eToro vs Coinbase in 2026 compares two of the most popular crypto exchanges for UK users, focusing on fees, safety, regulation, and ease of use.

This guide explains the key differences so you can quickly see which platform better suits beginners, long-term investors, or active crypto traders.

Key takeaway: Which platform is better?

Choose eToro if you want commission-free stock investing plus crypto in one beginner-friendly platform.

Choose Coinbase if you want a simple, secure way to buy and hold crypto using GBP with minimal setup.

eToro vs Coinbase: Main factors compared

| Factor | eToro | Coinbase |

|---|---|---|

| Platform focus | Multi-asset investing | Crypto-only exchange |

| Assets available | Stocks, ETFs, crypto, CFDs | 250+ cryptocurrencies |

| Fees | 0% stocks, ~1% crypto, $5 withdrawal | ~0.5% spread + 1.5–4% fees |

| Beginner tools | Demo account, CopyTrader | Learn & Earn, simple buy/sell |

| Advanced features | Limited | Coinbase Advanced, staking |

| UK regulation | FCA authorised, FSCS up to £85k* | FCA registered (crypto only) |

| Best for | Beginners wanting stocks + crypto | Crypto-only beginners |

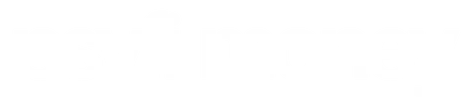

eToro – Best for beginners, commission-free investing, copy trading

eToro is one of the best platforms for beginners and casual investors in the UK, thanks to its 0% commission on real stocks and ETFs, FCA regulation, and simple, mobile-first design. It is less suitable for active traders or users focused on ultra-low crypto fees or advanced tools.

Overall rating: 4.4 / 5

- Main features: Commission-free real stocks and ETFs, copyTrader to follow other investors automatically, smart Portfolios for themed diversification, demo account with $100,000 virtual funds, fractional shares and mobile-first app

- Fees: Stocks and ETFs: 0% commission, crypto trading: ~1% per trade, forex spreads: From ~1.0 pip, withdrawal fee: $5 per withdrawal, currency conversion: ~0.75% to 1.5%

- Regulation and security: FCA authorised and regulated, FSCS protection up to £85,000 for eligible clients, crypto-assets are not FSCS protected

- What you can trade: UK, US and global stocks, ETFs, 140+ cryptocurrencies, Forex, indices and commodities via CFDs

- Transaction types: buy and hold real stocks and ETFs, buy and sell real cryptoassets, CFD trading on supported markets, copy trading and portfolio investing

- Who eToro is best for: Beginners learning to invest, investors wanting commission-free shares, users interested in copy trading, mobile-first and casual investors

Pros and cons

| Pros | Cons |

| 0% commission on stocks and ETFs | $5 withdrawal fee |

| FCA-regulated with FSCS protection | Higher crypto and forex fees |

| Very easy to use | Limited advanced charting |

| CopyTrader and Smart Portfolios | No SIPP, ISA via partner only |

Read the complete eToro review here.

Coinbase – Best for beginners, easy GBP crypto buying, security-first users

Coinbase is one of the most beginner-friendly and trusted crypto platforms in the UK, offering a clean crypto app, fast GBP deposits, and strong security standards. It is ideal for first-time buyers and casual investors, but its higher fees make it less suitable for frequent or high-volume traders.

