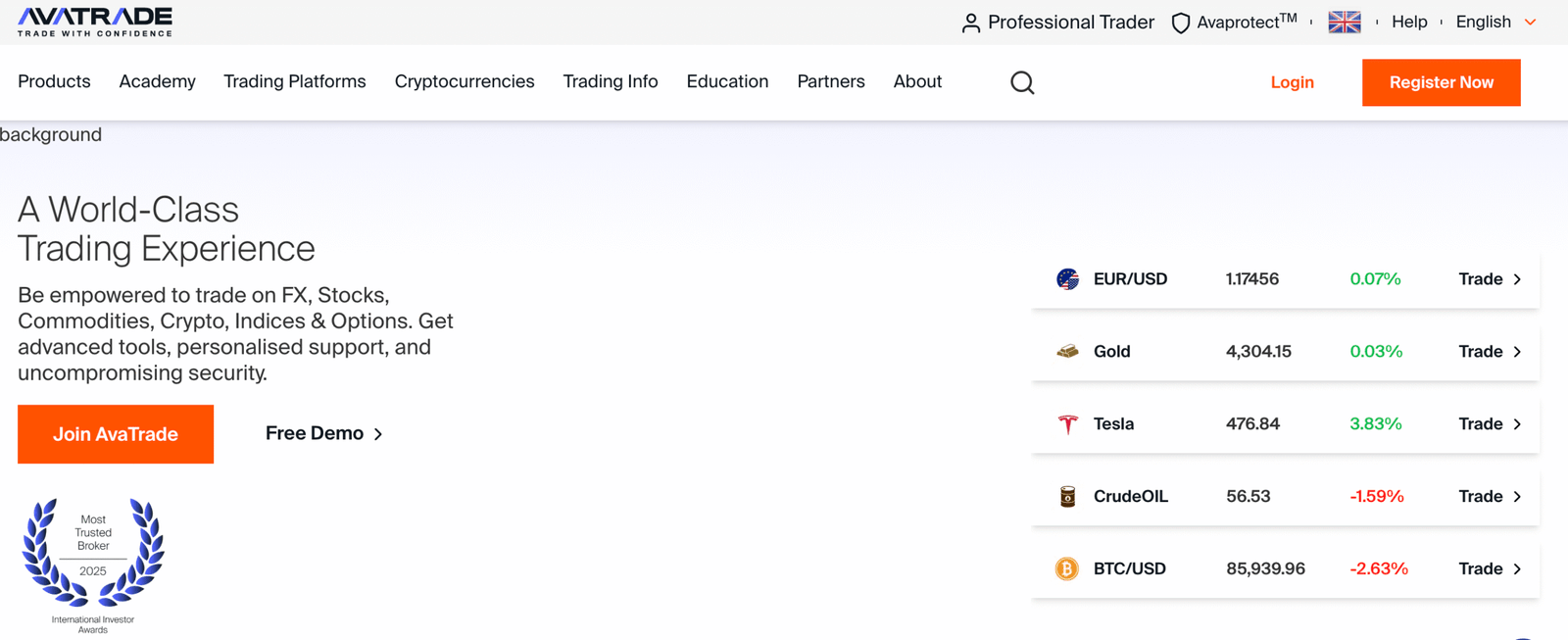

AvaTrade is an online trading platform offering CFDs, forex, indices, shares, commodities, and crypto to UK traders.

In this AvaTrade Review UK 2026, we assess fees, platforms, regulation, and safety to explain whether AvaTrade is trustworthy and who it is best for.

This review focuses on facts, risks, and suitability so you can decide if AvaTrade matches your trading needs.

Is AvaTrade good for beginners?

Yes, AvaTrade can be good for beginners who want a regulated platform with strong educational tools and multiple trading platforms. It offers FCA regulation, a free demo account, and clear risk warnings, but the platform choice and CFD complexity mean it suits beginners willing to learn rather than those seeking a simple investing app.

Quick verdict: How do we rate AvaTrade for UK traders in 2026?

