eToro vs Kraken in 2026 compares two leading crypto exchanges for UK users with very different strengths.

This guide explains how they differ on fees, FCA registration, supported assets, and ease of use, so you can see which platform better suits beginners versus active crypto traders. Cryptoassets are not FSCS protected, and choosing the right platform depends on how you plan to trade.

Key takeaway: Which platform is better, eToro or Kraken?

eToro is the better choice for UK beginners and casual investors who want commission-free stocks and ETFs, copy trading, and FSCS protection for eligible assets. Kraken is better for crypto-focused users who prioritise security, advanced trading tools, and lower fees on Kraken Pro.

eToro vs Kraken: comparison

| Factor | eToro | Kraken |

|---|---|---|

| Best for | Beginners, casual investors, copy trading | Crypto-focused and active traders |

| Assets available | Stocks, ETFs, crypto, forex, indices, commodities | Crypto only (490+ coins) |

| Fees | 0% commission on stocks and ETFs, ~1% crypto fee, $5 withdrawal | Low fees on Kraken Pro (0.25% / 0.40%), high Instant Buy fees |

| Regulation & protection | FCA authorised, FSCS protection up to £85,000 for eligible assets | FCA registered for AML only, no FSCS protection |

| Trading tools | Simple charts, CopyTrader, Smart Portfolios | Advanced charts, many order types, API access (Pro) |

| Mobile app | Single beginner-friendly app | Two apps: Standard and Pro |

| Staking / earn | Not available | Available on selected cryptocurrencies |

eToro – Best for beginners, commission-free investing, copy trading

eToro is a popular platform for UK beginners and long-term investors, combining 0% commission on real stocks and ETFs, FCA regulation, and a simple, mobile-first interface. It is less suitable for advanced or high-frequency traders who prioritise ultra-low crypto fees or professional-grade trading tools.

Overall rating: 4.4 / 5

- Main features: Commission-free investing in real stocks and ETFs, CopyTrader for automatically mirroring other investors, Smart Portfolios for themed diversification, a demo account with $100,000 virtual funds, fractional share dealing, and an intuitive app-led platform

- Fees: Stocks and ETFs 0% commission, crypto trading fees of around 1% per transaction, forex spreads from approximately 1.0 pip, $5 withdrawal fee, and currency conversion fees of roughly 0.75% to 1.5%

- Regulation and security: FCA authorised and regulated, FSCS protection up to £85,000 for eligible investments, segregated client funds, and negative balance protection.

- What you can trade: UK, US, and international stocks, ETFs, 140+ cryptocurrencies, forex, indices, and commodities via CFDs

- Transaction types: Buy-and-hold investing in real stocks and ETFs, buying and selling real cryptoassets, CFD trading on supported markets, copy trading, and portfolio-based investing

- Who eToro is best for: Beginners starting their investing journey, users looking for commission-free shares, investors interested in copy trading, and mobile-first or casual investors

Pros and cons

| Pros | Cons |

|---|---|

| 0% commission on stocks and ETFs | $5 withdrawal fee |

| FCA-regulated with FSCS protection | Higher crypto and forex fees |

| Very easy to use | Limited advanced charting tools |

| CopyTrader and Smart Portfolios | No SIPP, ISA available via partner only |

Read the complete eToro review here.

