eToro is a popular multi-asset trading and investing platform known for its commission-free stock trading, copy trading, and beginner-friendly mobile app.

It allows UK users to invest in stocks, ETFs, crypto, forex, and CFDs from one platform, with a strong focus on simplicity and social investing.

This eToro review UK 2026 explains fees, FCA regulation, safety, standout features, and who eToro is best suited for, helping you decide whether it is worth using for your investing goals.

Is eToro good for beginners?

Yes. eToro is one of the best platforms for beginners in the UK thanks to its simple interface, clear portfolio layout, and excellent mobile app.

Features like the demo account, commission-free stocks, and CopyTrader make it easier to learn and invest without needing advanced knowledge, though beginners should still be aware of higher crypto fees and the risks of copy trading.

Quick verdict: How do we rate eToro for UK traders in 2026?

Overall rating: 4.4 / 5 (good)

eToro scores highly for UK traders thanks to its FCA regulation, strong reputation, beginner-friendly design, and unique social trading features like CopyTrader and Smart Portfolios.

eToro offers commission-free stocks and ETFs, and is one of the best platforms for beginners and casual investors. However, it is not the cheapest option for crypto or forex, it has average customer support and it lacks tax-efficient ISAs and SIPPs directly on the platform.

Full score breakdown

| Category | Score | Reason |

|---|---|---|

| Security & Trust | 5/5 | FCA-regulated, FSCS protection up to £85,000, segregated client funds, negative balance protection for retail clients, and a long track record since 2007. Publicly listed, adding transparency and accountability. |

| Fees & Pricing | 4/5 | 0% commission on real stocks and ETFs is excellent. Forex spreads are average, while crypto fees (~1%), currency conversion costs, and a $5 withdrawal fee slightly reduce the score. |

| Features | 5/5 | Standout CopyTrader, Smart Portfolios, demo account, interest on cash, fractional shares, and broad multi-asset access make eToro one of the most feature-rich platforms for beginners. |

| Ease of Use | 5/5 | One of the easiest platforms to use in the UK. Clean interface, excellent mobile app, fast account opening, and intuitive navigation suit beginners exceptionally well. |

| Customer Support | 3.5/5 | Adequate but not best-in-class. Help centre and live chat work well for simple issues, but response times can be slow for complex queries unless you are a Club member. |

| Reputation | 4.5/5 | Over 30 million users worldwide, strong brand recognition in the UK, and generally positive user reviews. Some criticism around fees and account closures prevents a perfect score. |

eToro at a glance

eToro is a FCA-regulated multi-asset trading and investing platform that lets UK users buy real stocks and ETFs, trade CFDs, and invest in crypto from one app. It stands out for commission-free share dealing, copy trading, and a beginner-friendly mobile platform, but has higher crypto fees and a $5 withdrawal charge.

Key features

- Regulated by: Financial Conduct Authority (FCA)

- Minimum deposit: $50 (£ equivalent)

- Stock & ETF fees: 0% commission on real assets

- Crypto fees: ~1% per trade

- FSCS protection: Up to £85,000 for cash and investments. Crypto not protected

What are the pros and cons of using eToro as a trading platform?

Pros

- 0% commission on real stocks and ETFs

- Excellent mobile app with intuitive design

- CopyTrader™ to automatically follow other investors

- Wide asset range including stocks, ETFs, crypto, forex, indices

- Demo account with $100,000 virtual funds

- FCA regulation and FSCS protection for UK clients

Cons

- $5 withdrawal fee

- High crypto fees compared with specialist exchanges

- Limited charting and customisation for advanced traders

- Fewer base currencies than rivals

- Not ideal for active CFD or day traders

Who’s eToro best for?

- Beginners learning to invest

- Investors who want commission-free stocks

- Users interested in copy trading

- Mobile-first traders

- Those who want stocks, ETFs, and crypto in one app

Who’s eToro not ideal for?