Overall rating: 4.0 / 5

AvaTrade is a strong, globally established CFD and forex trading platform with excellent tools, multiple platforms, and solid international regulation. For UK traders, however, its appeal is limited by lack of FCA authorisation, no FSCS protection, no ISA, and inactivity fees. It is best suited to active traders who prioritise platforms and features over UK-specific regulation and tax efficiency.

Full score breakdown

| Category | Score | Summary |

|---|---|---|

| Security & Trust | 4.0 | Well-established since 2006 with strong global regulation and segregated client funds, but not FCA authorised for UK users. |

| Fees & Pricing | 3.5 | Competitive spread-only pricing and free withdrawals, offset by inactivity and annual admin fees. |

| Features | 4.5 | Excellent platform range including MT4, MT5, AvaTradeGO, AvaOptions, and copy trading tools. |

| Ease of Use | 4.0 | Smooth onboarding and strong mobile app, though web platform design feels dated. |

| Customer Support | 4.0 | Reliable 24/5 support via chat, phone, and email, but no UK-based support team. |

| Reputation | 4.0 | Well-known global broker with mostly positive reviews. Complaints focus on fees and UK regulation, not safety. |

AvaTrade at a glance

Key features

- Global CFD and forex broker founded in 2006

- Available to UK residents, but not FCA authorised

- Regulated by Central Bank of Ireland and other top-tier regulators

- CFD-only platform covering forex, indices, shares, commodities, ETFs

- Minimum deposit £100 equivalent

- No deposit or withdrawal fees

- Inactivity fee applies after 3 months

- Multiple platforms including MT4, MT5, AvaTradeGO, WebTrader

- Strong education suite with demo account, courses, and webinars

- 63% of retail CFD accounts lose money

What are the pros and cons of using AvaTrade?

Pros

- Strong global regulation with a long operating history

- Low trading fees on forex and index CFDs

- Wide platform choice, including MetaTrader and proprietary apps

- Excellent educational tools and demo account for practice

- Free deposits and withdrawals

- Supports GBP accounts for UK users

Cons

- Not FCA authorised, so no FSCS protection

- CFDs only, no real shares, ISAs, or SIPPs

- Inactivity fees can be costly for casual traders

- Product range narrower than top UK brokers

- Crypto CFDs restricted for UK retail clients

Who is AvaTrade ideal for?

- Traders focused on forex and CFD trading

- Users who want MetaTrader 4 or MetaTrader 5 access

- Beginners who value education and demo trading

- Active traders who avoid inactivity fees

- International traders comfortable using a non-UK broker

Who is AvaTrade not ideal for?

- UK investors wanting FCA regulation and FSCS protection

- Long-term investors seeking real shares or ETFs

- Anyone looking for a Stocks and Shares ISA or SIPP

- Casual traders who may trigger inactivity charges

- Beginners wanting a simple investing app rather than CFDs

Is AvaTrade available in the UK and who can open an account?

Yes, UK residents and UK tax residents can open an AvaTrade account, provided they meet standard identity and residency checks. AvaTrade accepts UK clients but operates under non-FCA regulation, meaning accounts are opened via its Irish or international entities rather than a UK-regulated arm. This affects investor protection and suitability.

AvaTrade has operated since 2006 and supports clients in over 150 countries. Account eligibility depends on tax residency, not just citizenship, which is standard across global brokers.

Is AvaTrade safe, regulated, and trustworthy?

AvaTrade is globally regulated and considered trustworthy, but it is not FCA authorised, which is a key consideration for UK traders.

