This Hargreaves Lansdown review UK 2026 explains how the platform works, what it costs, and where it excels or falls short for UK investors.

We cover fees, pros and cons, FCA regulation, ISA and SIPP options, and who Hargreaves Lansdown is best suited to, so you can quickly decide if it matches your investing needs.

Quick verdict: How do we rate Hargreaves Lansdown for UK traders in 2026?

Overall rating: 4.1 / 5

Hargreaves Lansdown scores highly as a premium, highly trusted UK investment platform built for long-term investors rather than active traders. It excels in security, customer support, research, and reputation, but loses points on fees, particularly for fund-heavy portfolios and frequent share dealing.

It is best suited to investors who value guidance, stability, and service over the lowest possible costs. Cost-conscious or high-frequency traders will usually find better value elsewhere.

Full score breakdown

| Category | Score (1–5) | Rationale |

|---|---|---|

| Security & Trust | 5.0 | FCA regulated, FSCS protection up to £85,000, segregated client funds, listed UK company with 40+ years of history. Among the safest UK platforms. |

| Fees & Pricing | 3.0 | Transparent but expensive. Platform fees on funds and share dealing costs are higher than most UK competitors, especially for smaller portfolios. |

| Features | 4.5 | Excellent research, wide asset coverage, tax-efficient accounts, ready-made portfolios, and strong planning tools. Lacks advanced trading features. |

| Ease of Use | 4.0 | Clean, intuitive web and mobile platforms with smooth onboarding. Can feel information-heavy for absolute beginners. |

| Customer Support | 5.0 | One of the best in the UK. Fast, knowledgeable, UK-based phone and secure messaging support sets HL apart from low-cost rivals. |

| Reputation | 5.0 | Market leader with over 1.8 million customers, strong Trustpilot and industry awards, and long-standing brand trust. |

Hargreaves Lansdown at a glance

Key features

- Customers: Over 1.8 million UK investors

- Assets under management: Over £170 billion

- Regulation: FCA regulated

- Listed on the London Stock Exchange

- FTSE 250 constituent

- FSCS protection: Up to £85,000

- Minimum investment: £100 lump sum or £25 monthly

- Accounts: ISA, SIPP, LISA, JISA, GIA

- Investment range: 13,000+ assets

- Best for: Long-term UK investors who value guidance and support

- Founded in 1981 by Peter Hargreaves and Stephen Lansdown

What are the pros and cons of using Hargreaves Lansdown?

Pros

- Strong investment research and market insights

- Excellent UK-based customer support

- Wide range of investments and account types

- Beginner-friendly onboarding and education

- FCA regulated with FSCS protection

- Fee caps benefit larger share-only portfolios

- Free Junior ISA and Junior SIPP

Cons

- Higher platform fees for funds

- Share dealing fees up to £11.95

- FX fees are expensive for overseas trading

- Limited advanced trading and charting tools

- Can feel overwhelming for first-time investors

Who is Hargreaves Lansdown best for?

- Beginners who want guidance and education

- Long-term ISA and SIPP investors

- Investors holding multiple funds and portfolios

- Parents investing via Junior ISAs

- Investors who value phone-based customer support

Who is not ideal for?

- Active day traders

- Fee-sensitive investors with small fund portfolios

- Traders focused on CFDs, forex, or derivatives

- Investors who mainly trade overseas shares

Is Hargreaves Lansdown good for beginners?

Hargreaves Lansdown is good for beginners, especially those who want guidance and reassurance rather than the cheapest platform. The interface is easy to use, account setup is straightforward, and the platform offers excellent educational content, ready-made portfolios, and UK-based customer support. The main drawback for beginners is cost, as fees are higher than investing app-based rivals, but many first-time investors find the extra support and clarity worth paying for.

How regulated and trustworthy is Hargreaves Lansdown in the UK?

Hargreaves Lansdown is fully regulated by the FCA and is one of the most trusted investment firms in the UK, with over 40 years of operating history.

- Client money is held in segregated accounts

- Covered by the FSCS up to £85,000 per person

- Listed on the London Stock Exchange

- Regular audits and strong cybersecurity controls

Important: Investments are not guaranteed and can go down as well as up.

