eToro and Interactive Brokers are both FCA-regulated trading platforms, but they serve very different types of UK investors.

eToro focuses on simplicity, social investing, and commission-free trading, while Interactive Brokers offers advanced tools, global market access, and professional-grade pricing.

This comparison explains which platform is better for beginners, active traders, and long-term investors in 2026.

Key verdict: Who wins, eToro or Interactive Brokers?

Choose eToro if you value ease of use, guided investing, and a low-effort investing experience. Choose Interactive Brokers if you trade frequently, invest internationally, or need advanced platforms, order types, and cost efficiency.

There is no single overall winner because eToro and Interactive Brokers are designed for very different types of UK investors.

Comparison table: How does eToro compare with Interactive Brokers

| Key factor | eToro | Interactive Brokers |

|---|---|---|

| Best for | Beginners, casual investors, copy trading | Experienced, active, and professional traders |

| Fees & pricing | 0% commission on stocks and ETFs, higher spreads and crypto fees | Very low commissions, ultra-low FX fees, complex pricing |

| Assets available | Stocks, ETFs, crypto, CFDs (forex, indices, commodities) | Global stocks, ETFs, options, futures, bonds, funds, FX, limited crypto |

| Trading tools & platforms | Simple web and mobile platform, CopyTrader, Smart Portfolios | Trader Workstation, IBKR Desktop, APIs, advanced order types |

| Mobile app | Single, beginner-friendly app | Multiple apps with advanced functionality |

| Education & support | Beginner-focused education and guidance | Advanced education, functional trader-focused support |

| Regulation & protection (UK) | FCA regulated, FSCS protection up to £85,000 (eligible assets) | FCA regulated, FSCS protection up to £85,000 (eligible assets) |

eToro – Best for beginners, zero-commission investing, copy trading

eToro is a well-known UK investment platform aimed at beginners and long-term investors, offering commission-free access to real stocks and ETFs alongside FCA oversight and a clean, app-first design. It is not designed for professional traders who need advanced analytics, deep order books, or the lowest possible crypto trading costs.

Overall rating: 4.4 / 5

- Main features: Commission-free trading on real shares and ETFs, CopyTrader to automatically follow other investors, Smart Portfolios for diversified themes, a $100,000 virtual demo account, fractional share investing, and a simple mobile-led platform experience

- Fees: No commission on stock and ETF trades, crypto fees typically around 1% per trade, forex spreads starting from roughly 1.0 pip, a $5 withdrawal charge, plus currency conversion fees usually between 0.75% and 1.5%

- Regulation and security: Fully authorised and regulated by the FCA, FSCS protection up to £85,000 on eligible investments, segregated client money, and negative balance protection. Cryptoassets are not covered by FSCS

- What you can trade: UK, US, and global equities, ETFs, over 140 cryptocurrencies, forex pairs, indices, and commodities through CFDs

- Transaction types: Long-term investing in real stocks and ETFs, buying and selling real cryptoassets, CFD trading on supported instruments, copy trading strategies, and portfolio-based investing

- Who eToro is best for: First-time investors, users seeking commission-free share dealing, those interested in social or copy trading, and casual or mobile-first investors

Pro and cons

| Pros | Cons |

|---|---|

| 0% commission on stocks and ETFs | $5 withdrawal fee |

| FCA-regulated with FSCS protection | Higher crypto and forex costs |

| Extremely beginner-friendly platform | Limited advanced charting |

| CopyTrader and Smart Portfolios | No SIPP, ISA available via partner only |

Read the complete eToro review here.

Interactive Brokers – Best for advanced traders, low fees, global market access

Interactive Brokers is a professional-grade trading platform for UK investors who prioritise low costs, deep global market access, and advanced trading tools. It is best suited to experienced and active traders, as the platform is powerful but complex and lacks the simplicity and guided investing features beginners often prefer.

