Our Forex.com review assesses whether Forex.com is a safe and cost-effective broker for UK traders, with a clear focus on fees, spreads, and FCA regulation.

We analyse trading costs, platform features, execution quality, and security protections, so you can quickly see who Forex.com is best for and where it falls short.

Quick verdict: How do we rate Forex.com for UK traders in 2026?

Forex.com is a strong choice for UK traders who want a regulated, professional-grade forex and CFD trading platform with reliable execution and competitive spreads.

It suits active traders and those who value robust platforms and market depth, but it is less appealing for beginners seeking ultra-simple apps or long-term investors who only want stocks and ETFs.

Overall rating: 4.2 / 5

UK ratings breakdown

| Category | Score | Summary |

|---|---|---|

| Security & Trust | 5/5 | FCA-regulated in the UK, strong parent company, segregated client funds |

| Fees & Pricing | 4/5 | Competitive spreads, no commission on standard accounts, some non-trading fees |

| Features | 4.5/5 | Advanced platforms, strong charting, wide forex and CFD coverage |

| Ease of Use | 4/5 | Powerful tools but steeper learning curve for beginners |

| Customer Support | 4/5 | UK support available, generally reliable response times |

| Reputation | 4.5/5 | Well-established global broker with strong UK presence |

Our verdict

Forex.com stands out for regulation, execution quality, and platform depth, making it best for active forex and CFD traders in the UK.

Traders who prioritise tight spreads, advanced charting, and FCA oversight will find it a solid option.

Beginners or investors looking for ISAs, share dealing, or a simple investing app may be better served by alternative UK trading platforms.

Is Forex.com good for beginners?

Forex.com is partially suitable for beginners, but it is better suited to traders who are willing to learn and take trading seriously. The platform offers strong education and demo tools, but its focus on forex and CFDs means new users face a steeper learning curve than with beginner-first investing apps.

Beginner friendliness

Forex.com is not a beginner-first platform. The interface, order types, and market focus are designed for active traders rather than casual investors. New traders can use it safely, but only if they are prepared to learn the basics of forex, leverage, and risk management.

Learning curve

The learning curve is moderate to high. Forex.com provides advanced platforms, detailed charts, and professional tools, which can feel overwhelming at first. However, the layout is logical, and traders who progress beyond basics tend to appreciate the depth rather than outgrow it.

Education, demo account, and support

Forex.com performs well on education and practice tools.

- Free demo account with virtual funds for risk-free practice

- Structured education hub covering forex basics, strategies, and risk

- Market analysis and webinars aimed at skill development

- UK-based customer support, though not beginner hand-holding

This makes it one of the better learning-focused CFD brokers once you commit time to it.

What are the pros and cons of using Forex.com?

Forex.com offers strong regulation, competitive forex pricing, and professional trading tools, but it is not designed as a beginner-first or long-term investing platform. The table below summarises the key advantages and drawbacks for UK traders.

Forex.com pros and cons (UK)

| Pros | Cons |

|---|---|

| FCA-regulated in the UK with segregated client funds | Not beginner-first. Steeper learning curve for new traders |

| Competitive spreads on major forex pairs | Limited to forex and CFDs. No share dealing or ETFs |

| No commission on standard accounts | Inactivity fees may apply to dormant accounts |

| Advanced platforms including proprietary web trader, MT4, and TradingView | Platform complexity may overwhelm casual users |

| Strong market analysis and risk tools | No FSCS protection for forex and CFD trading losses |

| Fast and reliable execution for active trading | FCA leverage limits restrict retail position sizes in the UK |

Who is Forex.com best for?

Forex.com is best suited to active UK traders who want a regulated, professional-grade forex and CFD platform. It prioritises execution quality, pricing, and trading tools over simplicity or long-term investing features, which makes it ideal for some traders but unsuitable for others.

Forex.com suitability by trader type

| Trader or investor type | Is it suitable? | Why it suits them or not |

|---|---|---|

| Beginners | Partially | Forex.com offers demos and education, but the platform and use of leverage create a steeper learning curve than beginner-first UK apps. |

| Active traders | Yes | Competitive spreads, fast execution, advanced charting, and multiple platforms make it well-suited to frequent and short-term trading. |

| Long-term investors | No | No Stocks and Shares ISA, no physical share dealing, and a focus on CFDs make it unsuitable for buy-and-hold investing. |

| International investors | Limited | Available in many regions, but UK traders are subject to FCA leverage caps and local product restrictions. |

How regulated and trustworthy is Forex.com in the UK?