- Active forex or CFD traders

- Professional or algorithmic traders

- Investors focused on ISAs or SIPPs

- High-frequency crypto traders

- Users who need advanced charting tools

What is eToro and how does it work for UK users?

eToro is a multi-asset trading and investing platform that lets UK users invest in stocks, ETFs and crypto, and trade CFDs, all from one FCA-regulated account. You can buy real shares with 0% commission, copy other investors automatically, and manage everything through a simple web or mobile app.

When you buy shares or ETFs without leverage, you own the real asset. When you use leverage, short sell, or trade forex, indices, or commodities, you are trading CFDs.

How easy is it to open an eToro account in the UK?

Opening an eToro account in the UK is fast, fully online, and usually completed within 24 hours, with no paperwork or branch visit required.

Account opening steps

- Create an account with email, Google, or Facebook

- Complete identity verification (name, date of birth, and contact details)

- Upload proof of ID and address

- Access demo account instantly

- Deposit funds to start real trading (standard minimum deposit of $50 required)

In testing, verification was completed within a day, deposits were instant via Faster Payments, and both web and mobile platforms were smooth and beginner-friendly.

Withdrawals took under three business days, though a £5 withdrawal fee applies.

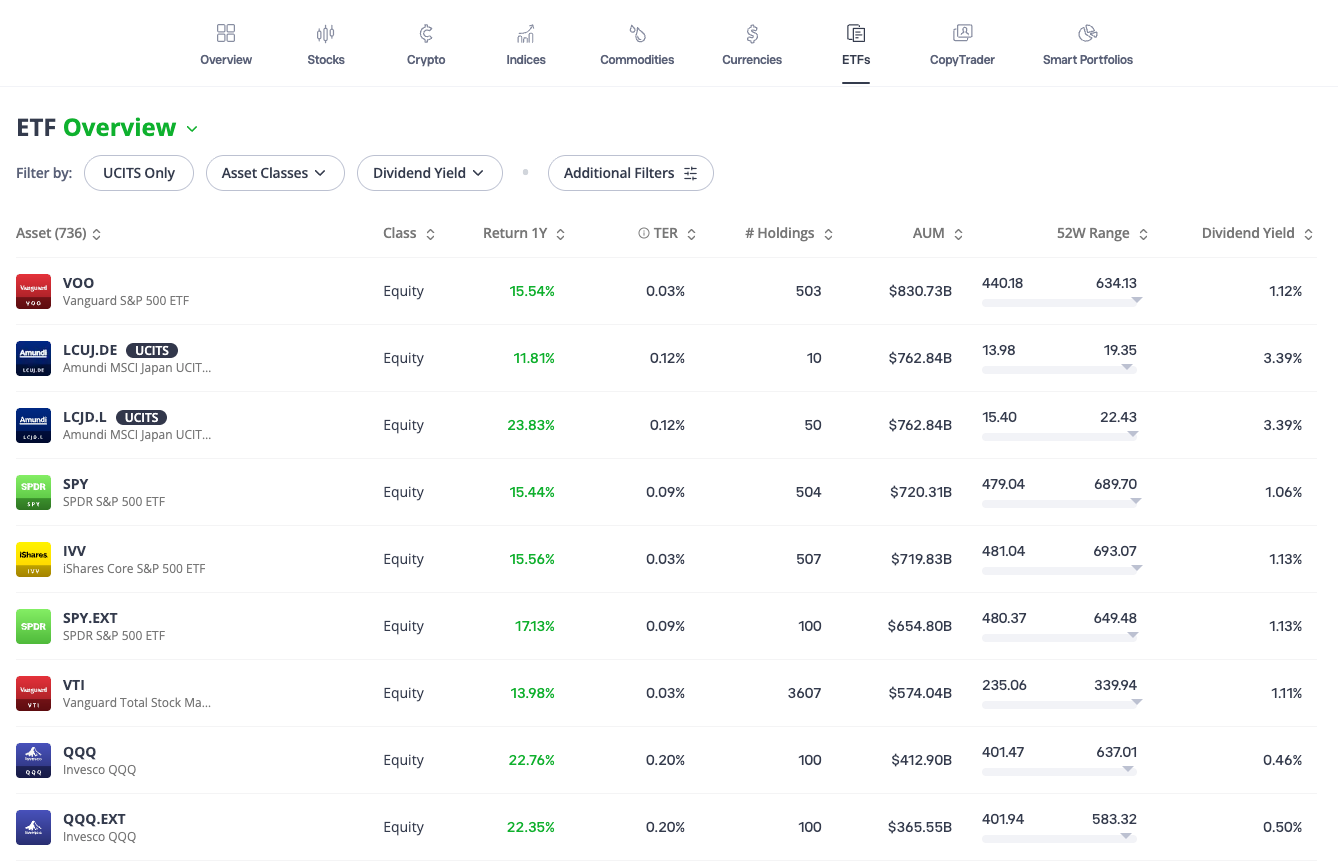

What can you trade on eToro in the UK?

| Asset type | What’s available for UK users |

|---|---|

| Stocks | UK, US, and international shares (real stocks when bought without leverage) |

| ETFs | Commission-free ETF investing |

| Cryptocurrency | 140+ cryptocurrencies available as real assets |

| Forex | Major and minor currency pairs traded via CFDs |

| Indices | FTSE 100, S&P 500, NASDAQ, DAX, and more |

| Commodities | Gold, oil, silver, and other popular commodities |

UK users can trade a wide range of markets on eToro, including real stocks and ETFs, cryptocurrencies, forex, indices, commodities, and CFDs. This makes eToro a true multi-asset trading platform rather than a single-purpose trading app.

Crypto derivatives are banned for UK retail users. This means you can buy and sell crypto, but you cannot trade crypto CFDs in the UK.

What trading accounts does eToro offer to UK investors?

