Choosing between Freetrade and Trading 212 in 2026 depends on how you invest, what fees you’re willing to pay, and which features matter most to you.

This comparison breaks down costs, investment options, safety, and ease of use to clearly show which platform is better for beginners, long-term investors, and active traders. By the end, you’ll know exactly which app fits your investing goals.

Quick verdict: Which is better, Freetrade or Trading 212?

Trading 212 is the better all-round choice for most UK investors because it offers lower FX fees, automated investing tools, and a demo account with no monthly subscription.

Freetrade is the better option for simplicity and long-term investing, especially if you want a free Stocks and Shares ISA and access to a flat-fee SIPP.

In short, choose Trading 212 for flexibility and overseas investing, and Freetrade for straightforward, buy-and-hold investing.

Freetrade vs Trading 212: Factor comparison at a glance

| Key factor | Freetrade | Trading 212 |

|---|---|---|

| Best for | Beginners, long-term and ISA/SIPP investors | Beginners, regular investors, overseas investing |

| Dealing fees | £0 on shares and ETFs | £0 on shares and ETFs |

| FX fees | 0.39%–0.99% (plan dependent) | 0.15% flat |

| ISA & pension access | Free ISA, flat-fee SIPP available | Free ISA, no SIPP |

| Automation tools | None | AutoInvest and Pies |

| Demo account | No | Yes |

| Overall simplicity | Very simple, beginner-first | Simple but more feature-rich |

Trading 212 – Best for beginners, ISA investors, low-cost long-term investing

Trading 212 is one of the most popular UK investing apps, offering genuinely commission-free trading on shares and ETFs alongside a free Stocks and Shares ISA. It is ideal for beginners and long-term investors who want a simple, low-cost platform, but advanced traders may find its tools, research, and support options limited.

Overall rating: 4.3 / 5

- Main features: Commission-free share and ETF trading, free Stocks and Shares ISA, fractional shares from £1, AutoInvest and Pies, interest on uninvested cash, multi-currency accounts, demo account, clean mobile and web platforms

- Fees: £0 commission on shares and ETFs, £0 ISA fee, £0 platform and custody fees, 0.15% FX conversion fee on non-GBP trades (charged on buy and sell), CFD trades priced via spreads and overnight financing

- Regulation and security: FCA-authorised UK broker, segregated client funds, FSCS protection up to £120,000 for eligible claims, strong regulatory oversight. Investment losses and CFD trading are not FSCS-protected

- What you can trade: Thousands of UK, US, and European shares and ETFs, fractional shares, CFDs on shares, indices, forex, commodities, and crypto (price exposure only, no direct ownership)

- Transaction types: Buy and sell real shares and ETFs, ISA investing, automated investing via AutoInvest and Pies, recurring investments, CFD trading with leverage, demo trading account

- Who Trading 212 is best for: UK beginners, long-term investors, ISA users, passive investors, cost-conscious traders, users who want automation without platform fees

Pros and cons

| Pros | Cons |

|---|---|

| £0 commission on shares and ETFs | 0.15% FX fee on overseas trades |

| Free Stocks and Shares ISA with no monthly fees | Limited research and advanced trading tools |

| Very low £1 minimum investment | No phone customer support |

| AutoInvest and Pies for hands-off investing | Narrow asset range compared with premium brokers |

| Fractional shares and interest on idle cash | CFD spreads less competitive than specialist platforms |

| FCA regulated with FSCS protection | CFDs carry high risk for retail investors |

Read the complete Trading 212 review here.

Freetrade – Best for beginners, ISA investors, simple long-term investing

Freetrade is a UK investment platform offering commission-free trading on shares, ETFs, and investment trusts, with optional paid plans for ISAs, SIPPs, and lower FX fees. It is ideal for beginners and long-term investors who want a clean, easy-to-use app, but it is less suitable for active traders who need advanced tools or a wider range of assets.

