Investing in AI in the UK is easier in 2026 than ever, but choosing the right approach is essential.

This guide explains the safest, simplest ways to get AI exposure using UK-regulated platforms, plus the risks, costs, and strategies beginners should understand before investing.

You’ll learn how AI investing works and how to get started step by step.

Key takeaway: How to invest in AI In the UK?

The safest and simplest way to invest in AI is to use diversified AI ETFs or broad tech funds on FCA regulated UK platforms, rather than picking individual stocks, so that you get a broad exposure to AI-focused stocks. These funds give you exposure to AI chipmakers, cloud providers and software innovators while keeping costs low and risk balanced. Always consider volatility, invest only what fits your long term goals and use an ISA to reduce tax.

What is the simplest way to invest in AI in the UK?

The simplest way to invest in AI in the UK is to use diversified AI ETFs or broad tech funds on FCA-regulated platforms rather than trying to pick individual winners.

These funds spread risk, reduce reliance on any single company and allow beginners to gain AI exposure with low fees and minimal research.

AI investing covers everything from chipmakers such as Nvidia, to cloud giants like Microsoft and Amazon, to application companies building AI tools for consumers and enterprises.

Because predicting future winners is difficult, ETFs and funds are often the safest starting point. These can be held inside a Stocks and Shares ISA for tax efficiency.

How does AI investing work?

AI investing works by buying shares or funds linked to companies that build or use artificial intelligence technology.

Investors gain exposure to chips, data centres, cloud software, robotics and AI applications that could benefit from long term growth.

AI stocks sit across three layers:

- Infrastructure companies build chips, cloud systems and data centres.

- Platform companies sell AI tools to enterprises.

- Application companies create AI products used by consumers such as chatbots or automation tools.

Most beginners start with diversified ETFs that invest across all three layers to reduce stock specific risk.

What are the main ways to invest in AI in the UK?

The main ways to invest in AI in the UK are through AI ETFs, diversified technology funds or individual shares.

Beginners usually choose ETFs and broad tech funds because they offer instant diversification and lower fees.

AI ETFs

AI ETFs track baskets of companies involved in AI development. These funds usually hold global stocks and keep charges low.

Common examples available through UK platforms include:

