Investing in gold in the UK is simple once you understand the safest ways to buy it, the costs involved, and how each option is regulated.

This beginner guide explains how to invest in physical gold, gold ETFs, and digital gold using secure, UK-regulated platforms.

You’ll learn the steps, risks, and key considerations so you can invest confidently in 2026.

Key takeaway: How to invest in gold in the UK?

To invest in gold in the UK, choose an FCA authorised platform, decide between physical gold, gold ETFs, or gold related funds, consider costs and tax treatment, and invest for diversification rather than short term speculation.

Why invest in gold in the UK?

Investing in gold can help diversify your portfolio, protect wealth during uncertainty, and act as a potential inflation hedge when cash and bonds lose purchasing power.

Gold often behaves differently from shares, which means it can reduce overall risk, though it still carries volatility and does not produce income.

Gold’s long-standing reputation as a store of value makes it popular with UK investors seeking stability. Analysts highlight that gold behaves independently of many traditional assets, which helps cushion portfolios during stress.

According to IG’s Chris Beauchamp, gold “moves differently from shares and bonds”, providing useful diversification when markets fall.

This defensive quality is why many investors add a small allocation of gold, particularly during periods of political, economic, or market instability.

Rising inflation has also boosted interest. AJ Bell’s Laith Khalaf notes that gold’s scarcity and durability support its appeal as a long-term inflation hedge.

Surveys from BullionVault show that diversification and inflation protection are the top reasons UK investors turn to gold, with over-50s adopting it at the fastest rate.

Older investors often have more capital to safeguard, and gold’s defensive qualities resonate strongly during global shocks, wars, and geopolitical tensions.

However, while gold can strengthen your portfolio, it shouldn’t be mistaken for a guaranteed winner. Prices rise and fall sharply, and there is no promise that gold will match or beat inflation over time.

Gold works best when used wisely as one component of a diversified portfolio, rather than a standalone investment.

How has the gold price performed recently?

Gold has delivered strong returns in recent years, rising sharply during inflationary periods and global crises.

But its long-term performance is uneven, with large peaks and deep corrections. This mix of resilience and volatility means investors should expect fluctuations rather than consistent growth.

Gold vs UK Shares: Annual Performance (%)

| Year | Gold Price (%) | UK Shares (%) |

|---|---|---|

| 2022 | 11.7 | 0.3 |

| 2023 | 7.8 | 7.9 |

| 2024 | 28.3 | 9.5 |

| YTD | ~20 | ~7–10 (varies by index) |

Historical returns demonstrate how unpredictable gold can be. BullionVault data shows annual swings from a 113% surge in 1979 to a 29% loss in 2013.

Gold lagged throughout the 1980s and 1990s, delivering an average annual decline of 0.7% in sterling terms. But since 2000, it has performed strongly, rising 11.7% per year on average and outperforming UK shares, bonds, and property over the same period.

The recent run has been especially strong. Gold rose 11.7% in 2022, 7.8% in 2023, and 28.3% in 2024, supported by war, inflation, and central bank buying.

In %currentyear%, the price has continued upward, rising around 20% year-to-date for UK investors (at the time of writing), although it remains below its April record high of £2,610 per ounce.

These sharp moves underline gold’s role as a safe-haven asset during global disruption, but also why analysts warn against assuming it will always rise. Gold has experienced deep drops too: it fell over 60% between 1980–1982 and nearly 45% between 2011–2015.

For some investors, these long periods underwater can be discouraging and highlight the need for a balanced approach.

Key takeaway: Gold has outperformed UK shares in three of the last four years, driven by inflation, war, and geopolitical instability. However, it also experiences deep multi-year drawdowns.

What are the risks and drawbacks of investing in gold?

Gold can strengthen a portfolio, but it comes with clear limitations: it produces no income, can be volatile, and incurs storage or fund fees depending on how you invest. Investors should view gold as a diversifier rather than a growth asset or risk-free investment.

The biggest drawback is that gold does not generate any yield. Unlike shares (which may pay dividends) or cash (which earns interest), gold provides no passive income.

RBC Brewin Dolphin’s John Moore stresses that gold has “no fundamental yield benchmark”, meaning investors rely entirely on price movements to generate returns.

Gold also carries a cost of ownership. Physical gold requires safe storage and insurance, while vaulted gold and gold-backed funds include platform or storage charges. These ongoing costs can reduce returns.