Regulation

- Central Bank of Ireland

- ASIC Australia

- FSCA South Africa

- Other international regulators

Security measures

- Client funds held in segregated accounts

- Negative balance protection for retail clients

- SSL encryption and strict verification

Important UK note

- No FSCS protection

- UK traders do not receive UK-specific regulatory safeguards

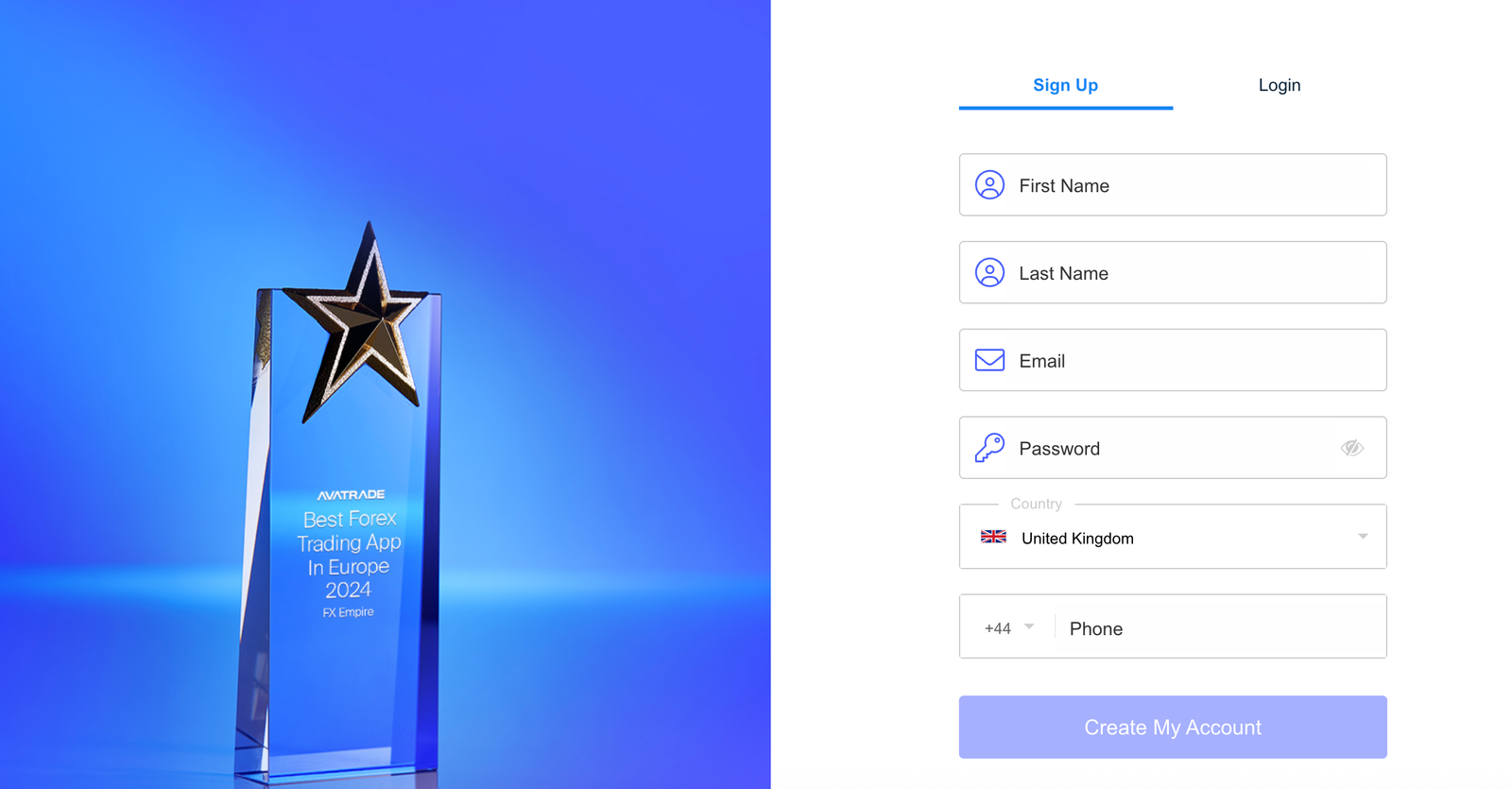

How easy is it to open an AvaTrade account?

Opening an account with AvaTrade is fast, fully online, and beginner-friendly, typically completed within 24 hours once documents are approved. The process is streamlined and comparable to leading CFD brokers.

