Investing in ETFs in the UK is one of the simplest ways to build a diversified portfolio with low fees.

This beginner guide explains what ETFs are, how they work, and the safest steps to start investing in 2026.

You’ll learn the investment apps to use, the costs, risks, and UK tax rules so you can invest confidently.

Key takeaway: How to invest in ETFs in the UK?

To invest in ETFs in the UK, open an FCA authorised investment platform, use a Stocks and Shares ISA or pension for tax efficiency, choose diversified ETFs that match your goals and risk level, and invest regularly for the long term rather than trading frequently.

What is an ETF and why do UK investors use them?

An ETF is a fund that tracks an index, sector or asset and trades on the stock exchange like a normal share.

They are popular in the UK because they are low cost, diversified and simple to buy through any FCA-authorised broker.

ETFs let beginners invest in hundreds of companies at once, lowering risk compared with picking individual stocks.

ETFs track market indices such as the FTSE 100, S&P 500 or MSCI World. When you buy one ETF, you automatically buy a slice of every company inside that index.

They trade during market hours, have transparent fees and can be held in a Stocks and Shares ISA for tax efficiency.

Most ETFs are passive, which keeps costs low. Some ETFs are physical, meaning they buy the underlying assets.

Others are synthetic and use derivatives to copy performance.

How do ETFs work in simple terms?

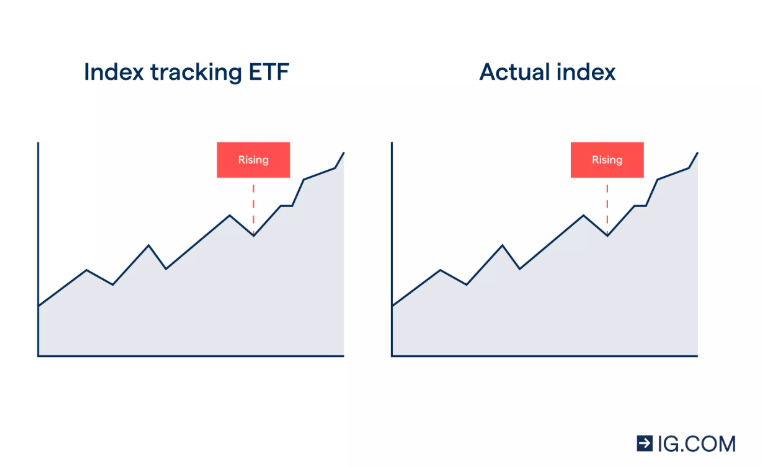

ETFs work by holding or replicating all the assets inside a specific index, and your investment rises or falls based on the index performance.

You trade them in real time on the stock exchange, and each ETF has a buy price, a sell price and a small gap between them known as the spread.

A FTSE 100 ETF buys all 100 companies or uses swaps to match the index. When the FTSE rises, your ETF rises. When it falls, your ETF falls.

ETFs have two live prices:

- Ask price is what buyers pay.

- Bid price is what sellers receive.

The spread is normally very small for popular ETFs.

ETFs publish their underlying holdings daily. Many offer accumulating shares that automatically reinvest dividends or distributing shares that pay dividends out to you.

ETFs can hold shares, bonds, commodities, property or mixed assets. Physical ETFs directly own the assets. Synthetic ETFs copy the returns using derivatives and carry additional counterparty risk.

How do I choose the right ETF in the UK?

Choose an ETF by looking at the index it tracks, the ongoing fees, the size of the fund, the provider and the type of exposure you want.

UK investors typically start with broad market indices because they offer simple, diversified exposure.

The FTSE 100 tracks the 100 largest UK companies, while the FTSE All-Share covers around 575 UK stocks of all sizes for broader domestic exposure.

The S&P 500 captures 500 major US companies such as Apple and Microsoft, making it popular for accessing the world’s biggest stock market.

For truly global diversification, many investors choose the MSCI World, which holds more than 1,500 companies across 23 developed countries in a single ETF.