Gold is also more volatile than many assume. While seen as a haven, it can fall sharply during long recoveries or periods of rising interest rates. Growth-focused investors may find gold too cautious compared to shares, particularly when equity markets are performing well.

Analysts agree that gold works best as a small allocation within a wider investment mix rather than a core holding.

Is gold exempt from inheritance tax in the UK?

Physical gold held personally is usually subject to inheritance tax because it forms part of your estate.

The main exception is gold held within certain pensions, which may be exempt under current rules, though planned changes from April 2027 will restrict this.

If you want to pass on gold during your lifetime, you can use standard HMRC gifting allowances. Giving gold sovereigns or Britannias as gifts can fall under the £3,000 annual gifting allowance, or may qualify as regular gifts out of income.

Gold can also be given as a marriage gift without triggering a tax charge. However, selling gold at a profit may create a Capital Gains Tax (CGT) liability unless you hold CGT-exempt UK coins.

What affects the price of gold?

Gold prices rise and fall based on interest rates, inflation, geopolitical tension, supply, investor demand, and currency movements.

The price typically climbs when uncertainty increases or when returns from cash and bonds are lower, but many factors interact simultaneously.

Key drivers include:

- Inflation: Rising prices increase gold demand as a store of value.

- Interest rates: Gold often rises when rates fall because the opportunity cost of holding gold decreases.

- US dollar strength: Gold is priced in dollars, so a weak dollar usually pushes prices higher for international buyers.

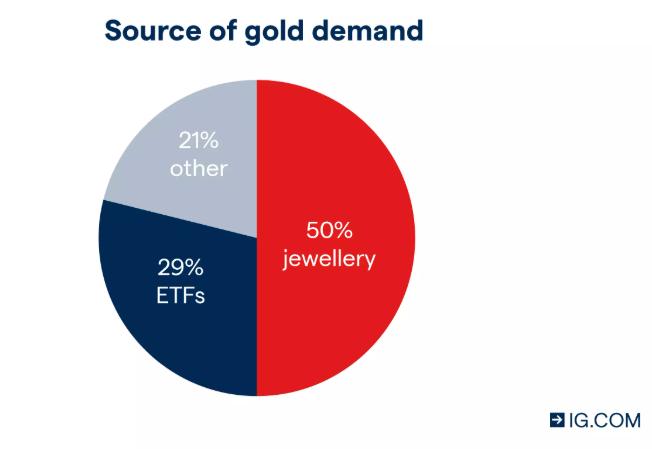

- Jewellery and consumption demand: Seasonal and cultural buying can influence global prices.

- Mining supply: Lower production and recycling levels create price pressure.

- Geopolitics: Wars, elections, trade disputes, or economic shocks increase safe-haven buying.

- Central bank purchases: Large-scale buying, particularly by emerging markets, can support prices.

Gold is priced through a global benchmark process known as the London Bullion Market Association (LBMA) Gold Price, set twice daily by major banks. This ensures transparency, although the market can still react quickly to world events.

Gold price drivers

| Factor | How it moves gold | Why it matters |

|---|---|---|

| Interest rates | Lower rates often lift gold | Reduced opportunity cost of holding gold |

| Inflation | High inflation boosts demand | Gold stores value better than cash |

| US Dollar | Weaker dollar raises prices | Gold is priced in USD |

| Geopolitics | Instability raises gold demand | Seen as a crisis hedge |

| Central bank buying | Increases global demand | Strong long-term support |

| Mining supply | Lower supply increases prices | Limited availability boosts scarcity value |

What is the difference between allocated and unallocated gold?

Allocated gold means you own specific gold bars or coins stored in a secure vault under your name, offering high security but higher storage fees.

Unallocated gold is cheaper because you hold a claim on pooled gold reserves rather than individual bars, but it carries counterparty risk.

Allocated gold gives you full legal ownership of identified bullion. It sits off the provider’s balance sheet, offering strong protection even if the provider fails.

However, greater security comes with higher storage and insurance charges.

Unallocated gold, by contrast, is more like a bank deposit backed by gold reserves. It is cheaper and highly liquid but relies on the provider’s financial strength.

Investors choose unallocated gold for convenience and cost efficiency, though with slightly higher risk.

What are the pros and cons of gold as an investment?

Gold offers stability, diversification, and inflation protection, but it lacks reliable growth and regular income.

It can help reduce portfolio risk during market stress, but its long-term returns depend heavily on timing.