What assets can you trade on Hargreaves Lansdown?

Hargreaves Lansdown offers one of the broadest investment selections in the UK, suitable for diversified, long-term portfolios.

- UK and international shares

- ETFs and investment trusts

- Mutual funds and tracker funds

- Corporate and government bonds

- Gilts and selected structured products

- Ready-made and model portfolios

How much does Hargreaves Lansdown cost? (Fees explained)

Hargreaves Lansdown’s fees are transparent but higher than discount trading platforms, especially for investors holding funds.

Platform fees

Funds:

- 0.45% on first £250,000

- 0.25% on £250k–£1m

- 0.10% on £1m–£2m

Shares, ETFs, bonds:

- 0.45% capped at £45 (ISA) or £200 (SIPP)

Dealing fees

- UK shares: £11.95 per trade

- Discounts for frequent trading

- No dealing charges on funds

Other costs

- No account opening or exit fees

- No withdrawal fees

- FX fees apply on overseas investments

Real-world impact: HL is competitively priced for large share-only portfolios but expensive for fund-heavy accounts under £100,000.

Example annual costs

| Portfolio size | Typical mix | Estimated annual cost |

|---|---|---|

| £5,000 | Funds | ~£23 |

| £20,000 | Funds & shares | ~£95 |

| £100,000 | Funds & shares | ~£450–£590 |

Funds vs shares cost difference: Funds are charged a percentage-based platform fee, which increases as your portfolio grows. Shares, ETFs, and investment trusts benefit from annual fee caps, making them much cheaper to hold at scale.

Why fee caps matter: If you mainly hold shares or ETFs, HL can be competitively priced for larger portfolios because costs stop rising once the cap is reached. Fund-heavy portfolios do not benefit in the same way.

What account types does Hargreaves Lansdown offer UK users?

Hargreaves Lansdown provides a full range of UK tax-efficient and general investment accounts.

- Stocks & Shares ISA

- Self-Invested Personal Pension (SIPP)

- Lifetime ISA (LISA)

- Junior ISA and Junior SIPP

- General Investment Account (GIA)

How good is Hargreaves Lansdown’s trading platform and mobile app?

Hargreaves Lansdown’s platform is intuitive, reliable, and designed for long-term investing rather than active trading.

- Clean web-based interface

- Highly rated mobile app with biometric login

- Real-time prices and portfolio tracking

- Alerts, watchlists, and research tools

- Limited advanced charting and technical analysis

How easy is it to open an account and start trading?

Opening an account with Hargreaves Lansdown is fast and beginner-friendly, typically taking under 15 minutes online.

- Choose account type

- Verify identity digitally

- Fund via debit card or bank transfer

- Start investing immediately

How to buy shares on Hargreaves Lansdown?

Buying shares on Hargreaves Lansdown is straightforward.

- Open an ISA, SIPP, or General Investment Account

- Fund your account via debit card or bank transfer

- Search for the share, ETF, or investment

- View the live price and dealing fee

- Confirm and place the trade

Shares typically appear in your portfolio immediately after execution.

How do deposits and withdrawals work?

Hargreaves Lansdown supports standard UK payment methods with no extra fees.

- Deposits: Debit card or bank transfer

- Withdrawals: Faster Payments to nominated UK bank account

- Fees: None for deposits or withdrawals

What unique features does Hargreaves Lansdown offer UK users?

Hargreaves Lansdown differentiates itself through guidance, research, and service quality.