Forex.com is a highly regulated and trustworthy broker for UK traders, authorised and supervised by the Financial Conduct Authority. It operates under strict UK rules on client protection, transparency, and risk controls, making it a well-established option for forex and CFD trading.

FCA regulation

Forex.com operates in the UK through StoneX Financial Ltd, which is authorised and regulated by the FCA. This means the broker must meet UK standards for capital adequacy, client money handling, complaints procedures, and fair marketing.

FSCS protection

Forex and CFD trading with Forex.com is not FSCS protected against trading losses. However, eligible UK clients may still be covered by the FSCS up to £85,000 if the firm were to fail and client money could not be returned. This is standard across FCA-regulated CFD brokers.

Global regulation

Forex.com is part of the StoneX Group, a publicly listed global financial services firm. The group is regulated by multiple top-tier authorities worldwide, including US and EU regulators, which strengthens its overall compliance and risk framework.

Track record and reputation

Forex.com has been operating for over 20 years and is widely recognised as a major global forex broker. Its long track record, strong parent company, and consistent regulatory standing support its reputation as a reliable and trustworthy platform for UK traders.

What assets can you trade on Forex.com?

Forex.com focuses primarily on forex and CFD trading, offering a broad range of currency pairs and major global markets for UK traders. It is designed for active trading rather than long-term investing in physical assets.

Forex

Forex.com’s strongest offering is forex.

- 80+ currency pairs, including majors, minors, and exotics

- Tight spreads on major pairs such as GBP/USD and EUR/USD

- Suitable for short-term, intraday, and swing trading strategies

CFDs

UK traders can access a wide range of CFDs across major asset classes:

- Indices such as the FTSE 100, DAX, and S&P 500

- Commodities including gold, oil, and silver

- Shares CFDs on selected UK, US, and global companies

CFDs allow speculation on price movements without owning the underlying asset and are not suitable for all investors.

Spread betting

Forex.com also offers spread betting for eligible UK clients.

- Tax treatment may be favourable, depending on individual circumstances

- Available across forex, indices, commodities, and shares

- Losses can exceed deposits due to leverage

Shares and ETFs

Forex.com does not offer physical shares or ETFs. There is no Stocks and Shares ISA, making it unsuitable for long-term buy-and-hold investors.

Crypto (UK limitations)

UK retail clients cannot trade crypto derivatives due to FCA restrictions. Forex.com may offer crypto exposure in other regions, but crypto CFDs are not available to UK retail traders.

Bonds and funds

Forex.com does not provide direct access to bonds, mutual funds, or investment funds. Its product range is focused on leveraged trading markets rather than traditional investing.

How much does Forex.com cost to use?

Forex.com uses a spread-based pricing model with optional commission accounts, making costs competitive for active UK forex and CFD traders. There are no account opening fees, but trading and non-trading charges can apply depending on how you use the platform.

Trading fees

Forex.com does not charge a separate trading fee on its standard account, as costs are built into the spread. For traders who want tighter pricing, raw pricing or commission-based accounts are available with lower spreads plus a fixed commission per trade.

Spreads and commissions

- Standard account: Spreads start from around 0.8 pips on major forex pairs, with no added commission.

- Raw pricing account: Spreads can start from 0.0 pips, with a commission per lot traded, which suits high-volume and active traders.

Spreads vary by market conditions, asset type, and liquidity.

FX fees

Forex.com primarily trades forex and CFDs quoted in base currencies, so there are no separate FX conversion fees in the way share dealing platforms charge them. Any currency costs are reflected in the spread rather than as a visible conversion charge.

Inactivity fees

Forex.com applies an inactivity fee to accounts with no trading activity for an extended period. If you place no trades and hold no open positions for 12 consecutive months, a fee of $15 per month or the local currency equivalent, around £12 in the UK, is charged until trading resumes, the account balance reaches zero, or the account is closed. Simply logging in, depositing, or withdrawing funds does not count as activity.

Fee details

- Amount: $15 USD or around £12 GBP per month

- Trigger: No trades or open positions for 12 months

- How it’s charged: Monthly, capped at the remaining account balance

- What counts as activity: Placing a trade or maintaining an open position

- Account suspension: Retail accounts may be suspended after 36 months of inactivity

How to avoid the fee

- Place at least one trade or keep an open position within any 12-month period

- Withdraw all funds if you do not plan to use the account again

How good is Forex.com’s trading platform and mobile app?