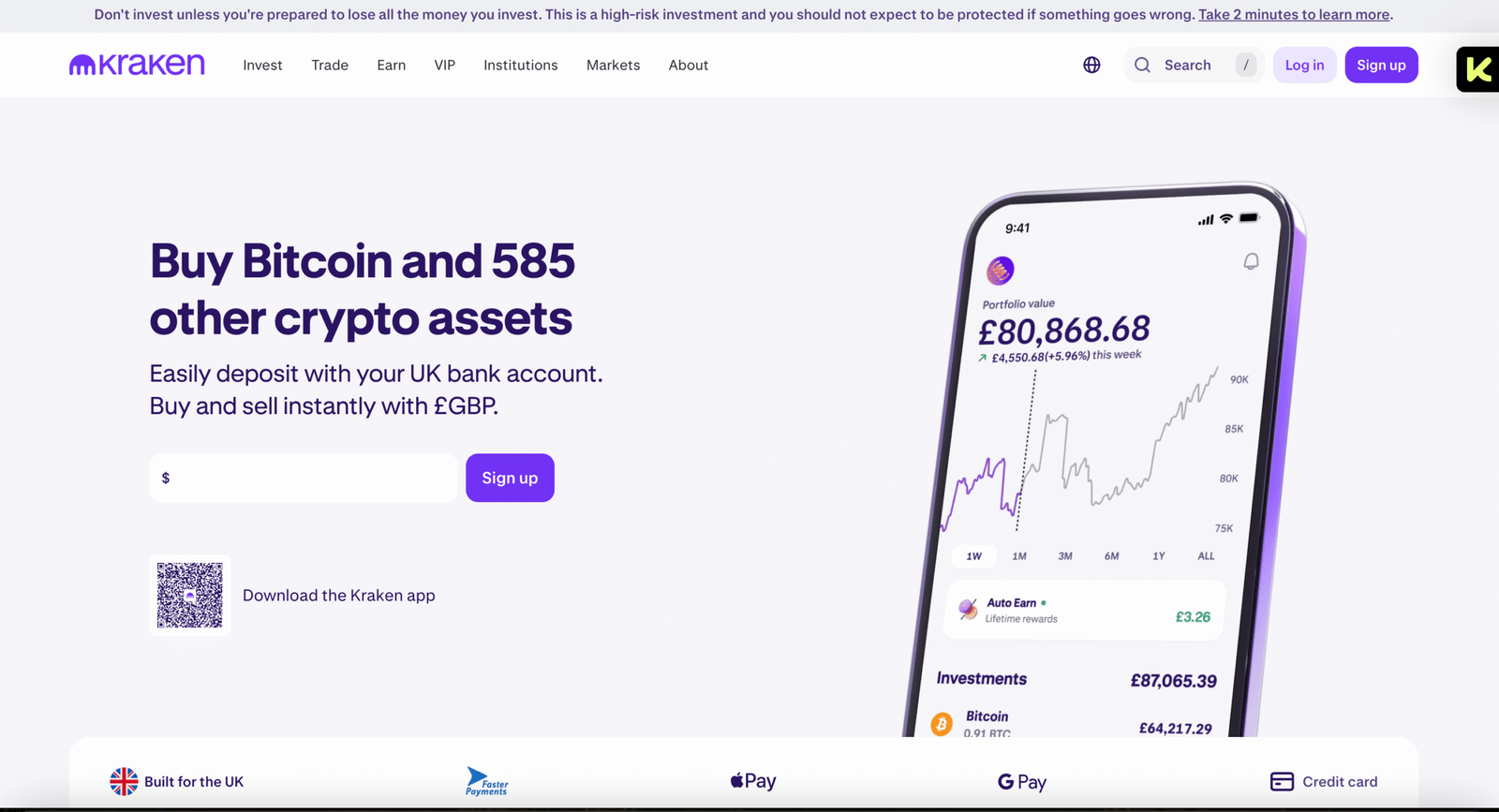

Kraken – Best for security-focused users, low-fee Pro trading, advanced crypto tools

Kraken is a long-established crypto exchange trusted by UK users who prioritise security, FCA registration, and low trading fees on Kraken Pro. It suits both beginners making occasional purchases and experienced traders, but is less ideal for users relying on Instant Buy due to higher fees or those seeking UK margin or futures trading.