Overall rating: 4.2 / 5

- Main features: Access to 90+ global stock markets, extremely low trading and FX fees, Trader Workstation and IBKR Desktop for advanced trading, IBKR Mobile and GlobalTrader apps, fractional shares from $1, multi-currency accounts, interest on uninvested cash above thresholds, and institutional-grade execution via SMART routing

- Fees: UK shares typically £3 per trade or 0.05% on larger orders, US shares from $0.005 per share, options and futures from around £0.15 per contract, FX conversion fees of roughly 0.03%, crypto fees around 0.12%–0.18%, £3 monthly ISA fee if inactive, one free withdrawal per month then £7

- Regulation and security: FCA authorised through Interactive Brokers (U.K.) Limited, FSCS protection up to £85,000 for eligible accounts, segregated client funds, strong capital position, two-factor authentication, and long global operating history. Crypto assets are not FSCS protected

- What you can trade: UK and international shares and ETFs, options, futures, bonds, mutual funds, forex, stock and index CFDs, and limited crypto exposure via regulated products and partners

- Transaction types: Long-term investing, active trading, options and futures strategies, margin trading (subject to eligibility), forex trading, multi-currency investing, and self-directed portfolio management

- Who Interactive Brokers is best for: Experienced and active UK traders, investors trading international markets, options and derivatives traders, cost-sensitive investors, and those comfortable managing their own portfolios

Pros and cons

| Pros | Cons |

|---|---|

| Very low trading fees across global markets | Complex platform with a steep learning curve |

| Ultra-low FX fees around 0.03% | Not beginner-friendly |

| Access to 90+ global stock markets | No ready-made or guided portfolios |

| FCA regulated with FSCS protection | £3 monthly ISA fee if inactive |

| Advanced trading platforms and tools | Bank transfer only for funding |

| Fractional shares from $1 | Crypto is available but not FSCS protected |

| Strong execution via SMART routing | Account setup can feel slow and detailed |

Read the complete Interactive Brokers review here.

Who should use eToro or Interactive Brokers?

eToro is best for beginners and casual investors who want a simple, low-effort way to invest, while Interactive Brokers is better for experienced traders who prioritise low fees, global market access, and advanced tools. The right choice depends on your experience level, trading frequency, and whether you value simplicity or professional-grade control.

Who should use eToro?

eToro is designed for ease of use and accessibility, making it a strong choice for newer UK investors or those who prefer a hands-off approach.

eToro is best if you are:

- New to investing and want a simple, app-first platform

- Looking for 0% commission on real stocks and ETFs

- Interested in copy trading or social investing features

- A casual or long-term investor who trades infrequently

- Comfortable with higher spreads in exchange for simplicity

Who should use Interactive Brokers?

Interactive Brokers is built for experienced, self-directed traders who want maximum control, low costs, and access to global markets.

Interactive Brokers is best if you are:

- An experienced or active UK trader

- Trading international shares, options, or multiple asset classes

- Highly fee-sensitive, especially on FX and frequent trades

- Comfortable using complex, professional trading platforms

- Managing your own portfolio without guided or social features

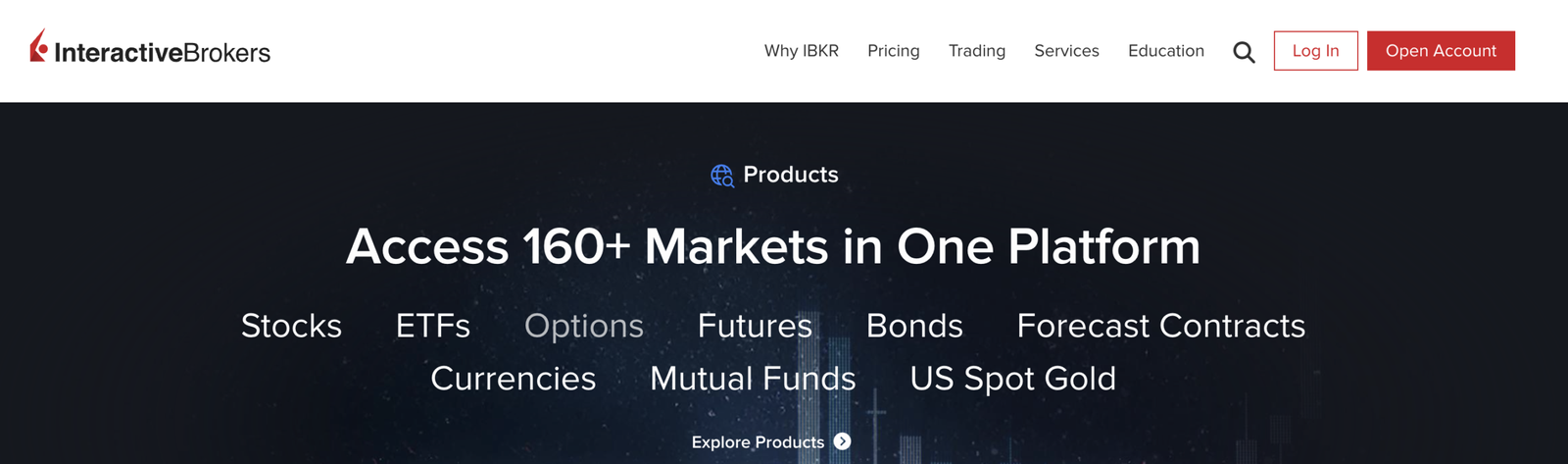

What assets are available on eToro and Interactive Brokers?

eToro offers a broad but simplified mix of assets suited to beginners, while Interactive Brokers provides one of the widest asset selections available to UK traders.

Both platforms cover shares and ETFs, but Interactive Brokers goes much further with global markets, derivatives, bonds, and professional instruments.

How eToro’s asset range suits UK investors

eToro focuses on accessibility rather than depth. UK users can trade real stocks and ETFs with 0% commission, alongside cryptoassets and CFDs on forex, indices, and commodities. This range suits beginners and casual investors who want exposure to popular markets without complex products.

- Best for: Shares, ETFs, crypto, and simple multi-asset investing

- Limitations: No bonds, options, futures, or professional derivatives

How Interactive Brokers’ asset range compares

Interactive Brokers offers institutional-level market access. UK traders can invest across 90+ global stock markets, trade options, futures, bonds, funds, forex, and manage multi-currency portfolios from one account.

This breadth is unmatched among FCA-regulated platforms.

- Best for: Global diversification, derivatives, fixed income, and active trading

- Limitations: Complexity and lack of simplified, beginner-focused assets

Asset coverage overview: eToro VS Interactive Brokers

| Asset type | eToro | Interactive Brokers |

|---|---|---|

| Stocks (UK & global) | Yes | Yes |

| ETFs | Yes | Yes |

| Cryptocurrencies | 140+ coins | Limited exposure via ETNs and partners |

| Forex | Yes (via CFDs) | Yes (spot FX and conversion) |

| Indices | Yes (via CFDs) | Yes |

| Commodities | Yes (via CFDs) | Yes |

| Options | No | Yes |

| Futures | No | Yes |

| Bonds | No | Yes (gilts, Treasuries, corporates) |

| Mutual funds | No | Yes (55,000+) |

| CFDs | Yes | Limited (mainly stocks and indices) |

How do fees compare between eToro and Interactive Brokers?

eToro keeps fees simple with commission-free share dealing but higher spreads, while Interactive Brokers offers some of the lowest trading and FX fees in the UK with a more complex, commission-based model.

eToro suits casual investors who value simplicity, while Interactive Brokers is cheaper for active and international traders.

Fees overview comparison

| Fee type | eToro | Interactive Brokers |

|---|---|---|

| Stocks & ETFs | 0% commission on real stocks and ETFs | ~£3 per trade or 0.05% on larger UK orders |

| Crypto trading | ~1% per trade | ~0.12%–0.18% |

| Forex / FX fees | Spreads from ~1.0 pip + conversion fees | ~0.03% FX conversion fee |

| CFDs | Spread-based pricing | Commission + tight spreads |

| ISA fee | Not offered directly | £3 per month if inactive |

| Withdrawal fees | $5 per withdrawal | 1 free per month, then £7 |

| Inactivity fee | None | None |

How eToro’s fees work in practice

eToro’s pricing is built for simplicity. UK investors pay no commission on real shares and ETFs, but costs are built into spreads, FX conversion, and crypto fees. This makes it easy to understand but more expensive for frequent trading.