Account opening steps

- Complete the online registration form

- Verify email and phone number

- Submit ID and proof of address

- Complete trading experience questionnaire

- Choose base currency such as GBP

There is a free demo account, which mirrors live market conditions and is one of AvaTrade’s strongest features for beginners.

What can you trade on AvaTrade?

AvaTrade is primarily a CFD and forex broker, offering leveraged trading rather than long-term investing in real assets. This makes it suitable for active traders, not buy-and-hold investors.

Available markets

- Forex CFDs: 50+ currency pairs

- Index CFDs: 30+ including FTSE 100, S&P 500

- Share CFDs: 600+ global stocks

- ETF CFDs: 60+

- Commodity CFDs: Gold, oil, silver and more

- Crypto CFDs: Restricted for UK retail clients

Not available

- Real shares or ETFs

- Stocks and Shares ISA

- SIPP or tax-wrapped accounts

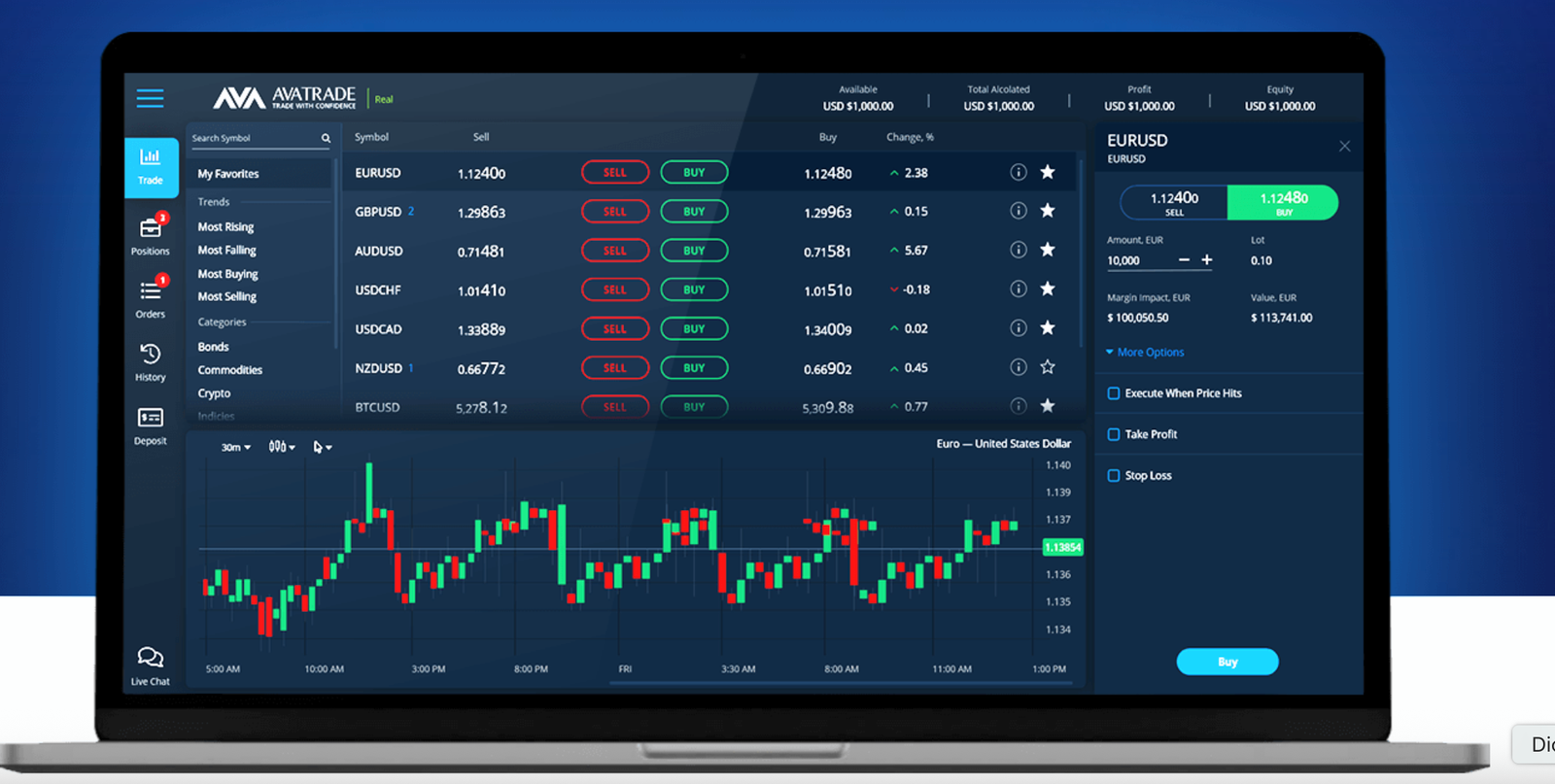

How good is the AvaTrade trading platform?

AvaTrade offers a strong platform lineup, particularly for traders who prefer MetaTrader or advanced tools. Platform choice is one of its key strengths.

Platforms available

- MetaTrader 4 and MetaTrader 5

- AvaTradeGO mobile app

- WebTrader browser platform

- AvaOptions for forex options

- Third-party copy trading: ZuluTrade and DupliTrade

A standout feature is AvaProtect, which allows you to insure specific trades against losses for a fee. This is rare among CFD brokers.

