City Index is a long-established trading platform offering CFDs, spread betting, and forex to UK traders under FCA regulation.

This City Index review UK 2026 provides a clear breakdown of fees, platforms, markets, and safety, helping you decide whether it suits your trading style and risk tolerance.

Quick verdict: How do we rate City Index for UK traders in 2026?

Overall rating: 4.5 / 5

City Index scores highly as a trusted, FCA-regulated trading platform with excellent tools, deep market access, and one of the strongest mobile apps in the UK CFD space. It is best suited to active and experienced traders, particularly those using spread betting or short-term strategies. It is less suitable for long-term investors or beginners who want simple investing in real shares or ETFs.

Full score breakdown

| Category | Score (1–5) | Reason |

|---|---|---|

| Security & Trust | 5.0 | FCA regulated, segregated client funds, negative balance protection, FSCS cover up to £85,000, and backed by NASDAQ-listed StoneX Group. |

| Fees & Pricing | 4.0 | Competitive, transparent spread-based pricing, but not the cheapest versus ultra-low-cost CFD brokers. |

| Features | 4.5 | Strong proprietary platforms, TradingView charts, Performance Analytics, PlayMaker risk tools, spread betting, and extended hours trading. |

| Ease of Use | 4.0 | Mobile app is excellent; web platform is powerful but can feel complex for beginners. |

| Customer Support | 4.5 | Phone, email, and platform support with experienced UK dealers and consistently strong user feedback. |

| Reputation | 5.0 | Operating since 1983, award-winning platforms, high Trust Scores, and long-standing presence in the UK trading market. |

City Index at a glance

Key features

- UK regulation: FCA regulated via StoneX Financial Ltd

- Parent company: StoneX Group Inc, NASDAQ-listed

- Minimum deposit: £0 (recommended £100 for margin)

- Markets: 13,500+ CFDs and spread bets

- Products: Forex, indices, shares CFDs, commodities, metals, options, spread betting

- Platforms: Web Trader, Mobile App, MT4, TradingView charts

What are the pros and cons of using City Index?

