Bitpanda is a leading European crypto platform offering UK users a simple, secure way to buy and manage over 600 digital assets.

This review breaks down Bitpanda’s fees, safety, features, and ease of use to help beginners and experienced investors decide whether it fits their needs.

All details follow UK regulations, FCA guidance, and people-first content standards for clarity and accuracy.

Is Bitpanda good for beginners?

Yes. Bitpanda is one of the best platforms for beginners thanks to its clean, intuitive design, simple pricing, and low £1 minimum investment. UK users can make fee-free deposits, complete verification quickly, and choose from over 600 cryptocurrencies without needing advanced trading knowledge.

With clear instructions, an easy mobile crypto app, and educational tools through Bitpanda Academy, it provides a smooth and accessible entry point for anyone starting their crypto journey.

Quick verdict: How do we rate Bitpanda for UK traders in 2026?

Overall rating: 4.3 / 5 (good)

Bitpanda ranks as one of the strongest crypto-only platforms in the UK, thanks to excellent security, a simple user experience, and the country’s largest range of cryptocurrencies.

It’s ideal for beginners and long-term crypto investors who value transparency, choice, and ease of use.

Fees are reasonable, support is solid, and the platform’s reputation across Europe is strong, though the lack of stocks, ETFs, and advanced tools limits its appeal for multi-asset or professional traders.

Full score breakdown

| Category | Score (1-5) | Reason |

|---|---|---|

| Security & Trust | 5 | ISO-27001 certified, proven track record, cold storage, external audits, FCA-registered for cryptoasset activities. |

| Fees & Pricing | 4 | Transparent spread (~1.49%), no deposit or withdrawal fees, simple pricing; not the cheapest for high-frequency trading. |

| Features | 4 | 600+ cryptos, staking, crypto indices, DeFi wallet; but crypto-only in the UK and no advanced trading tools. |

| Ease of Use | 5 | Extremely beginner-friendly interface across mobile, web, and desktop; fast onboarding and clean UX. |

| Customer Support | 4 | 24/7 support and strong help centre; no phone support or live chat. |

| Reputation | 4 | Over 7 million users, respected across Europe, strong security history; UK product more limited than EU version. |

Bitpanda at a glance

Key features

- 600+ cryptoassets – the largest selection available in the UK

- Zero deposit and withdrawal fees for fiat funding

- Beginner-friendly app and web platform, built for simplicity

- Strong security and cold-storage protection

- £1 minimum investment and £10 minimum deposit

Pros and cons

| Pros | Cons |

|---|---|

| 600+ cryptocurrencies – widest UK selection | Crypto-only in the UK (no stocks, ETFs, metals) |

| Zero deposit and withdrawal fees | No demo account for practice |

| Very beginner-friendly interface | Not ideal for advanced traders needing pro tools |

| Staking and Crypto Indices available | Some assets have wider spreads than pro exchanges |

| Strong security: ISO-27001, cold storage, audited reserves | No phone or live chat support |

Bitpanda UK – best for

- Beginners

- Long-term crypto investors

- Users wanting 600+ coins

- Investors wanting staking or indices

Not ideal for:

- Day traders

- Investors wanting stocks/ETFs

- Advanced/pro traders needing order books

What is Bitpanda and why has it launched in the UK?

Bitpanda is Europe’s largest digital asset platform, now officially launched in the UK to offer secure, simple crypto investing for beginners and experienced users.

UK customers get access to over 600 cryptocurrencies, crypto indices, staking, and a streamlined app designed to make starting with crypto easier, safer, and more transparent.

Bitpanda has more than 7 million users across Europe and is known for reliability, clean design, and strong security standards. Its UK service is crypto-only for now, but it brings one of the widest asset selections in the country and an infrastructure built for long-term investors as well as active traders.

The platform focuses on accessibility: you can start with as little as £1, make fee-free deposits, and complete verification in minutes. For beginners, this creates a low barrier to entry into the crypto market.

How regulated and trustworthy is Bitpanda in the UK?