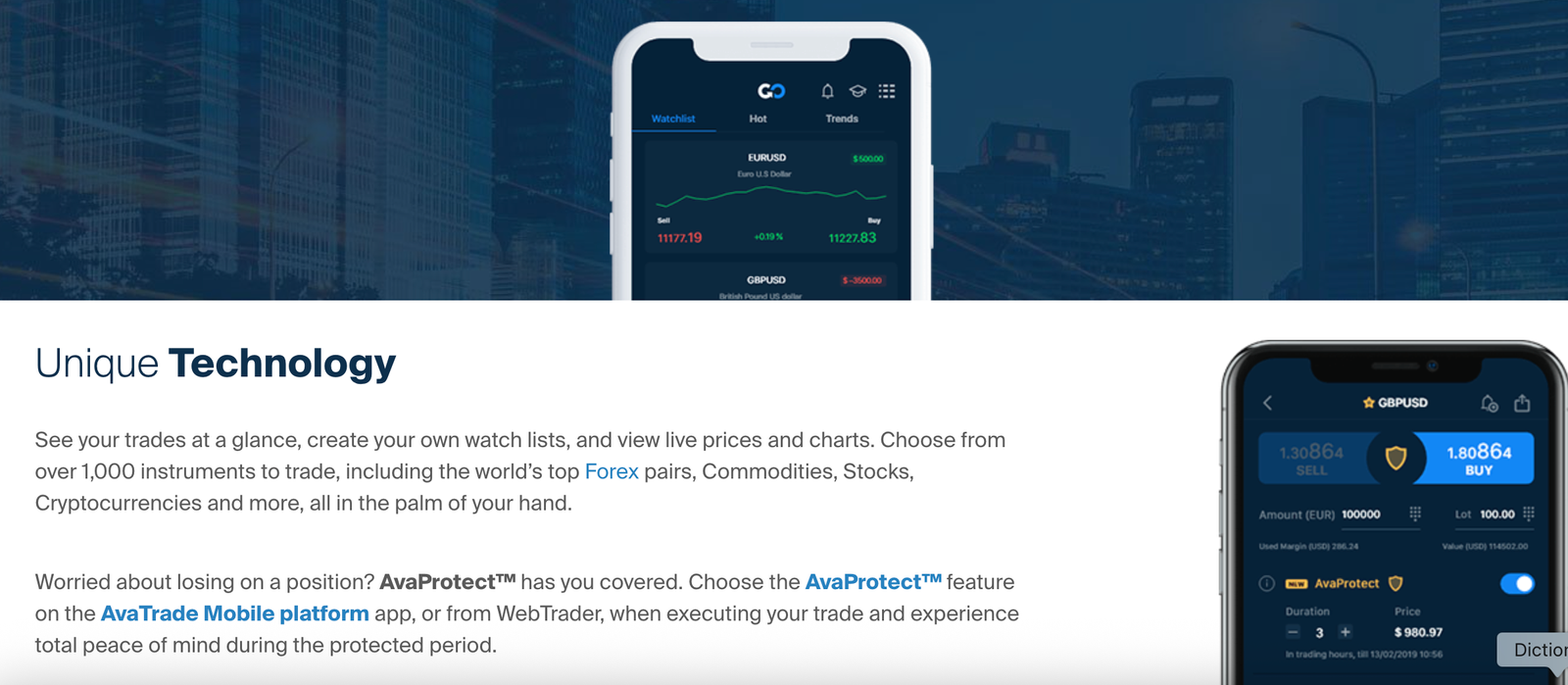

How good is the mobile trading experience?

The AvaTradeGO app is intuitive, stable, and well-designed for active traders. It mirrors the desktop experience closely and includes built-in risk tools.

Mobile highlights

- Fast execution and chart loading

- 90+ indicators

- Integrated stop-loss and take-profit tools

- AvaProtect available on mobile

Limitations

- No biometric login on some devices

- Less customisation than newer UK platforms

What fees and trading costs does AvaTrade charge?

AvaTrade uses a spread-only pricing model, meaning there are no separate trading commissions. Overall fees are competitive, though not the lowest in the market.

Typical spreads

- EUR/USD: ~0.8–1.2 pips

- S&P 500 CFD: ~0.5 points

- Gold CFD: ~0.37

Non-trading fees

- Minimum deposit: $100 or GBP equivalent

- Deposit fee: £0

- Withdrawal fee: £0

- Inactivity fee: £10 per quarter after 3 months

- Annual admin fee: £100 after 12 months inactive

The inactivity fee is one of AvaTrade’s biggest drawbacks for casual traders.

What account types does AvaTrade offer?

AvaTrade provides a small but practical range of account types, focused on CFD traders rather than investors.

Account options

- Standard retail trading account

- Professional account for eligible traders

- Demo account with virtual funds

- Islamic account (swap-free)

- Managed and copy trading accounts

There are no ISA or SIPP accounts, and all trading is taxable under UK rules.

How are trades executed on AvaTrade?

AvaTrade executes trades using a market maker model, meaning it sets prices internally rather than routing orders directly to an exchange. This allows for fixed spreads and fast execution, but it can increase slippage during volatile markets compared to agency-style brokers.

Execution and liquidity explained