Pros

- Very wide market coverage with 13,500+ instruments

- Excellent proprietary Web Trader and mobile app

- TradingView-powered charting with 80+ indicators

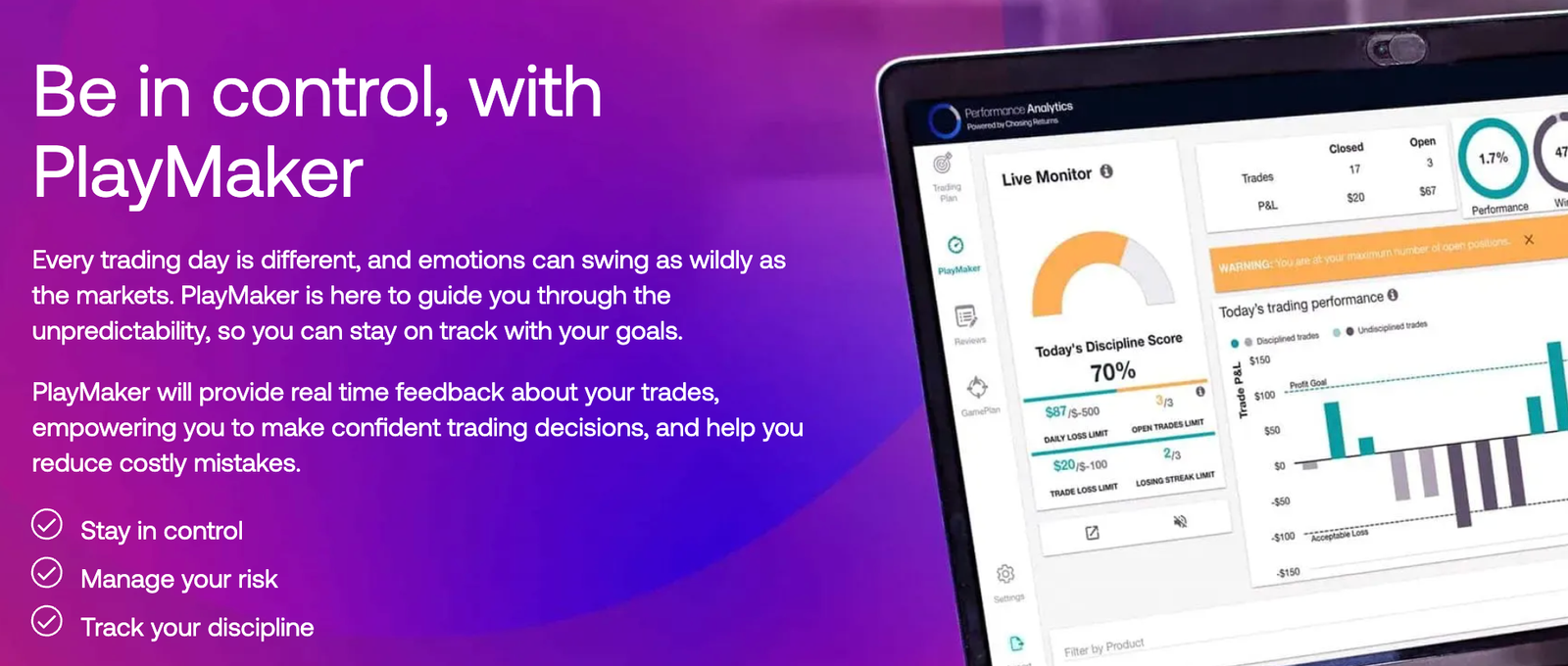

- Strong risk management tools, including PlayMaker and Performance Analytics

- FCA regulated and backed by a publicly listed group

- Spread betting available for UK users, which can be tax-efficient

Cons

- No MT5 for most UK users

- Pricing is average, not market-leading

- No investing in real shares or ETFs

- Desktop platform can feel cluttered

- Crypto CFDs not available to UK retail clients

- Economic calendar is weak

- Desktop platform can feel outdated

- MT4 offering is limited

Who is City Index best for?

- Active UK traders and day traders

- Spread betting traders seeking tax-efficient speculation

- Forex and index traders wanting advanced tools

- Intermediate to experienced traders who value analytics

- Traders who prefer platform features over ultra-low fees

Who is City Index not ideal for?

- Long-term investors wanting real stocks or ETFs

- Beginners who want a very simple investing app

- Crypto traders in the UK

- Algorithmic traders needing MT5 or DMA access

Is City Index good for beginners?

City Index can be good for beginners thanks to its intuitive platform, strong regulation in the UK, and a range of educational resources. However, its focus on CFDs and leveraged products means new traders should be aware of the risks and may benefit from starting with a demo account.

Is City Index good for day trading?

Yes, City Index is well suited to day trading, particularly for UK traders who need fast execution, advanced charting, and strong risk controls. The combination of its Web Trader platform, TradingView charts, and Performance Analytics makes it effective for intraday strategies across forex, indices, and shares CFDs.

Why it works for day traders

- Fast execution, typically under one second in normal market conditions

- Advanced order types including trailing stops, guaranteed stops, and OCO orders

- Integrated TradingView charting with a wide range of indicators

- Performance Analytics to review trading behaviour and improve discipline

Limitations for day traders

- Overnight financing applies if positions are held past market close

- Desktop platform can feel busy compared to IG or Saxo

- Execution is fast enough for most day trading strategies, but ultra-short-term scalpers may prefer brokers with tighter spreads and lower latency