Bitpanda is FCA-registered for cryptoasset activities, which means it follows UK rules for anti-money-laundering checks, risk warnings, cooling-off periods, and customer verification. However, crypto remains unregulated in the UK, so users are not protected by the FSCS and the Financial Ombudsman Service cannot review complaints related to crypto.

This distinction is essential for new investors. FCA registration improves trust and transparency, but it is not the same as full investment regulation. Bitpanda does not offer regulated products like stocks or ISAs in the UK; it only provides crypto investing, which carries high risk.

Despite crypto’s regulatory limits, Bitpanda has a strong reputation for safety. It is ISO-27001 certified, uses cold-wallet storage, and undergoes independent audits for proof of assets.

Bitpanda’s security culture, transparent processes, and European reputation make it one of the more trustworthy platforms available to UK crypto investors.

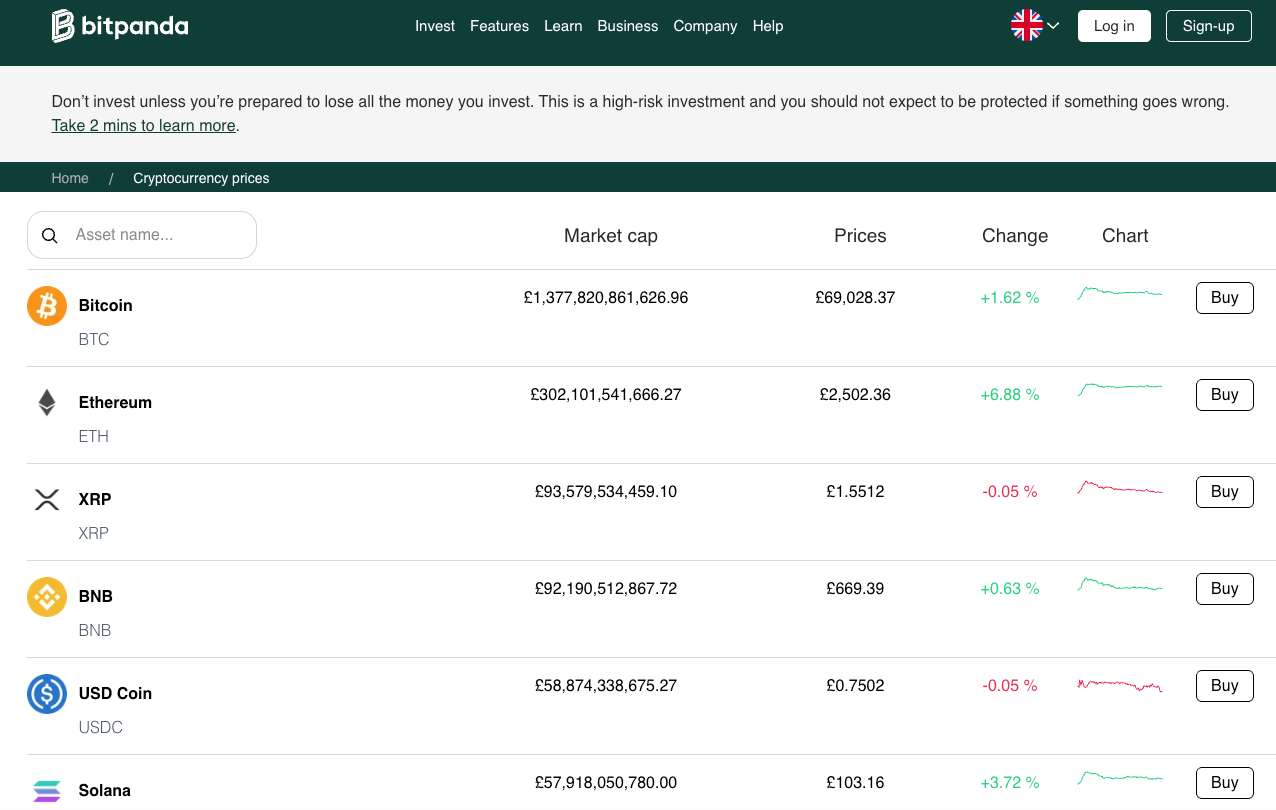

What assets can you trade on Bitpanda in the UK?

