AJ Bell is one of the UK’s most established investment platforms, known for low-cost funds, clear fees and strong regulation under the FCA.

In this review we go over AJ Bell’s fees, tools, account types and safety features to help you decide whether it suits your investing needs.

We also compare key alternatives so you can choose confidently.

Is AJ Bell good for beginners?

Yes, AJ Bell is generally good for beginners because it offers a simple interface, low-cost funds and clear, transparent fees.

Its educational content and easy account setup help new investors get started quickly. However, its research tools are more basic than some rivals, so complete beginners may still prefer platforms with guided portfolios.

Quick verdict: how do we rate AJ Bell for UK investors in 2026?

Overall rating: 4.2 / 5

AJ Bell scores highly for trust, reliability and long-term investing, with strong FCA regulation, excellent customer satisfaction and one of the UK’s widest investment ranges. Fees are competitive for ISAs and SIPPs, though not ideal for frequent share traders. Its platform is user-friendly but not advanced.

Overall, AJ Bell remains one of the best all-round UK investment platforms for long-term investors.

AJ Bell full score breakdown (2026)

| Category | Score | Reason |

|---|---|---|

| Security & Trust | 5 | FCA regulated, FSCS protected, publicly listed, long track record, excellent customer confidence. |

| Fees & Pricing | 4 | Competitive platform fees and strong value for large portfolios, but £5 share dealing and £1.50 fund fees hold it back. |

| Features | 4 | Huge investment range, ready-made portfolios, strong research and education. Missing fractional shares and advanced tools. |

| Ease of Use | 4 | Clean, intuitive platform ideal for beginners and long-term investors, though the app is basic for traders. |

| Customer Support | 4 | UK-based, responsive, strong satisfaction scores. Occasionally slow during peak periods. |

| Reputation | 5 | One of the UK’s most established platforms; Which? Recommended Provider; consistently high user ratings |

AJ Bell at a glance

Key features

- FCA regulated and FSCS protected up to £85,000

- Over 24,000 investment options, including funds, shares and ETFs

- Platform fee starts at 0.25% and drops as your portfolio grows

- Share dealing costs £5 per trade, or £3.50 for frequent traders

- Fund dealing costs £1.50 per trade (AJ Bell funds are free)

- Minimum investment is £500 upfront or £25 monthly

- Ready-made portfolios and pension accounts available

- Dodl app offers a simpler, lower-cost investing option

Pros and cons

Pros

- Very trustworthy platform with a strong track record and high customer confidence

- Huge choice of investments, giving you plenty of flexibility in how you build a portfolio

- Pricing structure is transparent, making it easy to understand what you’re paying for

- Helpful educational resources and regular webinars that genuinely support learning

- Smooth, dependable user experience on both the investment app and desktop platform

Cons

- £1.50 fee for fund trades is higher than some rivals

- £5 per share trade can be pricey for frequent or small trades

- No access to fractional shares

- Tools aren’t as advanced as those on dedicated trading apps

What is AJ Bell best for?

- Long-term investors who want tax-efficient ISAs, LISAs and pensions

- Fund investors who want low ongoing platform fees

- Hands-on investors who want to pick their own shares or ETFs

- Large portfolios, because fees fall at higher balances

- Beginners who want strong education and ready-made portfolios

- Those wanting reliability, FCA protection and an established brand

Is AJ Bell any good?

Yes. AJ Bell is a strong, well-rounded UK investment platform with low ongoing fees, a huge investment range and solid FCA-regulated protection.

It’s particularly good for ISAs and SIPPs, with consistently high customer satisfaction. While not the cheapest for frequent traders, it offers excellent value for long-term investors.

AJ Bell is a “Which? Recommended Provider for 2025–26”, scoring 78% and ranking joint 2nd out of 25 ISA providers.

Its biggest strength is choice: over 24,300 investments, the widest range in the Which? review. Great for investors who want flexibility, though total beginners may find the range a bit overwhelming.

How regulated and trustworthy is AJ Bell in the UK?

AJ Bell is fully FCA authorised and client assets are protected by the FSCS up to £85,000 per person if the platform fails.

It is publicly listed, has a long track record, strong financials and consistently high customer ratings, making it one of the UK’s most trusted platforms.

What can you invest in with AJ Bell?

AJ Bell has one of the largest investment ranges in the UK, making it popular with investors who want flexibility.

Investment types

- 4,480 funds (OEICs, multi-asset funds)

- 381 investment trusts

- 3,810 ETFs

- 15,430 global shares

- 135 bonds & 93 gilts

- Ready-made portfolios

Account types

- Stocks and Shares ISA (not flexible)

- General Investment Account

- Self-Invested Personal Pension (SIPP)

- Junior ISA

- Junior SIPP

- Lifetime ISA

- Income drawdown

- Cash savings account

This extensive coverage makes AJ Bell suitable for both simple passive portfolios and large, diversified portfolios.