When comparing ETFs, check:

- Index: what market you want to track

- OCF or TER: the annual fee, usually 0.04% to 0.35%

- Provider: such as iShares, Vanguard, HSBC, Amundi

- Structure: physical or synthetic

- Size: larger funds tend to have lower costs and tighter spreads

- Dividend type: accumulating or distributing

- Currency exposure: especially for US or global ETFs

Below is the fee range for major UK ETFs:

| Category | Typical ongoing charge (TER) |

|---|---|

| UK large cap (FTSE 100) | 0.04% to 0.07% |

| UK all-market | 0.04% to 0.33% |

| Europe ETFs | 0.06% to 0.35% |

| Small/mid-cap UK | 0.05% to 0.58% |

For beginners, the FTSE 100, FTSE All-Share or a low cost global tracker are the simplest starting points.

What UK indices can you invest in using ETFs?

You can invest in four main UK stock indices through ETFs. These offer different levels of diversification, costs and risk profiles. Fees range from 0.04% to 0.33% per year.

These are the primary indices:

| Index | Constituents | Focus | Number of ETFs | Typical fee |

|---|---|---|---|---|

| FTSE 100 | 100 | Largest UK companies | 11 | 0.04%–0.07% |

| FTSE All-Share | 575 | Broad UK market | 2 | 0.04%–0.33% |

| MSCI UK | 73 | Large and mid-caps | 3 | 0.05%–0.33% |

| Morningstar UK | 275 | Mid and large caps | 1 | 0.33% |

What are the best UK ETF options for beginners?

The best ETF depends on whether you want the lowest fee, the broadest market, or the highest liquidity.

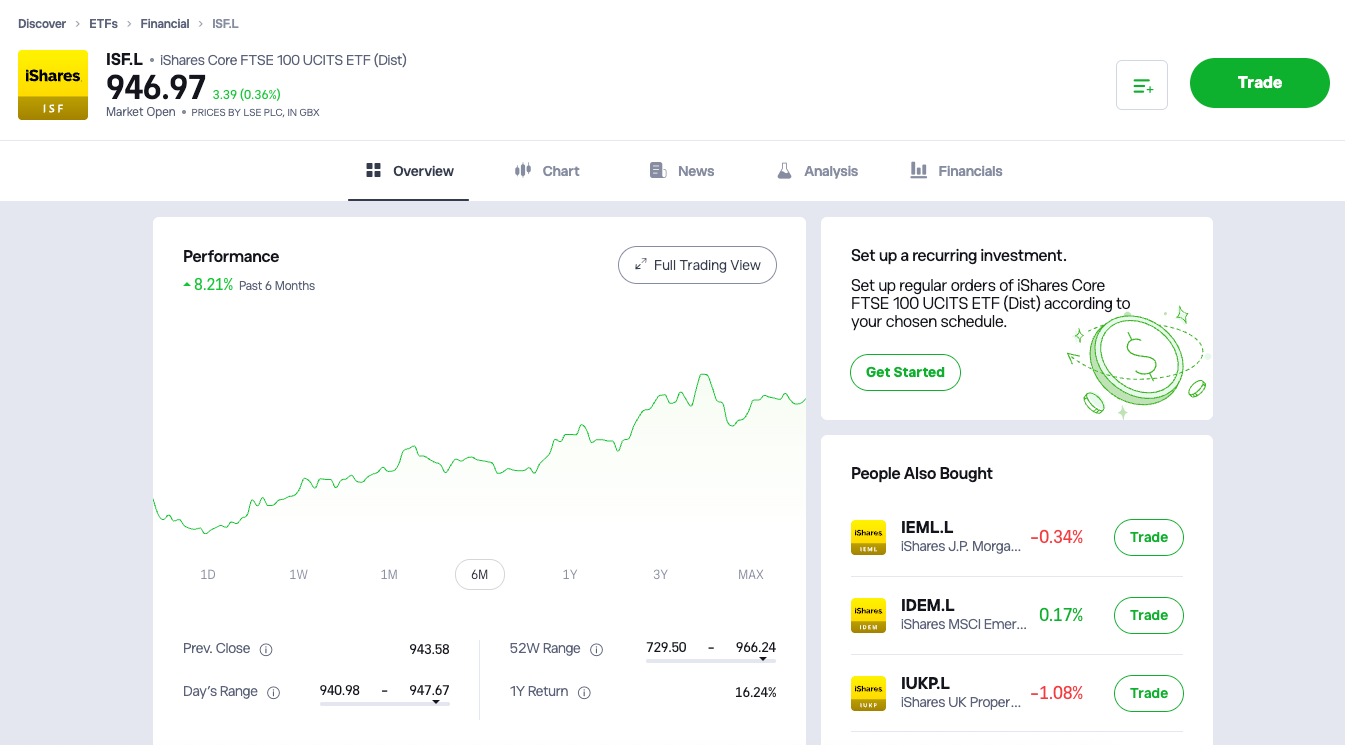

Top performing UK ETFs (1-year return)