Forex.com offers a powerful web platform and a reliable mobile app designed for active forex and CFD traders rather than casual investors. Both platforms focus on execution quality, advanced charting, and risk management, which suits frequent trading but comes with a learning curve.

Web trading platform

Forex.com’s web platform is feature-rich and professional, aimed at traders who rely on technical analysis and fast execution.

- Advanced charting with a wide range of indicators and drawing tools

- Multiple order types, including stop, limit, and guaranteed stops on some markets

- Integrated market analysis, economic calendar, and performance metrics

- Stable execution suitable for intraday and short-term strategies

It is less minimalist than beginner-first platforms, but experienced traders benefit from the depth and customisation.

Mobile app

The Forex.com mobile app mirrors much of the web platform’s core functionality in a streamlined format.

- Clean layout with responsive charts and real-time pricing

- Easy trade execution and position management on the go

- Built-in alerts, watchlists, and basic research tools

- Supports risk management features such as stops and limits

While the mobile trading app is strong for monitoring and executing trades, most advanced analysis is still easier on the web platform.

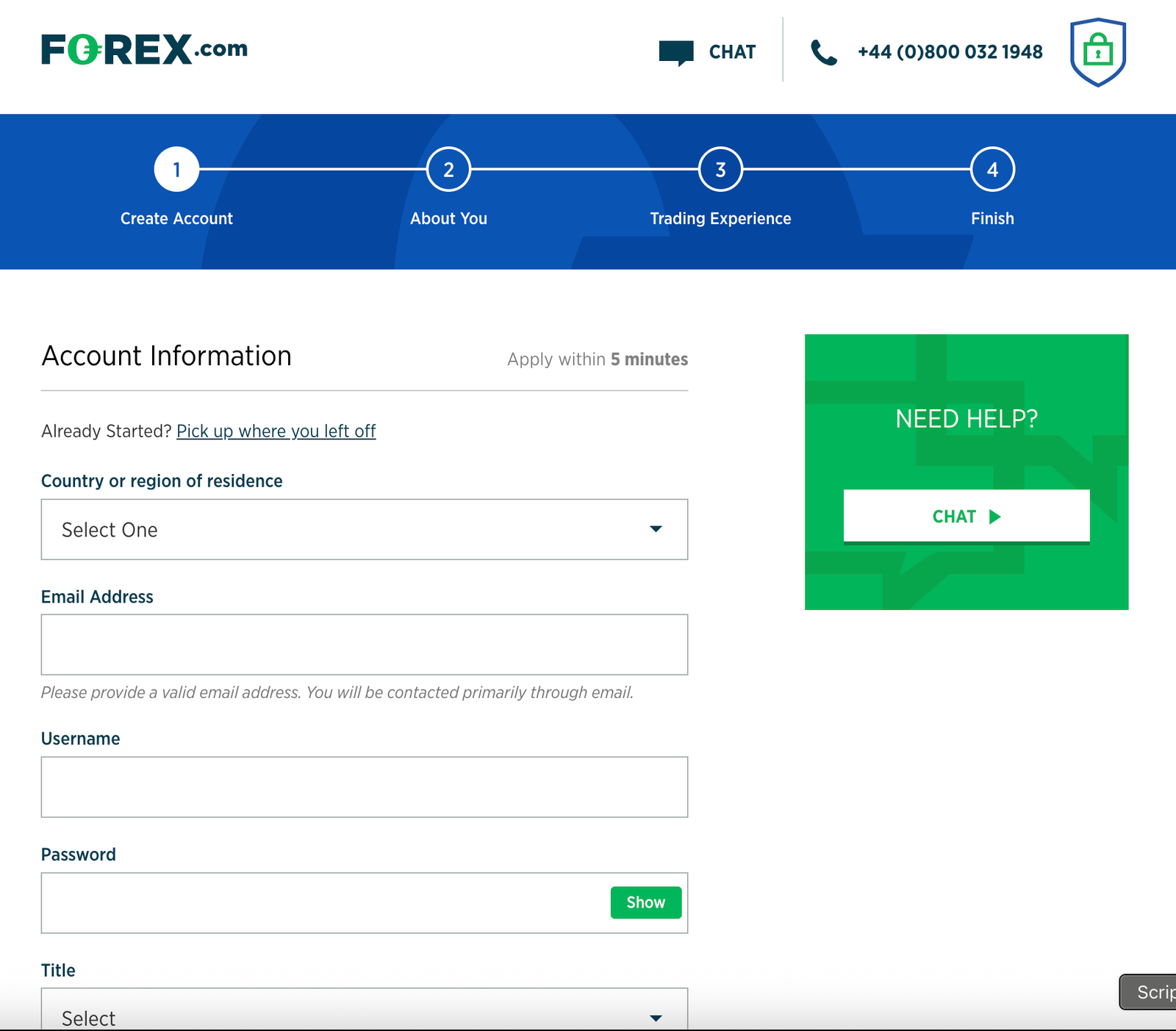

How easy is it to open an account and start trading?