- AvaTrade acts as the counterparty on CFD trades

- Prices are derived from underlying market liquidity providers

- Fixed spreads offer cost certainty

- Slippage can occur during major news events

Execution is reliable for most retail traders, but active scalpers and high-frequency traders may prefer FCA-regulated brokers with direct market access.

What risk management tools does AvaTrade offer?

AvaTrade provides strong risk controls, including standard order types and a unique trade-protection feature. These tools are essential because CFD trading involves leverage and rapid price movements.

Available risk management tools

- Stop-loss and take-profit orders

- Margin close-out protection

- Negative balance protection for retail clients

- AvaProtect, which insures specific trades against losses for a fee

AvaTrade does not offer guaranteed stop-loss orders. AvaProtect partially fills this gap but adds cost.

What leverage limits apply to UK traders using AvaTrade?

UK traders are subject to FCA leverage restrictions, even when trading with non-FCA brokers like AvaTrade. These limits are designed to reduce retail trading losses.

FCA leverage limits for UK retail traders

- 30:1 on major forex pairs

- 20:1 on indices, minor FX, and gold

- 5:1 on single-stock CFDs

- Crypto CFDs banned for UK retail clients

Leverage is capped for UK traders regardless of broker, limiting risk but also reducing potential position size.

How good is AvaTrade’s customer support?

AvaTrade offers 24/5 customer support via live chat, email, and phone. Support quality is generally reliable, with good response times during market hours.

Support features

- Live chat and email

- Multilingual support

- Large FAQ and help centre

- Strong onboarding assistance for beginners

Support is global rather than UK-based, which may matter to some users.

