Investing can help grow money over time, but getting started can feel confusing for beginners.

This guide explains where and how to invest in the UK, covering the main account types, investment options, risks, and costs, so beginners can make informed decisions and invest with confidence.

Key takeaway: How do I start investing as a beginner?

To start investing as a beginner in the UK, build an emergency fund first, use a tax efficient account like a Stocks and Shares ISA or pension, choose simple diversified funds, and invest regularly for the long term. Avoid rushing, keep costs low, and stay invested through market ups and downs.

What is investing and how does it work in the UK?

Investing is the act of putting money into assets such as shares, funds, or bonds with the aim of growing its value over time, but returns are not guaranteed and you could get back less than you invest. In the UK, investing typically suits medium to long-term goals and involves balancing risk, time, and potential reward.

Understanding the basics of investing

At its simplest, investing means buying something today in the hope it will be worth more in the future. Unlike savings, investment values can rise and fall, sometimes sharply. You do not need a large lump sum to start, but you should only invest money you can afford to leave untouched for several years.

Why people invest rather than only save

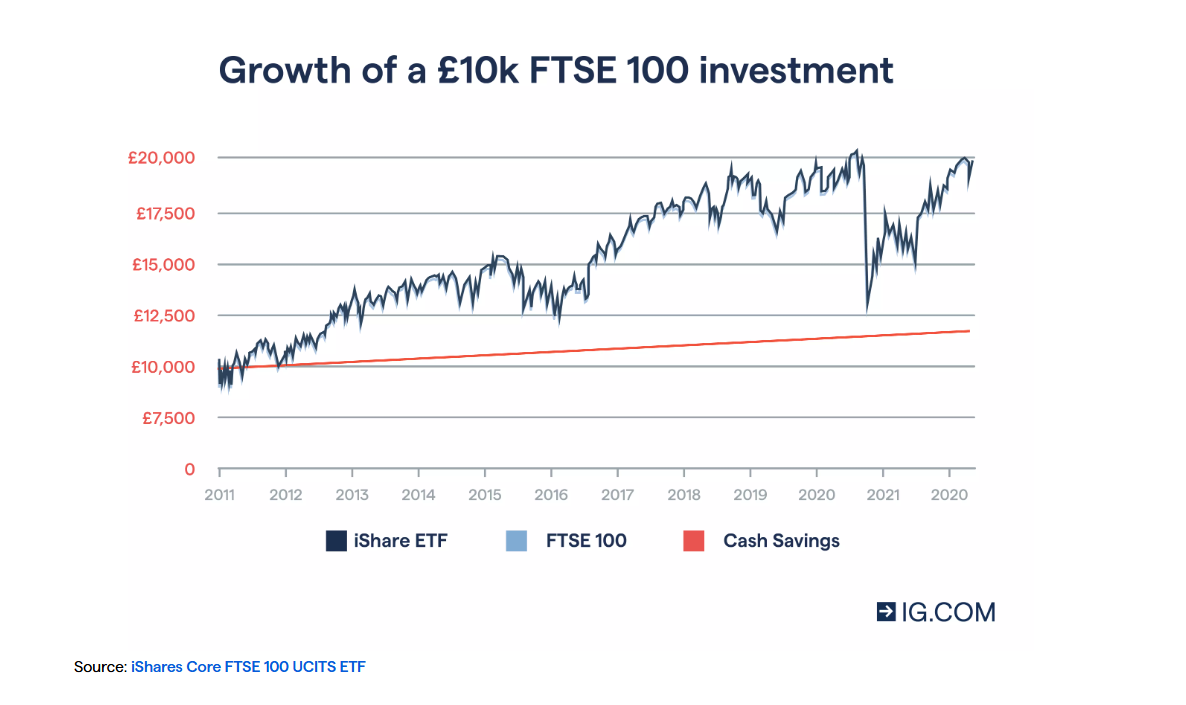

Many UK investors choose to invest because inflation reduces the real value of cash savings over time. While savings accounts offer stability and FSCS protection up to £85,000 per person per provider, their returns often struggle to keep pace with rising prices. Investing offers the potential for higher long-term growth, but with higher risk.

How investing works in practice

When you invest, your money is exposed to markets through assets such as:

- Shares, where you own a stake in a company

- Funds and ETFs, which pool money across many investments to spread risk

- Bonds and gilts, where you lend money to governments or companies for interest

Returns usually come from a mix of capital growth and income, such as dividends or interest.