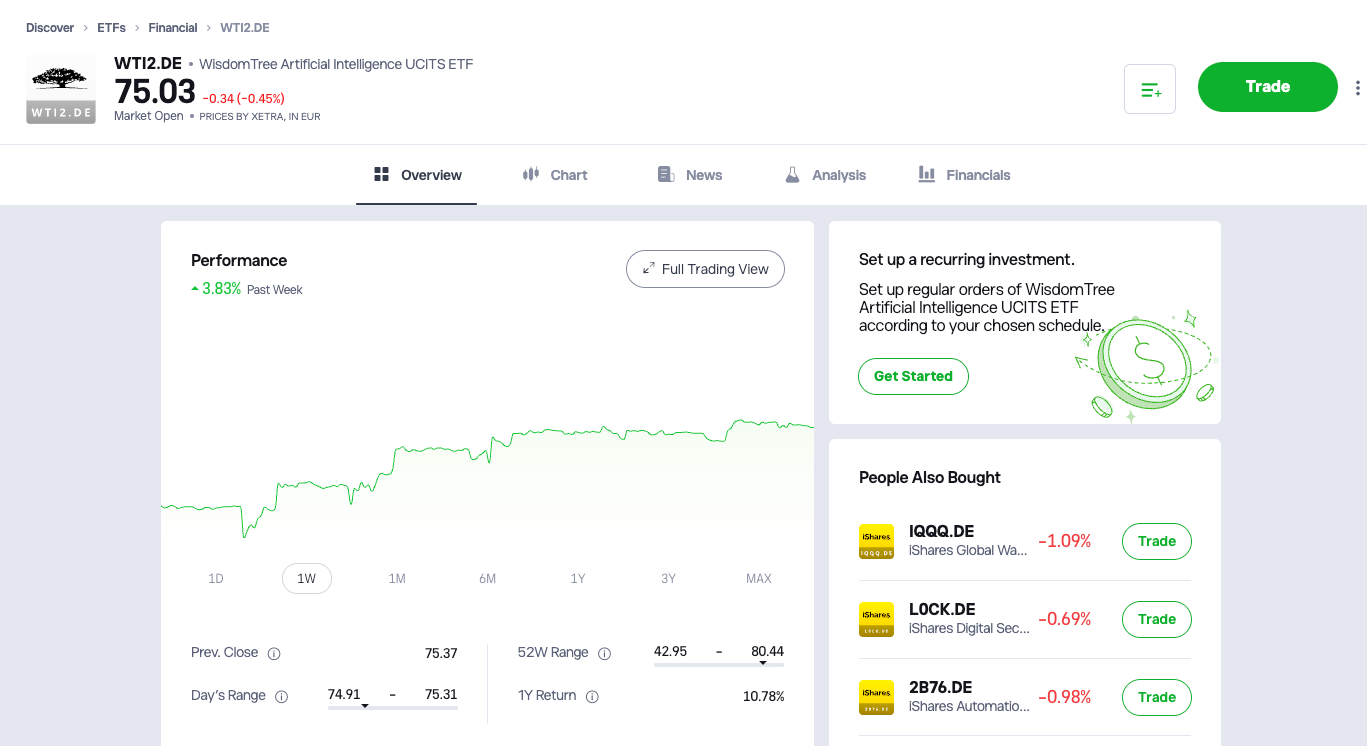

- WisdomTree Artificial Intelligence UCITS ETF

- L&G Artificial Intelligence UCITS ETF

- Xtrackers Artificial Intelligence and Big Data UCITS ETF

- ARK Innovation UCITS ETF (ARXK)

Annual fees usually range from 0.30 percent to 0.75 percent.

Broad tech funds

Broad tech funds such as Allianz Technology Trust, Polar Capital Technology Trust or AXA Framlington Global Technology invest heavily in AI related companies but also hold non AI tech names.

This gives more stability with lower concentration risk.

Individual AI stocks

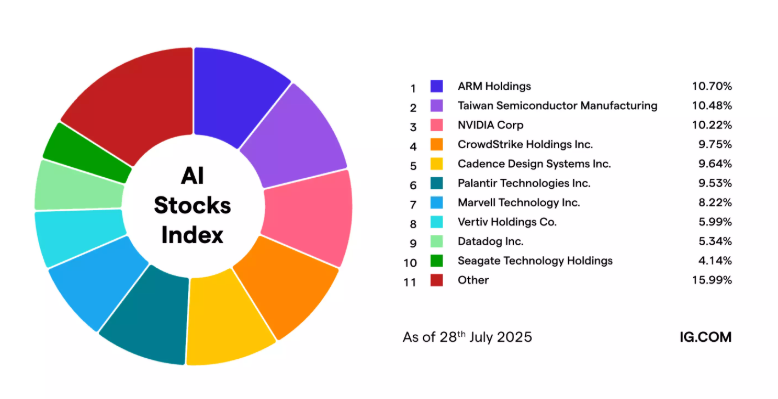

Popular AI stocks include Nvidia, Microsoft, Alphabet, AMD, TSMC and Amazon. AI application companies include Meta, Tesla and enterprise AI specialists like ServiceNow and Palantir.

Individual shares offer higher potential reward but also far higher risk because AI is fast moving and valuations can be volatile.

AI thematic trusts and active funds

Thematic funds such as Polar Capital Artificial Intelligence or Sanlam Global Artificial Intelligence aim to identify future AI winners.

These are higher risk because they are concentrated and actively managed.

What FCA regulated platforms can you use to invest in AI?

You can invest in AI using FCA regulated investment platforms such as eToro, IG, XTB, AJ Bell and InvestEngine.

All hold client money under FCA rules and offer UK payment methods such as bank transfer, debit card or Faster Payments.

Platform comparison table

| Platform | FCA status | Platform fee | AI ETFs available | Best for |

|---|---|---|---|---|

| eToro | FCA authorised | 0 percent platform fee | Wide ETF and US stock range | Beginners wanting simple app |

| IG | FCA authorised | 0 percent ISA fee, trading commissions apply | Broad global selection | Active investors |

| XTB | FCA authorised | Zero commission on stocks up to limits | US stocks and ETFs | Low cost share dealing |

| AJ Bell | FCA authorised | 0.25 percent | Full ETF and fund range | Long term investors |

| InvestEngine | FCA authorised | 0 percent for DIY ETFs | Strong ETF-only platform | Lowest cost ETF investing |

Platform cash is FSCS protected, but investments are not protected from losses.

