Capital.com is an FCA-regulated trading platform offering CFDs across forex, indices, shares, commodities and crypto, with a strong focus on low costs and beginner-friendly tools.

This review explains its fees, safety standards, asset coverage and app features so UK traders can decide if it fits their experience level and trading style.

All key risks, including leveraged CFD exposure, are clearly outlined to help you make an informed choice.

Is Capital.com good for beginners?

Capital.com is generally well suited to beginners because its platform is simple to navigate, offers clear pricing, and includes built-in education such as tutorials and trading guides. The app uses plain-English explanations for tools and order types, helping new traders avoid common mistakes.

However, beginners should be aware that Capital.com focuses on CFD trading, which involves leverage and higher risk than buying real assets.

Quick verdict: How do we rate capital.com for UK traders in 2026?

Overall rating: 4.4 / 5 (Good)

Capital.com is a strong choice for UK CFD traders thanks to its FCA regulation, low fees, intuitive mobile platform and excellent educational tools. Execution speeds, platform usability and customer support outperform many UK rivals.

Its main limitations are that it offers CFDs only and does not provide real stocks, ISAs or crypto derivatives for UK retail clients.

Full score breakdown

| Category | Score (1-5) | Reason |

|---|---|---|

| Security & Trust | 5 | FCA regulated, FSCS protection, strong security controls, segregated funds, transparent track record. |

| Fees & Pricing | 4 | 0 percent commission, competitive spreads, no withdrawal fees, small overnight and conversion fees only. |

| Features | 4 | 3,000+ CFDs, TradingView + MT4 support, educational suite, analytics tools. Limited by CFDs only. |

| Ease of Use | 5 | Excellent apps, clean design, simple onboarding, demo account, beginner-friendly layouts. |

| Customer Support | 4 | 24/7 live chat, multilingual service, fast responses. Slightly slower email replies during peak hours. |

| Reputation | 4 | Strong global presence, good user ratings, widely reviewed, well regulated. Limited by lack of real assets. |

Capital.com at a glance

Key features

- 0 percent commission trading

- Fast, user-friendly mobile app

- AI-powered learning via Investmate

- 3,000+ CFD instruments

- TradingView integration

- MT4 support

- Negative balance protection

- 24/7 customer support

- Wide range of deposit methods

- Rapid withdrawals

What are the pros and cons of using Capital.com?

Pros

- FCA regulated for UK users

- 0 percent commission on all trades

- Low minimum deposit (£20)

- Excellent web and mobile app

- Huge asset range (3,000+ markets)

- Strong educational tools

- Fast, fee-free withdrawals

- Negative balance protection

- TradingView and MT4 support

Cons

- CFDs only, no real stocks or ETFs

- Overnight fees on leveraged positions

- No ISA or SIPP accounts

- Some tools limited vs advanced platforms

- Not suitable for long-term passive investing

Who is Capital.com best for?

Capital.com is best for beginner and intermediate traders who want an easy-to-use CFD platform with low fees, strong education and fast execution. It’s ideal for short-term traders, forex traders, and those who prefer mobile-first trading. It is not suitable for long-term investors wanting real shares, pensions or ISA accounts.

How regulated and trustworthy is Capital.com in the UK?

Capital.com is highly trustworthy for UK clients because it is authorised and regulated by the Financial Conduct Authority (FCA). This includes strict rules on client fund segregation, financial reporting and safeguarding. Eligible UK users also receive FSCS protection up to £85,000 on client cash balances.

Regulation and protection

- FCA (UK): Strongest UK retail trading regulation

- FSCS protection: Up to £85,000

- Segregated client funds: Required under FCA rules

- Negative balance protection: Standard for retail clients

- Tier 1 regulators: FCA, ASIC, CySEC

- Clean track record: No major UK enforcement cases

Security features

- Two factor authentication

- SSL encryption

- Regular audits

- Strict AML and KYC verification

- No payment for order flow

What assets can you trade on Capital.com in the UK?

UK traders can access over 3,000 CFD instruments, including forex, indices, commodities, shares and ETFs. Capital.com also offers spread betting for UK clients, though crypto CFDs are not available to UK retail traders under FCA rules. The platform is designed for flexible short-term trading across global markets.