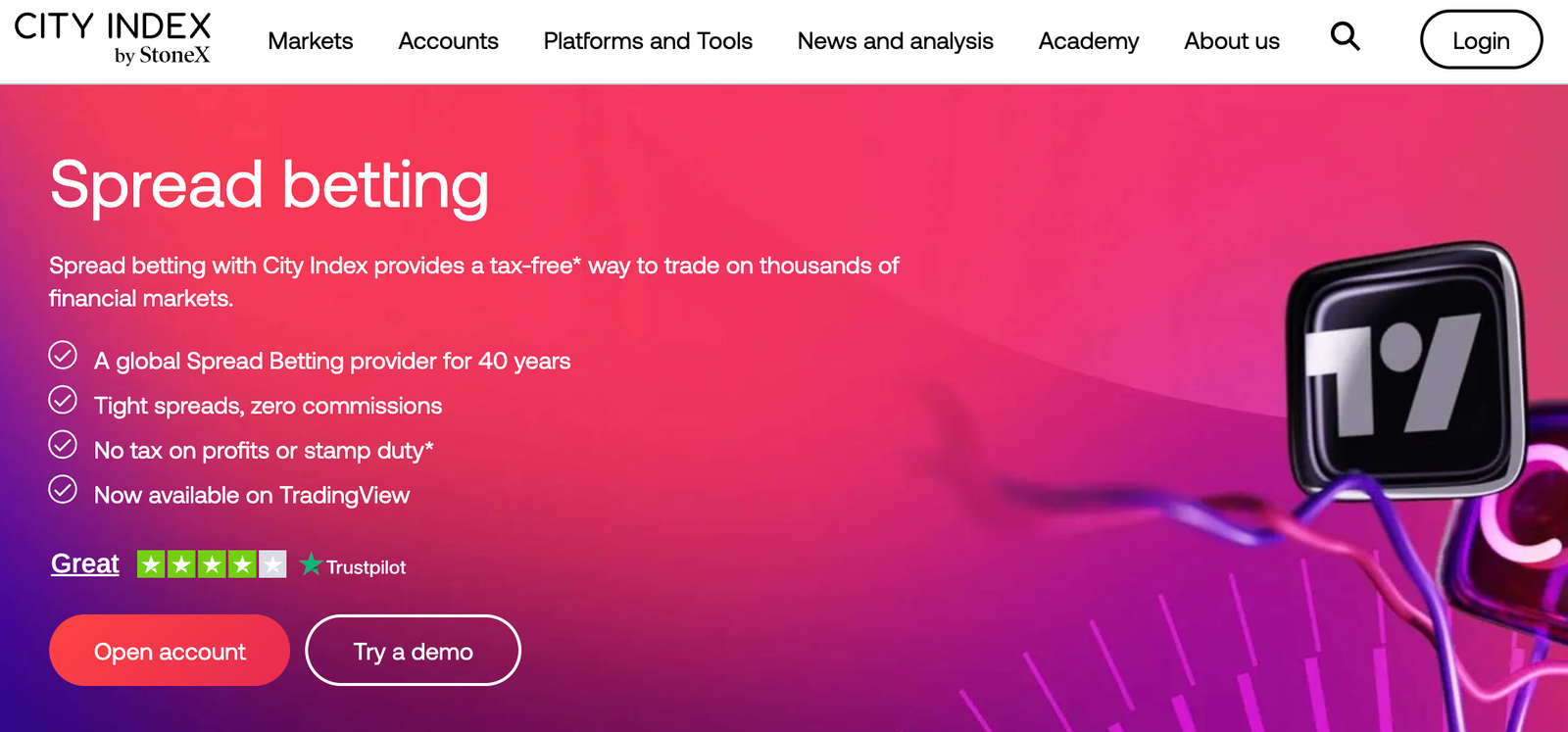

Is City Index good for spread betting?

Yes. Spread betting is one of City Index’s strongest offerings, and a major reason UK traders choose the platform. As one of the original spread betting providers, City Index offers broad market access and competitive spreads, with the added benefit that profits are free from UK capital gains tax.