*Read our guide to the best ETF platforms UK.

What are the costs of investing in AI?

The costs of investing in AI vary by product type. ETFs have ongoing charges, shares have trading fees and investment apps may add their own charges.

Common cost types

| Cost type | Typical amount | Applies to |

|---|---|---|

| ETF ongoing charge (OCF) | 0.30 percent to 0.75 percent | AI ETFs |

| Platform fee | 0 percent to 0.25 percent | Stocks and Shares ISAs and accounts |

| Share dealing commission | 0 to £10 | Buying individual companies |

| FX fee | 0.3 percent to 1 percent | Buying US shares |

| Stamp duty | 0.5 percent | UK shares only (not ETFs) |

AI ETFs tend to be cheaper than buying many individual AI stocks. FX fees matter because most AI companies are listed in the United States.

What are the risks of investing in AI?

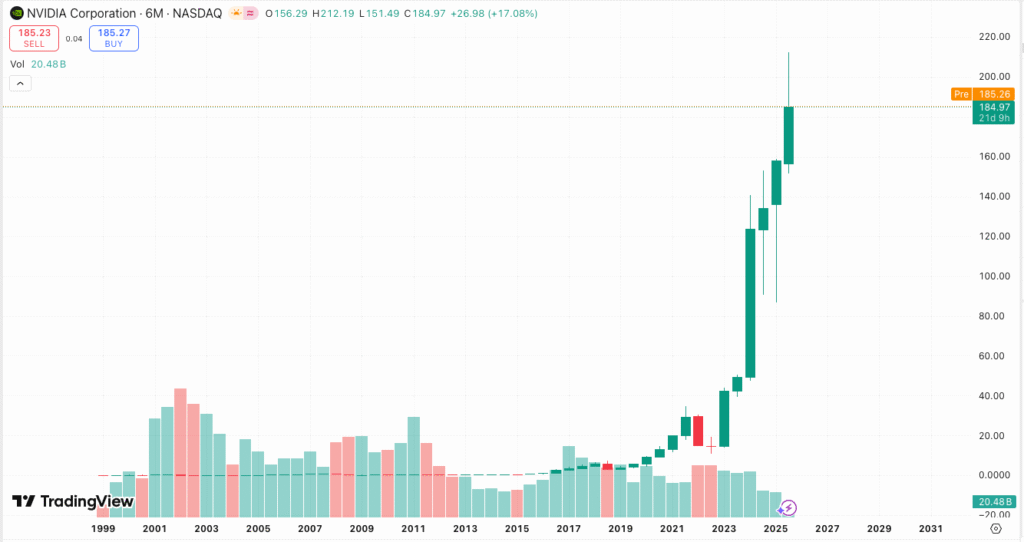

The main risks of investing in AI include high volatility, concentration in a small number of US companies, rapid technological change, regulatory uncertainty and overvaluation risk.

AI is a fast moving field and today’s leaders may not remain dominant. AI companies often trade at high valuations. If the market becomes less optimistic, share prices can fall sharply.

Ethical and regulatory issues, supply chain pressures and geopolitical tensions can also affect performance.

Beginners should avoid putting too much of their portfolio into AI. A small allocation as part of a diversified portfolio is usually more suitable.

How to invest in AI step by step (UK friendly)

Here is the simplest beginner process for investing in AI using a UK regulated platform.