Advantages

- Inflation resilience: Gold has historically held its value when currencies weaken.

- Store of wealth: Gold can preserve purchasing power during extreme downturns.

- Portfolio diversifier: Gold is often uncorrelated or inversely correlated to shares.

- Portable and globally recognised: Physical gold can be moved or stored internationally.

- Various forms available: Investors can choose physical, digital, or market-based gold.

Disadvantages

- No dividends or interest: Returns rely solely on price movements.

- Long stagnation periods: Gold can go years without meaningful growth.

- Volatility: Sharp drops are common.

- Storage and insurance costs: Physical and vaulted gold require secure storage.

- CGT and tax considerations: Some gold is taxable unless held in specific exempt forms.

Gold can serve as a hedge against downturns but should not be expected to outperform equities over long periods.

For most investors, a 5–10% allocation is typically suggested for diversification, though the right amount depends on your goals and risk tolerance.

Do you pay VAT and capital gains tax on gold in the UK?

Most investment-grade gold bullion is VAT exempt in the UK, meaning you don’t pay VAT when buying qualifying gold bars or coins.

But Capital Gains Tax may apply when you sell gold at a profit unless you’re holding specific CGT-exempt UK coins.

Gold bars and most gold bullion products are exempt from VAT under UK law. However, gains on gold may be taxable.

The CGT allowance is £3,000 for the 2025/26 tax year. Gains above this level are taxed at 18% for basic-rate taxpayers and 24% for higher/additional-rate taxpayers.

The key exception is gold coins classed as legal tender, such as Sovereigns and Britannias, which are CGT-free.

Digital gold, gold ETCs, and gold mining shares may also create CGT liabilities depending on your account type. Holding ETCs inside an ISA or SIPP can eliminate CGT entirely.

How can you invest in gold in the UK?

You can invest in gold through physical gold, vaulted bullion, gold ETCs, gold mining shares, and digital gold platforms.

The best option depends on your budget, storage preferences, risk tolerance, and whether you want direct ownership or simple market exposure.

Below is a breakdown of the main choices.

Physical gold (coins and bars)

Best for: investors who want direct ownership of gold.

Pros

- Tangible asset you fully control.

- Sovereigns and Britannias are CGT exempt.

- No counterparty or fund risk.

Cons

- Requires storage and insurance.

- Higher purchase premiums.

- Cannot be held in ISAs.

Physical gold appeals to investors who want full control and reassurance. But premiums, security costs, and buying logistics make it less suitable for beginners.

How to buy physical gold (coins & bars)

- Choose a reputable dealer (e.g., Royal Mint).

- Decide between coins (CGT-free) or bars.

- Compare premiums and purity (look for 999.9 fine).

- Purchase online or in person.

- Arrange secure storage or vaulting.

- Keep purchase receipts for CGT and insurance records.

Vaulted bullion

Best for: hands-off investors who want secure storage without handling gold.

Pros

- Professionally stored in secure vaults.

- Ability to buy small portions, even 1 gram.

- No need for home insurance or safes.

Cons

- Annual storage fees based on gold value.

- Not eligible for ISAs.

- Smaller liquidity fees may apply.

Vaulted gold removes the hassle of storage, but ongoing costs make it more suitable for medium- to long-term investors.

Exchange Traded Commodities (Gold ETCs)

Best for: low-cost, quick exposure to gold price movements.

Pros

- Easy to buy and sell like shares.

- Very low fees, typically around 0.2% per year.

- Most ETCs can be held in ISAs and SIPPs.

Cons

- You don’t own physical gold.

- Tracking depends on ETC structure.

- Requires a brokerage account.

Gold ETCs are the simplest and most tax-efficient way for UK investors to gain exposure, especially inside an ISA.

How to buy gold ETCs (ISA/SIPP eligible)

- Open an FCA-regulated investment platform (AJ Bell, IG, eToro, XTB).

- Choose an ISA, SIPP, or general account.

- Search for your preferred gold ETC (e.g., SGLN, IGLN).

- Place a market or limit order.

- Monitor fees and track the price.

- Review holdings annually as part of your diversification strategy.

Gold mining shares or funds

Best for: growth-focused investors comfortable with stock market risk.

Pros

- Potential for higher returns than gold itself.

- Income through dividends.

- ISA and SIPP eligible.

Cons

- Much more volatile than gold.

- Influenced by mining costs and company performance.

- Not a pure play on gold prices.

