IG is one of the UK’s most established trading platforms, offering a wide range of assets, competitive spreads and strong regulatory protection under the FCA. It’s trusted by more than 300,000 UK and international traders.

After testing IG’s apps, tools, execution speed and fees with a live UK account, this review breaks down everything you need to know: its fees, tools, safety standards and overall user experience so you can decide whether it fits your trading style.

Below, you’ll find a clear breakdown to help UK traders make an informed choice.

Is IG good for beginners?

Yes, IG is a good choice for beginners when using the IG Invest app, which offers a simple layout, clear explanations and access to diversified ETFs and Smart Portfolios.

While the main IG Trading platform can feel complex at first, IG’s strong education tools, demo account and FCA-regulated safety make it a secure and supportive place to start investing.

Quick verdict: How do we rate IG for UK traders in 2026?

Overall rating: 4.4 / 5 (Good)

IG scores highly for security, tools and investment choice, making it one of the most reliable all-round platforms for UK traders.

Fees can be higher for inactive users, but platform quality, FCA oversight and strong educational resources give IG an edge over most competitors.

Overall, it remains a top choice for traders who value trust, depth and performance.

Full score breakdown

| Category | Score | Reason |

|---|---|---|

| Security & Trust | 5 | FCA-regulated, FSCS protection, segregated client funds, long track record, strong security. |

| Fees & Pricing | 3.5 | Commission-free shares, but custody fees and FX costs affect inactive and small-balance users. |

| Features | 4.5 | 13,000+ assets, Smart Portfolios, CFDs, spread betting, crypto, advanced charting, weekend trading. |

| Ease of Use | 4 | IG Invest is beginner-friendly; main platform powerful but complex for new users. The app is fast and intuitive. |

| Customer Support | 4 | Fast live chat and WhatsApp; support not fully 24/7. |

| Reputation | 5 | Established FTSE 250 company, strong industry rankings, trusted by UK traders. |

IG at a glance

Key features

- FCA-authorised UK broker

- 13,000+ global shares & ETFs

- Commission-free UK, US, EU and Australian share trading

- 4% interest on uninvested GBP (conditions apply)

- Two apps: IG Trading (advanced) and IG Invest (beginner-friendly investment app)

- Smart Portfolios built with BlackRock

- Offers CFDs, spread betting, crypto, FX, options and futures

- FSCS protection up to £85,000 on eligible assets

- Broad research tools including IG Academy and daily Trade Live show

- Custody fee of £24 per quarter unless you make 3+ trades or hold £15,000 in a Smart Portfolio

What are the pros and cons of using IG as a trading platform?

Pros

- Fast, stable and professional trading platform

- Strong trust and long history

- Commission-free share dealing across major markets

- Massive product range (13,000+ shares & ETFs)

- Some of the best charts & research tools in the UK

- Excellent mobile experience across two tailored apps

- Smart Portfolios offer diversified, ready-made investing

- 4% interest on uninvested GBP

Cons

- £24 quarterly custody fee unless active or holding £15k+ Smart Portfolio

- Platform can feel complex for complete beginners

- FX conversion fee of 0.7% on overseas assets

- Phone dealing fees are high (£40–£50)

- No direct mutual funds or gilts outside ETF structures

IG – who’s it best for?

- Active UK traders wanting reliable execution and deep market coverage

- Share investors seeking zero-commission trading across global markets

- Beginners using the simplified IG Invest app and Smart Portfolios

- ETF investors building diversified portfolios

- Advanced traders using CFDs, spread betting, ProRealTime and advanced tools

- Long-term investors benefiting from Smart Portfolios and tax-efficient ISAs/SIPPs

- Safety-focused investors prioritising FCA regulation and FSCS protection

Who IG is NOT ideal for

- Very passive investors who rarely trade

- Users wanting mutual funds or OEICs

- Small portfolios (<£2,000) affected by custody fees

- Traders looking for ultra-cheap CFD fees

- People wanting simple, beginner-only interfaces

How easy is it to open an IG account in the UK?

Opening an IG account is quick and accessible for beginners. The application takes around five minutes, ID verification is usually automated, and most users are approved within 24 hours.

Once verified, you can immediately access both the demo environment (for CFD practice) and the live platform.

Steps to open an IG account

- Go to IG’s UK website or download the IG Invest or IG Trading app.

- Select your account type (ISA, GIA, SIPP, or CFD/spread betting).

- Enter personal details and complete the appropriateness questionnaire.

- Upload proof of identity and address.

- Fund your account via bank transfer, debit card, or PayPal.

What trading accounts does IG offer to UK investors?