Overall rating: 3.8 / 5

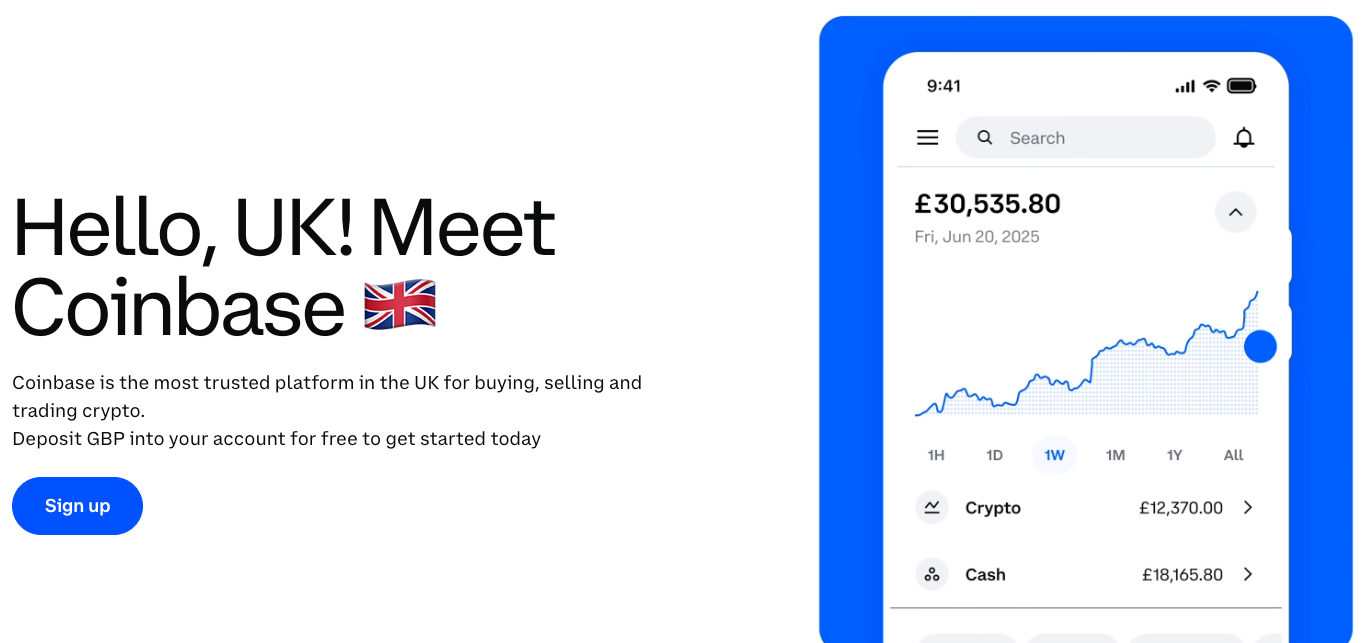

- Main features: 250+ cryptocurrencies, simple buy and sell mode, Coinbase Advanced for lower fees, staking on major assets, Learn & Earn crypto rewards, recurring buys, secure hosted wallet and optional Coinbase Wallet

- Fees: Spread of ~0.5% plus 1.5% to 4% transaction fees on standard trades, Coinbase Advanced fees from 0.6% (lower with volume), staking commission 15% to 35%, free GBP deposits

- Regulation and security: FCA-registered for UK cryptoasset activities, 98% cold storage, mandatory 2FA, encryption and device verification. Cryptoassets are not FSCS protected

- What you can trade: 250+ cryptocurrencies including Bitcoin, Ethereum, Solana, XRP and major GBP pairs

- Transaction types: Buy and sell real crypto, staking, recurring purchases, instant crypto withdrawals to external wallets. No CFDs, leverage or derivatives

- Who Coinbase is best for: First-time crypto buyers, casual investors, users wanting easy GBP deposits, mobile-first traders, people who prioritise security and regulation

Pros and cons

| Pros | Cons |

|---|---|

| Very easy to use | Higher fees than most UK exchanges |

| 250+ cryptocurrencies | Confusing fee structure |

| FCA-registered | No FSCS protection |

| Free GBP deposits | No demo account |

| Strong security and cold storage | Customer support can be slow |

Read the complete Coinbase review here.

Who should use eToro or Coinbase?

eToro suits UK users who want to invest in stocks, ETFs and crypto from one platform, while Coinbase suits users who only want to buy and hold cryptocurrency simply and securely. The best choice depends on whether you want multi-asset investing or a crypto-only exchange.

Who should use eToro?

eToro is best for beginners and casual investors who want commission-free stocks alongside crypto. Its simple app and copy trading tools make it easy to get started.

Best if you:

- Want 0% commission on stocks and ETFs

- Prefer a beginner-friendly app

- Like copy trading and ready-made portfolios

- Want stocks, ETFs and crypto in one account

Who should use Coinbase?

Coinbase is best for first-time crypto buyers who prioritise security and ease of use. It offers fast GBP deposits and real crypto ownership, but at higher fees.