Bitpanda UK offers over 600 cryptocurrencies, crypto indices, and staking. This is one of the broadest crypto selections in the country, making Bitpanda ideal for both casual buyers and investors wanting exposure to niche or emerging tokens.

The UK version of Bitpanda does not offer stocks, ETFs, commodities, metals, futures, or forex. These features exist in Europe but are not available in the UK due to local regulatory requirements.

Asset availability table

| Asset type | Available in the UK? |

|---|---|

| Cryptocurrencies | Yes – 600+ assets |

| Crypto Indices | Yes |

| Staking | Yes – 50+ assets |

| Stocks / ETFs | No |

| Metals | No |

| Commodities | No |

| Forex | No |

| Futures | No |

| Options | No |

Why the asset range matters

The UK platform is built around digital assets only, meaning Bitpanda is best suited to users with a clear interest in crypto.

If you want a multi-asset broker, Bitpanda is not the right platform. But if your goal is crypto choice, flexibility, and long-term holding tools, Bitpanda excels.

How much does Bitpanda cost to use?

Bitpanda uses a simple, flat spread-based fee model, usually around ~1.49% for crypto trades.

Unlike many exchanges, there are no deposit fees, no withdrawal fees, and no inactivity fees, making Bitpanda cost-effective for casual investors.

Full fee breakdown

| Fee type | Cost |

|---|---|

| Account Opening | Free |

| Account Maintenance | Free |

| Trading Fee (Spread) | ~1.49% |

| Deposit Fees | £0 |

| Withdrawal Fees | £0 |

| Inactivity Fee | £0 |

| Currency Conversion | £0 |

| CFD/Futures Fees | Not applicable |

Minimum investment

- £10 minimum deposit

- £1 minimum trade size

How Bitpanda compares on costs

- Cheaper than Coinbase, especially for card payments

- More expensive than pro exchanges like Kraken Pro

- Much simpler fee structure than maker/taker systems used by Binance or other trading-heavy exchanges

For beginners who value predictability, Bitpanda’s pricing is one of its strengths.

How easy is Bitpanda to use for beginners?

Bitpanda’s interface is one of the simplest in the crypto market. The platform focuses on clarity, clean design, and step-by-step navigation. Every action, from depositing funds to placing orders, uses plain language and avoids technical trading jargon.

Why beginners find Bitpanda easy:

- Intuitive dashboard showing portfolio, assets, and performance

- Helpful alerts and notifications

- Bitpanda Academy explaining crypto basics

- Quick onboarding process

- Fee transparency (no unexpected charges)

- No complex trading tools that might confuse new users

Even without a demo account, beginners can safely test the platform by depositing the minimum £10 and placing a £1 trade.