- In-depth fund and share research

- Model portfolios and ready-made investments

- Extensive education and webinars

- Phone-based customer support

- Award-winning Junior ISA offering

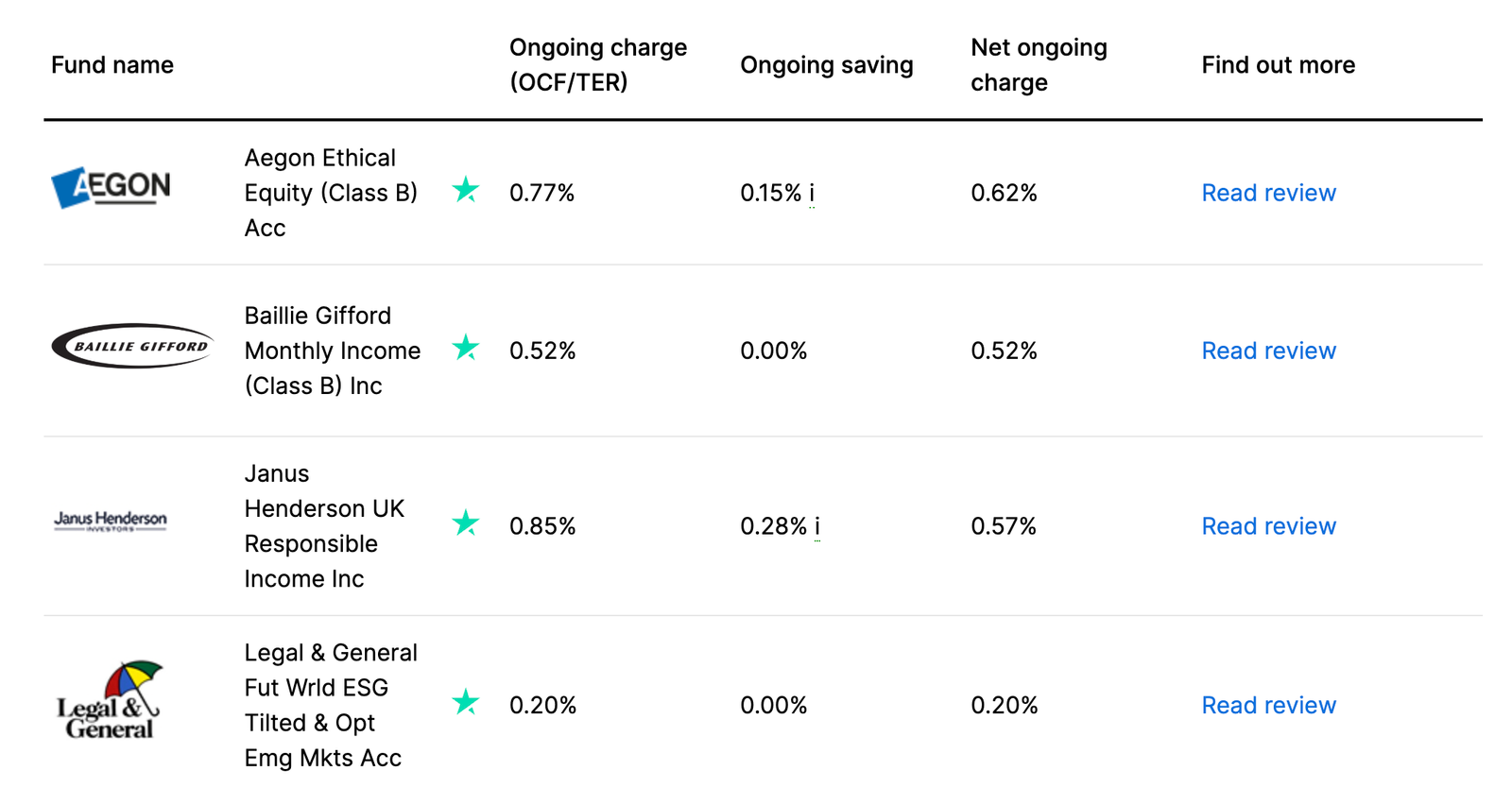

Is Hargreaves Lansdown good for ethical investing?

Hargreaves Lansdown offers ethical and ESG-focused funds, but it does not currently provide dedicated ESG filters across the entire platform.

Investors can still assess sustainability by reviewing fund holdings, sector exposure, and fund manager disclosures. HL also publishes commentary on responsible investing and climate-related risks.

This approach suits investors who want transparency and manual control, but may be less convenient than platforms with built-in ESG screening tools

What it’s really like to use Hargreaves Lansdown day to day

Using Hargreaves Lansdown feels more like a guided investment hub than a trading app.