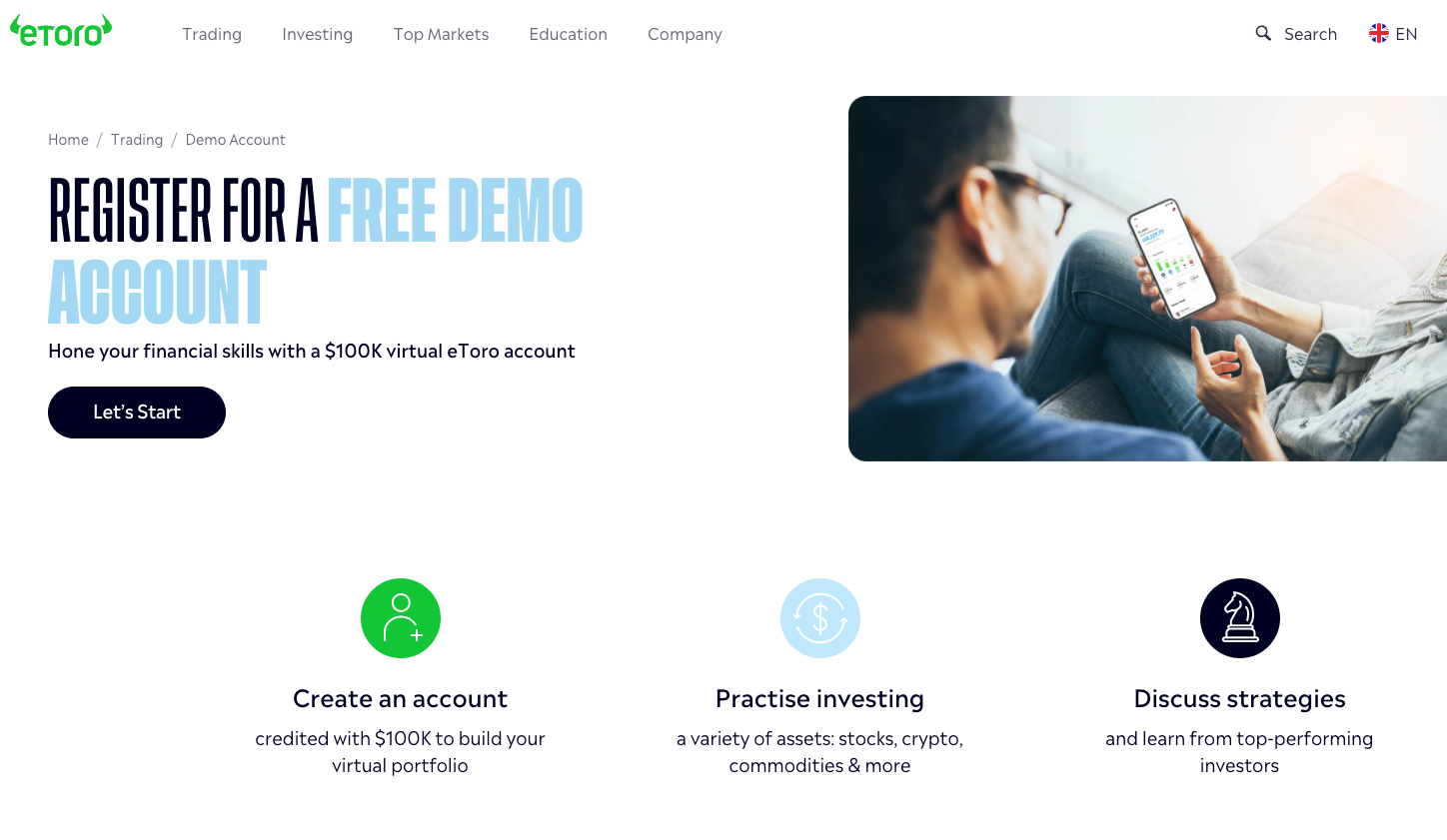

eToro offers UK investors a live trading account, a free demo account, and access to a Stocks and Shares ISA via a partner, keeping account choice simple and beginner-focused. There are no complex tiers or multiple retail accounts to choose between.

Account types available in the UK

- Live trading account: Invest and trade real markets

- Demo account: Practice with virtual money

- Stocks and Shares ISA: Offered via Moneyfarm partnership

- Professional account: Available if eligibility criteria are met

Not available: SIPP, Junior ISA, bonds.

Important: Crypto, CFDs, and copy trading are not ISA-eligible

How much does eToro cost for UK traders?

| Fee type | Cost |

|---|---|

| Stock & ETF trades | £0 commission on real stocks and ETFs |

| Crypto trading | ~1% per trade (spread included) |

| Forex spreads | From around 1.0 pip on EUR/USD |

| Withdrawal fee | $5 per withdrawal (around £4) |

| Inactivity fee | $10 per month after 12 months of inactivity |

| Currency conversion | Typically 0.75% to 1.5%, depending on currency and payment method |

eToro is low-cost for UK users investing in stocks and ETFs, offering 0% commission when buying real assets without leverage.

Trading costs are higher for crypto and forex, where fees are built into spreads, with crypto trades typically costing around 1% per transaction.

Non-trading charges such as a $5 withdrawal fee, inactivity fees, and currency conversion costs are the main drawbacks to be aware of.

Is eToro safe and regulated in the UK?

Yes, eToro is considered safe for UK users because it is authorised and regulated by the Financial Conduct Authority and offers FSCS protection up to £85,000 for eligible clients. Regulation is one of eToro’s strongest points compared to offshore trading apps.

| Area | eToro UK details |

|---|---|

| UK regulation | Authorised and regulated by the Financial Conduct Authority (FCA) |

| FSCS protection | Up to £85,000 if eToro UK fails (eligible clients only) |

| Client funds | Held in segregated accounts |

| Negative balance protection | Yes for retail clients |

| Cybersecurity standards | ISO 27001 certified and PCI-DSS compliant |

| Account security | Two-factor authentication (2FA) supported |

| Crypto protection | Cryptoassets are not FSCS protected |

How good is the eToro app and trading platform?

The eToro web and mobile platforms are intuitive, visually clean, and well suited to beginners, though they lack advanced customisation for professional traders. Everything is designed to be easy rather than complex.