Opening an account with Forex.com is straightforward for UK traders and can usually be completed within one working day. The process is fully online, FCA-compliant, and designed to meet UK identity and anti-money laundering requirements.

Account opening time

Most UK applications are reviewed and approved within a few hours to one business day. In some cases, approval can take longer if additional verification checks are required.

KYC requirements

Forex.com follows standard FCA KYC and AML rules. You will need to provide:

- Proof of identity such as a passport or driving licence

- Proof of address, for example a recent utility bill or bank statement

- Basic financial and trading experience information

These checks are mandatory for all UK-regulated trading accounts.

Minimum deposit

Forex.com has no fixed minimum deposit, but trading requires sufficient funds to meet margin requirements. In practice, most traders deposit £100 or more to trade comfortably and manage risk.

Approval delays

Delays are uncommon but can happen if documents are unclear, outdated, or do not match your application details. Providing accurate information upfront helps avoid hold-ups.

Account opening steps

- Complete the online application on the Forex.com website

- Verify your identity and address by uploading documents

- Answer suitability and experience questions

- Wait for approval and fund your account

- Access the trading platform and place your first trade

Summary: Forex.com offers a smooth and compliant account opening process for UK traders, with fast approvals and no minimum deposit requirement. The main delays come from incomplete or incorrect verification details.

How do deposits and withdrawals work on Forex.com?

Forex.com supports fast GBP deposits and FCA-compliant withdrawals for UK traders using standard local payment methods. The table below summarises how funding works in practice.

Forex.com deposits and withdrawals (UK)

| Feature | Details |

|---|---|

| Deposit methods | Debit card, bank transfer, Faster Payments |

| Deposit time | Debit card: instant Bank transfer: same day or next working day |

| Withdrawal methods | Returned to original card where possible, then bank transfer |

| Withdrawal processing | 1–2 business days by Forex.com |

| Time to receive funds | Bank transfer: 1–3 business days Card refunds: several working days |

| Fees | No deposit or withdrawal fees charged by Forex.com. Bank fees may apply |

| Currency support | GBP accounts supported for UK traders |

| Key rules | Withdrawals must be to an account in your own name. Verification must be complete |

What account types does Forex.com offer UK users?

Forex.com offers a small range of account types designed to suit different trading styles, from beginners testing the platform to active and professional traders. All UK accounts are FCA-regulated and support forex and CFD trading.

Standard account

The standard account is the default option for most UK retail traders.

- Spread-only pricing with no separate commission

- Suitable for beginners and lower-volume traders

- Access to all supported markets and platforms

Raw pricing account

The raw pricing account is aimed at active and higher-volume traders.

- Tighter spreads, often starting from 0.0 pips

- Fixed commission charged per trade

- Better suited to frequent and short-term strategies

Demo account

Forex.com provides a free demo account for UK users.

- Virtual funds for risk-free practice

- Access to the full trading platform

- Useful for learning, testing strategies, and platform evaluation

Professional account

Eligible UK traders can apply for a professional account.

- Higher leverage than retail accounts

- Fewer regulatory protections than retail status

- Only available to traders who meet FCA professional criteria

Is Forex.com right for your trading style?

Forex.com is well-suited to short-term and active trading styles, particularly in forex and CFDs, but it is less suitable for long-term investing. The platform’s pricing, execution speed, and tools are designed for frequent trading rather than buy-and-hold strategies.

Trading style suitability

| Trading style | Suitability | Reason |

|---|---|---|

| Scalping | ★★★★☆ | Tight spreads, fast execution, and advanced order types suit short-term strategies, though FCA leverage limits apply to retail traders. |

| Day trading | ★★★★★ | Excellent for intraday trading thanks to reliable execution, strong charting tools, and access to major forex and index markets. |

| Long-term investing | ★★☆☆☆ | Not designed for buy-and-hold investing. No physical shares, ETFs, or ISA accounts, and overnight financing costs can add up. |

What unique features does Forex.com offer?

Forex.com stands out for its trading-focused tools, execution quality, and strong regulatory backing rather than lifestyle or social investing features. Its strengths are designed to support active forex and CFD traders who rely on data, speed, and control.