Best for: Buy-and-hold investors and infrequent traders

Watch out for: Higher crypto, FX, and CFD costs over time

How Interactive Brokers’ fees compare

Interactive Brokers uses transparent, commission-based pricing that is extremely competitive for active traders.

FX conversion costs are among the lowest in the UK, making it especially attractive for international investing.

Best for: Active, cost-sensitive, and global traders

Watch out for: More complex fee structure and ISA inactivity charge

How do the tools and platforms compare between eToro and Interactive Brokers?

eToro focuses on simplicity and social investing tools, while Interactive Brokers delivers professional-grade platforms with advanced analytics and order control.

eToro is easier to use for beginners, whereas Interactive Brokers is better for experienced traders who need depth, flexibility, and precision.

Platform and tools overview

| Platform / tool | eToro | Interactive Brokers |

|---|---|---|

| Web platform | Simple, beginner-friendly web interface | Client Portal for investing and reporting |

| Desktop platform | Not available | Trader Workstation (TWS) and IBKR Desktop |

| Mobile app | Single app designed for beginners | IBKR Mobile and IBKR GlobalTrader |

| Charting tools | Basic charts and indicators | Advanced, highly customisable charting |

| Order types | Limited (market, stop, limit) | 90+ advanced and conditional order types |

| Social / copy trading | CopyTrader and Smart Portfolios | Not available |

| Research & analytics | Light, beginner-focused insights | Professional research, PortfolioAnalyst |

| API access | Not available | Full API access for automation |

eToro platform strengths

eToro is built around ease of use. The interface is clean, visual, and designed for mobile-first investors.

CopyTrader allows users to mirror other traders automatically, while Smart Portfolios provide thematic diversification without manual management.

Best for: Beginners, social trading, and hands-off investing

Limitations: Limited charting, order types, and professional tools

Interactive Brokers platform strengths

Interactive Brokers offers some of the most advanced trading technology available to UK traders. Trader Workstation and IBKR Desktop support complex strategies, while API access enables algorithmic and high-frequency trading.

Best for: Active traders, professionals, and data-driven investors

Limitations: Steep learning curve and less intuitive interface

How do the mobile apps compare between eToro and Interactive Brokers?

eToro offers a single, beginner-friendly mobile app focused on simplicity and social investing, while Interactive Brokers provides multiple mobile trading apps designed for different experience levels.

eToro is easier for casual UK investors, whereas Interactive Brokers’ apps offer far more functionality but come with added complexity.

- eToro is better if you want a simple, all-in-one mobile investing app.

- Interactive Brokers is better if you want advanced trading features and professional-level control on mobile.

Mobile app features comparison

| Mobile app feature | eToro | Interactive Brokers |

|---|---|---|

| Number of apps | One all-in-one app | Two apps: IBKR Mobile and IBKR GlobalTrader |

| Ease of use | Very beginner-friendly | Moderate to complex |

| Trading experience | Simple buy/sell and copy trading | Full multi-asset trading |

| Charting tools | Basic charts and indicators | Advanced charts and tools |

| Order types | Limited order options | Wide range of advanced orders |

| Copy / social trading | CopyTrader built in | Not available |

| Research & analytics | Light, app-level insights | In-depth analytics and alerts |

| Security features | Biometric login, 2FA | Biometric login, mandatory 2FA |

eToro mobile app experience

The eToro app is designed for simplicity and speed. It combines investing, copy trading, and portfolio tracking in one clean interface, making it easy for beginners to place trades and monitor investments on the go.

Interactive Brokers mobile app experience

Interactive Brokers offers two mobile apps. IBKR Mobile delivers near-desktop-level functionality for active traders, while IBKR GlobalTrader is a simplified option for smaller portfolios. Both are powerful but less intuitive than eToro.

How does customer support compare between eToro and Interactive Brokers?

eToro offers more beginner-friendly customer support with guided help and social features, while Interactive Brokers provides functional, trader-focused support designed for self-directed users.

eToro is easier for new UK investors to navigate, whereas Interactive Brokers suits experienced traders who need technical help rather than hand-holding.