Platform strengths

- Clear portfolio overview

- Simple order placement

- Integrated social feed

- Copy trading built in

- Biometric login on mobile

Platform limitations

- Limited chart customisation

- No MetaTrader 4 or 5

- Cannot edit pending orders directly

For most beginners, these limitations are unlikely to matter.

How do deposits and withdrawals work on eToro?

eToro makes deposits and withdrawals straightforward for UK users, with support for bank transfers (Faster Payments), debit cards, and selected e-wallets. Deposits are usually instant for cards and e-wallets, while bank transfers can take a few working days, and eToro does not charge deposit fees.

Withdrawals are processed to your original funding method and typically reach UK bank accounts within 2 to 5 business days. A $5 withdrawal fee applies to each request, and currency conversion fees may apply if funds are withdrawn in a different currency.

How does eToro compare to major UK trading alternatives?

Compared to UK alternatives, eToro excels at ease of use and social investing, but falls behind on pricing for forex and depth of research tools. It is more beginner-friendly than IG and more feature-rich than Trading 212.

Comparison snapshot

| Platform | Best for |

|---|---|

| eToro | Beginners, copy trading, multi-asset investing |

| Trading 212 | Low-cost investing and FX efficiency |

| IG | Advanced trading tools and research |

| XTB | Active traders and analytics |

What unique features does eToro offer UK users?

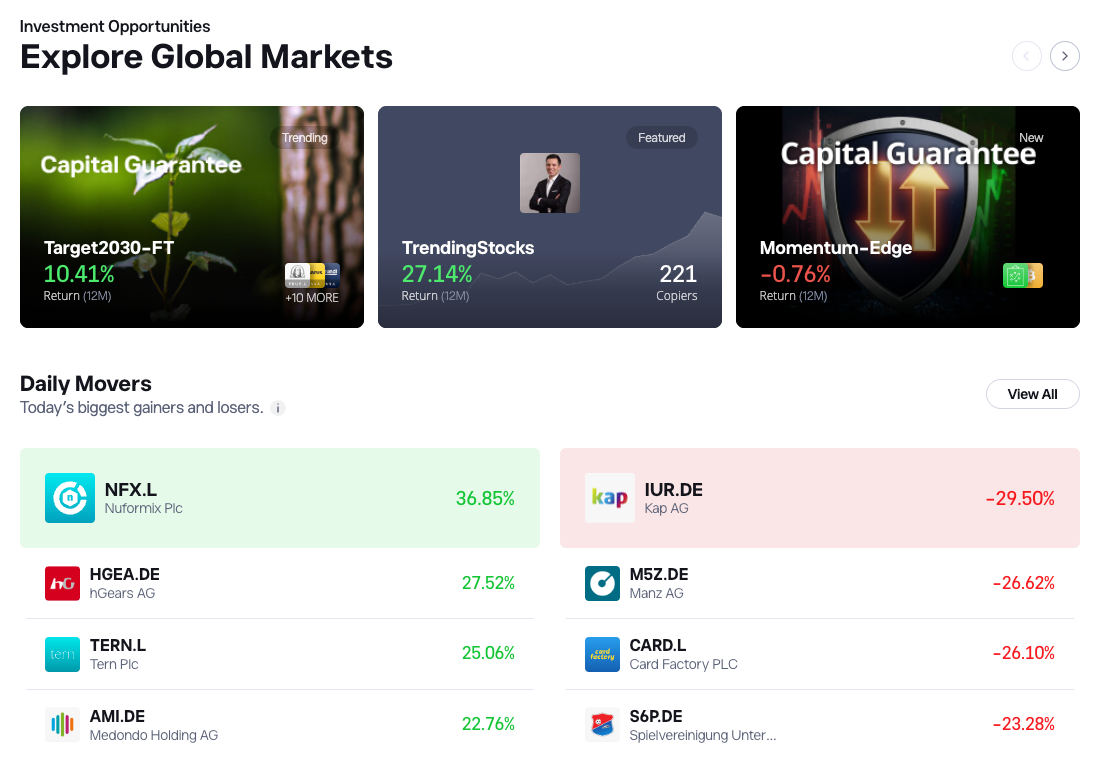

eToro’s standout features are copy trading, Smart Portfolios, and a built-in social investing feed, which are rarely available together on UK-regulated platforms. These tools are designed to reduce complexity and help beginners invest with guidance rather than isolation.

