on regulated exchanges

- Spot crypto via approved partners (where permitted)

- Fees: Around 0.12% to 0.18% per trade

- Important limitation:Crypto is not FSCS protected and is high risk

Interactive Brokers’ global reach is one of its biggest strengths.

Total access:

- 90+ stock markets

- 150+ exchanges

- 34+ countries

How much does Interactive Brokers cost? (fees, pricing & execution)

Interactive Brokers is one of the lowest-cost brokers available to UK traders, particularly for frequent, international, and multi-asset trading. Pricing is transparent, execution quality is strong, and most costs are usage-based rather than flat platform fees.

Trading commissions by asset class

Interactive Brokers charges commission-based pricing, which is typically cheaper than flat-fee UK platforms for active traders.

| Asset class | Typical UK cost |

|---|---|

| UK shares & ETFs | £3 per trade or 0.05% on larger orders |

| US shares | $0.005 per share (min $1) |

| Options | From £0.15 per contract |

| Futures | From £0.15 per contract |

| CFDs | Commission + spread |

| Crypto | 0.12%–0.18% of trade value |

FX conversion fees and multi-currency costs

Interactive Brokers is exceptionally cheap for currency conversion, which is a major advantage for UK investors trading overseas markets.

- FX conversion fee: Around 0.03%

- Multi-currency accounts: Hold and trade in 25+ currencies

- Auto FX conversion: Prevents unnecessary manual conversion costs

This makes IBKR far cheaper than most UK brokers that charge 0.5%–1.5% FX fees.

Spread structure and pricing transparency

Interactive Brokers uses exchange-based pricing rather than widening spreads.

- Trades are routed directly to exchanges

- No hidden mark-ups on spreads

- Commission and FX costs are shown before order confirmation

- Clear post-trade cost reporting via Client Portal

This structure benefits active traders who value price transparency and tight execution.

Margin rates and financing costs

Margin borrowing at Interactive Brokers is among the cheapest in the UK market, but margin trading increases risk.

- GBP margin rates: Typically lower than UK competitors

- USD margin rates: Around 5.4% (tiered, lower for larger balances)

- Minimum margin requirement: $2,000 equivalent

Margin is best suited to experienced traders who understand leverage risk.

Non-trading fees to be aware of

Most non-trading fees are low or avoidable, but they matter for inactive users.

| Fee Type | Cost |

|---|---|

| Account opening | £0 |

| Inactivity fee | None |

| ISA fee | £3 per month (waived if you trade £3+) |

| Withdrawals | 1 free per month, then £7 (GBP) |

| Custody fee | None |

Execution quality and smart order routing

Interactive Brokers is known for institutional-grade execution.

- SMART routing scans multiple venues for best price and liquidity

- Reduced slippage on large or fast-moving orders

- Access to deep global liquidity pools

- Suitable for high-frequency and professional-style trading

How good are Interactive Brokers’ trading platforms, tools, and mobile apps?

Interactive Brokers offers some of the most advanced trading platforms available to UK traders, designed for precision, speed, and flexibility rather than simplicity. The tools are excellent for active and professional users, but the depth can feel excessive for beginners.

| Platform / Tool | What It’s Best For | Key Strengths | Main Limitations |

|---|---|---|---|

| Trader Workstation (TWS) | Professional and active traders | Advanced multi-asset trading, deep analytics, highly customisable layouts, institutional-grade execution | Steep learning curve, not beginner-friendly |

| Web-based Client Portal | Everyday investing and portfolio management | Clean interface, easy share and ETF trading, clear reporting, PortfolioAnalyst tools | Fewer advanced tools than TWS |

| IBKR Mobile App | Active traders on the go | Full trading functionality, alerts, advanced orders, strong security | Can feel complex on smaller screens |

| IBKR GlobalTrader App | Beginners and small portfolios | Simplified design, fractional shares from $1, demo mode | Fewer order types and tools |

| Charting & Research Tools | Analysis-driven investors | Advanced charts, indicators, fundamentals, ESG data, news and earnings | Research is more US-focused than UK-specific |

| Advanced Order Types | Precision trading and risk control | 90+ order types, conditional orders, SMART routing | Requires experience to use effectively |

| API Access | Algorithmic and system traders | Robust APIs, automation support, direct market access | Not suitable for casual investors |