How much does AJ Bell cost to use?

AJ Bell charges 0.25% on the first £250k of your portfolio, 0.10% between £250k–£500k and 0% above £500k. Share trades cost £5 or £3.50 for frequent traders. Fund trades cost £1.50. FX fees range from 0.75% to 0.25% based on trade size. Costs are competitive for long-term investing but less so for frequent traders.

Pricing summary

| Cost type | Fees |

|---|---|

| Platform fee (on funds & ready-made portfolios) | 0.25% on £0–£250k |

| 0.10% on £250k–£500k | |

| 0% above £500k | |

| Share dealing | £5 per trade (or £3.50 for frequent traders) |

| Fund dealing | £1.50 per trade (AJ Bell funds are free) |

| FX fees (foreign shares) | 0.75% → 0.25% (lower for larger trade sizes) |

| Minimum investment | £500 lump sum or £25/month |

| Account fees | No ISA/SIPP setup fees |

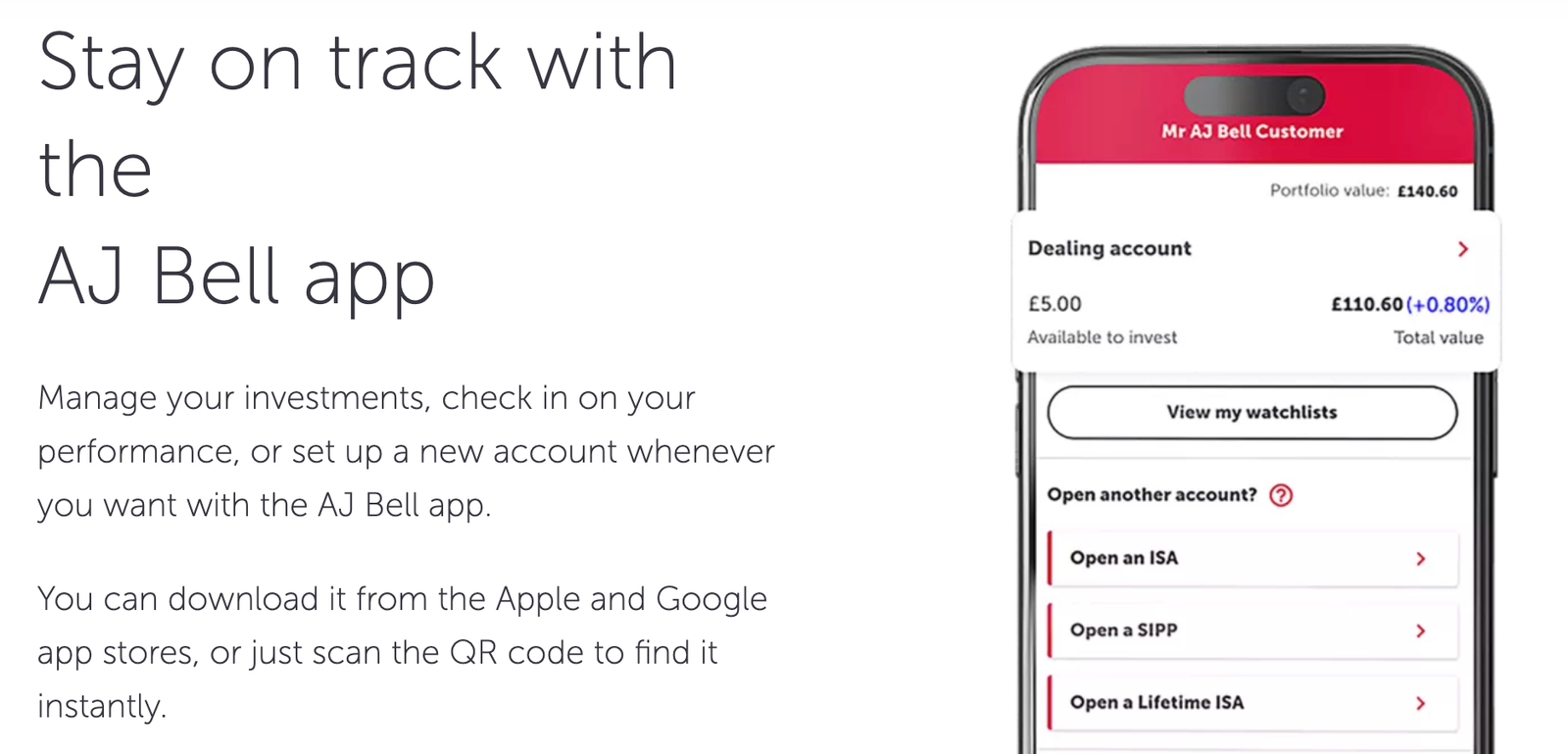

How good is AJ Bell’s trading platform and mobile app?