- Amundi Core FTSE 100 Swap Dist

- Amundi Core FTSE 100 Swap Acc

- iShares Core FTSE 100 GBP Dist

Cheapest UK ETFs

- Amundi UK Equity All Cap 0.04%

- HSBC FTSE 100 UCITS ETF 0.07%

- iShares Core FTSE 100 Acc 0.07%

A simple starting point for beginners is a low cost FTSE 100 or FTSE All-Share ETF.

How do I actually invest in ETFs in the UK?

The quickest way to invest in ETFs is to open an FCA-authorised investment platform, deposit funds and search for the ETF you want by name or ticker. You can invest a lump sum or set up monthly payments.

Steps to invest in ETFs

- Choose a platform such as eToro, IG, Vanguard, Hargreaves Lansdown, AJ Bell or Freetrade.

- Open an account Stocks and Shares ISA or General Investment Account.

- Deposit money using bank transfer or debit card.

- Search for your ETF for example, VUKE, ISF, CSP1, VWRL.

- Select order type market order or limit order.

- Buy shares review the total cost and confirm.

- Track performance and consider monthly investing.

Market orders buy at the best available price. Limit orders let you choose your maximum price. ETF prices update throughout the day based on market activity.

*New to investing? Read our Investing for Beginners guide for a simple, step by step introduction before you start investing.

Which platforms are best for buying ETFs in the UK?

Choose your platform based on fees, tools and the type of account you want. All platforms listed below are FCA-authorised, meaning they follow UK regulatory rules.

Cash held in these investment platforms is FSCS-protected up to £85,000, but your investments are not protected against losses.

| Platform | ETF fees | Platform fee | Best for |

|---|---|---|---|

| Vanguard | Very low | 0.15% | Beginners, cheap long term investing |

| Trading 212 | £0 commission | No platform fee | Fee-free ETF investing |

| Freetrade | £0 commission | £0–£4.99 | ETF buying with low fees |

| Hargreaves Lansdown | £11.95 share dealing | 0.45% | Research and tools |

| AJ Bell | £5–£11.95 | 0.25% | Wide ETF selection |

| eToro | £0 commission | FX fees apply | Social and US ETF access |

*Read our guide to the best ETF platforms UK.

How much do ETFs cost in the UK?

ETF costs are low, but you must understand four types of fees:

- Ongoing Charges Figure (OCF): the annual fee taken by the ETF provider. Typical UK range: 0.04% to 0.35%.

- Broker or dealing fees: for buying or selling ETFs. Some platforms charge £0. Others charge £5–£12.

- Platform fees: charged by your broker for holding investments. Some platforms charge 0% for ETFs.

- Bid-ask spread: a small hidden cost between buy and sell price.

Example of total UK ETF costs

If you invest £1,000 in a low cost FTSE 100 ETF:

OCF 0.07% = 70p per year

Platform fee 0.15% = £1.50 per year

No commission

Total yearly cost under £3 depending on platform.

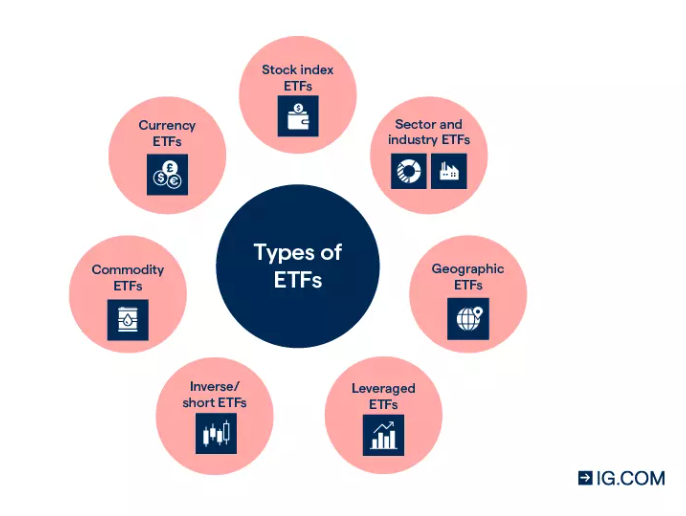

What types of ETFs can UK beginners invest in?