Customer support overview

| Support feature | eToro | Interactive Brokers |

|---|---|---|

| Support channels | Help centre, ticket system, live chat (limited) | Phone, live chat, secure message centre |

| Availability | Business hours | Extended hours, market-aligned |

| Response speed | Moderate | Generally fast for account and trade issues |

| Beginner guidance | Strong FAQs and tutorials | Limited guidance for beginners |

| Dedicated account support | Not standard | Available for higher-tier or professional users |

| Community support | Social feed and user discussions | None |

How does account verification compare between eToro and Interactive Brokers?

eToro offers a faster and simpler account verification process, while Interactive Brokers uses a more detailed and rigorous onboarding designed for experienced traders.

eToro is easier for beginners to get started quickly, whereas Interactive Brokers prioritises compliance and suitability checks over speed.

Account verification overview

| Verification feature | eToro | Interactive Brokers |

|---|---|---|

| Minimum age | 18+ | 18+ (21+ for margin accounts) |

| Identity documents | Photo ID | Photo ID |

| Proof of address | Required | Required |

| Financial suitability checks | Basic | Detailed |

| Trading experience questions | Limited | Extensive |

| Verification speed | Usually same day to 1–2 days | Typically 1–3 business days |

| Account complexity | Low | High |

eToro verification process

eToro’s onboarding is designed for speed and simplicity. UK users typically upload ID and proof of address, answer a short questionnaire, and can start trading quickly once verified.

Best for: Beginners and casual investors

Watch out for: Lower suitability checks mean fewer advanced trading permissions

Interactive Brokers verification process

Interactive Brokers requires more detailed information, including employment status, income, tax residency, and trading experience. This reflects FCA rules around complex products and access to advanced instruments.

Best for: Experienced and active traders

Watch out for: Longer application and more complex approval process

How do the demo accounts compare between eToro and Interactive Brokers?

eToro offers a simple, unlimited demo trading account designed for beginners, while Interactive Brokers provides a more realistic but complex paper trading environment.

eToro is better for learning the basics of investing, whereas Interactive Brokers’ demo is suited to experienced traders testing advanced tools and strategies.

eToro’s demo account is designed to help beginners practise without pressure. It uses the same interface as the live platform and allows users to test stock investing, crypto trading, and copy trading with virtual funds.

Interactive Brokers’ Paper Trading account closely mirrors live trading conditions. It is ideal for testing complex strategies, advanced order types, and platform functionality before committing real capital.

Demo account comparison

| Demo account feature | eToro | Interactive Brokers |

|---|---|---|

| Availability | Yes, standard for all users | Yes, via Paper Trading |

| Virtual funds | $100,000 | Varies by asset and account type |

| Time limit | None | No fixed limit |

| Ease of use | Very beginner-friendly | Complex, mirrors live platform |

| Market realism | Simplified pricing and execution | Real-time market data and execution logic |

| Platform access | Same interface as live app | Same tools as live account |

| Strategy testing | Basic investing and copy trading | Advanced strategies, options, margin |

How do the education materials compare between eToro and Interactive Brokers?

eToro provides beginner-friendly education focused on investing basics and platform use, while Interactive Brokers offers advanced, in-depth educational resources aimed at experienced traders.

eToro is better for learning how to start investing, whereas Interactive Brokers is stronger for developing professional-level trading knowledge.

- Choose eToro if you want simple, beginner-focused investing education.

- Choose Interactive Brokers if you want deep, professional-level trading courses and resources.

eToro education experience

eToro’s education is designed to help new UK investors get started quickly. Content focuses on core concepts like stocks, ETFs, crypto, risk management, and how to use features such as CopyTrader and Smart Portfolios.

Best for: Beginners and casual investors

Limitations: Limited depth for advanced or professional trading strategies

Interactive Brokers education experience

Interactive Brokers offers one of the most comprehensive education hubs in the market through its Traders’ Academy. Courses cover options, futures, technical analysis, portfolio construction, and platform-specific tools.