How does AvaTrade compare to other UK trading platforms?

Compared to UK-focused brokers, AvaTrade is better suited to international CFD traders than UK investors seeking regulation and tax efficiency.

| Platform | Regulation | Account types | Fees & spreads | Tax efficiency | Best for |

|---|---|---|---|---|---|

| AvaTrade | Not FCA authorised. Regulated by CBI and other global regulators | CFDs and forex only | Competitive spreads. Inactivity fee applies | No ISA. CFDs are taxable | International CFD traders and MetaTrader users |

| Spreadex | FCA authorised | Spread betting and CFDs | Tight spreads. No inactivity fee | Spread betting can be tax-free | UK traders wanting simplicity and FCA protection |

| IG | FCA authorised | Investing, CFDs, spread betting | Competitive but not the cheapest | ISA and spread betting available | All-round UK traders and investors |

| CMC Markets | FCA authorised | Investing, CFDs, spread betting | Very competitive pricing | ISA and spread betting available | Active traders and advanced charting |

| XTB | FCA authorised | Investing and CFDs | Commission-free shares. Low FX fees | No ISA. CFDs taxable | Beginners and low-cost investing |

Conclusion: Is AvaTrade worth using in the UK in 2026?

AvaTrade is a well-established global CFD and forex broker with strong platforms, solid education, and competitive spread-only pricing. It is trustworthy and well regulated internationally, but it is not FCA authorised, offers no ISA or FSCS protection, and charges inactivity fees, which limits its appeal for many UK traders.

FAQs

Is AvaTrade regulated in the UK?

No, AvaTrade is not authorised by the FCA. UK clients trade under AvaTrade’s Irish or international entities, regulated by bodies such as the Central Bank of Ireland and ASIC, which means FSCS protection does not apply.

Is AvaTrade safe to use?

Yes, AvaTrade is considered globally trustworthy, with regulation from multiple top-tier authorities, segregated client funds, and negative balance protection. However, UK traders should note the lack of FCA oversight and FSCS cover.

Does AvaTrade offer a demo account?

Yes, AvaTrade provides a free demo account with virtual funds. It mirrors live market conditions across platforms like MT4, MT5, and AvaTradeGO, making it suitable for beginners to practice without risking real money.

Does AvaTrade offer an ISA or tax-free trading?

No, AvaTrade does not offer a Stocks and Shares ISA or SIPP. All trading is done via CFDs, which means profits are taxable in the UK and must be reported to HMRC.

Can UK traders trade crypto on AvaTrade?

UK retail traders cannot trade crypto CFDs on AvaTrade due to FCA restrictions. Crypto CFDs are only available to professional clients who meet eligibility requirements.

Does AvaTrade charge inactivity fees?

Yes, AvaTrade charges an inactivity fee of £10 per quarter after 3 months of no trading activity, plus an annual administration fee of £100 after 12 months. This is a key downside for casual traders.

What do user reviews and complaints say about AvaTrade?

Most AvaTrade reviews are positive, highlighting platform stability, education, and MetaTrader support. Common complaints relate to inactivity fees, occasional withdrawal delays, and the lack of FCA regulation. There is no pattern of serious regulatory issues or unresolved client fund problem.

What leverage does AvaTrade offer to UK traders?

AvaTrade applies FCA-style leverage limits to UK retail traders, even though it is not FCA authorised. Leverage is capped at 30:1 on major forex, 20:1 on indices and gold, and 5:1 on single-share CFDs, helping limit downside risk when trading leveraged CFDs.

How do withdrawals work at AvaTrade and are they reliable?

AvaTrade withdrawals are generally reliable and fee-free, with most requests processed within 1–3 business days. Withdrawals must be made using the same method as the deposit where possible. While advertised as fast, some users report slightly slower processing during busy periods.

What is the minimum deposit at AvaTrade?

The minimum deposit at AvaTrade is $100 or the GBP equivalent, making it accessible for new traders. This applies to standard retail accounts and is lower than many professional-grade CFD brokers, though higher than some beginner-focused UK investing apps.