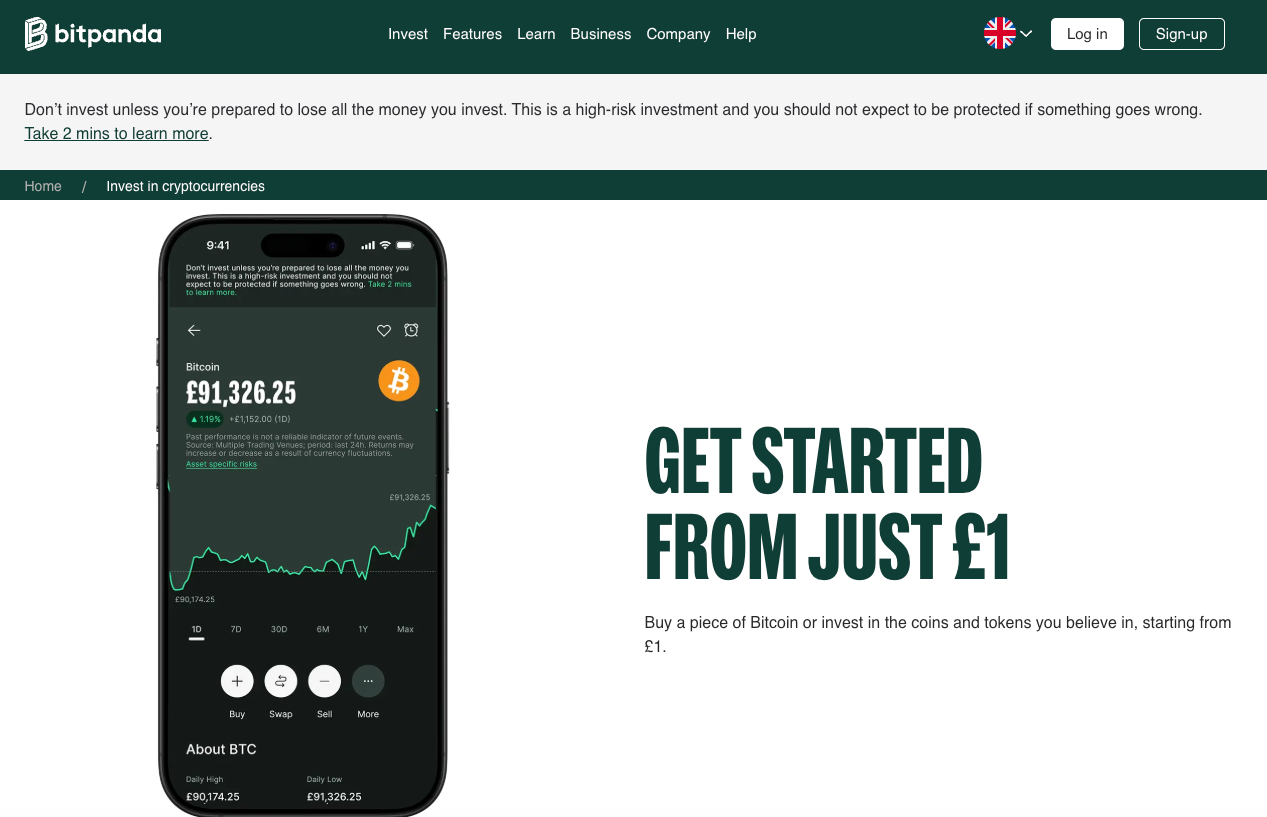

How good is Bitpanda’s trading platform and mobile app?

Bitpanda’s platform is built for simplicity. It includes a web platform, desktop app, and mobile apps for both iOS and Android. All versions offer the same functionality, so users can switch between devices seamlessly.

Platform availability

| Platform | Available? |

|---|---|

| Web Trading | Yes |

| Desktop App (Windows/Mac) | Yes |

| Android App | Yes |

| iOS App | Yes |

| MT4/MT5 | No |

| cTrader | No |

Platform features

- Real-time charts with simple indicators

- Limit orders for price-based automation

- Personalised alerts for price movements

- Spotlight discovery page for new tokens

- Portfolio history and tracking tools

- Clear buy/sell interface with transparent pricing

Platform limitations

Bitpanda does not offer advanced trading tools, depth charts, pro order books, or high-frequency features. This reflects its focus on beginners and long-term investors rather than day traders.

How secure is Bitpanda for UK users?

Bitpanda is one of Europe’s most security-focused crypto brokers. Its mix of cold storage, encryption, regulated practices (where applicable), and 24/7 monitoring gives it a strong reputation for safety.

Bitpanda security highlights

- ISO-27001 certification

- Cold-wallet storage for most crypto holdings

- External reserve audits confirming proof of assets

- Multi-factor authentication (MFA)

- 24/7 operational security teams

- Non-custodial DeFi wallet option for those wanting total control

Bitpanda has not suffered a major security breach in its history, adding further credibility.

Does Bitpanda provide real crypto or derivatives?