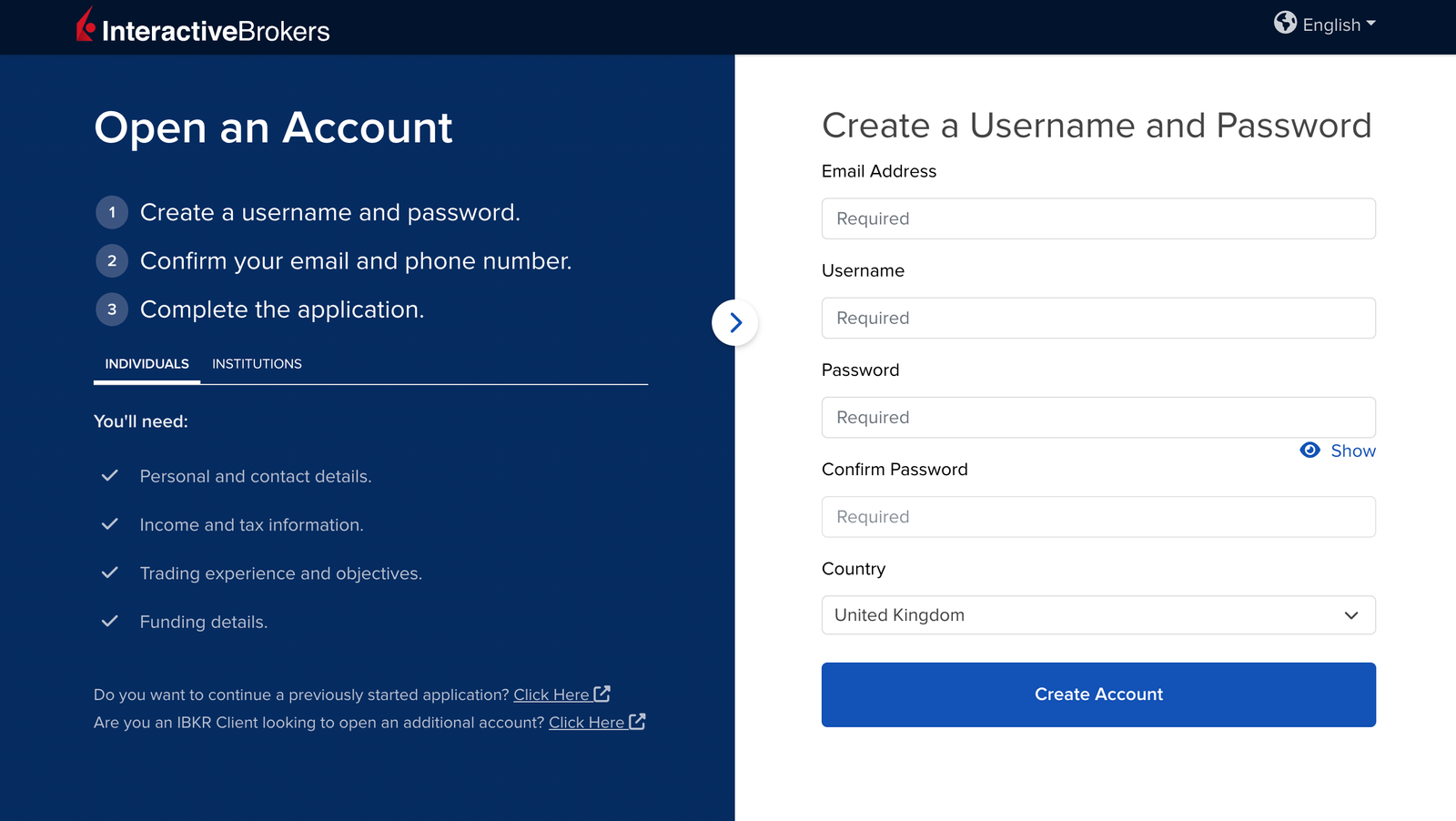

How easy is it to open an account and start trading?

Opening an Interactive Brokers account in the UK is fully online, but more detailed than most UK platforms. There is no minimum deposit, but expect thorough checks and a more involved setup due to FCA and product access requirements.

UK account opening requirements

- 18+ for a cash account

- 21+ for a margin account

- UK resident or UK tax resident

Identity verification and compliance checks

- Photo ID required

- Proof of address required

- Tax residency and NI details

- Employment, income, and investing experience questions

Account approval times

- Typical approval time: 1–3 business days

- Delays are usually caused by missing or unclear documents

Common onboarding pain points

- Longer application than UK trading app-first brokers

- Detailed financial and experience questions

- The interface can feel complex for beginners

Tips for a smoother application process

- Prepare ID and address documents in advance

- Answer all questions clearly and consistently

- Start with a cash account

- Use IBKR GlobalTrader for a simpler first setup

How do deposits and withdrawals work on Interactive Brokers?

| Feature | Deposits | Withdrawls |

|---|---|---|

| Available methods (UK) | Bank transfer only | Bank transfer only |

| Minimum amount | £0 | £0 |

| Fees | Free | 1 free withdrawal per month, then £7 (GBP) |

| Processing time | 1–3 business days | ~2 business days |

| Account name requirement | Must be in your own name | Must be in your own name |

| Currency support | 25+ supported base currencies | 25+ supported base currencies |

| Tracking | Pending deposits shown in Client Portal | Real-time tracking in Client Portal |

| Cards & e-wallets | Not supported | Not supported |

| Security | FCA rules, segregated client funds | FCA rules, segregated client funds |

What account types does Interactive Brokers offer UK traders?