Key unique features

- CopyTrader: Automatically copy other investors

- Smart Portfolios: Ready-made themed portfolios

- Social feed: See real trades and discussions

- Fractional shares: Invest small amounts easily

- Demo account: Learn risk-free

ESG scores on supported stocks, showing environmental, social, and governance ratings to help values-based investors assess sustainability risks

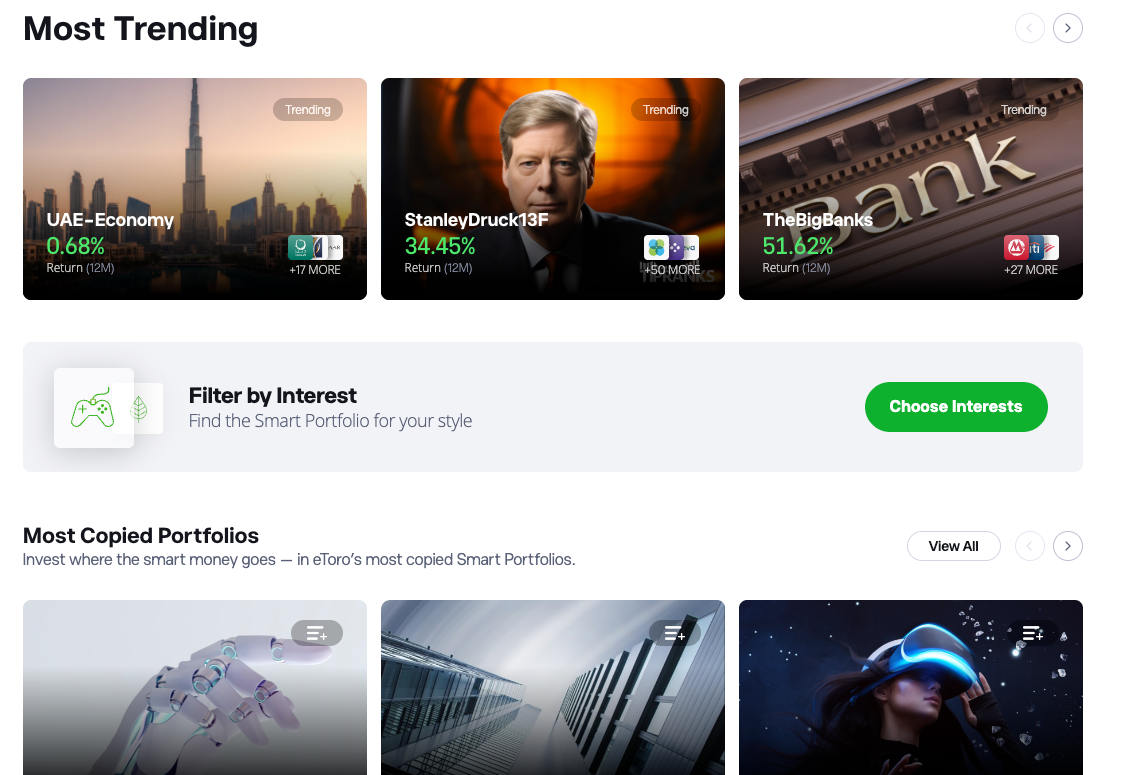

What are Smart Portfolios and how are they different?

Smart Portfolios are pre-built investment portfolios that bundle multiple assets or traders into a single themed strategy, offering diversification with minimal effort. They are designed to feel similar to managed funds but without traditional fund fees.

Types of Smart Portfolios

- Thematic portfolios: Technology, renewable energy, crypto

- Market portfolios: Broad asset exposure

- Top trader portfolios: Groups of popular investors

Minimum investment

- Thematic portfolios: $500

- Top trader portfolios: $5,000

These portfolios rebalance automatically but require a longer-term mindset.

