Investing in bonds in the UK is straightforward once you understand the different types, risks, and how to buy them through regulated platforms.

This beginner guide explains how gilts, corporate bonds, and bond funds work, and shows the safest, simplest ways to get started in 2026.

You’ll learn the key steps, costs, and tools you need to invest confidently.

Key takeaway: How to Invest in bonds in the UK?

To invest in bonds in the UK, use an FCA authorised platform, choose between individual bonds or bond funds, hold them in an ISA or pension for tax efficiency, and focus on income and diversification rather than short term price movements.

What are bonds and how do they work?

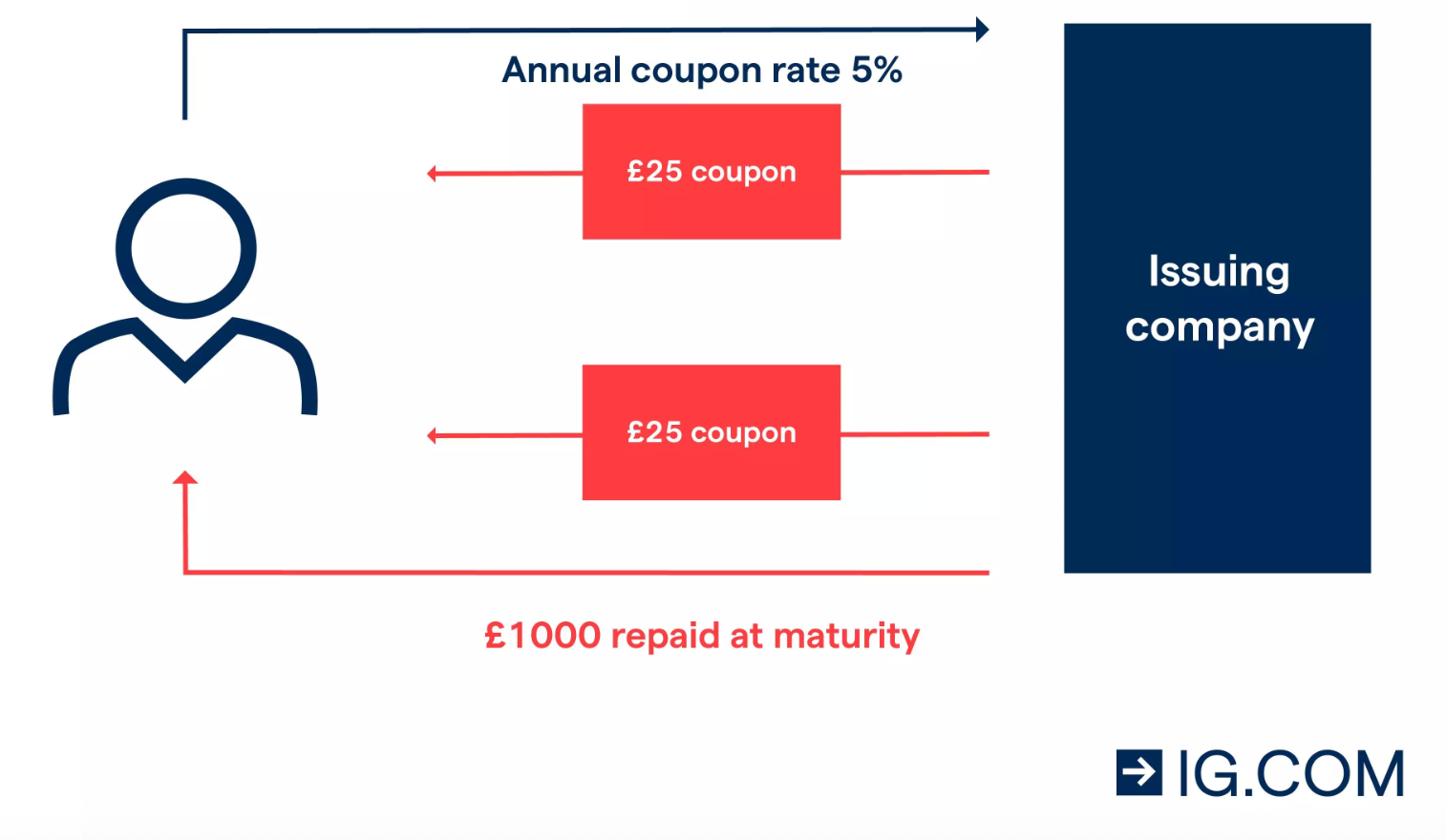

Bonds are loans to governments or companies in exchange for fixed interest payments, known as coupons, and the return of your original investment at maturity.

UK investors buy bonds for income, stability, and diversification, but bond prices can rise or fall and repayment is not guaranteed, so understanding risk is essential.

A bond is effectively an IOU: the issuer borrows money; you lend it. The bond then pays interest, typically twice a year, until a fixed maturity date.

At maturity, the face value should be repaid, assuming the issuer remains solvent. Bonds can be bought new (primary market) or traded on the secondary market where their prices fluctuate daily.

Key bond terms explained

- Face value (par): The amount repaid at maturity.

- Coupon: The fixed interest payment based on face value.

- Yield: The income you receive as a percentage of the current market price.

- Maturity: The year the bond ends and capital should be returned.

Bond prices move mainly due to changes in interest rates, inflation expectations, and the issuer’s creditworthiness.

When interest rates rise, existing bonds become less attractive, so prices fall. When rates drop, existing fixed coupons look more appealing and prices rise.

What are gilts and how do UK government bonds work?

Gilts are bonds issued by the UK government, paying fixed interest until maturity and returning your capital if the government does not default.

They’re viewed as low-risk, making them popular for diversification and income, though yields are usually lower than corporate bonds due to their safety.

The UK issues two main types of gilts:

Conventional gilts