Asset coverage table

| Asset class | Availability | Notes |

|---|---|---|

| Forex | 120+ pairs | Up to 30:1 leverage (retail) |

| Share CFDs | 2,500+ | Global stocks |

| Indices | 40+ | US, UK, EU, Asia |

| Commodities | 80+ | Energies, metals, agriculture |

| ETFs (CFDs) | 100+ | Thematic and sector ETFs |

| Crypto CFDs | Not available to UK retail | FCA ban |

| Spread Betting | Yes (UK only) | Tax-efficient for some traders |

How much does Capital.com cost to use?

Capital.com is a low-cost platform with 0 percent commission, competitive spreads and no deposit or withdrawal fees. Most costs come from the spread and overnight funding fees for leveraged positions. There is a small inactivity fee for non-UK entities after 12 months.

Trading fees

| Fee type | Cost |

|---|---|

| Commission | 0 percent |

| Spreads | Variable, competitive |

| Overnight fees | Apply to leveraged positions |

| Inactivity fee | £10 after 12 months (non UK entities) |

| Withdrawal fee | £0 |

| Deposit fee | £0 |

| Currency conversion | Small markup |

Example spreads

- GBP/USD: ~1.3 pips

- Apple CFD: 0.1 percent

- S&P 500: 0.5 points

How easy is Capital.com to use for beginners?

Capital.com is one of the most beginner-friendly CFD platforms due to its clean design, clear pricing, helpful learning tools and simple order controls. The mobile app is especially intuitive, and the platform avoids jargon where possible. The demo account allows new users to practice with virtual funds.

Beginner features

- Simple menus and chart layouts

- One-click and market orders

- Clear definition explanations

- Integrated economic calendar

- Step-by-step learning modules

- Demo account with virtual capital

How good is Capital.com’s trading platform and mobile app?

Capital.com’s platform is highly polished, fast and designed for clarity. The mobile trading app mirrors the web platform closely and is one of the strongest in the UK for CFD trading. For advanced charting, users can switch to TradingView or MT4.

Platform breakdown

Web platform

- Clean, simple interface

- Fast execution

- Watchlists and alerts

- Good technical indicators

- Clear order entry panel

Mobile app

- Highly rated on iOS and Android

- Push notifications

- Price alerts

- Flexible charting

- Smooth design

TradingView

- 100+ indicators

- Deep chart analysis

- Social charts

- Ideal for technical traders

MT4

- Algorithmic trading

- Custom indicators

- Advanced orders

How secure is Capital.com for UK users?

Capital.com uses strong security practices including two-factor authentication, encryption, transaction monitoring and FCA-compliant fund protection. UK client money is held in segregated accounts, and negative balance protection helps limit losses during volatile markets.