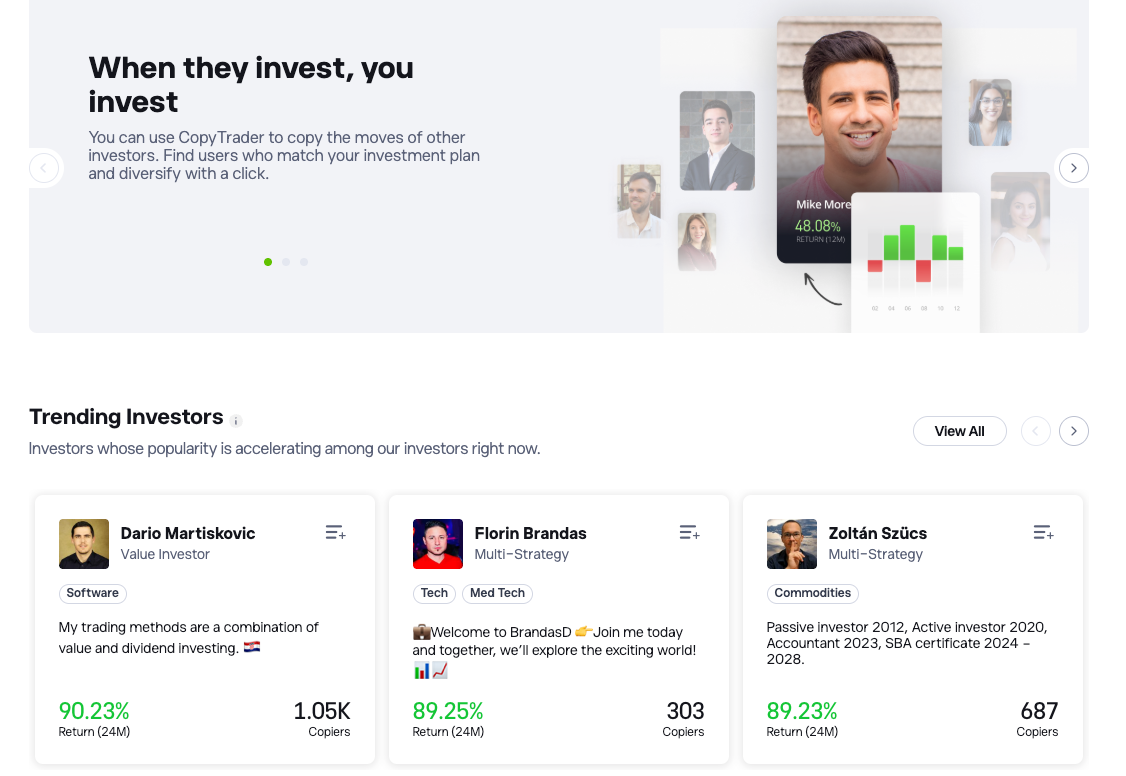

How does copy trading work on eToro?

Copy trading allows you to automatically copy the trades of other investors on eToro, making it easier to invest without managing every decision yourself. This is eToro’s most distinctive feature and a major reason for its popularity. You choose a trader, allocate funds, and your account mirrors their trades proportionally in real time.

CopyTrader basics

- Minimum copy amount: $200 per trader

- No extra management fee

- Trades copied automatically

- Risk score provided for each trader

Who should (and shouldn’t) use CopyTrader

Copy trading can be useful if you:

- Want a hands-off investing approach

- Are learning how portfolios are built

- Accept higher risk in exchange for simplicity

It may not be suitable if you:

- Need predictable income

- Are highly risk-averse

- Prefer full control over every trade

Copy trading does not guarantee profits. You are relying on another individual’s decisions, and past performance does not predict future results.

How good is eToro’s education and research for beginners?

eToro’s education is strong for beginners but limited for advanced traders, focusing on basic investing concepts, market explainers, and learning-by-observation through copy trading. It is designed to teach fundamentals rather than complex strategies.