IG offers an excellent mix of accounts for traders and long-term investors. You can choose a Stocks & Shares ISA, General Investment Account (GIA), Self-Invested Personal Pension (SIPP), or more advanced options such as CFD and spread betting accounts. Its range suits both casual investors and more advanced traders.

Stocks & Shares ISA

- 13,000+ shares & ETFs

- Commission-free trading

- Flexible withdrawals

- Smart Portfolios available

General Investment Account (GIA)

Best for users who:

- Maximise their ISA allowance

- Want CFD/spread betting access

- Want foreign shares or advanced tools

IG SIPP

- Run with Options UK

- £210 annual admin fee

- Access to shares, ETFs, Smart Portfolios

- Best for medium-large retirement portfolios

CFD & spread betting accounts

- For experienced traders only.

- Full access to forex, indices, commodities, shares, and crypto.

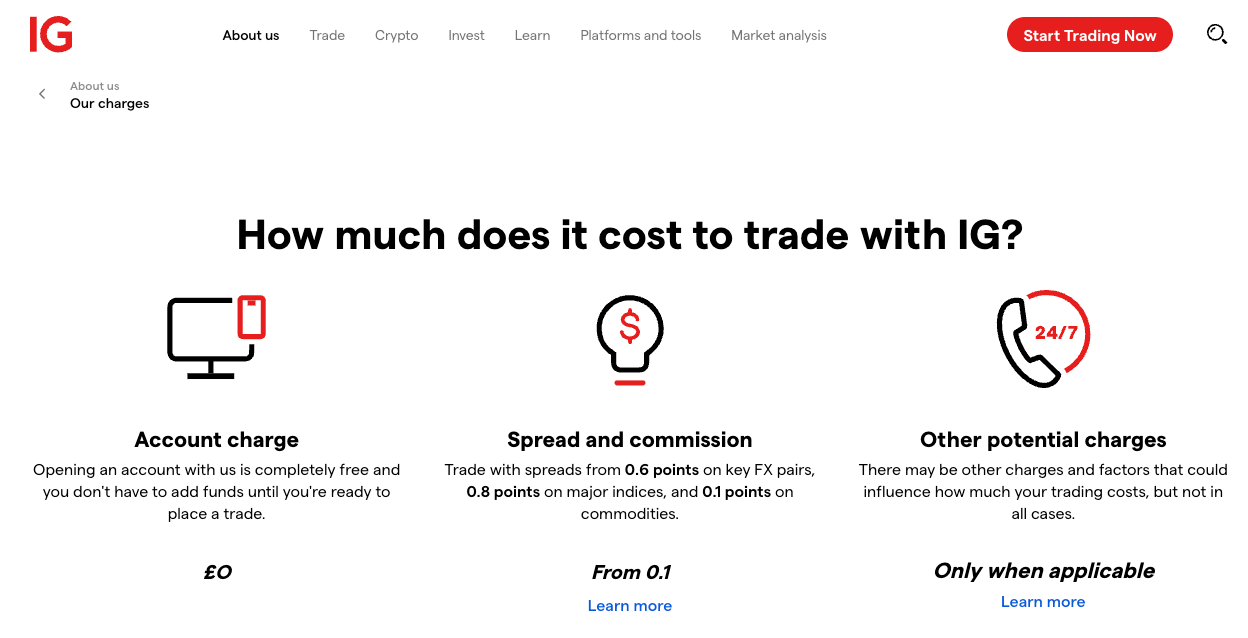

What fees and charges should UK traders expect on IG?

IG’s fees are competitive for active traders but can be costly for infrequent users. Online share dealing is commission-free, but FX fees and custody fees apply depending on activity.

Core IG fees summary

| Fee type | Cost | Notes |

|---|---|---|

| UK & US share dealing | £0 | Online trades only |

| Custody fee | £24/quarter | Waived with 3+ trades per quarter or £15,000 in Smart Portfolio |

| FX conversion | 0.7% | For non-GBP assets |

| Smart Portfolio fee | 0.50% up to £50k | Then 0% above £50k |

| ETF/fund charges | ~0.13% | Underlying fund costs |

| Phone dealing fee | £40–£50 | Only for phone-based trades |

Are IG’s fees competitive?

- Active traders: excellent value

- Beginners making occasional trades: potentially expensive

- Long-term investors: Smart Portfolios provide decent efficiency

Compared to rivals like Trading 212 or Freetrade, IG is pricier for small accounts but offers far more tools, education, and asset coverage.

What can you trade on IG in the UK?

IG offers one of the broadest selections of UK-accessible assets. From traditional shares and ETFs to complex derivatives, the platform is built for versatility.