Best if you:

- Only want to buy and hold crypto

- Need free GBP deposits

- Value strong security and FCA registration

- Prefer a clean, mobile-first experience

What assets are available on eToro vs Coinbase?

eToro offers a much broader range of assets than Coinbase, covering stocks, ETFs, crypto and CFDs, while Coinbase focuses exclusively on cryptocurrency. For UK users, this means eToro suits multi-asset investors, whereas Coinbase is designed purely for buying, holding and staking cryptoassets.

If your goal is diversification across traditional markets and crypto, eToro offers broader coverage. If your focus is purely crypto, Coinbase provides deeper coin selection and staking support.

| Asset type | eToro | Coinbase |

|---|---|---|

| Stocks | Yes (real shares) | No |

| ETFs | Yes (real ETFs) | No |

| Cryptocurrencies | 70+ | 250+ |

| Forex | Yes (CFDs) | No |

| Indices | Yes (CFDs) | No |

| Commodities | Yes (CFDs) | No |

| Crypto staking | No (UK retail) | Yes |

| Derivatives | CFDs only | No derivatives |

How do fees compare between eToro and Coinbase?

eToro is cheaper for stocks and ETFs, while Coinbase is typically more expensive for crypto trading, especially for beginners. For UK users, the main difference is that eToro offers 0% commission on real shares, whereas Coinbase charges a spread plus transaction fees on every crypto trade.

Fees comparison table

| Fee type | eToro | Coinbase |

|---|---|---|

| Stock & ETF trades | 0% commission (real assets) | Not available |

| Crypto trading | ~1% per trade | ~0.5% spread + 1.5% to 4% fee |

| Advanced trading fees | Included in spread | From 0.6% on Coinbase Advanced |

| Forex spreads | From ~1.0 pip | Not available |

| Withdrawal fees | $5 per withdrawal | Free GBP withdrawals |

| Inactivity fee | $10 after 12 months | None |

| Currency conversion | ~0.75% to 1.5% | Built into spread |

What tools and platforms do eToro and Coinbase offer?

eToro focuses on simplicity and social investing tools, while Coinbase focuses on clean crypto trading with optional advanced features. For UK users, eToro is better for guided, multi-asset investing, while Coinbase is better for straightforward crypto buying with strong security.

Tools and platform comparison

| Feature | eToro | Coinbase |

|---|---|---|

| Platform type | Multi-asset investing | Crypto-only exchange |

| Web platform | Yes | Yes |

| Mobile app | Yes | Yes |

| Demo account | Yes | No |

| Social trading | Yes (CopyTrader) | No |

| Ready-made portfolios | Yes (Smart Portfolios) | No |

| Advanced charts | Basic | Yes (Coinbase Advanced) |

| Order types | Market, limit, stop | Market, limit, stop |

| Staking tools | No (UK retail) | Yes |

| External wallet support | Limited | Yes (full support) |

How do the eToro and Coinbase mobile apps compare?

Both eToro and Coinbase offer excellent mobile apps, but they serve different needs. eToro’s app is designed for simple, guided investing across multiple assets, while Coinbase’s app focuses on fast, secure crypto buying with clear pricing and instant GBP access.

How does customer support compare between eToro and Coinbase?

eToro and Coinbase both offer adequate customer support for UK users, but neither is best-in-class. eToro performs better for account-related investing queries, while Coinbase offers more support channels but can be slow to reach a human adviser.

Customer support comparison

| Support feature | eToro | Coinbase |

|---|---|---|

| Live chat | Yes | Yes |

| Email or ticket support | Yes | Yes |

| Phone support | Limited (Club members) | Automated only |

| Help centre | Extensive | Extensive |

| Response speed | Average | Slow to average |

| Priority support | eToro Club | Coinbase One |

| UK phone line | No | No |

How does account verification compare between eToro and Coinbase?

Both eToro and Coinbase use fast, fully online identity checks, but Coinbase is usually quicker to verify UK users. eToro’s process suits multi-asset investing and may take longer due to suitability checks, while Coinbase focuses on rapid onboarding for crypto-only access.