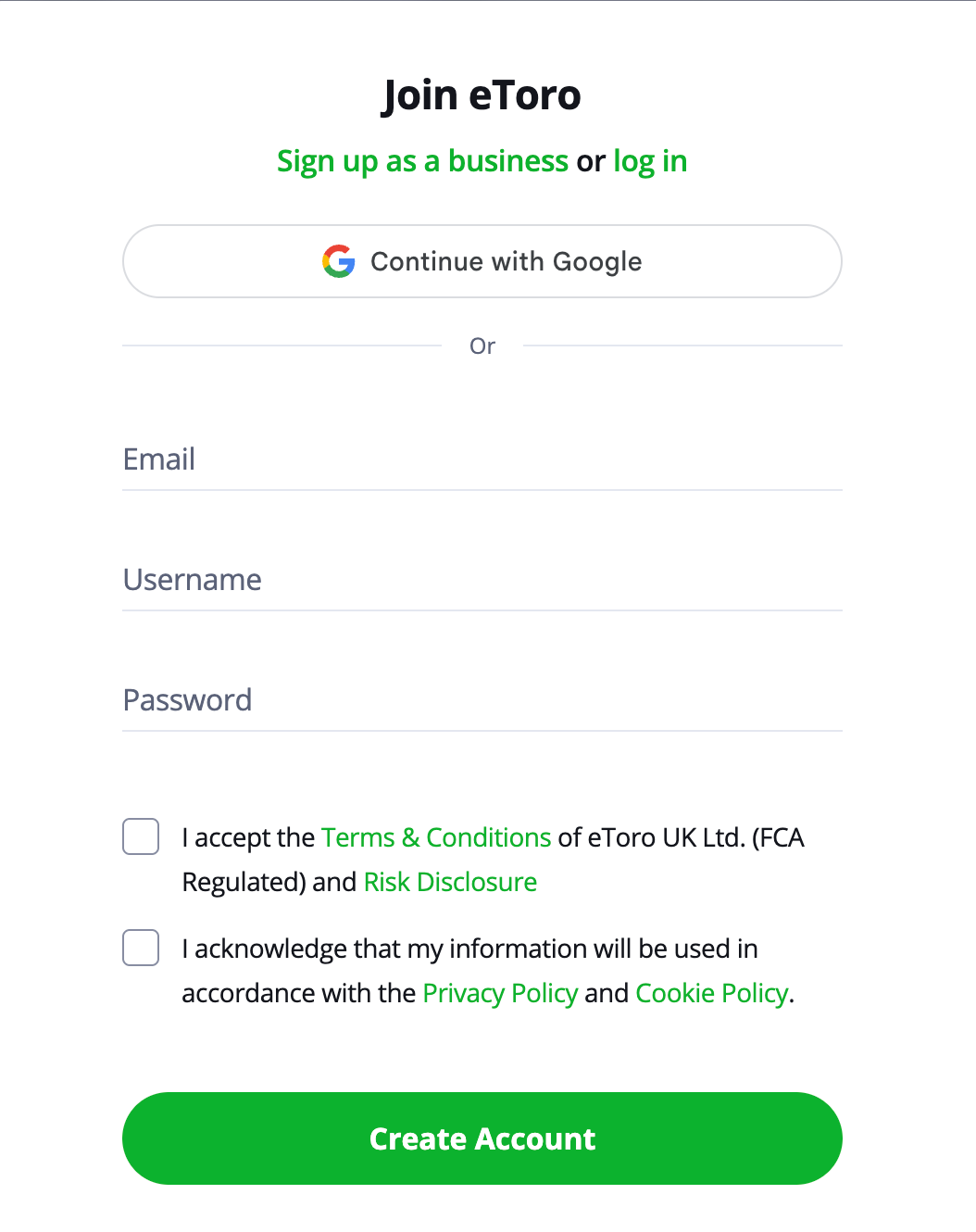

Step 1. Choose a UK platform

Pick an FCA regulated provider such as eToro, IG, AJ Bell or InvestEngine.

Check fees, available ETFs and whether you want an ISA.

Step 2. Open and verify your account

Upload ID, complete address checks and add security settings.

Verification typically takes minutes.