Key risks UK investors should understand

- Capital is at risk and values can fall as well as rise

- Investments are not FSCS protected against market losses

- Short-term investing increases the chance of losses

- Market volatility is normal, especially over shorter periods

For this reason, investing is generally most suitable when you have an emergency fund in place and a time horizon of five years or more.

Should beginners save or invest their money first?

Most beginners should save first, then invest. The priority is building a cash safety net before taking investment risk. In the UK, this usually means holding three to six months of essential expenses in an easy access savings account before committing money to investments that can rise or fall in value.

Saving first protects you from needing to sell investments at a loss if something unexpected happens, such as job loss or urgent bills. Investing comes later, once short term security is in place.

When saving should come first

Saving is usually the right first step if any of the following apply:

- You do not yet have an emergency fund

- You rely on your savings for short term needs

- You have high interest debt, such as credit cards

- You may need the money within the next five years

Cash savings in the UK are FSCS protected up to £85,000 per person per provider, meaning your capital is protected if the bank fails.

When investing can make sense

Once an emergency fund is in place, investing can help grow money over the medium to long term. Investing is typically suitable if:

- You will not need the money for at least five years

- You are comfortable with values going up and down

- You want to protect long term wealth from inflation

Investments are not FSCS protected against market losses, and you could get back less than you invest.

How inflation affects savings over time

While savings feel safe, inflation reduces their real value. The table below shows how inflation can erode £1,000 held in cash over time.

| Average inflation | Value after 5 years | Value after 20 years |

|---|---|---|

| 2.5% | £884 | £610 |

| 5.0% | £784 | £377 |

| 7.5% | £697 | £235 |

| 10.0% | £621 | £149 |

This is why many beginners eventually choose to combine saving and investing, rather than relying on cash alone.

A simple rule for beginners

A practical approach for most UK beginners is:

- Save an emergency fund in cash

- Keep short term goals in savings

- Invest surplus money for long term goals

This balance offers stability now, while giving your money the chance to grow over time.

How much money do you need to start investing in the UK?

You can start investing in the UK with as little as £25 to £100, depending on the investment and account type. Many UK platforms allow beginners to invest small monthly amounts into funds or ETFs, making investing accessible without a large lump sum. The key requirement is not the amount, but being financially ready to take risk.

There is no minimum “right” amount to invest

You do not need thousands of pounds to begin investing. What matters more is:

- You are comfortable with the money being invested

- You do not need the money in the short term

- You understand that capital is at risk

For beginners, starting small is often sensible. It allows you to learn how investing works without exposing yourself to unnecessary stress or losses.

Typical starting amounts for UK investors

While exact minimums vary by provider, these are common starting points:

- Monthly investing: £25 to £50 per month into funds or ETFs

- Lump sum investing: £100 to £500 is common for beginners

- Regular savings style investing: Small, fixed monthly contributions

Investing little and often can also reduce timing risk by spreading purchases over time.

What you should have in place before investing

Before investing any amount, most UK guidance agrees you should:

- Have 3 to 6 months of essential expenses saved in cash

- Avoid high interest debt such as credit cards

- Be prepared to invest for at least five years

Cash savings held with UK authorised providers are FSCS protected up to £85,000 per person per provider, but investments are not FSCS protected against market losses.

Why the amount matters less than your mindset

Investing is about long-term behaviour, not short-term results. Starting with a smaller amount helps beginners:

- Build confidence with market ups and downs

- Understand how different investments behave

- Develop a consistent investing habit

As confidence and financial stability improve, contributions can be increased over time.

What are the main investment options for beginners in the UK?

The main investment options for beginners in the UK include shares, funds, ETFs, bonds and gilts, and investment trusts. These options vary in risk, complexity, and potential return, making some more suitable for beginners than others. Most new investors start with diversified options rather than individual assets.

Below is a clear breakdown of each option, how it works, and the risks to consider.

What are shares and how do they work?