Asset coverage

| Asset type | Availability | Notes |

|---|---|---|

| Shares | 13,000+ | UK, US, EU, Australia, Asia |

| ETFs | Yes | Wide global selection |

| Investment Trusts | Yes | Good coverage |

| Smart Portfolios | Yes | Managed by BlackRock |

| Crypto | Yes | 35+ coins via Uphold |

| CFDs | Yes | Forex, indices, commodities, equities |

| Spread Betting | Yes | Tax-efficient for UK traders |

| Bonds | Indirect | Through bond ETFs |

IG stands out for its range, especially compared to simpler trading apps like Trading 212.

What unique features does IG offer UK users?

IG offers UK-specific features that make it stand out, including flexible ISAs, Smart Portfolios built with BlackRock, commission-free share dealing, and tax-efficient spread betting.

UK traders also benefit from weekend trading, top-tier education, and advanced charting tools that go beyond most other platforms.

Key unique features

- Flexible Stocks & Shares ISA

- Smart Portfolios (BlackRock)

- Commission-free global shares

- Spread betting (UK-exclusive)

- Weekend trading

- IG Academy & Trade Live

- Advanced ProRealTime charts

- 4% interest on uninvested GBP

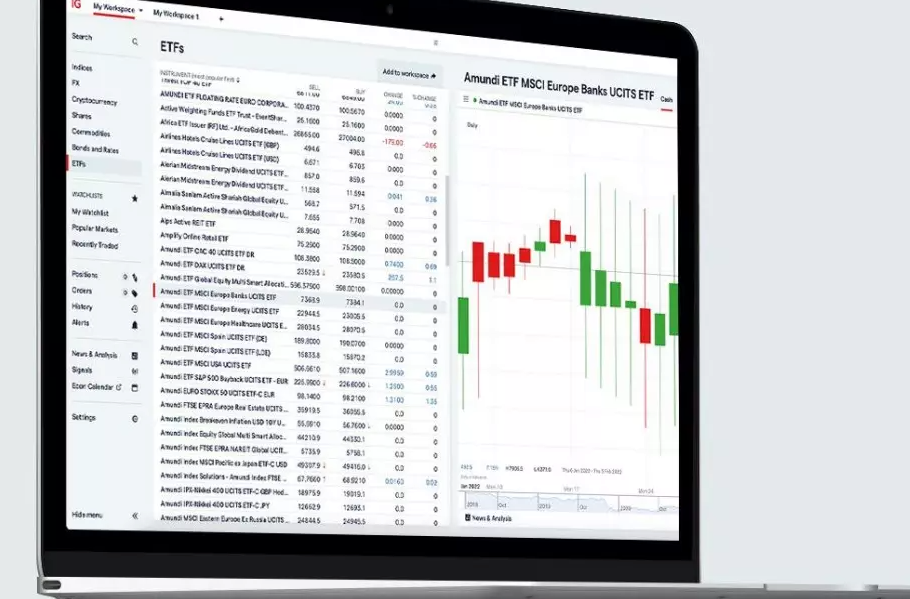

How good are IG’s trading platforms and tools?

IG offers two high-quality platforms: the advanced IG Trading platform and the simpler IG Invest app. Both are well-designed, responsive, and equipped with strong research features.

IG Trading Platform – advanced & powerful

Best for experienced traders. Features include:

- Deep chart customisation

- 30+ indicators

- Price alerts & level 2 data (subscription)

- Fast, reliable execution

- Access to CFDs, spread betting, crypto, FX

IG Invest App – beginner-friendly

Ideal for new investors.

Features include:

- Clear, simple layout

- Watchlists & market news

- Buy shares, fractional shares ETFs, crypto

- Bite-sized educational lessons

- Smart Portfolio access

ProRealTime (advanced charting)

- 30+ indicators

- Customisable charts

- Pro-level execution

- Level 2 data (add-on)

- Weekend trading

- Access to CFDs, spread betting, FX & crypto

- £30/month unless actively trading

Deposit & withdrawal experience

| Action | Speed | Fees | Verdict |

|---|---|---|---|

| Debit card deposit | Instant | Free | Fast & simple |

| Bank transfer | 1–3 days | Free | Standard |

| PayPal deposit | Instant | Free | Flexible but less used |

| Withdrawals | 1 working day processing | Free | Quick and reliable |

How good is IG’s education and research for beginners?

IG is arguably the strongest UK broker for education quality. Its IG Academy, webinars, research tools, and daily streaming content help beginners learn how to start trading and investing basics quickly.

IG learning tools overview

| Tool | Description |

|---|---|

| IG Academy | Free structured courses from beginner to advanced |

| Webinars | Daily and weekly sessions with market experts |

| Trade Live | Morning live show covering news and analysis |

| Invest Lessons | Beginner-friendly guides in the IG Invest app |

| Articles & Guides | Markets, psychology, technical analysis |

IG’s education is frequently ranked #1 in the UK across industry reviews.