Overall rating: 4.3 / 5

- Main features: Access to 490+ cryptocurrencies, free use of Kraken Pro with advanced charts and order types, deep liquidity, staking and Earn features, Proof-of-Reserves audits, strong security architecture, dual mobile apps for Standard and Pro users, and reliable GBP funding via Faster Payments

- Fees: Kraken Pro trading fees from 0.25% maker / 0.40% taker at entry level, reducing with volume; Instant Buy fees around 1% plus spread and payment fees; GBP deposits via Faster Payments are free; GBP withdrawals typically £1 to £35 depending on method

- Regulation and security: FCA registered for AML compliance, industry-leading security with cold storage, 2FA, Proof-of-Reserves audits, and no history of hacks. No FSCS protection applies, and cryptoassets are not protected

- What you can trade: 490+ cryptocurrencies, including major coins, stablecoins, and emerging tokens, plus staking and Earn products. No UK access to margin or futures due to FCA restrictions

- Transaction types: Spot crypto buying and selling, advanced trading via Kraken Pro, staking and Earn rewards, OTC trading for eligible users, and long-term holding

- Who Kraken is best for: UK users who prioritise platform security and trust, active traders using Kraken Pro for lower fees, long-term crypto investors interested in staking, and users who value FCA registration

Pros and cons

| Pros | Cons |

|---|---|

| FCA-registered and highly trusted | No FSCS protection |

| Never hacked with Proof-of-Reserves audits | Instant Buy fees are high |

| Low fees on Kraken Pro | No UK margin or futures trading |

| 490+ coins with deep liquidity | Pro interface may overwhelm beginners |

Read the complete Kraken review here.

Who should use eToro or Kraken?

eToro is best for UK beginners who want a simple crypto app, commission-free stocks and ETFs, and social tools like CopyTrader. Kraken is better for crypto-focused users who want strong security, 490+ coins, and lower fees by trading on Kraken Pro.

Use eToro if you:

- Are a beginner or casual investor

- Want 0% commission on real stocks and ETFs

- Like copy trading and ready-made portfolios

- Prefer an FCA-authorised platform with FSCS protection for eligible assets

Use Kraken if you:

- Trade crypto as your main activity

- Want access to 490+ cryptocurrencies

- Plan to use Kraken Pro for lower trading fees

- Prioritise security and Proof-of-Reserves

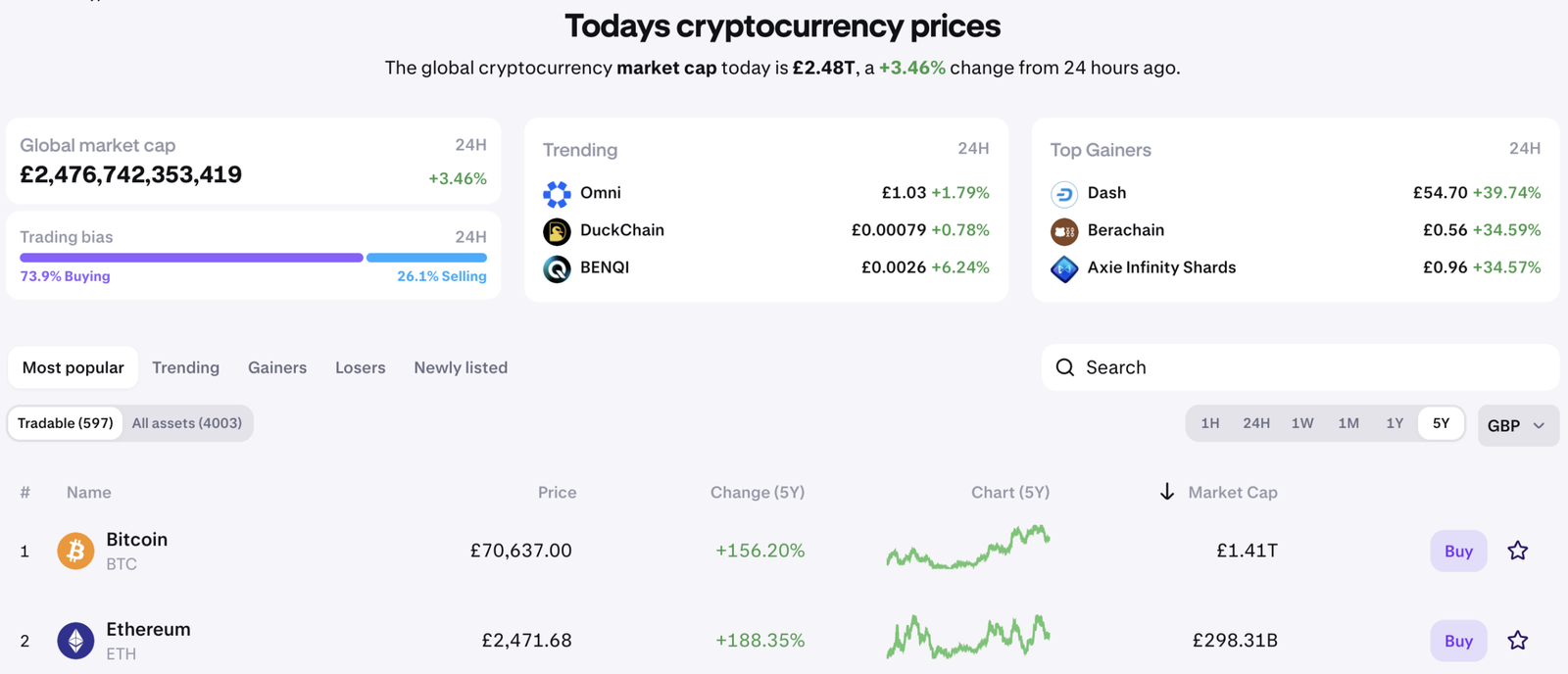

What assets are available on eToro vs Kraken?

eToro offers a broader multi-asset range, including stocks, ETFs, crypto, forex, indices, and commodities, while Kraken focuses almost entirely on cryptocurrencies and crypto-related products. For UK users, the choice depends on whether you want an all-in-one investing platform or a specialist crypto exchange.

Asset coverage comparison

| Asset type | eToro | Kraken |

|---|---|---|

| Stocks | UK, US, and international stocks (real shares) | Not available |

| ETFs | Commission-free real ETFs | Not available |

| Cryptocurrencies | 140+ cryptocurrencies (real crypto) | 490+ cryptocurrencies |

| Forex | Available via CFDs | Not available |

| Indices | Available via CFDs | Not available |

| Commodities | Available via CFDs | Not available |

| Crypto derivatives | Not available for UK retail users | Not available in the UK |

| Staking / Earn | Not available | Available on selected assets |

| Copy trading / portfolios | CopyTrader and Smart Portfolios | Not available |

How do eToro and Kraken fees compare?

Kraken is generally cheaper for active crypto traders, especially when using Kraken Pro, while eToro is cheaper for stock and ETF investors thanks to 0% commission on real shares. For UK users, fees depend heavily on whether you trade mostly crypto or invest across multiple asset classes.

Trading fees comparison

| Fee type | eToro | Kraken |

|---|---|---|

| Stocks & ETFs | 0% commission on real stocks and ETFs | Not available |

| Crypto trading | Around 1% per trade (spread included) | Pro: 0.25% maker / 0.40% taker (lower with volume) |

| Instant / simple buys | Included in spread | ~1% plus spread and payment fees |

| Forex spreads | From ~1.0 pip on EUR/USD | Not available |

| CFD trading | Yes (spreads apply) | Not available |

| Withdrawal fee | $5 per withdrawal | £1–£35 depending on method |

| Deposit fees (GBP) | Free via Faster Payments | Free via Faster Payments |

| Currency conversion | ~0.75% to 1.5% | None when trading GBP pairs |

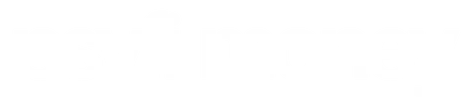

How do eToro and Kraken tools and platforms compare?

eToro focuses on simplicity, social investing, and beginner-friendly design, while Kraken offers powerful trading tools through Kraken Pro for active crypto traders. UK users should choose based on whether they value ease of use and guidance or advanced charting, order types, and lower-fee professional trading.