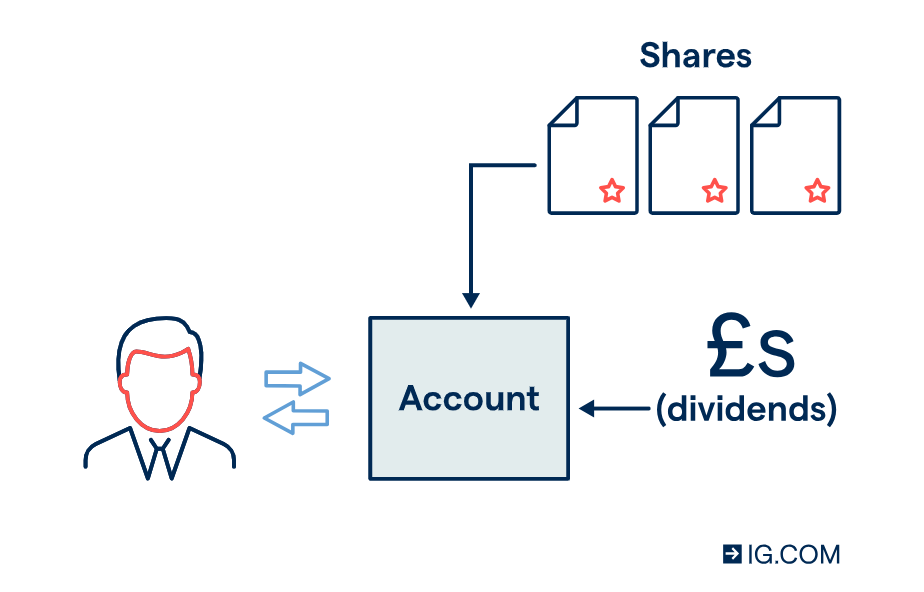

Shares give you part ownership in a company and rise or fall in value based on company performance and market conditions. When you buy shares, you profit from price growth and sometimes dividends, but you can also lose money if the share price falls.

Key points for beginners

- Higher potential long-term returns than cash

- Prices can be volatile in the short term

- Requires confidence to handle market ups and downs

Best for: Beginners willing to learn and invest long term

Risk level: Medium to high

What are investment funds?

Funds pool your money with other investors to buy a mix of assets, spreading risk across many holdings. These can include shares, bonds, property, or a combination, and are managed by professionals.

Key points for beginners

- Built-in diversification reduces risk

- Less effort than picking individual shares

- Fees apply for management

Best for: First-time investors who want simplicity

Risk level: Low to medium depending on fund type

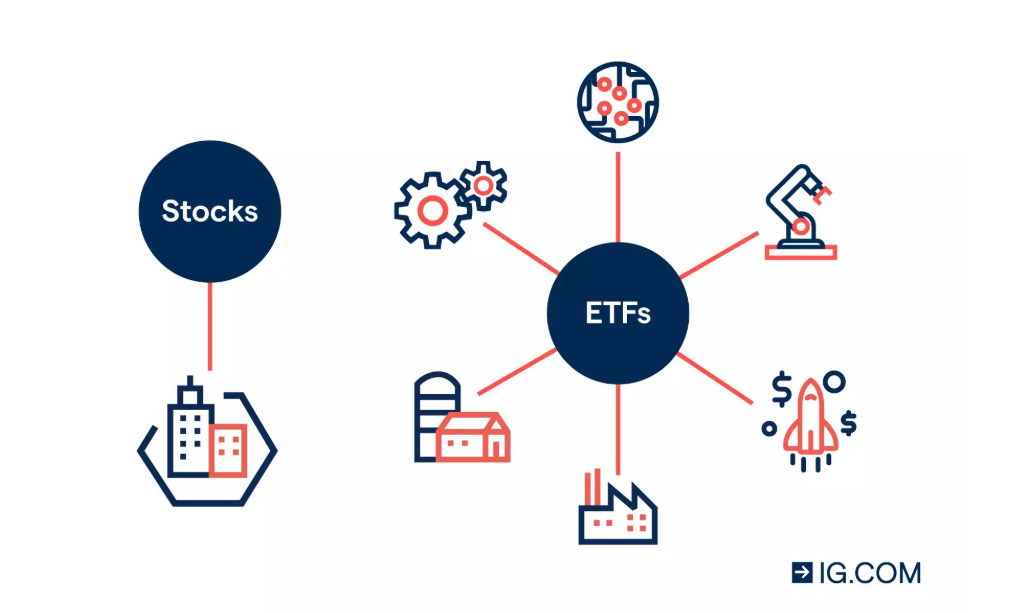

What are ETFs and why are they popular?

