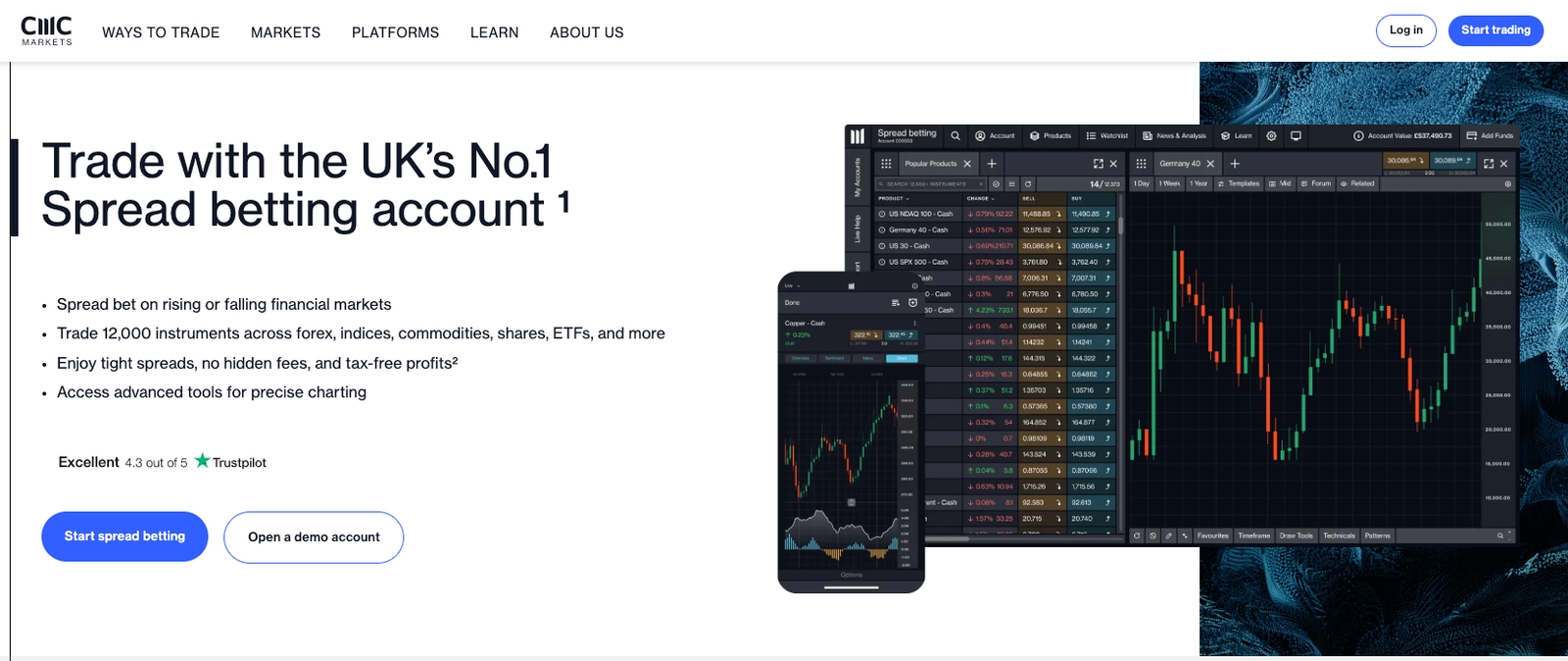

CMC Markets is a well-established UK trading platform offering CFDs, spread betting, and share investing with competitive pricing and advanced tools.

In this CMC Markets review UK 2026 we explain whether it is a good trading platform for UK traders by assessing fees, spreads, regulation, platform features, and who it is best for.

Is CMC Markets good for beginners?

Yes. CMC Markets is good for beginners who want an FCA-regulated platform with a demo account and strong learning tools, but it is not the simplest option. The platform is best for beginners willing to learn, rather than those wanting an easy, app-first experience.

It offers a free demo account, no minimum deposit, and built-in risk tools, but the platform focuses on CFDs and spread betting, which are higher risk and can feel complex for new traders.

Quick verdict: How do we rate CMC Markets for UK traders in 2026?

Overall rating: 4.6 / 5

CMC Markets ranks as one of the strongest trading platforms available to UK traders in %currentyear%. It scores exceptionally well for security, regulation, platform quality, and market depth, making it a top choice for active and professional traders. While it is not the cheapest for every product and may feel complex for beginners, its reliability, transparency, and execution quality place it firmly among the UK’s elite brokers.