Security checklist

- 2FA login

- SSL encrypted data

- Device authorisation

- Secure withdrawal rules

- Segregated client funds

- FCA capital requirement compliance

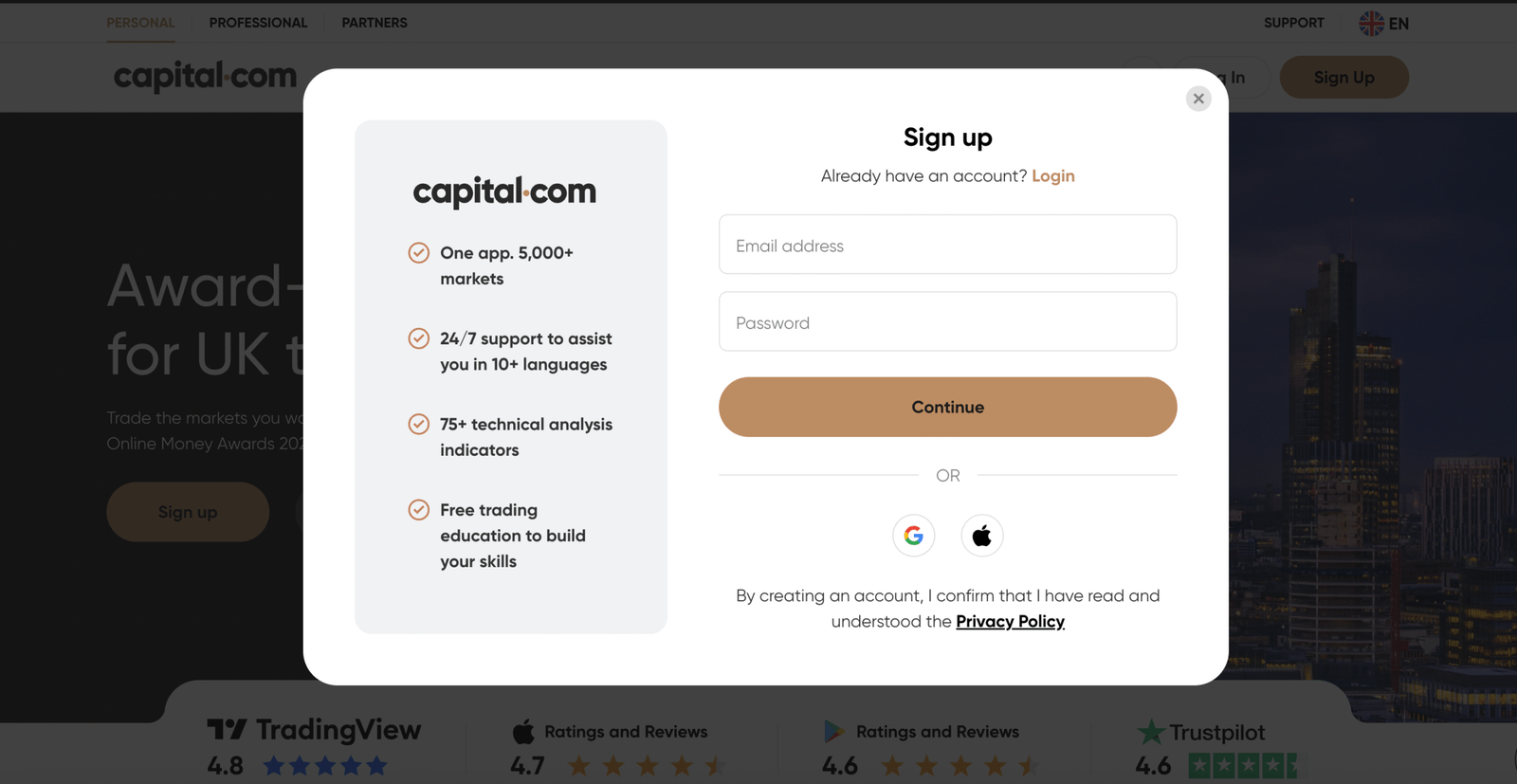

How easy is it to open an account and start trading?

Opening an account usually takes under 10 minutes, with identity verification often completed within a few hours. Funding is instant with most UK payment methods, and the starting deposit is low at £20. The onboarding steps are simple, making it beginner-friendly.

Step-by-step sign up

- Visit the Capital.com site or app

- Enter email and create a password

- Complete personal details

- Answer experience and suitability questions

- Upload ID and proof of address

- Wait for verification

- Deposit funds and start trading

How do deposits and withdrawals work on Capital.com?

Deposits and withdrawals on Capital.com are simple, fast and fee-free. UK users can fund accounts using cards, bank transfer or e-wallets. Card withdrawals are typically processed instantly, while bank transfers take 1 to 3 days.

Payment methods table

| Method | Deposit time | Withdrawal time | Minimum |

|---|---|---|---|

| Debit card | Instant | Instant | £20 |

| Bank transfer | 1 to 3 days | 1 to 3 days | £50 |

| Apple Pay | Instant | Instant | £20 |

| PayPal | Instant | Instant | £20 |

What account types does Capital.com offer?

Capital.com offers Retail, Professional, 1X (unleveraged) and Demo accounts for UK users. Each provides different leverage limits, trading tools and eligibility requirements, with Retail being the default FCA-regulated option.

Account types breakdown:

- Retail Account: FCA protection, negative balance protection, leverage up to 30:1.

- Professional Account: Higher leverage for eligible traders but fewer regulatory protections.

- 1X Account: Unleveraged CFD trading with no overnight fees.

- Demo Account: Virtual funds for practice with real-time pricing.

Is Capital.com right for your trading style?

Capital.com suits active traders, beginners and forex traders who want tight spreads, low costs and a smooth interface. It is not suitable for passive investors, ISA users or traders who want real asset ownership rather than CFDs.