ETFs, or Exchange Traded Funds, track an index, sector, or asset and trade like shares on the stock market. They offer instant diversification at a lower cost than many managed funds.

Key points for beginners

- Lower ongoing fees than most funds

- Easy way to track markets like the FTSE 100 or global stocks

- Designed to match market performance, not beat it

Best for: Cost-conscious beginners

Risk level: Medium

*Read our guide to the best ETF platforms UK.

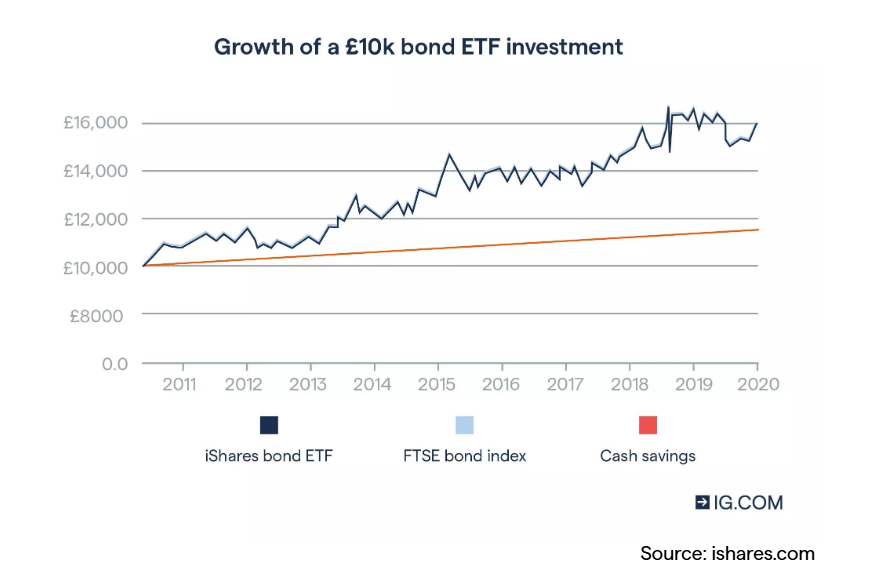

What are bonds and gilts?

Bonds and gilts are loans you make to companies or the UK government in return for regular interest payments. Gilts are issued by the UK government and are generally lower risk than company bonds.

Key points for beginners

- More stable than shares

- Lower growth potential

- Can be affected by interest rate changes

Best for: Cautious investors seeking stability

Risk level: Low to medium

What are investment trusts?

Investment trusts are companies that invest in a diversified portfolio of assets and trade on the stock exchange. Unlike funds, they have a fixed number of shares, which can affect pricing.

Key points for beginners

- Can borrow to increase returns and risk

- Prices may trade above or below asset value

- Often used for long-term investing

Best for: Beginners ready for slightly more complexity

Risk level: Medium

How do cash savings compare to investing?

Cash savings are safer but usually grow more slowly than investments due to inflation. While savings accounts offer FSCS protection up to £85,000 per person per provider, returns may not keep pace with rising prices.

| Average inflation | £1,000 after 5 years | £1,000 after 20 years |

|---|---|---|

| 2.5% | £884 | £610 |

| 5.0% | £784 | £377 |

| 7.5% | £697 | £235 |

| 10.0% | £621 | £149 |

Investments are not FSCS protected against market losses, and values can fall as well as rise.

Which investment options are best for beginners?

For most beginners, diversified funds or ETFs held inside a Stocks and Shares ISA are the simplest starting point. They reduce single-company risk, are easy to manage, and are tax-efficient.

A common beginner mix includes:

- Global equity fund or ETF for growth

- Bond fund or gilts for stability

- Cash savings for emergencies

What is the safest way to invest money for beginners in the UK?

The safest way for beginners to invest money in the UK is to combine low risk investments, broad diversification, and a long-term approach, usually through funds or ETFs held inside a tax-efficient wrapper like a Stocks and Shares ISA. There is no risk-free investment, but risk can be reduced through structure, time, and diversification.