Overall rating: 4.2 / 5

- Main features: Commission-free share and ETF trading, free Stocks and Shares ISA, fractional shares from £1, access to investment trusts, optional flat-fee SIPP, beginner-friendly mobile app, basic educational content, FCA regulation

- Fees: £0 commission on shares, ETFs, and investment trusts, £0 ISA fee on the Basic plan, FX fees from 0.39% to 0.99% on non-GBP trades (depending on plan), paid plans from £5.99 to £11.99 per month for SIPP access and lower FX fees

- Regulation and security: FCA-regulated UK broker, client money held in segregated accounts, FSCS protection up to £85,000, strong regulatory oversight. Investment losses are not protected

- What you can trade: UK, US, and European shares, ETFs, investment trusts, fractional US shares, mutual funds and UK gilts on paid plans, crypto ETNs (no direct crypto ownership)

- Transaction types: Buy and sell real shares and ETFs, ISA investing, long-term pension investing via SIPP (Plus plan), fractional investing, cash-only trading with no leverage or derivatives

- Who Freetrade is best for: UK beginners, ISA investors, long-term buy-and-hold investors, cost-conscious users, investors who want simplicity over advanced features

Pros and cons

| Pros | Cons |

|---|---|

| £0 commission on shares and ETFs | FX fees on non-GBP assets (0.39%–0.99%) |

| Free Stocks and Shares ISA on the Basic plan | Limited asset range compared with full-service brokers |

| Very beginner-friendly app and fast onboarding | Basic research and charting tools |

| Fractional shares from £1 | Paid plans required for SIPP and lower FX fees |

| FCA regulated with FSCS protection up to £85,000 | No phone customer support |

| Cash-only accounts reduce risk for beginners | No CFDs, options, or leveraged trading |

Read the complete Freetrade review here.

Who should use Freetrade or Trading 212?

Freetrade and Trading 212 both suit UK investors who want commission-free investing, but they appeal to slightly different needs. Freetrade is better for simple, long-term investing with ISAs and pensions, while Trading 212 is better for investors who want more features, automation, and lower FX fees on overseas shares.

Who should use Freetrade?

Freetrade is best for UK beginners and long-term investors who want a simple, low-cost way to invest in shares and ETFs. Its clean app, free Stocks and Shares ISA, and flat-fee SIPP make it ideal for buy-and-hold investing.

Best if you:

- Want a free Stocks and Shares ISA

- Prefer a very simple, beginner-friendly app

- Plan to invest long term rather than trade actively

- Want access to a flat-fee SIPP for pension investing

- Mainly invest in UK assets and trade infrequently

Who should use Trading 212?

Trading 212 is best for UK investors who want more flexibility and features while still keeping costs low. Its lower FX fees, fractional shares, and AutoInvest Pies make it a strong choice for international and hands-off investing.

Best if you:

- Want lower FX fees when buying US or European shares

- Like automation tools such as Pies and AutoInvest

- Want fractional shares and multi-currency support

- Plan to invest regularly rather than occasionally

- Do not need a SIPP or advanced research tools

In short, choose Freetrade for simplicity and long-term investing, and Trading 212 if you want more features and better value for overseas investments.

Assets available: Freetrade vs Trading 212 compared

Freetrade and Trading 212 both focus on low-cost investing for UK users, but the range of assets available differs in important ways.

Freetrade prioritises long-term, cash-based investing with mainstream assets, while Trading 212 offers a broader mix that includes higher-risk trading products.

- Freetrade offers a wider range of long-term investing assets, including investment trusts, mutual funds, gilts, and a SIPP, but avoids high-risk products like CFDs.