Platform tools comparison

| Feature | eToro | Kraken |

|---|---|---|

| Platform focus | Multi-asset investing and social trading | Crypto-first trading and analytics |

| Ease of use | Very beginner-friendly | Beginner (Standard), advanced (Pro) |

| Charting tools | Basic charts, limited customisation | Advanced TradingView-style charts (Pro) |

| Order types | Market, limit | Market, limit, stop, take-profit, trailing, iceberg |

| Copy / social trading | CopyTrader and Smart Portfolios | Not available |

| API access | Not available | Available on Kraken Pro |

| Mobile apps | Single mobile-first app | Separate Standard and Pro apps |

| Automation / bots | Not supported | Supported via API (advanced users) |

Which platform has better tools?

- Use Kraken if you want professional-grade crypto tools, lower Pro-tier fees, and advanced order execution.

- Use eToro if you want a simple investing experience, copy trading, and minimal technical complexity.

How do the eToro and Kraken mobile apps compare?

eToro offers a single, beginner-friendly mobile app focused on simplicity and social investing, while Kraken provides two apps: a simple Standard app and a powerful Kraken Pro app for advanced crypto trading.

UK users should choose based on whether they prefer ease of use or professional trading tools.

Mobile app features compared

| Feature | eToro app | Kraken apps |

|---|---|---|

| Number of apps | One all-in-one app | Two apps: Standard and Pro |

| Ease of use | Very beginner-friendly | Beginner (Standard), advanced (Pro) |

| Asset access | Stocks, ETFs, crypto, CFDs | Crypto only |

| Charting | Basic charts | Advanced TradingView-style charts (Pro) |

| Order types | Market and limit | Market, limit, stop, trailing, take-profit (Pro) |

| Copy trading | CopyTrader and Smart Portfolios | Not available |

| Security features | 2FA, biometric login | 2FA, device approvals, withdrawal whitelisting |

How does customer support compare on eToro vs Kraken?

Kraken offers stronger overall customer support, with 24/7 live chat and phone support, while eToro provides adequate but more limited support mainly through live chat and tickets. For UK users, Kraken generally delivers faster and more consistent help, especially for urgent account or trading issues.

- Kraken’s support is stronger for crypto users who want direct help, including phone access and round-the-clock live chat.

- eToro’s support is sufficient for beginners, but response times can be slower unless you qualify for higher-tier account support.

Which platform has better support?

- Choose eToro if you value a self-service help centre and only need occasional assistance.

- Choose Kraken if you want faster responses, 24/7 chat, and access to phone support.

Customer support features compared

| Support feature | eToro | Kraken |

|---|---|---|

| Live chat | Yes | Yes (24/7) |

| Phone support | No (Club members only) | Yes (weekdays) |

| Email / ticket support | Yes | Yes |

| Help centre / FAQs | Extensive but basic | Extensive and detailed |

| Response speed | Moderate, slower for complex issues | Generally fast |

| Education and guides | Beginner-focused | Beginner to advanced |

How is tax reporting handled on eToro and Kraken?

Neither eToro nor Kraken calculates or pays UK taxes for you, but both provide exportable transaction reports to help with HMRC reporting. UK users are responsible for tracking gains and declaring Capital Gains Tax (CGT) and Income Tax where applicable.

Tax reporting on eToro

eToro does not deduct tax automatically, but it provides clear account statements and trading history exports.

- Downloadable account statements and CSV trade history

- Supports tracking of stocks, ETFs, CFDs, and crypto

- UK users may owe CGT on shares and crypto

- Income Tax may apply to dividends or some copy trading income

- No direct HMRC filing or built-in tax calculator

Tax reporting on Kraken

Kraken focuses on crypto reporting and offers strong compatibility with third-party tax tools.