AJ Bell’s trading platform is reliable, intuitive and built for long-term, buy-and-hold investors rather than active traders. It supports watchlists, price alerts, straightforward order placement and clear portfolio tracking.

The mobile app mirrors the simplicity of the desktop platform, making it easy to check balances, place trades and automate regular investing.

However, its charting tools, research filters and screeners are basic compared with advanced trading platforms, and it does not offer features like fractional shares or in-depth technical analysis.

Overall, the platform focuses on clarity and convenience, making it well suited to beginners and cost-conscious investors, but less ideal for traders who need sophisticated tools.

How good Is AJ Bell’s customer support?

AJ Bell is consistently rated as having responsive and helpful customer service. Support is UK-based and reachable via:

- Phone

- Secure online messaging

- Extensive online help centre

Users report quick response times and friendly support agents. During peak periods, support may experience delays, but satisfaction is generally high.

What unique features does AJ Bell offer UK users?

AJ Bell stands out with:

- One of the UK’s widest investment ranges

- Ready-made fund portfolios

- Morningstar sustainability filters for ethical investing

- Dodl: a low-cost beginner-friendly app at 0.15%

- Weekly “Money & Markets” podcast and extensive investor education

These features make the platform appealing to both learners and independent investors.

How easy is it to open an account and start trading?

Opening an AJ Bell account takes around 10 minutes. You verify identity online, fund your account via bank transfer or debit card, and can start investing immediately once cash clears. The process is smooth and designed for beginners.

How do deposits and withdrawals work on AJ Bell?

Deposits can be made with bank transfer, Faster Payments or debit card, and funds usually appear the same day. Withdrawals take 1–3 working days to reach your linked bank account. Security checks apply each time you withdraw funds.

AJ Bell vs competitors (quick comparison)

| Feature | AJ Bell | Hargreaves Lansdown | InvestEngine | Trading 212 |

|---|---|---|---|---|

| Platform Fee | 0.25% → 0% | 0.45% | 0% | 0% |

| Share Trading | £5 | £11.95 | N/A | £0 |

| Fund Trading | £1.50 | £0 | 0% | N/A |

| Fractional Shares | No | No | No | Yes |

| Best For | ISAs & SIPPs | Research & support | Low-cost ETF investing | Frequent small trades |

AJ Bell is cheaper than HL for most portfolios, more flexible than InvestEngine, but pricier than Trading 212 for share dealing.

AJ Bell UK limitations

- £1.50 fund dealing fee uncommon among competitors

- £5 share dealing may deter active traders

- No fractional shares

- No crypto or derivatives

- App tools are simpler than trading-focused platforms

Is AJ Bell right for your investing style?

AJ Bell is a strong match for investors who want reliability, extensive asset choice and transparent fees. It works best for long-term investing in ISAs and SIPPs, with good value for fund investors and medium-to-large portfolios.

It may not be ideal if you:

- Trade frequently

- Rely heavily on advanced charting

- Want fractional shares

- Prefer ultra-low-cost, minimalist apps

In those cases, cheaper or more simplified platforms may suit you better.

Conclusion

AJ Bell is one of the UK’s strongest all-round investment platforms, combining competitive fees, exceptional investment choice and FCA-regulated safety.

It works best for long-term investors using ISAs, LISAs or SIPPs and those wanting the support of high-quality research and education.

While not ideal for frequent traders or fractional-share investors, AJ Bell offers excellent value for most UK investors seeking a reliable, transparent and well-established platform.

FAQs

Is AJ Bell.co.uk legit?

Yes. It is FCA regulated, LSE-listed and FSCS protected.

Can I trust AJ Bell?

Yes. It has 25+ years of history, strong customer scores and robust security.

Is AJ Bell UK based?

Yes. It is headquartered in Manchester and operates exclusively under UK regulation.

Are AJ Bell fees high?

Not usually. Platform fees are competitive, though £5 trades and £1.50 fund fees can be high for frequent traders.

Does AJ Bell offer crypto?

No. AJ Bell currently offers no crypto or derivatives.

How much do I need to start?

You can start investing with AJ Bell from £500 as a lump sum or £25 per month if you prefer regular contributions. Both options give you access to the full range of accounts and investments.