ETFs come in many varieties. Here are the most common categories:

- Market index ETFs: FTSE 100, FTSE All-Share, S&P 500, MSCI World.

- Sector ETFs: Tech, energy, healthcare, financials.

- Geographic ETFS: Europe, emerging markets, Asia-Pacific, UK-focused.

- Currency ETFs: USD, EUR, JPY exposure.

- Bond ETFs: UK gilts, corporate bonds, global bonds.

- Dividend ETFs: High yield ETFs like FTSE UK Dividend+.

- Small and mid-cap ETFs: FTSE 250, MSCI UK Small Cap.

- Ethical ETFs:ESG-focused options like Solactive UK Large & Mid Cap.

- Commodity ETFs: Gold, oil or metals. Often synthetic. Each type carries different risks and diversification levels.

- Leveraged ETFs: Using financial derivatives to amplify daily returns of an index (e.g., 2× or 3×).

- Inverse / Short ETFs: Designed to deliver the opposite daily performance of an index—used for hedging or short-term speculation.

What are the risks of investing in ETFs in the UK?

ETFs carry risk because the value can fall, and you may get back less than you invest. They are diversified but not risk free.

Key ETF risks include:

- Market risk: If the index falls, your ETF falls.

- Currency risk: US or global ETFs fluctuate with GBP exchange rate.

- Liquidity risk: Smaller ETFs may have wider spreads.

- Synthetic ETF risk: Counterparty risk if swaps fail.

- Tracking difference: Some ETFs do not perfectly match index returns.

Long term investing typically reduces volatility, but you must be comfortable with short term ups and downs.

How are ETFs taxed in the UK?

ETFs in the UK are taxed like shares, and the treatment depends on the account you use.

In a Stocks & Shares ISA, all gains, dividends and income from ETFs are completely tax-free, and you can contribute up to £20,000 per tax year.

In a General Investment Account, gains may be subject to Capital Gains Tax once you exceed the allowance, dividends can be taxed above the dividend allowance, and income from bond ETFs may also be taxable.

Tax rules can change and depend on individual circumstances

Do ETFs pay dividends?

Many ETFs pay dividends because their underlying companies do.

Dividends can be:

Distributing: paid into your account

Accumulating: reinvested automatically

Dividends are usually paid every quarter or twice a year. Inside an ISA, all ETF dividends are tax free.

How do order types work when buying ETFs?

When buying ETFs you can choose:

- Market order: Buys at the best available price. Fast but price may move.

- Limit order: Lets you choose your maximum buy price or minimum sell price.

Market orders suit beginners. Limit orders suit volatile markets.

What is the difference between physical and synthetic ETFs?

Physical ETFs buy the underlying assets. Synthetic ETFs use swaps to copy returns.

- Physical ETFs: Simpler, transparent, lower risk for beginners

- Synthetic ETFs: Use derivatives, slight counterparty risk, access harder markets

Beginners usually choose physical ETFs unless tracking commodities.

FAQs

How to invest in ETFs UK for beginners?

Beginners can invest by opening an FCA-authorised platform, depositing money and buying an ETF by name or ticker. A Stocks and Shares ISA is the simplest account to use.

What is the best ETF to invest in the UK?

There is no single best ETF, but many UK beginners choose low cost FTSE 100, FTSE All-Share or global trackers like MSCI World. The right option depends on your goals and risk level.

Can I invest in US ETFs from the UK?

Yes, you can invest in US-listed ETFs through brokers that give access to American exchanges, but some US ETFs are restricted due to PRIIPs rules. Most UK investors use UK-listed versions of S&P 500 or Nasdaq ETFs instead.

How much money do I need to start investing in ETFs?

Many brokers allow you to start with small amounts, sometimes as low as £25 for regular investing or the price of one ETF share.

How do I choose the right ETF?

Look at the ETF’s index, fees (TER/Ongoing Charges), diversification, size, liquidity, and tracking method (physical vs synthetic).

What’s the difference between accumulating and distributing ETFs?

Accumulating ETFs reinvest dividends automatically; distributing ETFs pay out dividends as cash.

Do ETFs charge fees?

Yes, but fees are usually low. Costs are built into the fund’s ongoing charges and don’t require manual payment.

Can I sell my ETFs at any time?

ETFs trade on stock exchanges during market hours, so you can buy or sell whenever markets are open.