Full score breakdown

| Category | Score | Reason |

|---|---|---|

| Security & Trust | 5.0 | FCA-authorised, LSE-listed, segregated client funds, FSCS protection up to £85,000, negative balance protection, and over 35 years of operating history make CMC one of the safest UK brokers. |

| Fees & Pricing | 4.3 | Tight FX spreads from 0.7 pips and no deposit or withdrawal fees. Overnight financing and stock CFD commission minimums reduce the score slightly for longer-term or equity-focused traders. |

| Features | 4.7 | Exceptional Next Generation platform, 80+ indicators, advanced order types, client sentiment data, share and currency baskets, and a deep research ecosystem including OPTO. |

| Ease of Use | 4.5 | Very polished platform and mobile app, but the sheer depth of tools creates a learning curve for beginners. Strong once familiar. |

| Customer Support | 4.0 | Knowledgeable, UK-based support with reliable response quality. Limited to 24/5 availability, which holds it back from a top score. |

| Reputation | 5.0 | Founded in 1989, trusted by ~300,000 active clients, consistently strong reviews, and widely regarded as a benchmark for execution and platform stability in the UK market. |

CMC Markets at a glance

Key features:

- Next Generation platform with 80+ technical indicators

- Ultra-fast execution, with median latency around 0.004 seconds

- Guaranteed stop-loss orders for defined downside risk

- Client sentiment and positioning tools

- Advanced order types, including trailing and conditional orders

- Highly customisable layouts, templates, and watchlists

What are the pros and cons of CMC Markets?

Pros

- FCA-regulated and LSE-listed, with strong transparency

- Tight spreads from 0.7 pips on major FX pairs

- No deposit or withdrawal fees

- Exceptional execution speed and stability

- Advanced charting and research tools

- Powerful mobile app that mirrors desktop functionality

Cons

- CFDs and spread betting are high-risk leveraged products

- No direct crypto ownership for UK retail clients

- Learning curve for beginners

- Overnight financing fees apply to CFDs

- £10 inactivity fee after 12 months

- Customer support is 24/5, not 24/7

Who is CMC Markets best for?

- Intermediate and advanced traders

- FX, index, and CFD specialists

- Traders who value tight spreads and reliability

- Strategy-driven and technical traders

- UK traders who want FCA oversight and FSCS protection

Who is CMC Markets not ideal for?

- Casual investors who want buy-and-hold investing only

- Users seeking social or copy trading as a core feature

- Traders wanting direct crypto ownership

- Absolute beginners looking for a minimal learning curve

- Investors focused on ISAs or long-term portfolios (better suited to CMC Invest)

What is CMC Markets and how does it work?

CMC Markets is a non-dealing desk CFD trading platform and spread betting broker that allows traders to speculate on price movements without owning the underlying assets. You can trade markets long or short using leverage, with pricing delivered through aggregated liquidity from multiple providers.

CMC operates two main UK offerings:

- CMC Markets for CFDs and spread betting.

- CMC Invest for long-term investing in real shares, ETFs, and ISAs.

What markets and instruments can you trade on CMC Markets?

CMC Markets offers one of the largest market ranges in the UK, with over 12,000 tradable instruments across global asset classes. This depth allows traders to diversify widely or focus on niche opportunities.

Available asset classes

- Forex: 300+ currency pairs

- Indices: FTSE 100, S&P 500, Germany 40, US 30

- Shares: 9,000+ global equities

- Commodities: Gold, oil, natural gas, agriculture

- Treasuries and bonds

- Crypto CFDs for eligible clients only

Crypto trading is available via CFDs only. UK retail traders cannot own crypto directly on CMC, and crypto is not FSCS protected.

What are CMC Markets’ fees and spreads?

CMC Markets offers transparent and competitive pricing, with most costs built directly into spreads. There are no deposit or withdrawal fees, but overnight financing applies to leveraged positions

| Fee type | Cost |

|---|---|

| Minimum deposit | £0 |

| FX spreads | From 0.7 pips |

| Deposit fees | Free |

| Withdrawal fees | Free |

| Inactivity fee | £10 after 12 months |

Is CMC Markets safe and regulated in the UK?

Yes. CMC Markets is one of the most secure and transparent brokers available to UK traders.

- Authorised and regulated by the FCA

- Client funds held in segregated accounts

- FSCS protection up to £85,000 for UK clients

- Negative balance protection for retail traders

- Publicly listed on the London Stock Exchange

CMC also publishes execution quality reports, a practice that enhances trust and accountability.

What account types does CMC Markets offer?

CMC Markets offers two main account types for UK users, with additional professional options available for eligible clients.

Account options

- CFD Account: Standard leveraged trading with commissions on share CFDs

- Spread Betting Account: UK-only, tax-efficient for eligible traders

- Professional Account: Higher leverage but reduced protections

There is no minimum deposit, and joint accounts are supported. Professional clients lose negative balance protection and FSCS safeguards.