Account setup is smooth, with clear explanations of each account type and investment option. The dashboard prioritises portfolio value, performance, and research, making it easy to monitor long-term investments rather than trade frequently.

Research is deeply integrated, with fund factsheets, analyst commentary, and investment ideas easy to find. For beginners, this can feel reassuring, though more experienced traders may find the platform slower and less flexible than specialist trading tools.

How good is Hargreaves Lansdown customer support?

Hargreaves Lansdown is widely regarded as one of the best UK platforms for customer service.

- UK-based phone support

- Secure in-app messaging

- Fast response times

- Knowledgeable investment specialists

Hargreaves Lansdown offers a Stocks & Shares ISA that allows UK investors to invest up to £20,000 per tax year tax free, making it a strong option for long-term investing.

You can hold shares, funds, ETFs, investment trusts, bonds, gilts, and ready-made portfolios within the ISA.

Platform fees on funds start at 0.45%, which is higher than low-cost rivals, but share and ETF holdings benefit from a £45 annual fee cap, improving value for larger portfolios.

Minimum investment is £100 lump sum or £25 per month, making it accessible for beginners.

Is a Hargreaves Lansdown SIPP good for retirement investing?

Hargreaves Lansdown’s SIPP is designed for investors who want control over their retirement savings, with access to a wide range of investments and strong planning tools.

You can invest up to £60,000 per tax year, with the same investment options as the ISA.

Platform fees are identical to the ISA, but the share and ETF fee cap rises to £200 per year, which can be good value for larger pensions holding listed securities.

There are no fees for entering drawdown, transferring out, or taking lump sums, which compares favourably with some competitors.

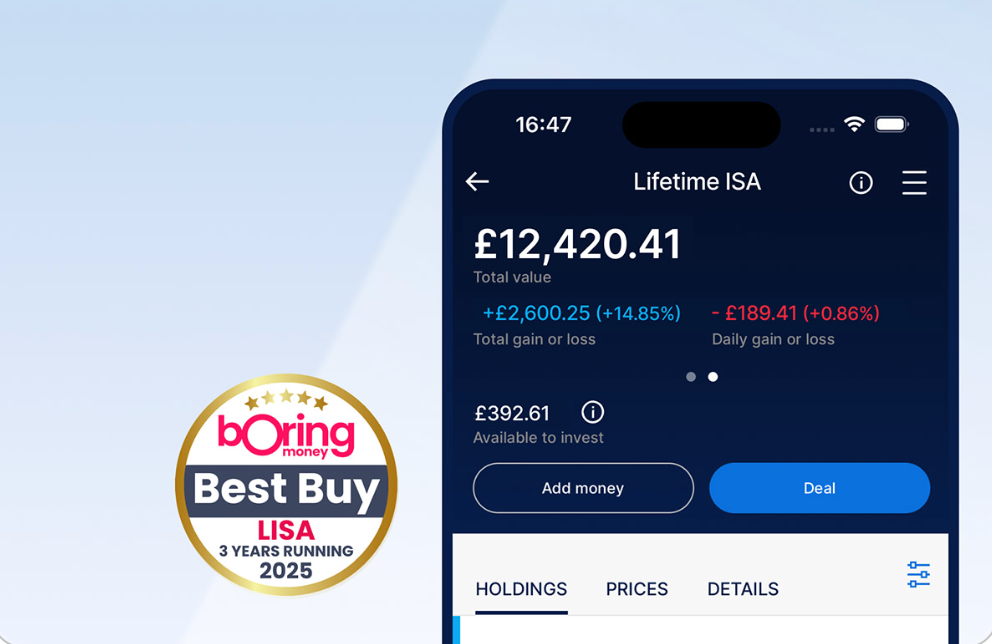

Hargreaves Lansdown Lifetime ISA (LISA) review

Hargreaves Lansdown offers a Stocks & Shares Lifetime ISA for first-time buyers and retirement savers.

You can invest up to £4,000 per year, with a 25% government bonus added automatically.

The platform charge for LISAs is reduced to 0.25%, making it cheaper than HL’s standard ISA and SIPP.

Investments include funds, ETFs, shares, and ready-made portfolios. Minimum investment remains £100 lump sum or £25 monthly.