Education tools available

- eToro Academy: Articles and videos

- Demo account: Learn by doing

- Social feed: Real-world investing examples

- Webinars: Market updates and basics

Not included: Deep fundamental research or advanced technical screening.

How good is eToro’s customer support for UK users?

Customer support on eToro is good but not best-in-class, with live chat and ticket-based support rather than direct phone access for most UK users. Response times are usually reasonable but can be slow during peak periods.

Support options

- Live chat

- Help centre and FAQs

- Ticket-based email support

- WhatsApp support for higher-tier clients

No general UK phone support for standard accounts.

What limitations should UK users be aware of?

UK users should be aware of currency conversion costs, withdrawal fees, limited research tools, and the lack of tax wrappers like SIPPs directly on eToro. These limitations matter most for long-term or high-frequency investors.

Key drawbacks

- $5 withdrawal fee

- USD-based trading model

- FX conversion costs

- No SIPP

- Limited advanced analytics

- Higher crypto and forex fees

Conclusion: Is eToro worth using for UK traders in 2026?

eToro is a strong all-round platform for UK beginners and casual investors, combining commission-free stock and ETF investing, FCA regulation, and standout social features like CopyTrader and Smart Portfolios.

Its clean design, excellent mobile investment app, fast account opening, and wide asset range make it one of the easiest ways to invest in stocks, ETFs, and crypto from a single app.

With an overall rating of 4.4 / 5, eToro is best suited to users who value simplicity, guidance, and flexibility over ultra-low fees or advanced trading tools.

It is less ideal for active forex traders, high-frequency crypto traders, or investors focused on SIPPs and advanced research, but for most UK users starting out or investing casually, eToro remains a reliable, beginner-friendly choice in 2026.

FAQs

Is my money safe with eToro?

Client funds are held in segregated accounts, and UK users have FSCS protection up to £85,000. eToro also uses two-factor authentication and strong cybersecurity standards. Investment losses are not protected.

Is eToro good for beginners?

Yes. eToro is one of the best platforms for beginners thanks to its simple interface, demo account, commission-free stocks, and social features like CopyTrader and Smart Portfolios.

Is eToro good for UK users?

Yes. eToro is well suited to UK users because it is FCA-regulated, supports GBP deposits, offers commission-free stocks and ETFs, and provides access to stocks, ETFs, crypto, and CFDs in one app.

Is eToro regulated in the UK?

Yes. eToro is authorised and regulated by the UK Financial Conduct Authority (FCA). UK clients also receive FSCS protection up to £85,000 if eToro UK fails. Cryptoassets are not FSCS protected.

Can you make money from eToro?

Yes, it is possible to make money on eToro, but profits are not guaranteed. Returns depend on market performance, fees, and your strategy. Copy trading and CFDs involve risk, and past performance does not predict future results.

Does eToro offer a demo account?

Yes. eToro provides a free demo account with $100,000 virtual funds, allowing you to practise trading risk-free.

Can I use eToro for long-term investing?

Yes, for stocks and ETFs. However, it is less ideal for long-term tax planning due to the lack of a SIPP and limited ISA integration.

Is copy trading safe?

Copy trading is not guaranteed and carries risk. You are relying on another individual’s decisions. Always review risk scores and diversify. Past performance is not a guarantee of future results.

What is eToro best for?

eToro is best for beginners and casual investors who want commission-free stock investing, copy trading, and a mobile-first platform that combines stocks, ETFs, and crypto in one app.

Do I pay tax on eToro UK?

Yes. UK users may owe Capital Gains Tax on profits and Income Tax on dividends or some copy trading income. eToro does not deduct tax automatically, so you must report gains to HMRC. Crypto and CFDs are taxable, and eToro is not tax-free.

What are the disadvantages of eToro?

eToro’s main drawbacks are the $5 withdrawal fee, higher crypto and forex costs compared with specialist platforms, and limited advanced charting and research tools. It does not offer a SIPP, provides ISAs only via a partner, and its USD-based trading model can lead to currency conversion fees for UK users.