Spread betting strengths

- Very wide range of UK, US, and European shares

- Competitive spreads on major indices and forex

- Advanced risk management tools built directly into the platform

- FCA-regulated UK provider with segregated client funds

Things to know

- Losses are not tax-deductible

- Still a leveraged product with high risk

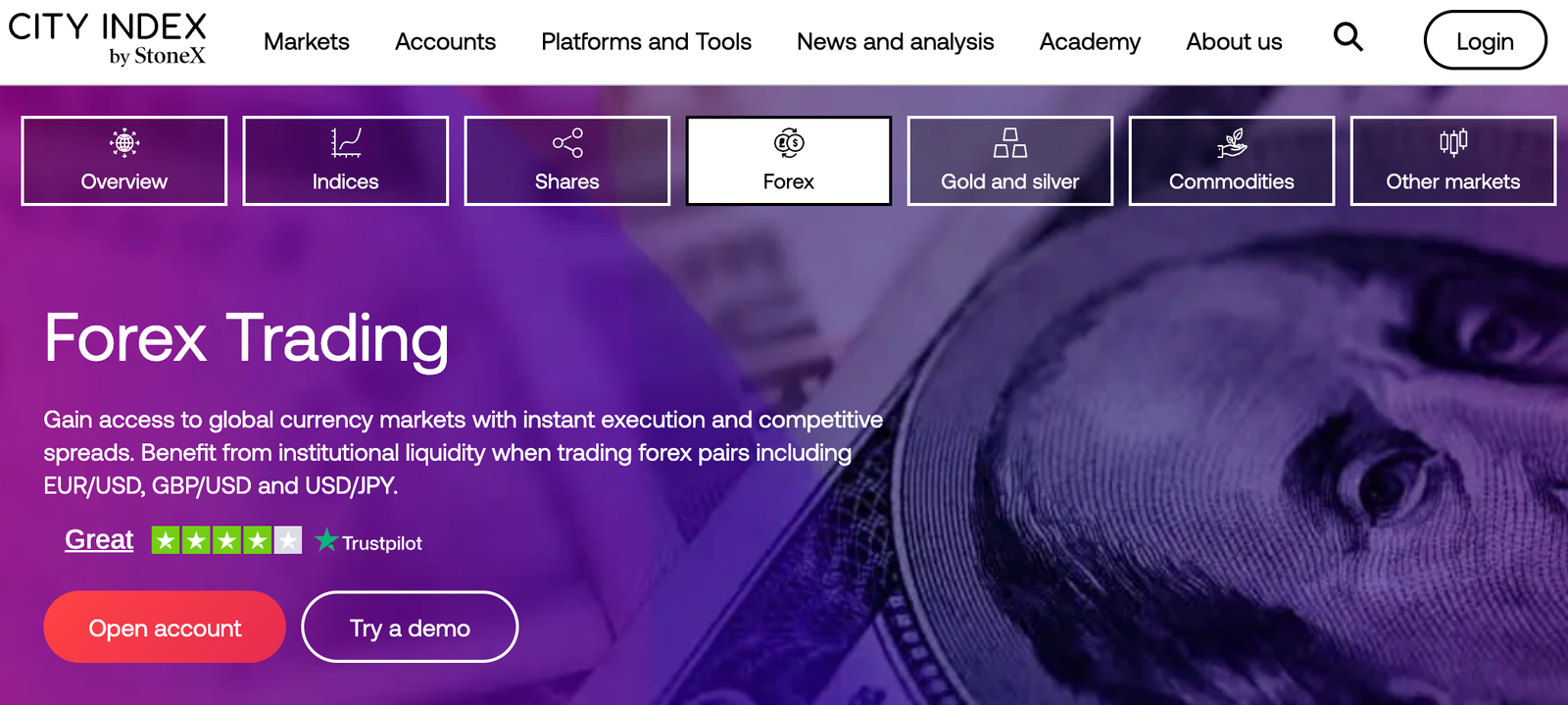

Is City Index good for forex traders?

City Index is a solid choice for forex trading, especially for traders who value tools and platform quality over ultra-low spreads. With 80+ currency pairs, TradingView charting, and MT4 support, it covers most retail forex needs.

Forex trading highlights

- Major, minor, and selected exotic pairs

- EUR/USD spreads typically ~0.8–1.2 pips

- MT4 available for algorithmic and EA-based trading

- Strong technical analysis and news integration

Forex drawbacks

- Spreads are not as tight as specialist low-cost brokers

- No MT5 for most UK users

How regulated and trustworthy is City Index in the UK?

City Index is authorised and regulated by the FCA, operates under StoneX Financial Ltd, and is backed by StoneX Group Inc, a NASDAQ-listed company. Client funds are segregated, retail clients have negative balance protection, and eligible UK clients are covered by the FSCS up to £85,000. Crypto assets are not FSCS protected.

What assets can you trade on City Index?

City Index focuses exclusively on leveraged trading and speculation, rather than long-term investing.

You can trade:

- Forex: 80+ major, minor, and exotic currency pairs

- Indices: UK, US, European, and global indices

- Shares CFDs: Thousands of UK, US, and European equities

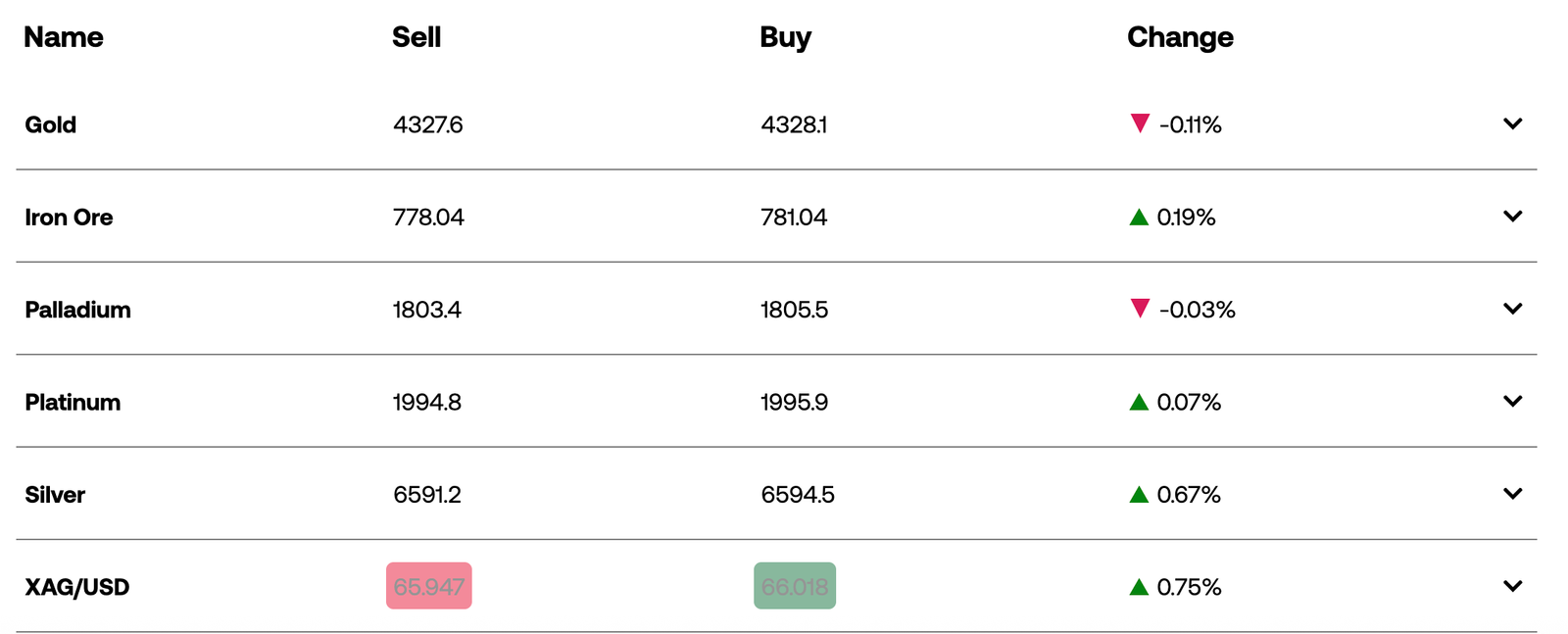

- Commodities: Energy, metals, and agricultural markets

- Options CFDs and spread bets on selected indices and commodities

- Synthetic and thematic indices, including sector and volatility-based products

You cannot buy real shares, ETFs, funds, or crypto assets outright. City Index is designed for traders, not investors.

What are the fees on City Index?

City Index uses a spread-based pricing model, meaning most costs are built into the buy-sell spread rather than charged as a separate commission. Overall pricing is competitive but not the cheapest in the UK.

| Fee type | Typical cost |

|---|---|

| EUR/USD spread | ~0.8–1.2 pips |

| UK shares CFD | ~0.08% |

| US shares CFD | From $0.018 per share |

| Inactivity fee | £12 per month after 12 months |

| Deposit fees | £0 |

| Withdrawal fees | £0 |

Overnight financing charges apply to CFDs and spread bets held beyond market close. There are no account maintenance fees for active traders.

What account types does City Index offer UK users?

City Index offers three main account types depending on experience and trading volume:

- Standard Account: No minimum balance, leverage capped at 30:1, full FCA retail protections

- Premium Trader Account: £10,000 balance, access to a relationship manager and enhanced support

- Professional Account: Higher leverage up to 400:1, but no FSCS or negative balance protection

A free demo account is available on both Web Trader and MT4, allowing you to test strategies with virtual funds.

How good is City Index’s trading platform and mobile app?