- Trading 212 offers a broader trading-style asset mix, adding CFDs, forex, and automation tools, but does not support pensions, funds, or investment trusts.

| Asset type | Freetrade | Trading 212 |

|---|---|---|

| UK shares | Yes | Yes |

| US shares | Yes (fractional) | Yes (fractional) |

| European shares | Yes | Yes |

| ETFs | Yes | Yes |

| Investment trusts | Yes | No |

| Mutual funds / OEICs | Yes (paid plans) | No |

| UK gilts & T-bills | Yes (paid plans) | No |

| Stocks & Shares ISA | Yes | Yes |

| SIPP (pension) | Yes (Plus plan) | No |

| Fractional shares | Yes (US stocks) | Yes |

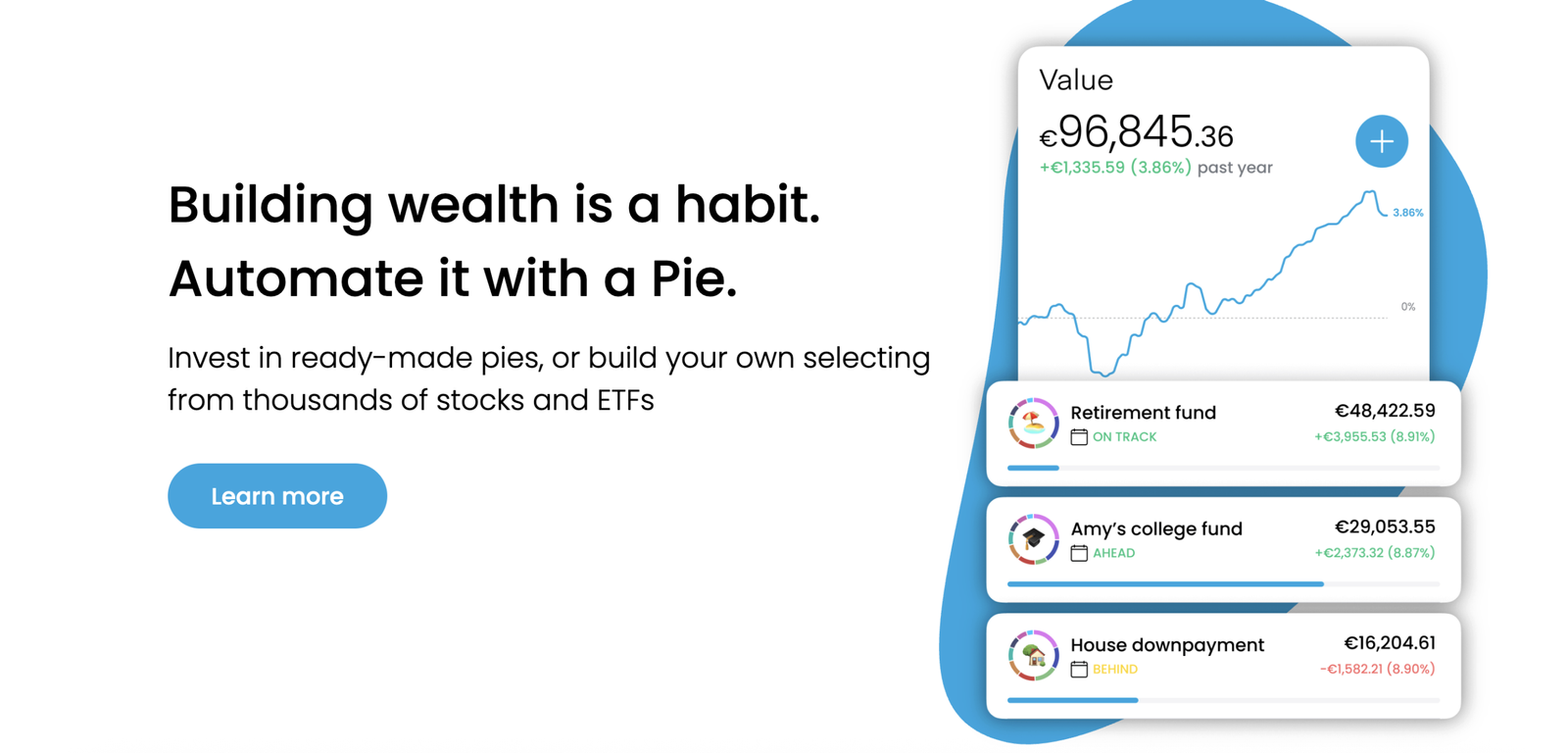

| Automated investing | No | Yes (Pies & AutoInvest) |

| CFDs (leveraged trading) | No | Yes |

| Forex trading | No | Yes (via CFDs) |

| Crypto exposure | Crypto ETNs only | CFDs only |

| Direct crypto ownership | No | No |

Fees comparison: Freetrade vs Trading 212

Freetrade and Trading 212 both promote commission-free investing, but their fee structures differ in ways that can materially affect long-term costs. Freetrade uses a subscription-based model with higher FX fees, while Trading 212 relies on lower FX fees and optional charges tied to specific actions.