How easy is it to open an account with CMC Markets?

Opening an account with CMC Markets is fully online and typically takes under 24 hours for UK traders. There is no minimum funding requirement, making it accessible to new users.

Account opening steps

- Complete the online application

- Verify identity with photo ID and address proof

- Choose account type and base currency

- Fund your account and start trading

Most UK users are approved within one business day.

What deposit and withdrawal methods are available?

CMC Markets supports UK-friendly payment methods, with fast processing and no platform fees.

Payment options

- Bank transfer

- Debit card

- PayPal

Deposits are usually instant, while withdrawals typically clear within 1 to 2 business days. Withdrawals must be made to an account in your own name.

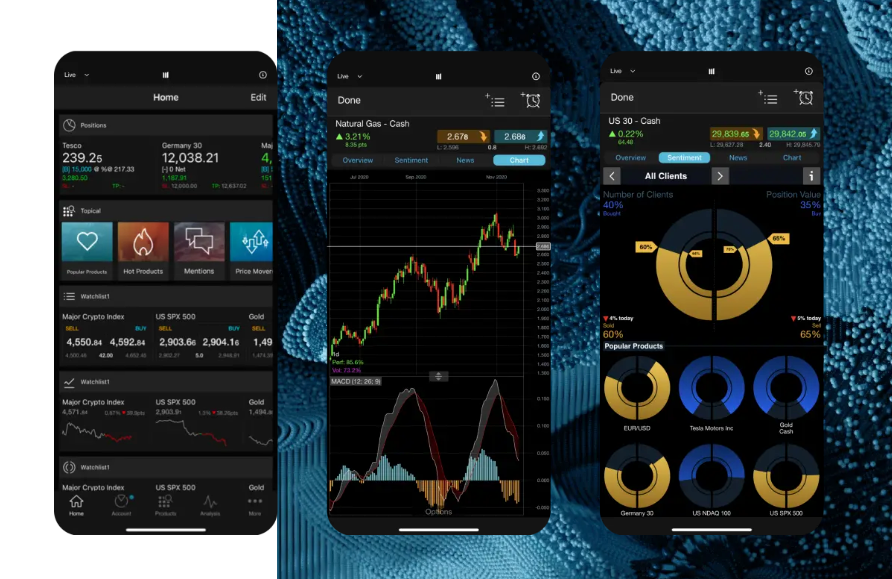

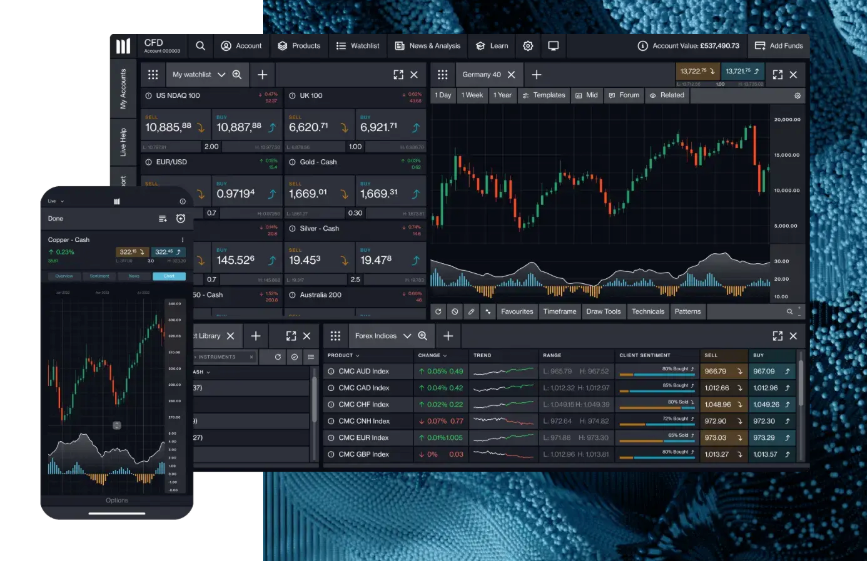

How good is the CMC Markets trading platform and app?

CMC Markets’ Next Generation platform is widely regarded as one of the best proprietary trading platforms in the UK. It is fast, stable, and highly customisable, making it ideal for active traders.

Platform highlights

- 80+ technical indicators

- Advanced order types including guaranteed stop-loss

- Multi-chart layouts and saved templates

- Integrated news and economic calendar

- Client sentiment and positioning data

The mobile trading app mirrors most desktop functionality and supports biometric login, real-time alerts, and advanced charting. MT4 is also available for traders who prefer third-party platforms.