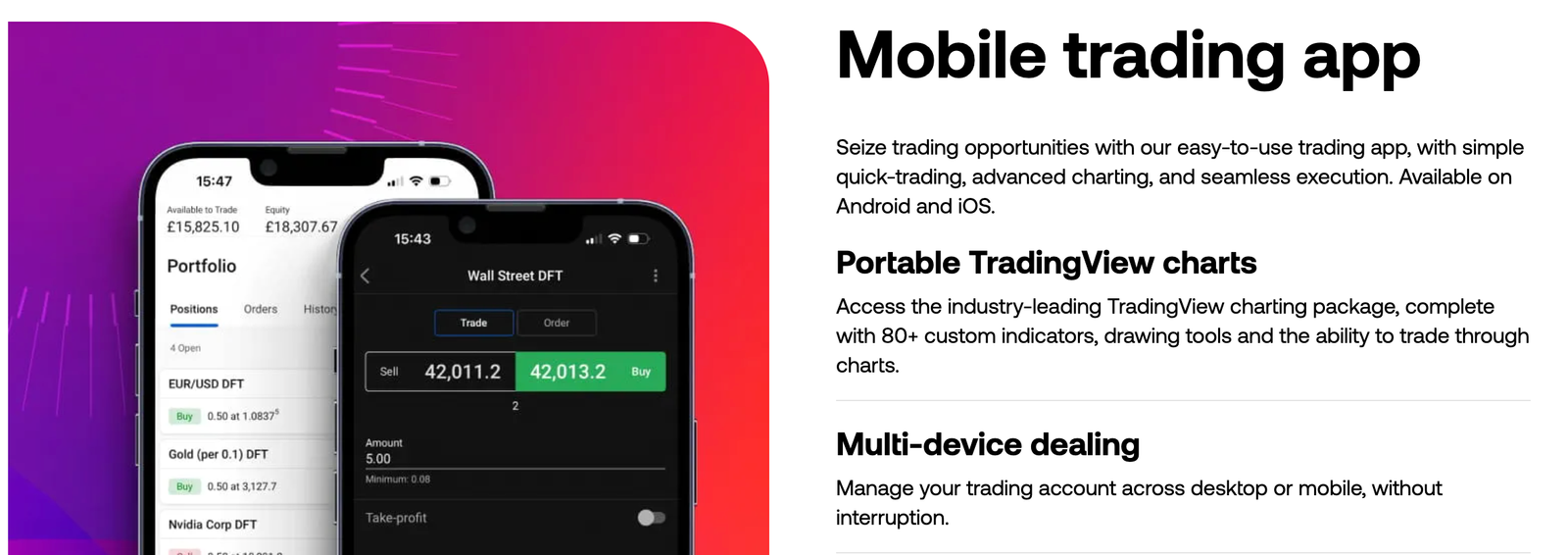

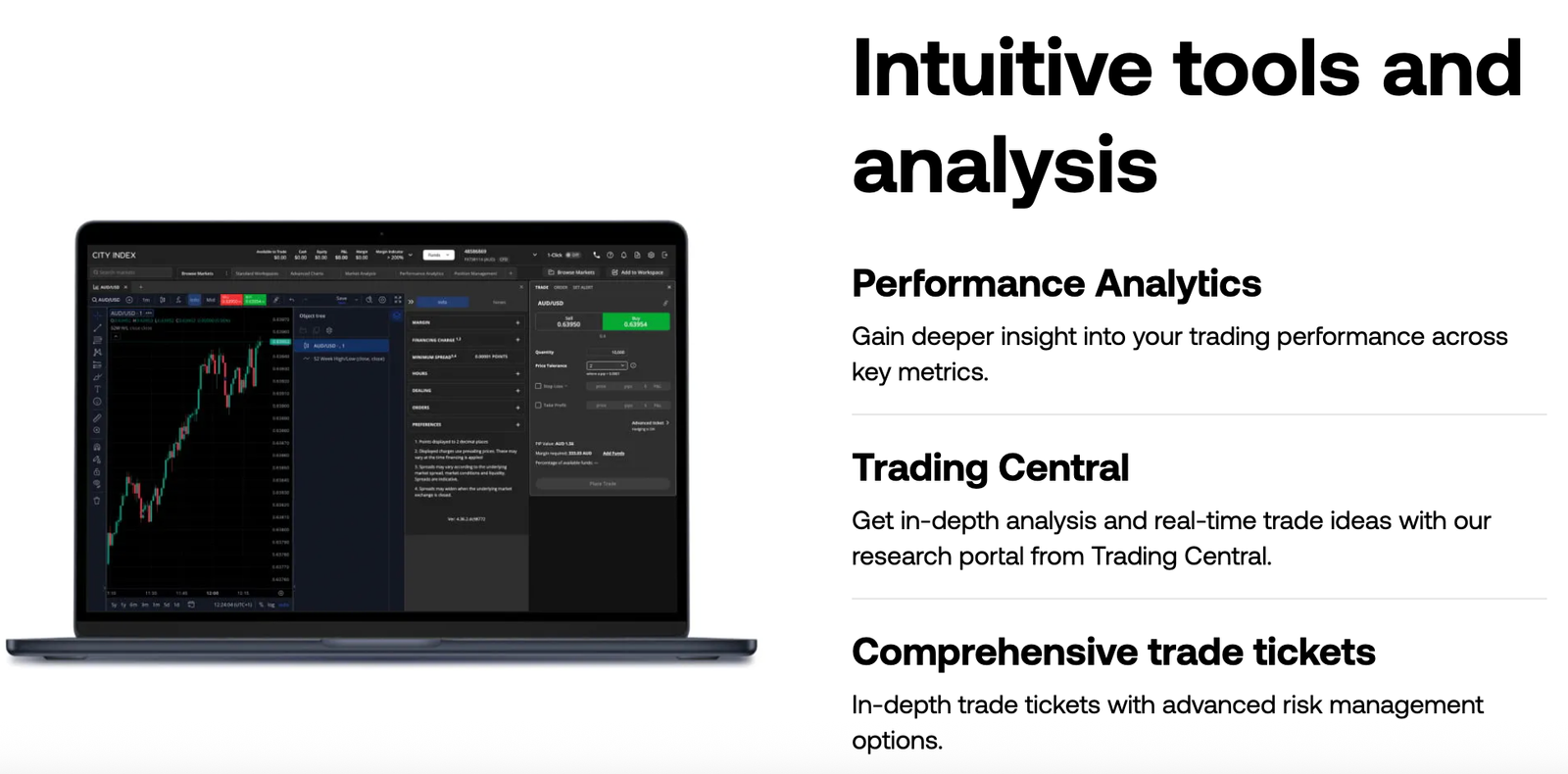

City Index’s platforms are one of its strongest selling points. The proprietary Web Trader platform is built for active traders, offering fast execution, advanced order types, and deep integration with TradingView charts and Trading Central research. It supports complex orders, chart-based trading, and highly customisable layouts.