These pay a fixed coupon and return the face value at maturity. A gilt named “1.5% Treasury 2047” pays 1.5 percent annually until 2047.

Index-linked gilts

These pay interest that rises with inflation, based on the Retail Price Index (RPI). They help protect income from inflation but can fluctuate sharply when inflation expectations shift.

Why gilts appeal to UK investors

- Lower risk than corporate bonds

- Often used by retirees or cautious investors

- Free from Capital Gains Tax (CGT)

- Can be held in Stocks and Shares ISAs and SIPPs for tax efficiency

However, gilts still carry interest rate risk, meaning prices fall when rates rise. They also offer lower yields than riskier alternatives.

What are corporate bonds and how risky are they?

Corporate bonds are loans to companies and usually offer higher interest than gilts because businesses carry more risk.

They can provide attractive income, but investors must assess the issuer’s financial strength, credit rating, and likelihood of default before buying.

Companies issue bonds to raise capital for expansion, refinancing, acquisitions or operational needs. Unlike gilts, corporate bonds vary widely in risk depending on the issuer’s stability.

Types of corporate bonds

- Investment-grade bonds (AAA–BBB): Lower risk, lower yields.

- High-yield or junk bonds (BB and below): Higher risk of default but offer higher coupons.

Credit ratings (S&P, Moody’s, Fitch)

| Rating | Type | Risk level |

|---|---|---|

| AAA–AA | Investment grade | Very low risk |

| A | Investment grade | Low risk |

| BBB | Investment grade | Medium risk |

| BB–B | High yield | Speculative, high risk |

| CCC–C | High yield | Very high risk |

| D | Default | Issuer cannot pay |

A higher coupon does not always equal a better investment; it may simply reflect higher credit risk.

Corporate bonds are also sensitive to the economy: during downturns, riskier issuers may struggle to make payments.

What risks do UK bond investors need to understand?

Bonds carry several risks, including interest rate, credit, inflation, and liquidity risk.

Prices can move sharply when rates change, and companies can default, so investors must assess these risks before buying individual bonds or funds.

Key bond risks

- Interest rate risk: Rising interest rates reduce existing bond prices.

- Inflation risk: Inflation erodes the value of fixed income payments.