If you invest mostly in UK assets and value predictable, flat fees, Freetrade is often the better value. If you regularly buy US or European shares, Trading 212 usually works out cheaper overall.

| Fee type | Freetrade | Trading 212 |

|---|---|---|

| Share & ETF dealing commission | £0 | £0 |

| Platform / custody fee | £0 | £0 |

| Stocks & Shares ISA fee | Free on Basic plan | Free |

| Monthly subscription | £0 (Basic), £5.99 (Standard), £11.99 (Plus) | None |

| FX fee on non-GBP trades | 0.39%–0.99% (plan dependent) | 0.15% |

| Minimum investment | No minimum (£1 for fractionals) | £1 |

| Dividend reinvestment fees | £0 | £0 |

| Deposit fees | £0 | £0 (card deposits free up to £2,000) |

| Withdrawal fees | £0 standard (£5 same-day) | £0 |

| Inactivity fee | £0 | £0 |

| CFD trading costs | Not offered | Spread-based + overnight financing |

| SIPP fee | Included in Plus plan (£11.99/month) | Platform/custody fee |

Tools and platform comparison: Freetrade vs Trading 212

Freetrade and Trading 212 both aim to provide accessible investing platforms, but their tools and interfaces reflect different priorities.

Freetrade focuses on simplicity and a clean beginner-friendly experience, while Trading 212 offers a slightly richer set of features geared toward self-directed investors without overwhelming new users.

Platform strengths and limitations

- Freetrade delivers one of the simplest and most approachable trading apps for UK investors. Beginners will appreciate the uncluttered interface and straightforward trade execution. However, the limited order types, basic charting, and lack of automation can frustrate users as they get more experienced.

- Trading 212 balances ease of use with more intermediate tools. Its AutoInvest and Pies features allow hands-off investing and recurring allocation, while broader fractional share support and multi-currency balances appeal to international investors. On the flip side, it still lacks deep research tools and advanced order execution that serious traders may want.

| Category | Freetrade | Trading 212 |

|---|---|---|

| Mobile app usability | Excellent – intuitive, clean, built for beginners | Very good – easy to navigate with more tools |

| Web platform | Good – mirrors the app, basic functionality | Good – similar to the app, slightly more feature-rich |

| Charting tools | Basic – standard view, limited indicators | Basic to moderate – more indicators, but still not advanced |

| Order types | Market and limit | Market, limit, stop (no advanced algos) |

| Automated investing | No | Yes – AutoInvest & Pies for recurring or portfolio-style investing |

| Fractional share support | Yes (US stocks) | Yes (UK, US, EU stocks & ETFs) |

| Demo / practice account | No | Yes – built-in practice mode |

| Advanced research tools | Minimal – simple company info | Limited – some research data but not professional-level |

| Price alerts / notifications | Basic | Yes – more alert options |

| Multi-currency support | Limited | Yes – hold and use multiple currencies |

| CFD trading tools | Not offered | Yes – charts and execution for CFDs |

| Custom portfolios | Manual only | Yes – Pies allow custom weights and automated rebalancing |

How do the mobile apps compare: Freetrade vs Trading 212?

Both Freetrade and Trading 212 offer polished mobile apps that make investing easy on the go, but they cater to slightly different types of users. Freetrade’s app is designed for simplicity and first-time investors, while Trading 212 adds more intermediate features and flexibility without sacrificing usability.