- Full CSV export of all trades, deposits, withdrawals, and staking rewards

- Integrates with tools like Koinly, CoinTracker, and CryptoTaxCalculator

- CGT applies when selling, swapping, or spending crypto

- Income Tax may apply to staking and Earn rewards

- Kraken may share data with HMRC upon request

How do eToro and Kraken compare on education materials?

eToro offers strong beginner-focused education built into its platform, while Kraken provides more in-depth crypto education suited to users who want to understand markets, security, and trading tools.

For UK users, eToro is easier to learn from, while Kraken is better for developing deeper crypto knowledge.

- eToro’s education is designed for beginners, focusing on how to invest, use the platform, and learn through copy trading and a demo trading account.

- Kraken’s education goes deeper into crypto, covering blockchain mechanics, security best practices, and advanced trading concepts.

Which platform is better for learning?

- Choose eToro if you are new to investing and want a guided, low-pressure learning experience.

- Choose Kraken if you want serious crypto education and plan to trade or stake digital assets actively.

Education materials compared

| Education feature | eToro | Kraken |

|---|---|---|

| Learning hub | eToro Academy | Kraken Learn Centre |

| Beginner guides | Yes, very beginner-friendly | Yes, crypto-focused |

| Advanced education | Limited | Strong crypto depth |

| Video content | Yes | Yes |

| Market explainers | Basic investing concepts | Crypto, blockchain, security |

| Learn-by-doing tools | Demo account, CopyTrader | Pro tools tutorials |

| Webinars / updates | Occasional | Regular educational content |

What does eToro offer that Kraken doesn’t and vice versa?

eToro offers multi-asset investing, copy trading, and FSCS protection for eligible assets, which Kraken does not.

Kraken offers far more cryptocurrencies, staking, and advanced crypto trading tools, which eToro does not. For UK users, the difference comes down to investing simplicity versus crypto depth.

What eToro offers that Kraken doesn’t

- Commission-free real stocks and ETFs

- CopyTrader and Smart Portfolios for social and guided investing

- Multi-asset access including stocks, ETFs, crypto, forex, indices, and commodities

- FSCS protection up to £85,000 for eligible cash and investments

- Demo account with $100,000 virtual funds

- Beginner-first mobile app with social investing features

What Kraken offers that eToro doesn’t

- 490+ cryptocurrencies compared to eToro’s smaller crypto range

- Staking and Earn rewards on supported assets

- Kraken Pro with advanced charts, order types, and API access

- Lower crypto trading fees for active traders using maker–taker pricing

- Proof-of-Reserves audits and a long, hack-free security record

- Crypto-first tools built for active and professional traders

Conclusion: eToro vs Kraken for UK users

eToro and Kraken serve very different UK investor needs, and the better choice depends on what you want to trade and how hands-on you plan to be.

eToro is the stronger option for beginners and casual investors, offering commission-free stocks and ETFs, copy trading, a demo account, and FCA authorisation with FSCS protection for eligible assets. It is designed for simplicity rather than low-cost active trading.

Kraken is the better choice for crypto-focused users who value security, transparency, and low fees on Kraken Pro. With 490+ cryptocurrencies, staking, and advanced trading tools, Kraken suits active and experienced crypto traders, but it offers no FSCS protection and fewer non-crypto investment options.

Choose eToro if you want an easy, all-in-one investing platform with guidance and protection for traditional assets.

Choose Kraken if you want a specialist crypto exchange with deeper markets, stronger trading tools, and lower fees for frequent crypto trading.

FAQs

Is Kraken legal in the UK?

Yes. Kraken is legal to use in the UK and is registered with the Financial Conduct Authority (FCA) for AML compliance.

Which UK banks work with Kraken?

Most major UK banks work with Kraken, allowing GBP deposits and withdrawals via Faster Payments.

Is Kraken or eToro better?

eToro is better for UK beginners who want commission-free stocks and ETFs, copy trading, and FSCS protection for eligible assets. Kraken is better for crypto-focused users who want lower fees on Kraken Pro, more coins, and advanced trading tools, but offers no FSCS protection.