What “safe” really means when investing

Investing is not the same as saving. All investments carry risk, and you could get back less than you invest. In UK investing terms, “safe” usually means:

- Lower volatility rather than guaranteed returns

- A reduced chance of permanent loss over time

- Avoiding concentration in single companies or assets

The lowest risk investment approach for beginners

For most beginners, safety comes from how you invest, not chasing specific assets.

The core principles of safer investing are:

- Invest for at least five years

- Use diversified funds or ETFs, not individual shares

- Spread money across regions and asset types

- Start small and invest regularly

- Accept short-term ups and downs

This approach reduces the risk of poor timing and single-company failure.

Safer investment options for beginners in the UK

| Investment type | Risk level | Why it is considered safer |

|---|---|---|

| Cash savings | Very low | FSCS protection, no market risk, but inflation erodes value |

| Government bonds and gilts | Low | Backed by governments, more stable than shares |

| Bond funds | Low to medium | Spread risk across many bonds |

| Global equity funds | Medium | Diversified across hundreds or thousands of companies |

| ETFs tracking broad markets | Medium | Low cost, diversified, transparent |

For beginners, diversified funds and ETFs are generally safer than picking individual shares.

Why funds and ETFs are safer than individual shares

Funds and ETFs spread your money across many investments, reducing the impact of any single company performing badly.

For example:

- A single share depends on one company

- A global equity fund may hold 1,000 to 5,000 companies

This diversification lowers risk and smooths returns over time.

ETFs are often preferred by beginners because:

- They have lower ongoing fees

- They track markets rather than trying to beat them

- They are simple and transparent

Using ISAs to improve investment safety

A Stocks and Shares ISA does not reduce market risk, but it improves overall outcomes by reducing tax.

Key benefits:

- No UK income tax on dividends

- No capital gains tax on profits

- Annual allowance of £20,000 per person

Reducing tax drag makes long-term investing more predictable and efficient.

Why time is one of the biggest safety factors

The longer money stays invested, the lower the risk of a loss historically.

Short-term investing increases risk because markets move unpredictably. Over longer periods, markets have had more time to recover from downturns.

A common beginner rule:

- Less than 5 years: savings or low risk options

- 5 years or more: diversified investing becomes more suitable

How does risk work and how much risk should beginners take?

Risk in investing is the chance that your money goes down in value or delivers lower returns than expected, and beginners should usually take a low to medium level of risk aligned to long-term goals. In the UK, risk is best managed through time, diversification, and only investing money you can afford to leave untouched for at least five years.

How investment risk works in simple terms

Every investment carries risk because there are no guarantees. Prices move up and down due to factors such as company performance, interest rates, inflation, and wider economic events. Higher potential returns usually come with higher risk, while lower-risk investments tend to offer more modest growth.

Key points beginners should understand:

- You could get back less than you invest

- Short-term investing increases risk

- Long-term investing can reduce the impact of market swings

- Investments are not FSCS protected against market losses

Cash savings feel safer, but they carry inflation risk, meaning your money can lose spending power over time.

Risk versus return for common UK investments

| Investment type | Typical risk level | What that means for beginners |

|---|---|---|

| Cash savings | Very low | Stable value but inflation reduces real returns |

| Bonds and gilts | Low | More stable, lower growth potential |

| Bond funds | Low to medium | Diversified income with some price movement |

| Global funds and ETFs | Medium | Ups and downs, but diversified across markets |

| Individual shares | Medium to high | Higher volatility and higher potential losses |

For beginners, diversified funds or ETFs usually provide a better balance between risk and potential return than individual shares.

How much risk should beginners take?

Most beginners are best suited to low or medium risk investing, especially at the start. This typically means:

- Investing gradually rather than all at once

- Avoiding concentrated bets on single companies or sectors

- Accepting that short-term losses are normal

Why time reduces risk

Time is one of the most important risk management tools. Markets are unpredictable in the short term but have historically been more stable over longer periods. Staying invested gives your money time to recover from downturns and benefit from compound growth.

Inflation and hidden risk in “safe” money

Holding everything in cash feels safe, but inflation reduces real value over time.

| Average inflation | £1,000 after 5 years | £1,000 after 20 years |

|---|---|---|

| 2.5% | £884 | £610 |

| 5.0% | £784 | £377 |

| 7.5% | £697 | £235 |

| 10.0% | £621 | £149 |

This is why many beginners combine cash for emergencies with investing for long-term goals.