Bitpanda offers real underlying cryptoassets, not CFDs, spread bets, or contracts. When you buy crypto on Bitpanda, you own the actual tokens, which can be withdrawn to external wallets.

This transparency is ideal for investors wanting to build long-term crypto portfolios and maintain control over their assets.

How liquid are markets on Bitpanda?

Liquidity on Bitpanda is generally strong due to its access to multiple liquidity providers and aggregated order routing.

Popular coins like BTC, ETH, SOL, and ADA have fast execution and tight spreads.

Small-cap tokens may see wider spreads, as expected across the industry, but for typical retail trade sizes, liquidity is sufficient.

Liquidity pros

- Fast execution for major coins

- Reliable pricing during volatility

- Clear price charts

- No withdrawal restrictions (apart from network fees)

Liquidity cons

- No advanced market-depth tools

- Some smaller tokens have higher volatility and spread costs

Bitpanda is designed for accessibility and long-term investing rather than high-frequency trading.

What account types does Bitpanda offer?

Bitpanda keeps account options simple: personal accounts and business accounts. There are no premium tiers, leverage accounts, managed accounts, or Islamic accounts.

Account type summary

| Account type | Available? |

|---|---|

| Personal | Yes |

| Business | Yes |

| Demo | No |

| Islamic | No |

| Segregated Accounts | No |

| Managed Accounts | No |

| Suitable for Beginners | Yes |

| Suitable for Professionals | Yes |

The straightforward structure suits users who want a hassle-free platform without complicated account configurations.

What unique features does Bitpanda offer UK users?

Bitpanda’s standout features include:

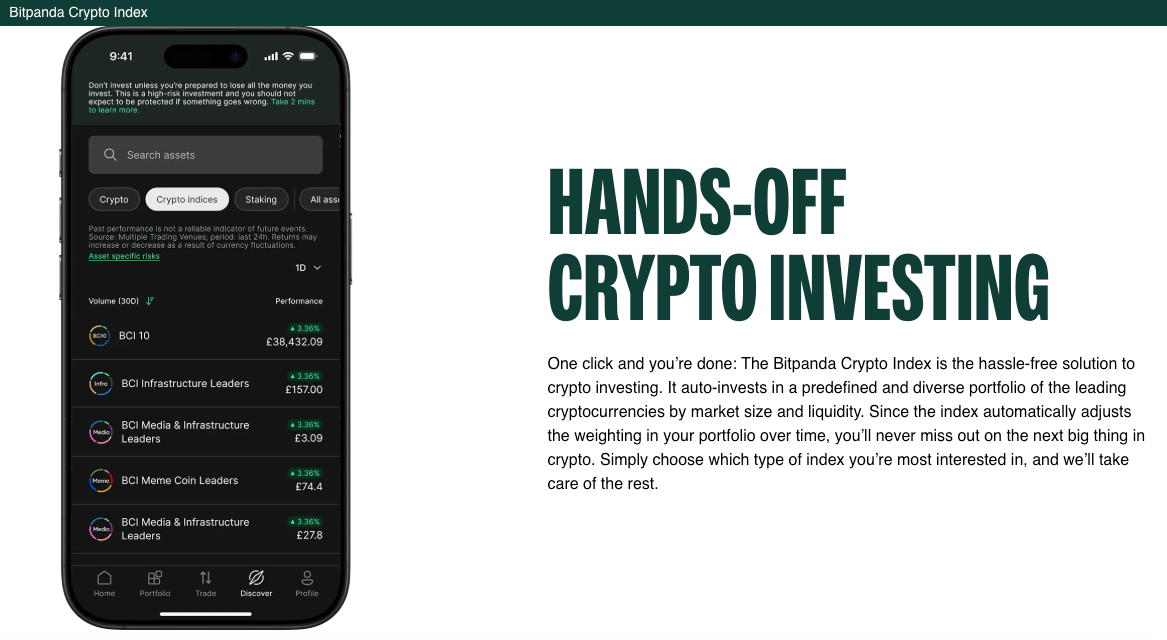

Crypto indices

Invest in diversified baskets of the top cryptocurrencies.