How they compare in practice

- Freetrade’s app is one of the easiest investing apps to use in the UK. Its uncluttered interface and simple menus help new investors place trades quickly and manage portfolios with minimal friction, making it ideal for beginners.

- Trading 212’s app offers more flexibility through automation, enhanced charting, and additional order types, which suits users who want more control without the complexity of professional trading platforms.

How does customer support compare: Freetrade vs Trading 212?

Customer support is an important part of the overall investing experience, especially for beginners or users who value timely help. Both Freetrade and Trading 212 offer digital-first support channels, but there are differences in availability and responsiveness.

- Freetrade’s support relies on in-app chat and a help centre. Beginners will find the guidance adequate for routine queries, though response times on the free plan can be slower. Paid plans can offer faster support, but there’s no phone or live voice option.

- Trading 212’s support also uses in-app chat and email, with generally quicker reply times. Email adds another layer of contact that some users prefer for non-urgent issues, but like Freetrade, there’s no phone support.

| Support feature | Freetrade | Trading 212 |

|---|---|---|

| Primary support channel | In-app chat | In-app chat |

| Email support | No | Yes |

| Phone support | No | No |

| Response speed | Often 24–48 hours (faster on paid plans) | Typically 2–24 hours |

| Help centre / FAQs | Yes – basic guidance | Yes – covers common topics |

| Live chat availability | Yes – in-app only | Yes – in-app only |

| Priority support | Yes – on paid plans | No formal priority tier |

How is tax reporting handled on Freetrade and Trading 212?

Both Freetrade and Trading 212 provide tools to help UK investors understand their tax obligations, but the depth and format of tax reporting differ slightly depending on account type and the platform’s focus on simplicity.

Quick comparison

| Tax reporting aspect | Freetrade | Trading 212 |

|---|---|---|

| ISA tax reporting | No reporting needed (tax-free) | No reporting needed (tax-free) |

| GIA capital gains reporting | Exportable trade history for Self Assessment | Exportable trade history for Self Assessment |

| Dividend reporting | Exportable dividend history | Exportable dividend history |

| SIPP tax reporting | Tax-free, no reporting required | Tax-free, no reporting required |

| Automatic tax calculation | No | No |

| Format exports (CSV/PDF) | Yes | Yes |

Freetrade – tax reporting

- ISA accounts: Profits and dividends within a Stocks and Shares ISA are tax-free in the UK and do not need to be reported to HMRC. Freetrade does not generate taxable events inside an ISA, so reporting is minimal.

- General Investment Accounts (GIAs): Trades and dividends outside an ISA may trigger UK capital gains tax (CGT) and dividend tax obligations. Freetrade provides transaction history statements that you can use to calculate gains/losses for HMRC reporting.

- Exportable reports: You can download your trade history, dividend history, and account statements directly from the app or web platform – useful when completing a Self Assessment tax return.

- SIPP accounts: Gains and income inside a SIPP are also tax-advantaged in the UK, so you typically won’t report these on a UK tax return.

- FX and international assets: Freetrade does not automatically calculate UK CGT or tax liabilities; users must manually include FX gains/losses in their UK tax calculations where relevant.

Trading 212 – tax reporting

- ISA accounts: As with Freetrade, Stocks and Shares ISA gains and income are tax-free under UK rules and don’t need to be reported to HMRC. Trading 212 does not generate taxable reports for ISA accounts since no tax is due.

- Invest and GIA accounts: Trading 212 supplies trade history and dividend reports that you can download to calculate UK capital gains and dividend tax. These downloadable reports are typically suitable for Self Assessment.

- Export formats: You can export transaction data (buys, sells, dividends, FX conversions, etc.) in CSV or PDF formats, which help when preparing a UK tax return or using tax software.

- CFDs and leveraged products: If you use CFD accounts, note that CFD profits/losses may be treated differently under UK tax rules; Trading 212’s statements will include the necessary details, but you may want professional tax advice.

- FX considerations: Similar to Freetrade, any taxable FX gains (on UK GIAs when buying/selling non-GBP assets) must be included manually in your UK tax calculation.