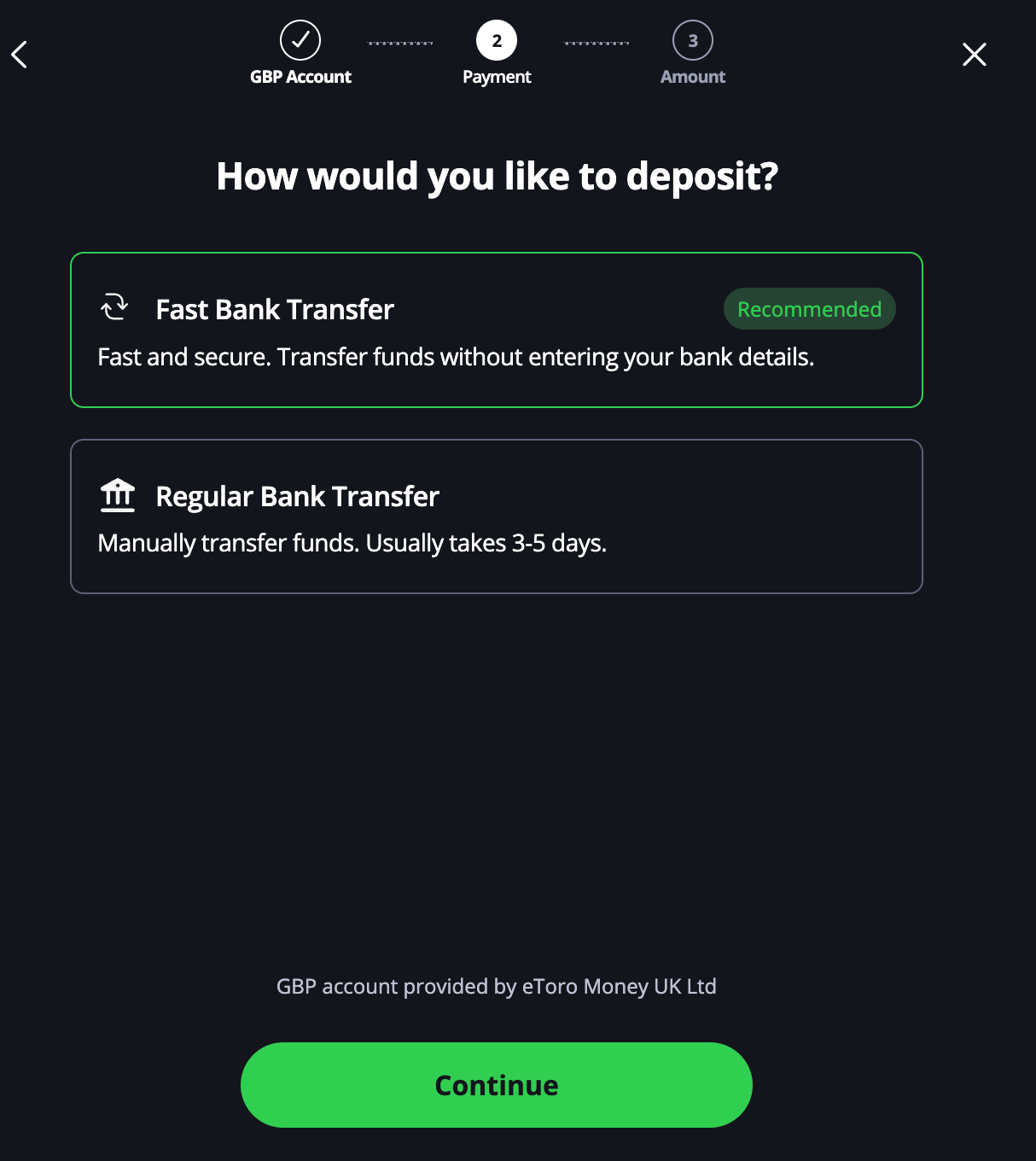

Step 3. Deposit money

Use bank transfer for low fees or debit card for instant funding.

Most platforms support Faster Payments.

Step 4. Choose your AI exposure

For your first investment, beginners often pick an AI ETF for instant diversification.

Options include the L&G Artificial Intelligence UCITS ETF or the WisdomTree Artificial Intelligence UCITS ETF.

Step 5. Place your order

Use a market order for quick execution or a limit order to set your preferred price.

Step 6. Hold and monitor

Track performance, rebalance if needed and review risk regularly. Remember that long term investing reduces the impact of short term volatility. Once you’re set up, many investors continue building their AI exposure with small, regular contributions (£10–£100 a month depending on your budget and goals)

Monthly investing helps smooth out price swings through pound-cost averaging and makes it easier to grow your position gradually without taking on too much risk at once.

*New to investing? Read our Investing for Beginners guide for a simple, step by step introduction before you start investing.

Which AI ETFs are popular with UK investors?

The most widely used AI ETFs in the UK provide diversified exposure across infrastructure, platforms and application companies.