How good is the Hargreaves Lansdown Lifetime ISA for first-time buyers and retirement?

Hargreaves Lansdown’s Junior ISA is one of its strongest offerings.

There are no platform fees and no dealing fees on the JISA, making it completely free at the platform level.

Parents and grandparents can invest up to £9,000 per tax year, with access to the same wide investment range.

Only the underlying fund management charges apply, which makes the JISA excellent value for long-term child investing.

Hargreaves Lansdown vs competitors (UK comparison)

| Feature | Hargreaves Lansdown | AJ Bell | Fidelity |

|---|---|---|---|

| FCA regulated | Yes | Yes | Yes |

| Platform fee (funds) | 0.45% | 0.25% | 0.35% |

| UK share trade | £11.95 | £9.95 | £10.00 |

| Research quality | Excellent | Good | Very good |

| Best for | Long-term investors | Low-cost investors | Fund investors |

Awards, ratings, and third-party trust signals

Hargreaves Lansdown has one of the strongest reputations in the UK investment market.

- Over 1.8 million UK customers

- 4.3 Trustpilot rating from thousands of reviews

- Winner of multiple Boring Money Best Buy Awards, including ISA, Pension, LISA, and Customer Service

- Regularly rated highly for customer support and ease of use

These third-party endorsements reinforce HL’s position as a trusted, long-established platform.

What are the main limitations of Hargreaves Lansdown?

Hargreaves Lansdown’s biggest drawbacks are cost and suitability for active traders.

- Higher fund platform fees

- Expensive FX charges

- Limited advanced trading tools

- Not designed for frequent trading strategies

So, is Hargreaves Lansdown worth it?

Hargreaves Lansdown isn’t trying to be the cheapest platform in the UK, and that’s clear once you look at the fees. What it offers instead is confidence. For many investors, especially those starting out or managing long-term savings, that reassurance matters just as much as cost.

Using HL feels calm and structured. You’re guided through decisions, not rushed into trades, and the platform puts research and education front and centre. That makes it particularly appealing if you’re investing for the long term through an ISA, SIPP, or Junior ISA rather than actively trading shares every week.

Customer support is another standout. Being able to speak to a knowledgeable UK-based team is something many newer app-based platforms simply don’t offer.

That said, HL isn’t for everyone. If you’re fee-focused, trade frequently, or mainly invest in overseas shares, the costs can add up and better-value alternatives exist. Likewise, experienced traders may find the tools a little restrictive compared to specialist trading platforms.

Overall, Hargreaves Lansdown suits investors who want a reliable, well-established platform that helps them invest with clarity and confidence.

You’re paying a premium, but for many UK investors, especially those with long-term goals, that premium buys peace of mind, strong guidance, and a platform that’s built to last.

FAQs

Who owns Hargreaves Lansdown?

Hargreaves Lansdown was co-founded by Peter Hargreaves and Stephen Lansdown and is now a publicly listed company on the London Stock Exchange, part of the FTSE 250.

Is Hargreaves Lansdown safe?

Yes. Hargreaves Lansdown is FCA regulated, holds client money in segregated accounts, and offers FSCS protection up to £85,000, although investment values can fall as well as rise.

Does Hargreaves Lansdown charge exit fees?

No. Hargreaves Lansdown does not charge exit fees if you close your account or transfer investments to another provider

Can I transfer investments to Hargreaves Lansdown?

Yes. You can transfer existing ISAs, pensions, and general investments into Hargreaves Lansdown, usually without selling your investments, although transfer times vary by provider.

Does Hargreaves Lansdown pay interest on cash?

Yes. Hargreaves Lansdown pays interest on uninvested cash, but rates are typically lower than top UK savings accounts and can change over time.

Is Hargreaves Lansdown good value for money?

Hargreaves Lansdown offers strong value for investors who prioritise research, support, and long-term investing, but it is less competitive on fees for cost-focused or frequent traders.

Does Hargreaves Lansdown offer fractional shares?

No. Hargreaves Lansdown does not currently offer fractional shares, meaning you must buy whole shares, which can increase the minimum cost of investing in higher-priced stocks.