- Credit/default risk: Companies may fail to repay; gilts carry much lower default risk.

- Liquidity risk: Some corporate bonds are harder to sell at a fair price.

- Currency risk: Applies only when buying bonds in non-GBP currencies.

- Time risk: Your capital may be tied up until maturity.

Bondholders rank above shareholders if a company fails, but recovery is not guaranteed; defaults can still result in capital loss.

What affects the price and yield of a bond?

Bond prices move based on interest rates, inflation expectations, and supply and demand. When prices fall, yields rise; when prices rise, yields fall.

Understanding these forces helps investors buy bonds at fair value and avoid avoidable losses.

Main price drivers

- Bank of England interest rates

- Inflation and market expectations

- Credit rating upgrades/downgrades

- Investor demand for safety or risk

- Time to maturity

Yield is calculated as:

Yield = Annual coupon ÷ Current market price × 100

If a bond with a £100 face value pays a £3 coupon:

- At £100, yield = 3 percent

- At £90, yield = 3.33 percent

- At £110, yield = 2.72 percent

This dynamic is why higher yields often signal higher perceived risk.

How do you invest in bonds directly in the UK?

You can buy bonds directly through stockbrokers, investment platforms, or the UK Debt Management Office for gilts. Direct investing suits confident investors who want fixed income, but minimum purchases and limited liquidity can make diversification challenging.

Buy gilts directly via the UK Debt Management Office (DMO)

You open an account with Computershare and buy newly issued or existing gilts without using a broker:

- Create a Gilt Account on the DMO/Computershare site.

- Pick the gilt (e.g., “1.5% Treasury 2047”).

- Check the price and minimum amount.

- Transfer funds and place your order.

Pros: Low fees, simple, CGT-free.

Cons: Limited choice and flexibility.

Buy gilts or corporate bonds through a broker

Most UK investors use a platform such as HL, AJ Bell, Interactive Investor or Barclays:

- Open an ISA/SIPP or general account.

- Search for the bond by name, ISIN, maturity or yield.

- Review coupon, yield, rating and minimum size (often £1,000).

- Place an order (corporate bonds often require phone dealing).

Pros: Big choice, can hold in ISAs/SIPPs.

Cons: Dealing fees, some bonds illiquid.

3. Buy bond funds (actively managed)

Funds invest in many bonds on your behalf:

- Open a platform account (ISA/SIPP recommended).

- Choose a fund type: gilt, corporate, high-yield, or strategic.

- Buy units like any other fund.

Pros: Instant diversification, low minimum amounts.

Cons: No fixed maturity; prices fluctuate.