AI ETF comparison table

| ETF | TER | Replication | Focus |

|---|---|---|---|

| Xtrackers Artificial Intelligence and Big Data | 0.35 percent | Full | Global AI and big data |

| L&G Artificial Intelligence UCITS ETF | 0.49 percent | Full | Robotics, AI, automation |

| WisdomTree AI UCITS ETF | 0.40 percent | Full | Global AI innovators |

| Global X Robotics and AI | 0.50 percent | Full | Robotics heavy exp |

These ETFs typically include companies such as Nvidia, AMD, TSMC, Palantir, Alphabet and Microsoft.

Should beginners pick individual AI stocks?

Beginners should only pick individual AI stocks if they understand the risks. AI leaders can change quickly and single companies can fall sharply during market downturns.

For most new investors, diversified ETFs offer a better balance of risk and reliability. Individual stocks may suit more experienced investors who can handle volatility and research demands.

What UK tax rules apply when investing in AI?

UK investors may pay Capital Gains Tax or Dividend Tax when investing in AI unless the investment is inside an ISA.

- ISA tax: A Stocks and Shares ISA shields all gains and dividends from tax, and you can invest up to £20,000 per tax year, with most platforms offering AI ETFs and AI stocks within an ISA.

- Capital Gains Tax: Outside an ISA, Capital Gains Tax applies when you sell investments for a profit; the reduced CGT allowance in recent years means more investors are affected, and the rate you pay depends on your income band.

- Dividend Tax: Dividend Tax may also apply if AI companies or ETFs pay dividends above your annual tax-free allowance, though some ETFs reinvest income to simplify reporting.

- US withholding tax: For US AI stocks, investors typically complete a W-8BEN form to benefit from reduced US withholding tax on dividends.

How should beginners choose between AI ETFs and tech funds?

Beginners usually choose AI ETFs if they want pure AI exposure with low fees.

Tech funds may suit investors who want AI exposure but also want exposure to wider technology sectors for added stability.

AI ETFs follow indexes and are usually cheaper. Active tech funds may charge higher fees but offer expert stock selection.

How much should you invest in AI?

Beginners typically invest a small portion of their overall portfolio. You can start investing in AI with any amount, even very small sums. Many beginners add a small, affordable amount each month to keep risk low while still gaining exposure to the sector.

You can start with £10–£20 a month to £75–£100 a month if it fits your budget and goals. The key is consistency rather than size. Choose an amount you can comfortably afford each month and adjust later as your confidence and finances grow.

AI is high risk and volatile so most investors start with between 5 percent and 15 percent of their investment portfolio depending on risk tolerance. Always consider your time horizon and financial goals.

Is AI investing right for beginners?

AI investing can be suitable for beginners if they use diversified ETFs rather than betting on individual companies.

AI is a powerful long term theme that could influence many sectors. However, it carries high volatility, valuation risk and uncertainty.

Beginners should invest gradually, avoid overconcentration and use ISAs to reduce tax.

FAQs

Is AI a good long term investment?

AI is a major long term trend, but returns are not guaranteed and valuations can be volatile.

What is the safest way to invest in AI?

Diversified AI ETFs on FCA regulated platforms offer the safest entry point. Popular options include the L&G Artificial Intelligence UCITS ETF or the WisdomTree Artificial Intelligence UCITS ETF.

Can I invest in AI inside an ISA?

A Stocks and Shares ISA lets you buy AI ETFs and AI-related stocks, and all gains and dividends are tax-free. Most UK platforms offer AI ETFs (like L&G or WisdomTree AI funds) and individual AI companies within an ISA. You just need to open an ISA account on your chosen platform and invest as normal.

Do AI ETFs pay dividends?

Many AI ETFs invest in tech companies that either pay small dividends or none at all, so payouts can be low. Some AI ETFs distribute dividends to you as cash, while others accumulate them (reinvest automatically), which means you won’t see a dividend payment but your ETF value grows instead. You can whether the ETF says “distributing” (pays dividends) or “accumulating” (reinvests them).

How much money do I need to start investing in AI?

You can start with as little as £10 to £25 on most UK platforms.

References

- https://www.gov.uk/government/publications/ai-opportunities-action-plan/ai-opportunities-action-plan

- https://www.business.gov.uk/campaign/grow-your-business-in-the-uk/artificial-intelligence

- https://www.fidelity.co.uk/markets-insights/ask-fidelity/how-do-i-invest-in-ai-stocks

- https://www.vanguard.co.uk/professional/insights-education/insights/look-at-the-bigger-equity-picture-ai-beyond-tech