The mobile app closely mirrors the web platform, making it one of the best mobile trading apps among UK CFD brokers. It balances advanced tools with usability, allowing traders to manage positions, analyse markets, and execute trades efficiently on the go.

| Platform | Strengths | Weaknesses |

|---|---|---|

| Web Trader | Most powerful, best tools, full market access | Can feel busy for beginners |

| Mobile App | Fast, intuitive, excellent charts | No two-step authentication |

| Desktop (Advanced) | Full functionality | Outdated design, less user-friendly |

How good is City Index Web Trader for active traders?

City Index’s Web Trader is its flagship platform and one of the best proprietary platforms available to UK CFD and spread betting traders. It is designed for frequent trading, offering speed, flexibility, and deep market insight.

Why active traders like it

- TradingView-powered charts with nearly 90 indicators

- Drag-and-drop stop-loss and limit orders directly on charts

- Customisable layouts, watchlists, and screeners

- Integrated Trading Central research and Reuters news

Main weakness

- Initial workspace setup can feel manual and cluttered

What order types and risk tools does City Index support?

City Index offers a strong range of professional-grade order types, particularly compared with app-only trading platforms.

| Order type | Web Trader | Mobile App | MT4 |

|---|---|---|---|

| Market & Limit | Yes | Yes | Yes |

| Stop orders | Yes | Yes | Yes |

| Trailing stop | Yes | Yes | Yes |

| Guaranteed stop | Yes | Yes | No |

| OCO orders | Yes | Yes | No |

Risk management tools

- Guaranteed stop-loss orders

- Trailing stops

- Price and indicator alerts

- Performance Analytics to identify behavioural risk

City Index charting tools, indicators, and execution speed

City Index offers advanced charting and fast execution, making it suitable for active traders, day traders, and technical analysts. Charting is powered by TradingView on proprietary platforms, with MetaTrader 4 available for automation.

Charting and indicators

Web Trader

- 88 technical indicators and 20+ drawing tools

- Multiple timeframes from 1 minute to monthly

- Trade directly from charts with drag-and-drop stops and limits

Mobile app

- 50+ TradingView indicators

- Core drawing tools and real-time alerts

- Chart-based trading supported

MT4

- 30+ built-in indicators plus custom indicators and EAs

- Automated trading supported, but limited to ~80 markets

Execution speed and performance

- Typical execution time: under 1 second

- Stable performance in normal market conditions

- Suitable for day trading and short-term strategies

Execution is fast enough for most active traders, though ultra-short-term scalpers may prefer brokers with tighter spreads and lower-latency environments.

How easy is it to open an account and start trading?

Opening an account with City Index is fully digital and typically completed within one business day. The process includes an online application, a trading knowledge assessment, and standard UK identity verification.

Step-by-step process:

- Create an account online by entering your email and setting a password

- Complete the application form, including personal details and employment status

- Answer a trading knowledge check to meet FCA suitability requirements

- Verify your identity by uploading a passport or driving licence and proof of address

- Choose your account type (Standard, Premium, or Professional if eligible)

- Fund your account using bank transfer, debit or credit card, or PayPal

- Start trading on Web Trader, mobile app, or MT4 once approved

There is no minimum deposit requirement, but City Index recommends depositing around £100 to meet margin requirements when trading CFDs or spread bets.

How do deposits and withdrawals work?

UK clients can fund their accounts using bank transfer, debit or credit card, and PayPal. Card and PayPal deposits are usually instant, while bank transfers can take a few working days.

Withdrawals are free of charge and typically processed within 3–5 working days. Funds must be withdrawn to an account in your own name to comply with UK anti-money laundering rules.

What unique features does City Index offer to UK users?

City Index differentiates itself with several trader-focused tools:

- Spread betting, which can be free of UK capital gains tax

- Performance Analytics, helping traders analyse strengths and weaknesses

- PlayMaker, an advanced risk management tool

- Extended hours trading on selected US shares

- Integrated Trading Central research, signals, and market commentary

These features are particularly valuable for active and high-frequency traders.

How does City Index compare to its competitors?