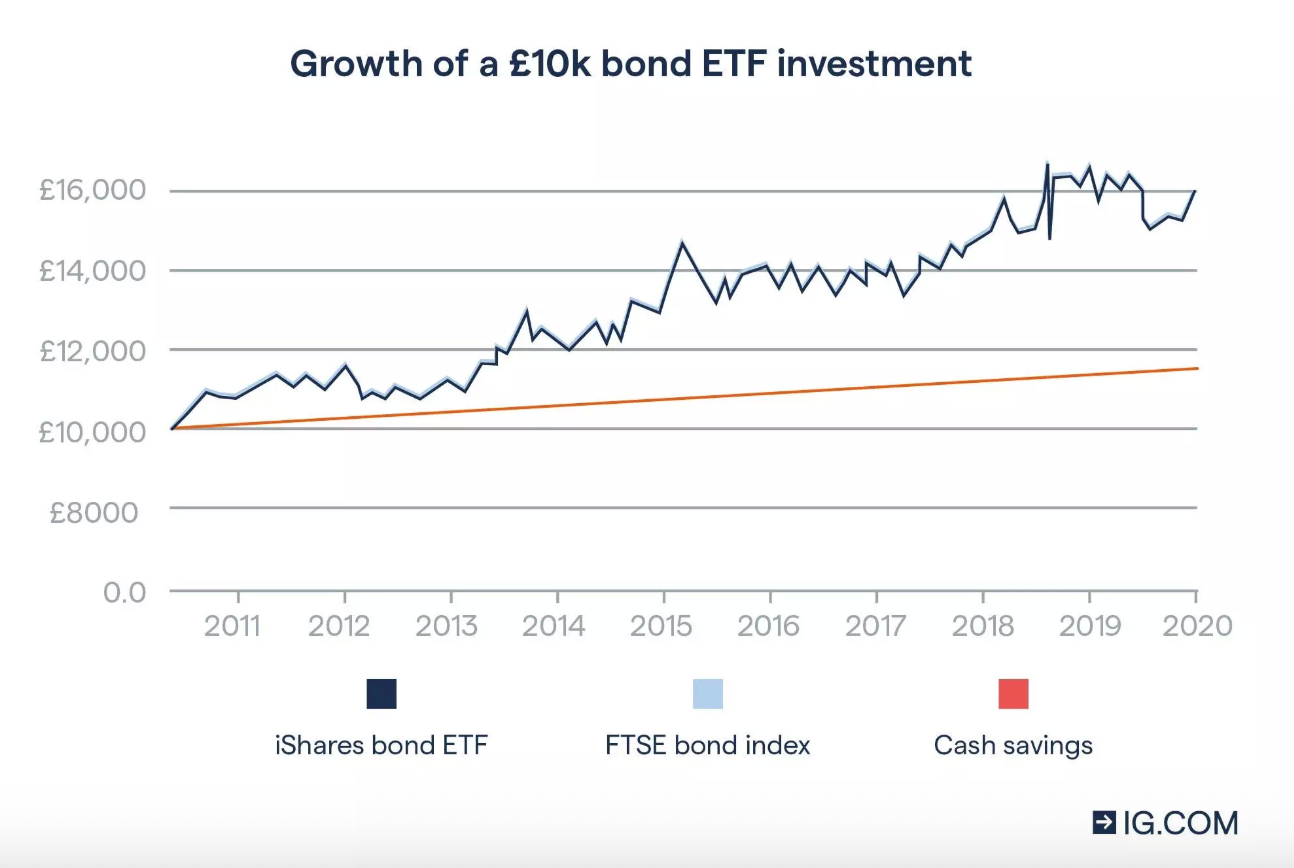

4. Buy bond ETFs (index trackers)

ETFs track an index of bonds and trade like shares:

- Search ETF tickers (e.g., IGLT for gilts, SLXX for corporate).

- Check yield, duration, and fees.

- Buy units on your platform.

Pros: Low cost, diversified, easy to trade.

Cons: ETFs don’t mature; income varies.

How do bond funds and bond ETFs work?

Bond funds and ETFs let you invest in hundreds of bonds at once, offering instant diversification and professional management. They are popular with beginners because they reduce issuer-specific risk and often have low minimum investment amounts.

Types of bond funds

- Government bond funds (UK gilts or global government bonds)

- Corporate bond funds (investment-grade or high-yield)

- Strategic bond funds (flexible, multi-sector)

- Index-tracking bond ETFs (passive, low-cost)

Benefits

- Lower cost and lower minimum investment

- Diversification across many issuers

- Easy to buy and sell

- Suitable for ISAs and SIPPs

Considerations

- No fixed maturity date

- Prices fluctuate with the market

- Income varies depending on the fund’s holdings

Bond ETFs differ from direct bonds because ETF units never mature, meaning capital is market-based rather than tied to a repayment date.

How does tax work on bonds in the UK?

Most gilts and many UK corporate bonds are free from Capital Gains Tax, but coupon payments count as taxable income unless held in an ISA or SIPP. Tax treatment varies by product, so investors should check the rules before choosing between direct bonds and bond funds.

Tax rules in brief

- Gilts: No CGT. Coupon income = taxable unless held in an ISA/SIPP.

- Corporate bonds: Many are qualifying securities and exempt from CGT.

- Bond funds/ETFs: CGT applies on gains when sold.

- Income: Taxed at your marginal income tax rate unless sheltered in an ISA or pension.