Interactive Brokers offers more account types than most UK brokers, making it flexible for individuals, families, and professionals, but setup complexity increases with advanced accounts.

| Account Type | Who is it for | Key Features | Notes for UK traders |

|---|---|---|---|

| Individual Cash Account | Most retail investors | No leverage, simple investing | Best starting option for beginners |

| Individual Margin Account | Experienced traders | Leverage and short selling | 21+ required, higher risk |

| Joint Account | Two account holders | Shared ownership and access | Useful for couples or families |

| Stocks & Shares ISA | Tax-efficient investing | Capital gains and income tax-free | £3 monthly fee if inactive |

| Junior ISA | Children under 18 | Long-term tax-free investing | £1 monthly fee if inactive |

| SIPP (via third party) | Retirement investors | Pension tax advantages | Not directly run by IBKR |

| Trust Account | Trustees and beneficiaries | Legal separation of assets | More complex setup |

| Business Account | Companies | Corporate investing | Extra documentation required |

| Friends & Family Account | Small investor groups | Linked account management | Up to 15 members |

| Advisor / Money Manager | Professionals | Manage client portfolios | Not typical for retail users |

How good is Interactive Brokers’ customer support?

Interactive Brokers offers reliable but functional customer support, focused more on problem-solving than hand-holding. It suits experienced UK traders, but beginners may find support less accessible than with UK app-first platforms.

Interactive Brokers vs competitors (UK quick comparison)

| Platform | FCA regulated | Typical fees | Markets & assets | Platform complexity | Best for |

|---|---|---|---|---|---|

| Interactive Brokers | Yes | Very low commissions, tight spreads, low FX fees | Very broad. Global shares, ETFs, options, futures, bonds, FX | High | Active, professional, and global traders |

| Trading 212 | Yes | £0 commission on stocks and ETFs | Shares, ETFs, limited CFDs | Low | Beginners and long-term investors |

| IG | Yes | Commission-free shares, wider spreads on CFDs | Shares, ETFs, CFDs, spread betting | Medium | CFD and spread betting traders |

| Saxo | Yes | Higher commissions and FX fees | Shares, ETFs, options, futures, bonds, FX | Medium to high | Affluent and sophisticated investors |

| eToro | Yes | £0 stock commission, high FX and crypto spreads | Shares, ETFs, CFDs, crypto | Low | Social trading and casual investors |

How safe, secure, and FCA-regulated is Interactive Brokers in the UK?

Interactive Brokers is very safe for UK traders, with strong regulation, client protections, and a long track record.

It is authorised and regulated by the FCA, meaning it must meet strict UK standards on capital, conduct, and client money handling.

Key safety points for UK users

- FCA regulated through Interactive Brokers (U.K.) Limited

- FSCS protection up to £85,000 for eligible accounts

- Client funds held in segregated accounts

- Two-factor authentication and encrypted systems

- Publicly listed company with $14bn+ equity capital

Is Interactive Brokers right for your trading style?

| Trading style | Suitability | Why |

|---|---|---|

| Long-term investing | ★★★★★ | Very low fees, access to global shares and ETFs, strong portfolio tools |

| Day trading | ★★★★☆ | Excellent execution and tools, but platforms can feel heavy and complex |

| Options trading | ★★★★★ | Industry-leading options tools, strategies, and pricing |

| International investing | ★★★★★ | 90+ global markets, ultra-low FX fees, multi-currency accounts |

| Beginners | ★★☆☆☆ | Powerful but complex, steep learning curve |

| Hands-off investing | ★☆☆☆☆ | No ready-made portfolios or guided investing options |

Conclusion: Is Interactive Brokers the right choice for UK traders?

Interactive Brokers is a top-tier platform for experienced UK traders who want low fees, global market access, and advanced trading tools.

Its FCA regulation and FSCS protection add trust, but the platform’s complexity means it is not the best starting point for beginners.

If you are confident in managing your own investments and trade regularly, Interactive Brokers offers outstanding value.

If you prefer simplicity or hands-off investing, UK-focused platforms may be a better fit.

FAQs

Is Interactive Brokers FCA regulated?

Yes. Interactive Brokers operates in the UK through Interactive Brokers (U.K.) Limited, which is authorised and regulated by the FCA, meaning it must follow strict UK rules on client money and conduct.

How safe is my money with Interactive Brokers?

Your money is well protected. Client funds are held in segregated accounts with FSCS protection up to £85,000, plus strong security such as two-factor authentication. Crypto is not FSCS protected.

Can I lose my funds if IBKR goes bankrupt?

It is unlikely. Eligible UK clients are covered by the FSCS up to £85,000, and segregated accounts keep client money separate. Losses can still occur due to market movements or leverage.