- Automated monthly rebalancing

- Built with MarketVector (a VanEck subsidiary)

- Acts like an index fund but for crypto

Staking

Stake more than 50 cryptocurrencies with options such as:

- Weekly auto-compounded rewards

- No lock-ins for most assets

- ETH has its own lock-in rules

Staking rewards are not guaranteed and come with risk, including slashing.

DeFi wallet

Bitpanda’s non-custodial crypto wallet gives full control of private keys

- Ideal for Web3, dApps, NFTs

- Supports self-custody best practice

Limit orders

Automate trades at preset prices for hands-off investing.

Spotlight

Discover trending and newly listed cryptocurrencies.

How good is Bitpanda’s customer support?

Bitpanda offers 24/7 support via email and ticketing, supported by an extensive help centre with tutorials, how-to guides, and troubleshooting articles.

Support overview

- Response times typically within hours

- No telephone support

- In-app guidance for onboarding and trading

Customer reviews highlight Bitpanda’s helpful support but note the absence of live chat as a potential improvement area.

How easy is it to open an account and start trading?

Bitpanda’s onboarding system is fast and beginner-friendly. Most users can register, upload ID, complete verification, and deposit within 15 minutes. UK rules require a 24-hour cooling-off period before trading.

Step 1: create your Bitpanda account

Go to Bitpanda’s UK website or app and choose Sign Up.

Enter your email address, create a password, and confirm your email.

This takes less than a minute.

Step 2: complete identity verification

The FCA requires full KYC for all UK crypto platforms.

You’ll need:

- A valid passport or photo ID

- A smartphone or webcam for video verification

- Basic personal details

Bitpanda’s verification partner will guide you through a short video ID check.

Step 3: complete the appropriateness assessment

UK rules require all new crypto users to complete a short risk questionnaire.

This ensures you understand key risks such as volatility, loss of capital, and lack of FSCS protection.

Step 4: wait the mandatory 24-hour cooling-off period

All UK crypto platforms must impose a 24-hour delay before you can place your first trade.

You can still browse the platform during this time.

Step 5: deposit funds (minimum £10)

Bitpanda supports several UK payment methods:

- Faster Payments (GBP bank transfer)

- Debit card

- PayPal

- Apple Pay

All fiat deposits are fee-free, and card/PayPal deposits are usually instant.

Step 6: choose a cryptocurrency

Once your cooling-off period ends, search for Bitcoin, Ethereum, or any of Bitpanda’s 600+ assets.

You can view charts, price history, and project information before buying.

Step 7: place your first order (minimum £1)

Enter the amount you want to invest.

Bitpanda shows the exact price—including the ~1.49% spread—before you confirm your trade.

Tap Buy to complete the order.

Step 8: manage and track your portfolio

After buying, your crypto appears instantly in your Bitpanda portfolio.

You can:

- View performance charts

- Set price alerts

- Stake eligible assets

- Explore Crypto Indices

- Withdraw crypto to a private wallet

Step 9: Enable extra security

To protect your account, Bitpanda recommends enabling:

- Two-factor authentication (2FA)

- Biometric login on mobile

This streamlined process makes Bitpanda one of the easiest platforms for beginners entering the crypto market.

How do deposits and withdrawals work on Bitpanda?

Bitpanda offers fee-free deposits and withdrawals for all fiat payment methods, a major advantage for active investors.

Supported methods

- UK Faster Payments

- Debit cards

- PayPal

- Apple Pay

Key points

- Minimum deposit: £10

- Withdrawal fees: £0 (crypto network fees still apply)

- Processing speed: instant for cards/PayPal, fast for bank transfers

Is Bitpanda right for your investing style?