How good is CMC Markets’ execution and liquidity?

CMC Markets offers excellent execution quality, making it one of the fastest and most reliable trading platforms in the UK for CFDs and spread betting. Trades are filled quickly with minimal slippage, supported by deep liquidity and professional-grade infrastructure.

CMC reports median execution latency of around 0.004 seconds, which helps keep pricing stable during volatile markets. While CMC acts as a market maker on many products, pricing is transparent and execution quality reports are published, which adds trust. This makes CMC particularly strong for active FX, index, and short-term traders.

Is CMC Markets for trading or investing?

CMC Markets is designed for active trading, not long-term investing. Its main platform focuses on CFDs and spread betting, which are leveraged products used to speculate on price movements rather than to own assets.

CMC runs two separate UK platforms:

- CMC Markets: CFDs and spread betting for short-term trading

- CMC Invest: Real shares, ETFs, and ISAs for long-term investing

This separation is clear and deliberate. CMC Markets suits traders who want leverage, short-selling, and advanced tools, while CMC Invest is better for buy-and-hold investors.

What education and research tools does CMC Markets provide?

CMC Markets offers above-average education and research, suitable for both improving beginners and experienced traders refining strategies.

Learning and research tools

- Learn Hub with structured courses

- Weekly webinars and video tutorials

- Unlimited demo account

- In-house market analysis

- OPTO magazine, podcasts, and interviews

- Client sentiment and positioning tools

These tools are included at no extra cost and are among CMC’s strongest differentiators.

How does CMC Markets compare to other UK brokers?

CMC Markets compares very favourably to other FCA-regulated brokers, particularly in platform quality, execution speed, and market depth.

| Broker | Platform strength | Fees and spreads | Market range | Best for | Key limitation |

|---|---|---|---|---|---|

| CMC Markets | Advanced proprietary Next Generation platform with pro-grade charting and execution | FX spreads from 0.7 pips, no deposit or withdrawal fees | 12,000+ markets | Active and professional traders prioritising precision and regulation | Steeper learning curve for beginners |

| IG | Strong proprietary platform plus ProRealTime | Competitive spreads, slightly wider than CMC on FX | 17,000+ markets | All-round traders wanting maximum market coverage | Platform less customisable than CMC |

| eToro | Simple, mobile-first platform | Higher FX and CFD spreads | ~3,000 markets | Beginners and social or copy traders | Limited advanced analysis and execution tools |

| XTB | Clean and intuitive xStation platform | Low fees, competitive spreads | ~2,500 markets | Beginners and casual traders | Fewer markets and less advanced tooling |

Conclusion

CMC Markets is one of the most trusted and established trading platforms in the UK, making it a strong choice for traders in %currentyear% who value FCA regulation, platform reliability, and competitive pricing.

With spreads from 0.7 pips, no deposit or withdrawal fees, and access to 12,000+ global markets, it is particularly well suited to active and experienced traders.

While beginners may face a learning curve and crypto exposure is limited to CFDs, CMC’s execution quality, research tools, and long-standing reputation justify its position as a top-tier UK broker for serious, strategy-driven trading.

FAQs

Is CMC Markets regulated in the UK?

Yes. CMC Markets is authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Client funds are held in segregated accounts, and eligible UK clients are protected by the FSCS up to £85,000 if the firm fails.

Is CMC Markets safe for UK traders?

CMC Markets is considered very safe for UK traders due to FCA regulation, segregated client funds, negative balance protection for retail clients, and its long operating history since 1989. It is also publicly listed, which adds transparency through regular financial reporting.

Does CMC Markets have a minimum deposit?

No. CMC Markets has no minimum deposit requirement for UK traders. This allows users to start with any amount, although margin requirements will still apply when placing leveraged trades.

Can beginners use CMC Markets?

Yes, but with caution. CMC Markets offers a free demo account, educational resources, and risk management tools, which help beginners learn. However, the platform focuses on CFDs and spread betting, which are complex and higher risk, making it better suited to beginners who are willing to learn to trade rather than those wanting a simple investing app.

Does CMC Markets offer a demo account?

Yes. CMC Markets provides an unlimited demo account that mirrors live market conditions. This allows users to practise strategies, learn the platform, and understand risk without using real money.

Can I trade crypto on CMC Markets?

Yes, but only via crypto CFDs for eligible clients. UK retail traders cannot own crypto directly on CMC Markets, and crypto CFDs are not FSCS protected. Weekend crypto trading is available for qualifying accounts.

What platforms does CMC Markets support?

CMC Markets supports its proprietary Next Generation platform, MetaTrader 4 (MT4), TradingView, and fully featured iOS and Android mobile apps. The Next Generation platform offers the most advanced tools and features.