For most investors, the simplest approach is to hold bonds inside a Stocks and Shares ISA for tax-free income and growth.

How do you choose between corporate bonds, gilts, and bond funds?

Choose gilts for safety, corporate bonds for higher income, and bond funds or ETFs for diversification. Your choice depends on your risk tolerance, income needs, and investment timeframe.

When gilts may be better

- Maximum capital security

- Lower volatility

- Inflation-linking available

- Useful for cautious or retired investors

When corporate bonds may be better

- Higher income required

- Willingness to accept credit risk

- Medium-term investment goals

When bond funds or ETFs may be better

- Small starting amounts

- Need instant diversification

- Prefer professional management

Most portfolios combine multiple bond types depending on goals.

How do you decide if bonds are right for your portfolio?

Bonds may suit you if you want stable income, lower volatility than shares, and clearer expectations of returns over time. They are less suitable if you require very high growth or are comfortable with large price swings.

Bonds often form the defensive portion of a diversified portfolio. Younger investors may hold fewer bonds, while older or cautious investors may hold more. The right allocation depends on your time horizon, goals, and risk appetite.

How to compare bonds before investing?

Compare bonds by yield, credit rating, maturity, issuer strength, and tax treatment. Higher yields typically reflect higher risk, so aim for quality first rather than chasing the highest income.

Essential comparison factors

- Coupon vs current yield

- Issuer credit rating

- Time to maturity

- Interest rate sensitivity (longer maturities = more sensitivity)

- Liquidity and dealing costs

High-yield bonds offer attractive income but should be used carefully and ideally via diversified funds due to elevated default risk.

What steps should UK beginners follow before buying their first bond?

Beginners should start by learning key terms, choosing whether to buy direct bonds or funds, deciding their risk level, and using an FCA-regulated investment app. Bond investing is simple once the structure is understood, but rushing in without assessing risk can lead to losses.

Steps to get started

- Learn bond basics: coupon, yield, maturity, credit risk.

- Decide whether you prefer gilts, corporate bonds, or funds.

- Choose an FCA-regulated broker or platform.

- Consider using an ISA or SIPP for tax benefits.

- Start small and diversify across issuers and maturities.

- Match bond maturity to your savings goals.

- Review interest rate trends and inflation before investing.

If unsure, seek regulated financial advice.

*New to investing? Read our Investing for Beginners guide for a simple, step by step introduction before you start investing.

FAQs

Are bonds safe for UK investors?

Gilts are considered low risk, while corporate bonds carry varying levels of credit risk. All bonds can fall in value when interest rates rise.

Can beginners invest in bonds?

Yes. Bond funds and ETFs are usually the easiest route for beginners because they give instant diversification without needing large amounts.

Are bonds a good investment in the UK?

Bonds can be a good investment if you want lower volatility, regular income, and diversification. They’re less suitable if you want high growth or can tolerate large price swings.

How do beginners invest in bonds?

Most beginners start with bond ETFs or managed bond funds through an FCA-regulated platform. These products diversify risk and have low minimum investment amounts.

How much do UK bonds cost?

Direct corporate bonds often start at £1,000 per bond, gilts can start from £100, and bond funds let you invest from much smaller amounts, depending on the platform.

What are the safest bonds to invest in the UK?

UK gilts and index-linked gilts are generally the safest because the UK government has a low default risk. Corporate bonds from AAA–A rated issuers sit next in the safety hierarchy.

How to invest in bonds UK for beginners?

Beginners typically open an ISA or investment account, choose a diversified bond fund or ETF, and invest small amounts regularly to spread risk and avoid timing the market.

How to invest in bonds UK online?

You can buy gilts, corporate bonds, bond ETFs, and bond funds online through FCA-regulated brokers such as AJ Bell, Hargreaves Lansdown, Vanguard, HSBC, or Trading 212.

Are UK government bonds a good investment?

Gilts can be a good option for security, diversification, and predictable income. They suit cautious investors and those nearing retirement but usually offer lower yields than corporate bonds.