Investing in REITs in the UK is one of the simplest ways to access property income without buying a physical home.

This guide explains how REITs work, the steps to invest, the risks, fees and UK tax rules to know in

2026.

By the end, you’ll understand exactly how to choose and buy REITs using FCA-regulated platforms.

Key takeaway: How to invest in REITs in the UK?

To invest in REITs in the UK, use an FCA authorised investment platform, buy UK listed REIT shares or REIT ETFs, hold them in a Stocks and Shares ISA for tax efficiency, and invest for income and diversification rather than short term gains.

What is a REIT and how do they work in the UK?

A UK REIT is a property investment company that owns or finances real estate and pays out at least 90% of rental profits to investors.

REITs avoid double taxation, are exempt from corporation tax on rental income and property gains, and let investors access property income without buying a physical building.

A REIT works similarly to a property fund: investors buy shares, the trust manages properties, collects rent, and distributes income (called Property Income Distributions, or PIDs).

REITs must invest at least 75% of assets in property and earn 75% of income from rent, mortgage interest, or property sales.

Key features of UK REITs

- No corporation tax on rental income or property gains.

- Must pay out 90% of net rental income annually.

- Income paid as PIDs, taxed as property income.

- Listed or non-listed REITs allowed (post-2022 rule changes).

- Can own a single commercial property worth £20m+, or three smaller properties.

- Must meet the non-close company test, with recent relaxations for institutional investors.

Why REITs exist

REITs remove the double taxation that occurs when property is held inside a corporation by shifting tax to the investor level.

This makes them particularly attractive for pension funds, ISAs, SIPPs, and institutional investors who can receive gross returns.

Why invest in REITs in the UK?

Investing in REITs lets UK investors access commercial and residential property income with low costs, high liquidity, and strong governance.

REITs often provide higher dividend yields than many UK shares, and income can be sheltered in an ISA or SIPP.

REITs are also popular because UK property markets offer long-term rental stability.

Many REITs own essential infrastructure, logistics centres, housing, or healthcare property, sectors less sensitive to economic downturns.

Key investor benefits

- High dividends: legally required 90% payout of rental profits.

- Diversification: access to offices, warehouses, student housing, logistics, retail, healthcare.

- Low entry cost: invest from as little as £25–£50 via ETFs or platforms.

- Liquidity: buy/sell instantly on the London Stock Exchange.

- Tax efficiency: can be held tax-free in an ISA or SIPP.

- No property management duties and professional tenant selection.

What types of REITs can you invest in?

There are many types of REITs, each focused on different property sectors.

Beginners usually start with equity REITs through UK-listed companies or ETFs.

Equity REITs (most common)

Own physical buildings. Earn money from rent and property value growth.

Examples include:

- Logistics (e.g., SEGRO, Tritax Big Box)

- Retail property

- Offices

- Residential and student housing

- Healthcare facilities

- Industrial storage and warehouses

- Hospitality and leisure

- Data centres and infrastructure

Mortgage REITs (mREITs)

Invest in mortgages and loan financing rather than buildings. They earn interest but carry higher risk and are more sensitive to interest rates.

Specialist REITs

Useful for diversification.

Includes:

- Data centre REITs

- Self-storage REITs

- Healthcare REITs

- Infrastructure REITs

- Hotel REITs

How do REITs generate returns for UK investors?

REITs generate returns from income and capital growth. Most UK investors buy REITs for income stability.

Income (dividends)

REITs generate rental income and must distribute 90% of it. Investors receive Property Income Distributions (PIDs), which mimic rental income.

Capital growth

The value of REIT shares rises if:

- The underlying properties grow in value

- Rents rise

- Vacancies fall

- Sector conditions improve

- NAV (Net Asset Value) increases

NAV (Net Asset Value)

NAV = total property value minus debts.

If a REIT is trading below NAV, shares may be “cheap”, but discounts can reflect risk (vacancies, leverage, refinancing concerns).

How to invest in REITs in the UK (step by step)

The easiest way to invest in REITs in the UK is through an ISA, SIPP, or general investment account on an FCA-regulated investment platform. Here are the steps.

Step 1: Choose how you want to invest

You can invest in REITs via:

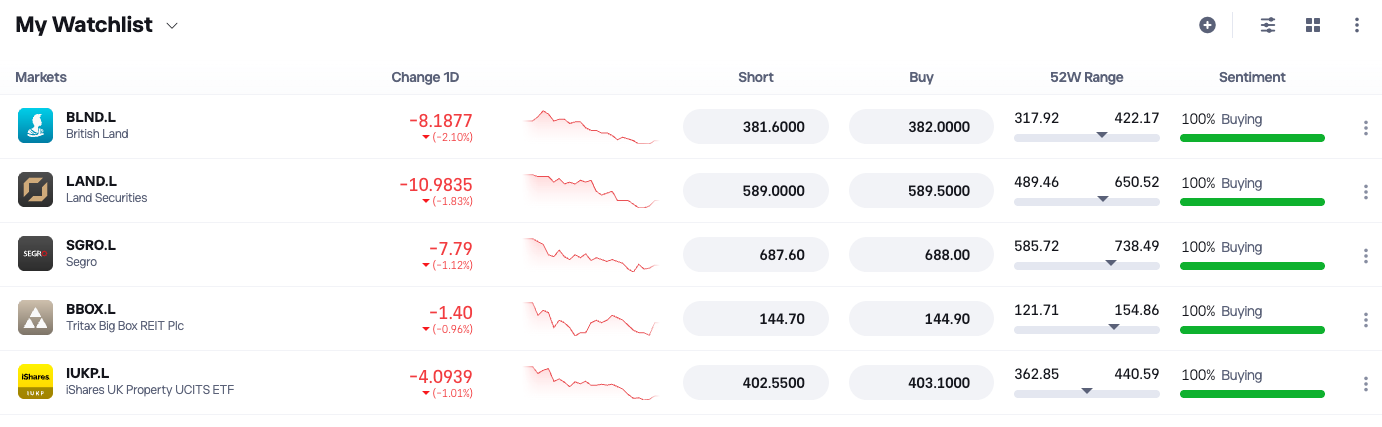

- Individual REIT shares (e.g., SEGRO, British Land, Land Securities Group).

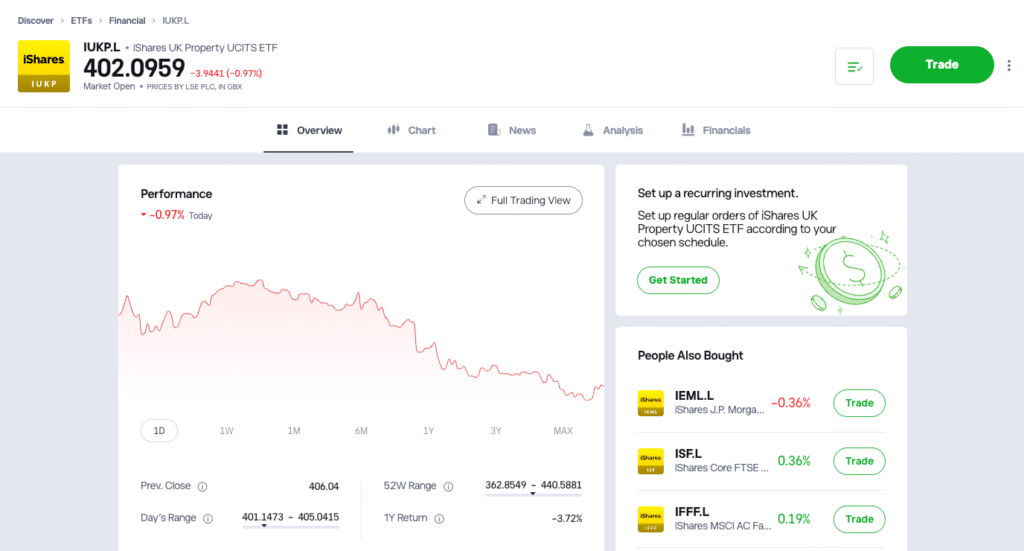

- REIT ETFs (diversified baskets of REITs like iShares UK Property UCITS ETF and Vanguard REIT ETF)

- Active funds specialising in global or sector-specific REITs.

Beginners typically start with REIT ETFs because they reduce single-property or single-sector risk.

Step 2: Choose an FCA-regulated UK platform

UK-approved platforms commonly used for REITs include:

- eToro – Best for beginners and simple REIT ETF investing

- IG – Best for broad REIT market access

- XTB – Low-cost REIT ETF access

- AJ Bell – Suitable for ISAs and SIPPs

- InvestEngine – Best for low-cost ETF-only portfolios

Cash on these platforms is FSCS-protected up to £85,000, but investments are not protected from market losses.

Step 3: Open an account

You’ll need to:

- Sign up

- Verify identity (KYC)

- Add a UK bank account

- Deposit via bank transfer, Faster Payments, or debit card

Step 4: Search for your chosen REIT or REIT ETF

Examples:

- LON: SGRO – SEGRO

- LON: LAND – Land Securities

- IUKP.L – iShares UK Property ETF

- GLRE – Global REIT exposure ETF

Step 5: Place a buy order

Choose:

- How much you want to invest

- Whether to place a market or limit order

- Whether to hold inside an ISA or SIPP for tax efficiency

Step 6: Monitor your investment

Track:

- Dividend yield

- NAV discounts/premiums

- Vacancy rates

- Leverage (LTV ratio)

- Sector conditions (e.g., logistics vs. office market)

Which platforms are best for investing in REITs in the UK?

Each platform offers different fees, tools, and account types. Here’s a simple comparison.