Is IG safe and trustworthy for UK investors?

Yes, IG is one of the safest and most regulated brokers in the UK. It has been operating since 1974, holds strict FCA authorisation, and uses strong security measures.

Safety & trust checklist

| Protection level | Details |

|---|---|

| FCA Regulation | Fully authorised & compliant |

| FSCS Protection | Up to £85,000 on eligible assets |

| Segregated Funds | Client money separate from IG’s |

| 2FA Security | Available across all platforms |

| History | 50+ years of operation |

| Public Company | FTSE 250 listed, strong transparency |

IG also provides:

- Negative balance protection

- Regular audits

- Bank-grade encryption

These factors place IG in the top tier of UK brokers for reliability.

How good is IG’s customer support?

IG’s customer support is generally strong, with fast responses via live chat, WhatsApp and phone during UK trading hours. It’s professional and reliable, though not fully 24/7.

Beginners may prefer more hand-holding, but overall support quality is above average for a UK trading platform.

Support summary

- Live chat (fastest)

- WhatsApp & email support

- UK phone support

- Extensive help centre

- Not fully 24/7

What limitations should UK users be aware of?

IG’s main limitations are its quarterly custody fee for inactive traders, FX costs on foreign assets, and a platform that can feel complex for beginners.

It also lacks mutual funds and charges high phone dealing fees, making it less suitable for very small or passive portfolios.

Key limitations

- £24 quarterly inactivity fee

- 0.7% FX conversion fee

- Complex for beginners

- No mutual funds

- High phone trading fees

- Limited bonds (via ETFs only)

How does IG compare to major UK trading alternatives?

IG competes closely with the UK’s biggest platforms. It’s not the cheapest, but its overall package is one of the strongest.

IG vs key competitors

| Broker | Best for | Key strength | Weakness |

|---|---|---|---|

| IG | Balanced investors & active traders | Regulation, tools, education | Custody fees for low activity |

| Pepperstone | Forex professionals | Ultra-low spreads | Limited share coverage |

| CMC Markets | Charting & analytics | Very powerful tools | Complex interface |

| Trading 212 | Beginners & fee-hunters | Zero fees | Fewer advanced tools |

| Freetrade | Long-term investors | Cheap SIPP, fee-free ISA | Smaller asset range |

IG’s advantage lies in its complete offering: a blend of research, safety, tools, and professionalism.

Is IG right for beginner investors in the UK?

Yes, especially when using the IG Invest app. Beginners get education, simple navigation, and access to diversified ETFs and Smart Portfolios. The only drawback is custody fees if you are not an active trader.

Beginners will like:

- Zero-commission UK and US share dealing

- IG Academy learning

- Smart Portfolios managed by BlackRock

- Strong safety and FCA regulation

Beginners may dislike:

- £24 quarterly inactivity fee

- Too many advanced tools on the main platform

Conclusion

IG remains one of the strongest and most trustworthy trading platforms in the UK, combining FCA regulation, a wide choice of investments, and polished tools suitable for both beginners and experienced traders.

While its fees can be higher for infrequent users, the platform’s reliability, education, Smart Portfolios, and commission-free global shares make it a standout choice for committed UK investors.

If you value safety, depth, and a professional trading experience, IG is a platform that consistently delivers.

FAQs

Is IG UK legit?

Yes. IG is a legitimate, FCA-regulated UK broker with over 50 years of operating history and strong client protection standards.

Is IG regulated in the UK?

Yes. IG is authorised and regulated by the Financial Conduct Authority (FCA), meaning it must meet strict rules on conduct, transparency and client fund protection.

Is my money safe with IG?

Yes. Client funds are held in segregated accounts, and eligible assets are protected up to £85,000 under the FSCS. Crypto assets are not FSCS-protected.

What is the minimum deposit for IG?

There is no minimum deposit for bank transfers. Card deposits typically require £500.

What does the IG ISA offer?

The IG Stocks & Shares ISA offers 13,000+ global assets, flexible withdrawals, Smart Portfolios, and commission-free share dealing for active users.

What are the IG ISA fees in the UK?

IG charges £24 per quarter unless you trade at least 3 times per quarter or hold £15,000+ in a Smart Portfolio. Smart Portfolios cost 0.50% on the first £50k, plus small fund fees.

What are IG’s trading fees in the UK?

Online share dealing is commission-free, with a 0.7% FX fee for overseas assets and a £24 quarterly custody fee unless activity thresholds are met. Phone dealing incurs additional charges.