How do the demo accounts compare: Freetrade vs Trading 212?

When learning to invest or test strategies without risking real money, the availability and quality of demo accounts can make a big difference, especially for beginners. In this area, Trading 212 offers a built-in practice mode, while Freetrade does not currently provide a dedicated demo environment.

How does educational material compare: Freetrade vs Trading 212?

Educational resources can help beginners understand investing basics and build confidence over time. Freetrade and Trading 212 take different approaches: Freetrade offers light in-app explanations and simple guides, while Trading 212 provides a more structured set of learning tools, including practice opportunities.

- Freetrade’s educational content is designed for absolute beginners with simple definitions and context around investing basics. It gives you just enough to start trading shares and ETFs, but doesn’t offer in-depth lessons or hands-on learning tools.

- Trading 212’s educational material is broader, including a demo/practice account that lets you apply what you learn without risk, a deeper help centre, and more systematic guides covering topics like order types, risk management, and strategy basics.

| Educational feature | Freetrade | Trading 212 |

|---|---|---|

| In-app guides / explanations | Yes – basic | Yes – basic with help centre |

| Structured learning content | Limited | More lessons and tutorials |

| Demo account for practice learning | No | Yes – built-in practice mode |

| Glossary or terminology help | Basic | Yes |

| Market news / insights | Limited | Yes – market insights and news |

| Beginner investing FAQs | Yes | Yes |

| Interactive or video tutorials | No | Some interactive guides |

What does Freetrade offer that Trading 212 doesn’t, and vice versa?

When comparing Freetrade and Trading 212, both platforms deliver commission-free investing, but each has unique features and limitations that set them apart.

Understanding what one offers that the other doesn’t helps you choose the right app for your investing style.

What Freetrade offers that Trading 212 doesn’t

- Flat-fee SIPP (pension investing) on the Plus plan, which Trading 212 does not offer

- Mutual funds and UK gilts available on paid plans

- A more simplified, beginner-first experience with fewer tools and less complexity

- A free Stocks and Shares ISA on the Basic plan, alongside optional pension access

- Plain-language guidance built into onboarding and core app flows

What Trading 212 offers that Freetrade doesn’t

- A built-in demo trading account with virtual funds for risk-free practice

- Automated investing tools such as Pies and AutoInvest

- Lower FX fees (0.15%) on non-GBP trades, which benefit frequent overseas investors

- Multi-currency balances to reduce repeated FX conversions

- More order types, including stop orders

- Stronger intermediate tools such as charting, alerts, and research features

Conclusion: Freetrade vs Trading 212 – which is better?

Freetrade and Trading 212 are both excellent UK investing apps, but the better choice depends on how you plan to invest.

Freetrade is a top pick for beginners and long-term investors who want a simple app, a free Stocks and Shares ISA, and the option of a flat-fee SIPP, making it ideal for buy-and-hold investing.

Trading 212 stands out for investors who want lower FX fees, automation tools like Pies and AutoInvest, and a demo account to practise before investing real money.

For most UK beginners, Freetrade is the easiest place to start. For investors who plan to buy overseas shares regularly or want more features without paying monthly fees, Trading 212 is often the better value.

If your priority is long-term, low-cost investing with minimal complexity, Freetrade is the safer choice. If flexibility and automation matter more, Trading 212 is the stronger all-rounder.

FAQs

Are Trading 212 and Freetrade really commission-free?

Yes, both platforms offer genuine £0 commission on share and ETF trades, though FX fees and optional subscription costs still apply.

Is my money safe with Trading 212 and Freetrade?

Yes, both are FCA-regulated UK brokers that segregate client funds and provide FSCS protection up to the eligible limit, but market losses aren’t covered.

Are Freetrade fees high?

Freetrade’s core trading is commission-free, but its FX fees (0.39%–0.99%) and paid plans can make overseas investing more expensive than some rivals.

Is Trading 212 the best platform?

It’s one of the best for UK investors wanting low FX fees, automated investing, and a demo account, but “best” depends on your goals, Freetrade may be better for simplicity and pension access.