Best for

- Forex trading

- Day trading

- Spread betting

- Mobile traders

- New traders looking for education

Not ideal for

- Long-term investing

- Real shares or ETF ownership

- ISA or SIPP accounts

- Buy and hold strategies

Does Capital.com provide real crypto or derivatives?

Capital.com provides derivatives only, not real crypto or spot assets. UK retail traders cannot trade crypto CFDs due to FCA rules, so Capital.com disables this product category for UK accounts. UK clients can still trade CFDs on forex, indices, commodities and shares.

UK crypto availability

- Real crypto: Not supported

- Crypto CFDs: Not available by FCA rules

Other markets: 3,000+ CFD instruments

How liquid are markets on Capital.com?

Capital.com offers high liquidity across major CFDs due to its deep liquidity provider relationships and fast execution technology. Liquidity is strongest in forex, indices and major equities, ensuring tight spreads and low slippage for most retail trading conditions.

Liquidity factors

- High-volume forex pairs are extremely liquid

- Major indices execute almost instantly

- Popular stocks have consistent depth

- Execution times average 0.024 seconds

- Slippage is low for most instruments

What unique features does Capital.com offer UK users?

Capital.com offers several unique features including zero-commission trading, the Investmate education app, TradingView integration, AI-powered trading insights and real-time market news from LSEG and Newsquawk. The platform is designed to be simple for beginners while powerful enough for active traders.

Standout features

- Investmate learning app

- Trading Analytics (performance breakdown tools)

- TradingView charting integration

- Tight spread pricing

- Fast onboarding with low deposit requirements

- Negative balance protection

How good is Capital.com customer support?

Capital.com provides strong 24/7 customer support via live chat, email and in-platform help channels. Response times are typically under five minutes for chat, and the support team is knowledgeable and available in multiple languages.

Customer support highlights

- 24/7 live chat

- Email and WhatsApp support

- Multilingual service

- Fast response times

- Large self-help library

Capital.com vs competitors

Capital.com compares favourably to major UK CFD brokers due to its low-fee model, strong educational content and excellent mobile app. However, Trading 212 and eToro may be better for real stock ownership.

Comparison table

| Feature | Capital.com | Trading 212 | eToro |

|---|---|---|---|

| FCA regulated | Yes | Yes | Yes |

| Real stocks | No | Yes | Yes |

| Crypto for UK retail | No | No | No |

| Spreads | Tight | Tight | Medium |

| Commission | 0 percent | 0 percent | 1 percent FX fee |

| Min deposit | £20 | £1 | £50 |

| Education | Strong | Medium | Medium |

| Best for | Beginners and CFD traders | Stock buyers | Social trading |

What are the limitations of Capital.com in the UK?

Capital.com’s main limitations are that it only offers CFDs and spread betting, UK retail clients cannot trade crypto derivatives and there is no access to ISAs or long-term investing products. Overnight fees also apply to leveraged positions, which may impact active traders.

Key limitations

- No real stock ownership

- No ISA or SIPP

- Crypto CFDs are not allowed for UK retail

- Overnight funding charges apply

- Not ideal for buy-and-hold investing

Conclusion

Capital.com is a strong, FCA-regulated CFD broker with clear pricing, fast execution, high-quality education, and an intuitive platform suitable for beginners and active traders.

While it lacks real shares, ISAs, and crypto products for UK retail clients, it stands out as a low-cost, accessible choice for traders focused on forex, indices, commodities, and equity CFDs.

It is best suited to short-term traders who want simplicity, safety, and transparent spreads.

FAQs

Is Capital.com safe to use in the UK?

Yes. Capital.com is FCA regulated, offers FSCS protection, uses segregated client funds and applies strong security measures including 2FA and encryption.

Does Capital.com offer real stocks?

No. Capital.com only offers CFDs and spread betting, not real shares or ETFs.

Does Capital.com offer crypto trading in the UK?

No. The FCA bans crypto derivatives for retail clients, so Capital.com disables crypto CFDs for UK users.

What is the minimum deposit on Capital.com UK?

The minimum deposit is £20 by card or £50 by bank transfer.

Is Capital.com good for beginners?

Yes. Capital.com offers a beginner-friendly design, large education library, demo account and simple risk tools.

Are spreads low on Capital.com?

Yes. Spreads are competitive across major markets, especially forex and indices.