REIT platform comparison (ISA-compatible)

| Platform | Platfrom fee | REIT access | Best for |

|---|---|---|---|

| eToro | £0 | UK & global REIT ETFs | Beginners |

| IG | 0–0.1% | Very wide REIT choice | Research tools |

| XTB | £0 | ETF-focused REIT access | Low fees |

| AJ Bell | 0.25% | Strong REIT coverage | ISAs & SIPPs |

| InvestEngine | £0 | ETF-only REIT options | Long-term passive |

All listed investment apps are FCA-authorised.

What are the costs of investing in REITs?

REIT investing in the UK includes platform fees, fund charges, and sometimes trading costs.

Always check the OCF (Ongoing Charge Figure) of ETF products.

Typical REIT investment costs

- ETF OCF: 0.1%–0.5%

- Platform fee (ISA/SIPP): 0%–0.25%

- Stamp Duty: none on REIT ETFs; 0.5% on UK REIT shares

- Trading fee: £0–£11 depending on broker

- Currency conversion: if buying non-UK REITs

What are the risks of investing in REITs?

REITs offer stable income but still carry risk. Understanding these risks helps set realistic expectations.

Market and property risk

Property values can fall during downturns. Sectors such as offices or retail may be vulnerable to long-term structural change.

Interest rate risk

Higher interest rates increase borrowing costs and reduce REIT valuations. REITs with high leverage (LTV > 40%) are especially exposed.

Tenant risk

REIT income depends on tenants paying rent. Vacancies or tenant failures reduce income.

Economic shocks

Covid-19 was a key example:

- Healthcare REITs benefited

- Retail REITs struggled

- Hospitality REITs saw sharp valuation drop

Liquidity and discount risk

REIT share prices can trade below NAV if investors are pessimistic. Discounts do not guarantee value.

How are REITs taxed in the UK?

UK REIT taxation is simple once you understand PIDs and account wrappers.

Property Income Distributions (PIDs)

PIDs are taxed as property income, not dividends. They normally have 20% withholding tax applied.

Holding REITs in ISAs and SIPPs

- ISA: No tax on income or gains

- SIPP: No tax on income or gains

- Withholding tax normally reclaimed automatically in a SIPP

Most UK investors hold REITs inside ISAs for simplicity.

Capital Gains Tax

You pay CGT only if you sell REIT shares for a profit outside an ISA/SIPP and exceed the annual allowance.

What are the most popular REITs in the UK?

Here are the largest UK REITs by market capitalisation.

Major UK REITs

- SEGRO (SGRO) – industrial/logistics

- Land Securities (LAND) – offices, retail, mixed use

- Unite Group (UTG) – student accommodation

- LondonMetric Property (LMP) – logistics and warehousing

- British Land (BLND) – offices and prime retail

Should beginners invest in REITs in 2026?

REITs can be a suitable beginner investment if you want passive property income, long-term diversification, and exposure to essential sectors like logistics or residential property.

They are liquid, easy to buy, and tax-efficient in an ISA.

However, they can fall sharply in downturns and are sensitive to interest rate changes.

For most investors, REITs should form part of a diversified portfolio, not the entirety of it.

*New to investing? Read our Investing for Beginners guide for a simple, step by step introduction before you start investing.

FAQs

Are REITs a good investment in the UK?

REITs can be a good option for income-focused investors because they pay out 90% of rental profits and offer diversified property exposure. They still carry risks such as interest rate sensitivity, sector downturns and tenant defaults.

How do beginners invest in REITs?

Beginners can buy REITs through an FCA-regulated investment platform by investing in individual REIT shares or low-cost REIT ETFs. Most people start with ETFs to spread risk.

Which is the best REIT in the UK?

There is no single “best” REIT, because it depends on your strategy. Popular choices include SEGRO (logistics), Tritax Big Box (warehouses), Unite Group (student housing) and British Land (offices and retail).

How are REITs taxed in the UK?

REIT income is paid as Property Income Distributions (PIDs) and taxed as property income. Inside an ISA or SIPP, PIDs are tax-free, making these wrappers the most efficient way to hold REITs.

What is the tax on REIT dividends in the UK?

PIDs generally have 20% withholding tax applied automatically. This can be avoided in an ISA and reclaimed in many SIPPs. Outside tax wrappers, PIDs are taxed at your income tax rate.

Which UK REITs pay monthly?

Most UK REITs pay quarterly, but a few specialist or smaller REITs may offer monthly income. Always check the distribution schedule on your platform before investing.

What are the disadvantages of UK REITs?

Key drawbacks include sensitivity to interest rates, sector-specific risks (like offices or retail), limited growth due to the 90% payout rule, and potential declines in property values during economic downturns.

Is British Land a REIT?

Yes. British Land (BLND) is one of the UK’s largest REITs, focused on offices, retail parks and urban mixed-use developments.