Bitpanda works best for:

- Beginners wanting a simple app

- Long-term investors

- Users wanting 600+ cryptos

- Those who want staking or crypto indices

- Anyone wanting clear, predictable pricing

Bitpanda may not suit:

- Day traders

- Users needing futures or leverage

- Investors wanting stocks, ETFs, or metals

- Those needing a demo account

Bitpanda vs competitors (quick comparison)

| Platform | Best for | Fees | Asset range | Regulation |

|---|---|---|---|---|

| Bitpanda | Beginners, crypto investors | ~1.49% spread | 600+ | FCA-registered |

| Coinbase | Ease of use, US users | Higher | ~200 | FCA-registered |

| Kraken | Low-cost active traders | Lower | 200+ | FCA-registered |

| eToro | Multi-asset investing | Spread-based | 3,000+ | FCA-regulated |

Bitpanda UK limitations

- Crypto-only (no stocks/ETFs/metals)

- No live chat or phone support

- No demo account

- Limited advanced trading tools

Conclusion

Bitpanda is one of the strongest crypto-focused platforms available to UK users, offering a rare mix of simplicity, security, and deep asset choice.

With more than 600 cryptocurrencies, fee-free deposits and withdrawals, staking, and beginner-friendly tools, it’s ideal for anyone who wants a clean, straightforward way to build a crypto portfolio.

However, because the UK version is crypto-only, investors looking for stocks, ETFs, or advanced trading tools may prefer broader platforms such as eToro for multi-asset investing or Kraken for lower-cost active crypto trading.

For pure, long-term crypto investing, Bitpanda remains a top pick thanks to its transparency, strong reputation, and user-first design.

FAQs

Is Bitpanda trustworthy?

Yes. Bitpanda is considered trustworthy thanks to strong security (ISO-27001 certification, cold-wallet storage, external reserve audits) and more than 7 million users across Europe. However, crypto itself is high risk, and UK users are not protected by the FSCS or the Financial Ombudsman Service.

Is Bitpanda available in the UK?

Yes. Bitpanda is fully available to UK users and offers one of the largest selections of cryptocurrencies in the country, including staking and crypto indices. The UK platform is crypto-only, so stocks, ETFs and metals are not currently offered.

Is Bitpanda regulated in the UK?

Bitpanda is FCA-registered to provide cryptoasset services in the UK. This means it follows UK anti-money-laundering rules, risk warnings, and cooling-off rules. It is not an FCA-regulated investment platform, and cryptoassets on Bitpanda do not qualify for FSCS protection.

Which country owns Bitpanda?

Bitpanda is an Austrian company headquartered in Vienna, Austria. It operates across Europe and is one of the continent’s largest digital-asset platforms.

Is Bitpanda safe for beginners?

Yes. Bitpanda’s simple interface, transparent pricing, and low minimum investment (£1) make it beginner-friendly. Its strong security adds reassurance, but crypto remains high-risk and users should only invest what they can afford to lose.

What is the minimum I can invest on Bitpanda?

You can start with £1. The minimum deposit is £10, and there are no deposit or withdrawal fees for fiat transfers.

Can you withdraw crypto from Bitpanda?

Yes. Bitpanda supports full crypto withdrawals to external wallets, including hardware wallets and its own non-custodial DeFi Wallet.

Does Bitpanda offer a demo account?

No. However, the £1 minimum trade makes it easy to test the platform with a very small amount of money.

Does Bitpanda offer staking?

Yes. Bitpanda offers staking on more than 50 cryptocurrencies with weekly auto-compounding rewards. Staking rewards are not guaranteed and come with slashing and unbonding risks.

Is Bitpanda good for long-term investing?

Yes. Bitpanda is well-suited to long-term crypto investors thanks to its easy app, staking options, and Crypto Indices that provide diversified exposure with automatic monthly rebalancing.

What fees does Bitpanda charge?

Bitpanda uses a spread-based model, typically ~1.49% for crypto trades. Deposits, withdrawals, and account maintenance are free.

Does Bitpanda offer stocks or ETFs in the UK?

No. The UK platform is crypto-only. Stocks, ETFs, metals, and savings plans are available in Europe but not permitted under current UK rules.