Account verification comparison

| Verification step | eToro | Coinbase |

|---|---|---|

| Verification type | Full KYC + suitability | KYC for crypto |

| ID required | Passport or driving licence | Passport or driving licence |

| Proof of address | Sometimes required | Sometimes required |

| Questionnaire | Yes (trading suitability) | No |

| Typical approval time | Same day to 24 hours | Minutes to same day |

| Demo access before approval | Yes | No |

| Minimum to start | $50 deposit | £2 trade minimum |

How do the demo accounts compare between eToro and Coinbase?

eToro offers a full-featured demo trading account, while Coinbase does not provide a demo account at all. For UK users who want to practise investing before risking real money, this is a major difference between the two platforms.

Demo account comparison

| Feature | eToro | Coinbase |

|---|---|---|

| Demo account available | Yes | No |

| Virtual balance | $100,000 | Not available |

| Markets supported | Stocks, ETFs, crypto, CFDs | Not available |

| Time limit | None | Not applicable |

| Access before verification | Yes | No |

| Risk-free practice | Yes | No |

How does education material compare between the two?

eToro offers broader beginner education across investing, while Coinbase provides simple crypto-focused learning with rewards. For UK users, eToro is better for learning general investing concepts, whereas Coinbase is better for learning crypto basics quickly.

Education material comparison

| Education feature | eToro | Coinbase |

|---|---|---|

| Beginner guides | Yes (investing basics) | Yes (crypto basics) |

| Video tutorials | Yes | Yes |

| Learn & Earn rewards | No | Yes |

| Demo-based learning | Yes | No |

| Market explainers | Yes | Limited |

| Advanced education | Limited | Limited |

| Webinars | Yes | Occasional |

How is tax reporting handled on eToro vs Coinbase?

Neither eToro nor Coinbase automatically handle UK taxes for you, but both provide transaction histories to help you report to HMRC. UK users are responsible for calculating and declaring Capital Gains Tax and Income Tax where applicable

- You must report taxes yourself on both platforms

- eToro users may owe CGT on stocks, ETFs, crypto and CFDs, plus Income Tax on dividends

- Coinbase users may owe CGT on crypto trades and Income Tax on staking rewards

- Coinbase integrates more easily with third-party crypto tax software

- Neither platform provides a full HMRC-ready tax return

What does eToro offer that Coinbase doesn’t and vice versa?

eToro offers multi-asset investing and social trading tools that Coinbase does not, while Coinbase offers deeper crypto features and simpler ownership that eToro cannot match. The difference comes down to all-in-one investing vs crypto-only focus.

What eToro offers that Coinbase doesn’t

- Real stocks and ETFs with 0% commission

- CopyTrader to automatically copy other investors

- Smart Portfolios with themed diversification

- Demo account with virtual funds

- Multi-asset access including forex, indices and commodities via CFDs

- Social investing feed and investor transparency tools

What Coinbase offers that eToro doesn’t

- 250+ cryptocurrencies vs eToro’s smaller crypto range

- Direct crypto ownership only, no CFDs

- Staking rewards on major assets like ETH and SOL

- Advanced crypto trading mode with order books and TradingView charts

- External wallet support and self-custody integration

- Learn & Earn rewards for learning about crypto

Conclusion: eToro vs Coinbase for UK users

eToro is the better choice for UK users who want commission-free stocks, ETFs and crypto in one beginner-friendly platform, while Coinbase is the better choice for users who only want to buy, hold and stake cryptocurrency simply and securely.

Choose eToro if you want multi-asset investing, copy trading and a demo account. Choose Coinbase if your focus is crypto only, with easy GBP deposits, strong security and real asset ownership.

FAQs

What is the difference between eToro and Coinbase?

eToro offers stocks, ETFs and crypto, while Coinbase is a crypto-only platform. eToro suits multi-asset investors, while Coinbase suits users focused purely on crypto.

What is the downside to eToro?

eToro’s main downsides are higher crypto fees, a $5 withdrawal fee, and limited advanced tools. It also uses USD accounts, which can add currency conversion costs for UK users.

Is eToro good for crypto?

Yes, eToro is good for casual crypto investing, but it is not ideal for frequent traders due to ~1% fees. Cryptoassets are not FSCS protected.

Is there a better platform than Coinbase?

For beginners, Coinbase is hard to beat for ease and security, but lower-fee platforms like Kraken or Crypto.com are often better for active traders. Coinbase is rarely the cheapest option.