Best for: Experienced and active traders

Limitations: Content can feel overwhelming and highly technical for beginners

Education overview comparison

| Education feature | eToro | Interactive Brokers |

|---|---|---|

| Beginner guides | Strong, plain-English content | Limited beginner focus |

| Platform tutorials | Step-by-step guides and videos | Detailed but technical documentation |

| Trading concepts | Basic investing and risk concepts | Advanced trading, derivatives, and risk |

| Video content | Short videos and explainers | Webinars and recorded classes |

| Market education | Introductory market insights | In-depth courses via Traders’ Academy |

| Learning curve | Low | High |

How is tax reporting handled on eToro and Interactive Brokers?

eToro keeps tax reporting simple with basic statements, while Interactive Brokers provides detailed, exportable tax reports suited to active UK traders.

Neither platform files taxes for you, so UK users remain responsible for reporting capital gains and income to HMRC.

Tax reporting on eToro

eToro provides downloadable account statements showing trades, profits and losses, dividends, and fees. These reports help UK users calculate Capital Gains Tax (CGT) and dividend income but are relatively high level and may require manual organisation for HMRC reporting.

What to know:

- No automatic HMRC reporting

- Statements available in PDF and CSV formats

- CGT and dividend calculations are the user’s responsibility

- Crypto transactions are taxable and not FSCS-protected

Best for: Casual investors with low trade volume

Limitation: No advanced tax analytics or UK-specific tax summaries

Tax reporting on Interactive Brokers

Interactive Brokers offers one of the most comprehensive tax reporting systems available to UK traders. Users can access detailed, customisable reports covering realised gains, dividends, interest, FX gains, and corporate actions, which is especially useful for active and multi-asset investors.

What to know:

- No automatic HMRC filing, but highly detailed reports

- Extensive tax and performance reports via Client Portal

- Supports CGT tracking across shares, ETFs, options, and FX

- ISA accounts are tax-free, subject to ISA rules

Best for: Active traders and complex portfolios

Limitation: Reports can feel complex for beginners

What does eToro offer that Interactive Brokers doesn’t and vice versa?

eToro offers social and copy trading tools that Interactive Brokers does not, while Interactive Brokers provides advanced trading features and global market access that eToro lacks. The difference comes down to simplicity and social investing versus professional-grade control and depth.

What eToro offers that Interactive Brokers doesn’t

eToro is built to make investing accessible and social, with features designed for beginners and hands-off investors.

Unique eToro features:

- CopyTrader, allowing users to automatically copy other investors

- Smart Portfolios, offering ready-made, theme-based portfolios

- Single, beginner-friendly app and platform

- Simpler fee structure with 0% commission on real stocks and ETFs

- Social feed, where users can follow and interact with other investors

Best for: Beginners, casual investors, and those who want guided or social investing

Limitation: Lacks advanced order types, derivatives, and professional tools

What Interactive Brokers offers that eToro doesn’t

Interactive Brokers is designed for experienced traders who need flexibility, scale, and advanced functionality.

Unique Interactive Brokers features:

- Access to 90+ global stock markets from a single account

- Advanced trading platforms like Trader Workstation and IBKR Desktop

- Derivatives trading, including options, futures, and bonds

- Ultra-low FX fees and true multi-currency accounts

- API access for algorithmic and automated trading

- Extensive tax and performance reporting tools

Best for: Active, professional, and international traders

Limitation: Steep learning curve and no social or copy trading

Conclusion

eToro and Interactive Brokers are both strong FCA-regulated platforms, but they suit very different UK investors.

eToro is the top pick for beginners and casual investors thanks to its simple app, 0% commission on stocks and ETFs, and copy trading features. Interactive Brokers is the top pick for experienced and active traders due to its ultra-low fees, global market access, and professional-grade tools.

If you want an easy, hands-off investing experience, eToro is the better choice. If you prioritise low costs, advanced platforms, and international investing, Interactive Brokers offers better long-term value.

FAQs

Is eToro or Interactive Brokers better for beginners?

eToro is better for beginners because it offers a simple platform, copy trading, and commission-free stocks, while Interactive Brokers is more complex and designed for experienced traders.

Are eToro and Interactive Brokers FCA-regulated in the UK?

Yes. Both eToro and Interactive Brokers are FCA-regulated.

Which platform is cheaper, eToro or Interactive Brokers?

Interactive Brokers is cheaper overall for active and international traders due to very low commissions and FX fees, while eToro can be more expensive because costs are built into spreads and crypto fees.