Mining shares can outperform during price booms, but they often underperform when companies face operational challenges.

Digital gold (e.g. Royal Mint DigiGold)

Best for: small investors wanting fractional ownership with secure backing.

Pros

- Low entry point (from £25).

- Backed by physical metal.

- Secure vault storage included.

Cons

- Fees vary by provider.

- Not ISA eligible.

- No physical delivery unless purchased separately.

Digital gold is a modern way to buy fractional gold without the complexity of physical ownership.

How to buy digital gold (Royal Mint DigiGold)

- Create a Royal Mint account.

- Deposit funds (bank transfer/debit card).

- Choose gold, silver, or platinum

- Buy from £25 upwards.

- Gold is allocated against a physical bar.

- Store digitally or convert to physical delivery (fees apply).

Should you use a financial adviser to invest in gold?

A financial adviser can help you decide whether gold suits your goals, choose the right gold products, and determine how much of your portfolio should be allocated.

Advisers are especially helpful for first-time investors or those considering larger allocations.

Gold isn’t right for everyone. Advisers can explain the risks, compare alternatives such as bonds or diversified funds, and ensure your overall portfolio remains balanced and tax-efficient.

Gold ETCs are usually the simplest and most reliable way to track the gold price, while mining shares offer higher potential returns but far more volatility.

The best choice depends on whether you want stability or growth.

ETCs track the price of physical gold held in vaults and aim to mirror price movements closely. Mining shares, however, can amplify gold’s movements, rising faster when gold climbs but falling harder when gold drops.

Mining returns depend on company performance, costs, and operational risks, making them more unpredictable.

Most long-term investors who want gold exposure choose physical gold ETCs for convenience, cost efficiency, and tax efficiency.

*New to investing? Read our Investing for Beginners guide for a simple, step by step introduction before you start investing.

FAQs

Is gold a good investment?

Gold can be a useful diversifier and safe-haven during inflation or uncertainty, but it is volatile and produces no income, so it works best as a small part of a balanced portfolio.

How much gold should I hold?

Most diversified investors hold around 5% to 10% in gold, depending on their goals and risk tolerance.

Is physical gold better than gold ETCs?

Physical gold gives direct ownership and, for certain UK coins, CGT-free gains, while gold ETCs are cheaper, ISA-eligible and easier for most UK investors to manage.

Can I hold gold in an ISA?

You cannot hold physical gold in an ISA, but you can hold gold ETCs such as SGLN or IGLN inside a Stocks and Shares ISA.

Is gold CGT-free?

Only UK legal tender coins like Sovereigns and Britannias are CGT-exempt; other gold investments may incur CGT unless held in an ISA or SIPP.

Is it worth buying gold in the UK?

It can be worthwhile if you want diversification or protection during uncertainty, although gold is volatile and should not replace income-producing or growth investments.

How can a beginner invest in gold?

Beginners usually start with an ISA-eligible gold ETC through a UK broker because it is simple, low-cost and does not require storage or insurance.

What if I invested $1,000 in gold 10 years ago?

A £1,000 gold investment a decade ago would be worth significantly more today, although the exact figure depends on the purchase date, exchange rates and product fees.

What is 50g of gold worth today in the UK?

The value of 50g of gold equals fifty times the current UK spot price per gram, which changes throughout the day and should be checked on a live price feed.

How to invest in gold in the UK with little money?

The simplest way is to buy a low-cost gold ETC inside an ISA or use digital gold platforms that allow small purchases from around £25.

How to invest in gold ETF in the UK?

You can buy a gold ETF by opening a UK investment app, searching for a physical gold ETC such as SGLN or IGLN, and purchasing it inside an ISA or general investment account.

References

- https://www.gov.uk/guidance/investment-gold-coins-and-vat-notice-70121a

- https://www.royalmint.com/invest/discover/invest-in-gold/value-added-tax-on-investments

- https://www.royalmint.com/invest/discover/invest-in-gold/an-introduction-to-gold-investment

- https://www.economicsobservatory.com/is-gold-a-safe-haven-for-investors

- https://www.cardiff.ac.uk/research/impact-and-innovation/research-impact/past-case-studies/why-gold-is-the-key-to-a-glittering-future

- Pattnaik, Debidutta & Hassan, M. Kabir & DSouza, Arun & Ashraf, Ali, 2023. “Investment in gold: A bibliometric review and agenda for future research,” Research in International Business and Finance, Elsevier, vol. 64(C).