Advanced execution and pricing

Forex.com provides reliable, low-latency execution with multiple pricing models, including standard spread-only and raw pricing with commission. This flexibility allows traders to match costs to their trading frequency and strategy.

Professional-grade platforms

Traders can choose between Forex.com’s proprietary web platform, MetaTrader 4, and TradingView integration. This range is broader than many UK brokers and suits both discretionary and technically driven traders.

TradingView integration

Direct TradingView charting and trading access allows advanced technical analysis using one of the most popular charting suites in the market, without relying on third-party bridges.

Guaranteed stop-loss orders

Forex.com offers guaranteed stop-loss orders on selected markets, helping traders cap downside risk during volatile conditions. This feature is not available across all UK brokers.

Performance analytics and risk tools

Built-in trading analytics, position reporting, and risk management tools help traders review performance and refine strategies over time.

How good is Forex.com’s customer support?

Forex.com offers reliable, UK-focused customer support with multiple contact channels and generally fast response times. The table below summarises how support works for UK users.

Forex.com customer support (UK)

| Feature | Details |

|---|---|

| Support channels | Phone, email, live chat |

| Live chat response | Within 1 working day |

| Email response time | Typically within 1 working day |

| Support hours | UK trading hours with extended market coverage |

| UK relevance | FCA-regulated support familiar with UK rules and leverage limits |

| Issue resolution | Generally effective for account, funding, and trading queries |

Forex.com vs competitors (UK comparison)

Forex.com competes best on regulation, execution quality, and professional trading tools, while some UK platforms focus more on simplicity and investing features. The comparison below shows how Forex.com stacks up against two popular UK alternatives.

Forex.com vs competitors (UK)

| Feature | Forex.com | eToro | Trading 212 |

|---|---|---|---|

| FCA regulation | Yes | Yes | Yes |

| Primary focus | Forex and CFDs | Multi-asset trading and investing | Investing and CFDs |

| Forex spreads | Tight, trading-focused | Wider on average | Competitive |

| Commission model | Spread-only or raw + commission | Spread-based | Commission-free investing |

| Platforms | Web platform, MT4, TradingView | Proprietary web and app | Proprietary web and app |

| Advanced charting | Strong | Moderate | Basic to moderate |

| Beginner friendliness | Moderate | High | High |

| Physical shares & ETFs | No | Yes | Yes |

| ISA available | No | No | Yes |

| Best for | Active forex and CFD traders | Beginners and social traders | Long-term investors and beginners |

Forex.com stands out for active UK traders who prioritise execution, pricing, and professional tools. eToro and Trading 212 are better suited to beginners and long-term investors who want simplicity, physical shares, or ISA access.

What are the main limitations of Forex.com?

Forex.com is a strong trading platform, but it has clear limitations that UK users should understand before opening an account. The drawbacks below are not deal-breakers for active traders, but they matter depending on your goals.

- Not beginner-first: The platform is powerful but complex, with a steeper learning curve than beginner-focused UK apps.

- No physical shares or ETFs: Forex.com does not support long-term investing in real stocks or funds.

- No Stocks and Shares ISA: UK tax-efficient investing is not available, which limits its appeal for investors.

- Inactivity fees: Accounts with no trading activity for 12 months may be charged a monthly inactivity fee.

- CFD and leverage risk: Trading involves leverage, which increases risk and is not suitable for all users.

- UK leverage restrictions: FCA rules cap leverage for retail clients, which may limit some strategies.

Conclusion

Forex.com is a strong choice for UK traders who want a regulated, professional forex and CFD platform with competitive spreads and reliable execution. It stands out for active and day traders who value advanced tools and FCA oversight.

Beginners and long-term investors may prefer platforms like Trading 212 for ISA investing or eToro for simplicity and multi-asset access. For serious forex trading, Forex.com remains one of the top UK options in 2026.

FAQs

Is Forex.com regulated in the UK?

Yes. Forex.com is authorised and regulated by the FCA, meaning it must meet strict UK standards for client protection and conduct.

Is Forex.com safe for UK traders?

Forex.com is considered safe due to FCA regulation, segregated client funds, and its long track record. Trading losses are not FSCS protected.

Does Forex.com charge inactivity fees?

Yes. An inactivity fee of around £12 per month applies after 12 months with no trading activity.

What can I trade on Forex.com?

UK users can trade forex, indices, commodities, share CFDs, and spread betting markets. Physical shares, ETFs, and crypto derivatives are not available.