General comparison

| Feature | City Index | IG | Saxo |

|---|---|---|---|

| FCA regulated | Yes | Yes | Yes |

| Markets | 13,500+ | 17,000+ | 30,000+ |

| Spread betting | Yes | Yes | No |

| TradingView charts | Yes | Limited | Yes |

| MT4 support | Yes | Yes | No |

| Best for | Active traders | All-round traders | Professionals |

City Index vs IG vs Saxo: fee comparison (UK)

| Fee type | City Index | IG | Saxo |

|---|---|---|---|

| EUR/USD spread | ~0.8–1.2 pips | ~0.6 pips | ~0.9 pips |

| UK shares CFD | ~0.08% | ~0.10% | ~0.10% |

| Inactivity fee | £12 after 12 months | £0 | £0 |

| Spread betting | Yes | Yes | No |

City Index account types comparison

| Account type | Minimum balance | Max leverage | Key features |

|---|---|---|---|

| Standard | £0 | 30:1 | Full FCA protections |

| Premium Trader | £10,000 | 30:1 | Relationship manager |

| Professional | £0 | Up to 400:1 | No FSCS or NBP |

Market coverage comparison

| Market type | City Index | IG | Saxo |

|---|---|---|---|

| Total markets | 13,500+ | 17,000+ | 30,000+ |

| Forex pairs | 80+ | 90+ | 180+ |

| Shares CFDs | Yes | Yes | Yes |

| Real shares | No | Yes | Yes |

| Spread betting | Yes | Yes | No |

How good is City Index customer support?

City Index provides phone, email, and in-platform support, including access to experienced UK-based dealers.

Unlike many newer app-only platforms, users can speak directly to a human adviser. Customer reviews frequently highlight fast response times and knowledgeable support staff, especially for account and trade-related queries.

What are the main limitations?

- No long-term investing products such as real shares or ETFs

- No MT5 or direct market access for most UK users

- Spreads are average compared to ultra-low-cost CFD brokers

- Crypto derivatives unavailable to UK retail traders

- Desktop platform can feel less intuitive than the mobile trading app

How good are City Index’s education and learning tools?

City Index offers strong educational support for beginner and intermediate traders, with a focus on practical trading skills rather than theory alone. UK users get access to a structured Trading Academy, video courses, webinars, and platform tutorials covering CFDs, spread betting, risk management, and technical analysis.

Learning tools are integrated into the platform, making it easy to move from education to live or demo trading, although advanced traders may find the written content less extensive than at some competitors.

Conclusion: Is City Index worth using in the UK?

City Index is a well-established, FCA-regulated trading platform that stands out for its powerful tools, wide market coverage, and strong mobile and web platforms.

With access to 13,500+ markets, spread betting for UK users, and advanced features like TradingView charting, Performance Analytics, and PlayMaker risk controls, it is particularly well suited to active and experienced traders.

That said, City Index is not designed for long-term investing. You cannot buy real shares, ETFs, or crypto, and pricing is competitive rather than market-leading.

For traders who prioritise platform quality, regulation, and market access over simplicity or investing features, City Index remains one of the strongest UK trading platforms in 2026.

FAQs

Is City Index regulated in the UK?

Yes. City Index is authorised and regulated by the Financial Conduct Authority (FCA) and operates under StoneX Financial Ltd. Eligible UK clients are covered by the FSCS up to £85,000, though CFDs and spread betting are high-risk products.

Is City Index safe to use?

City Index is considered highly trustworthy. Client funds are held in segregated accounts, retail clients have negative balance protection, and the company is backed by NASDAQ-listed StoneX Group Inc. Crypto assets are not FSCS protected.

What is the minimum deposit at City Index?

There is no fixed minimum deposit to open an account. However, City Index recommends around £100 to meet margin requirements when trading CFDs or spread bets.

Does City Index offer a demo account?

Yes. City Index provides a free demo account on both its proprietary Web Trader platform and MetaTrader 4 (MT4), allowing you to practise with virtual funds before trading live.

Can I buy real shares or ETFs on City Index?

No. City Index does not offer real shares, ETFs, or funds. It is a trading-only platform focused on CFDs, spread betting, and forex.

Is City Index good for beginners?

City Index can suit beginners due to its strong regulation, demo account, and educational content. However, because it focuses on leveraged products, beginners should start cautiously and understand the risks before trading live.

Is spread betting tax-free with City Index?

Spread betting profits are free from UK capital gains tax. However, tax treatment depends on individual circumstances and losses are not tax-deductible.

How long do withdrawals take at City Index?

Withdrawals are free of charge and usually take 3–5 working days. Funds must be withdrawn to an account in your own name to comply with UK regulations.

Does City Index charge inactivity fees?

Yes. A £12 monthly inactivity fee applies after 12 months of no trading activity.

What platforms does City Index offer?

City Index offers its proprietary Web Trader, a highly rated mobile app, and MetaTrader 4 (MT4). MetaTrader 5 (MT5) is not available to most UK users.