Matching risk to your reason for investing

Your reason for investing should guide how much risk you take.

- Investing for growth: usually involves higher risk assets like shares and equity funds

- Investing for income: often uses dividends, bonds, or income-focused funds

- Most beginners: use a mix of growth and income assets

Reinvesting income can accelerate compound growth, but it also increases exposure to market movements.

Key takeaway for beginners

Beginners do not need to avoid risk entirely, but they should control it. In practice, this means starting small, investing for the long term, and using diversified funds or ETFs rather than taking large risks on individual investments.

What is compound growth and why does it matter for new investors?

Compound growth is when your investment grows not only on the money you put in, but also on any returns it has already generated, and it matters because it is one of the most powerful drivers of long-term wealth for new investors. The longer money stays invested, the more compounding can work in your favour.

What is compound growth in simple terms?

Compound growth happens when returns are reinvested rather than taken as cash. Any growth or income earned is added back to the original investment, and future returns are then calculated on this higher amount.

In investing, compounding usually comes from:

- Reinvested dividends from shares or funds

- Reinvested interest from bonds or bond funds

- Ongoing capital growth over time

This creates a snowball effect, where growth accelerates as time passes.

How compound growth works step by step

For beginners, compounding can be broken down into three stages:

- You invest an initial amount

- That investment generates growth or income

- The growth or income is reinvested and also begins to grow

Over time, the majority of your portfolio value can come from growth on growth, not just the money you originally invested.

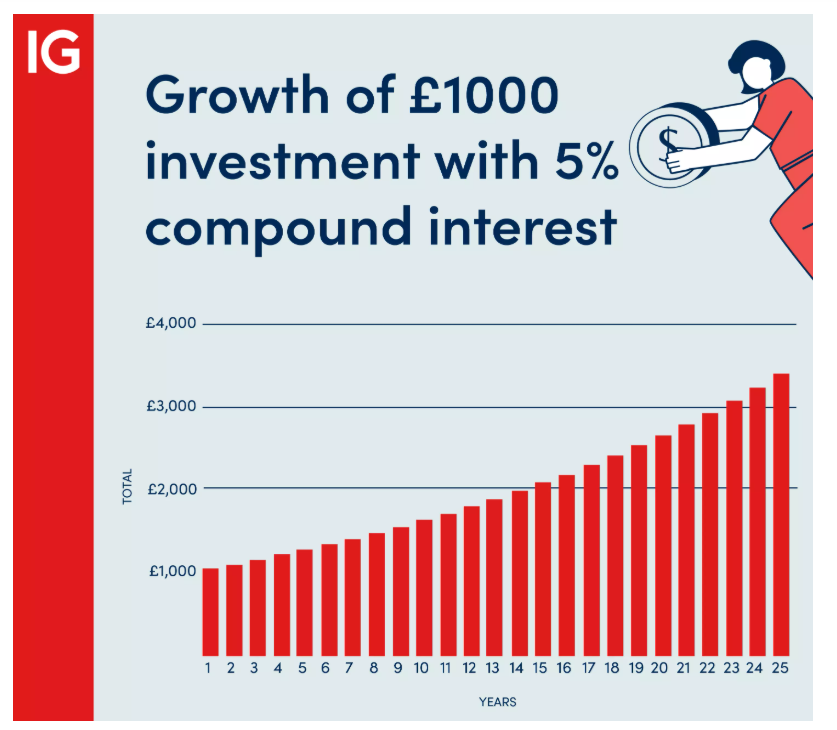

A simple example of compound growth

The table below shows how £1,000 could grow over time if returns are reinvested. Figures are illustrative and not guaranteed.

| Annual return | Value after 5 years | Value after 20 years |

|---|---|---|

| 3% | £1,159 | £1,806 |

| 5% | £1,276 | £2,653 |

| 7% | £1,403 | £3,870 |

This shows why time matters more than short-term performance for new investors.

Why compound growth matters so much for beginners

Compound growth is especially important for beginners because:

- Starting early gives compounding more time to work

- Small, regular investments can grow significantly

- Reinvesting income accelerates long-term results

- Patience often matters more than picking investments

Even modest returns can lead to meaningful growth when combined with time and consistency.

Compound growth versus simple saving

Cash savings usually earn interest only on the original amount plus interest paid, and rates often struggle to keep up with inflation. Investing allows compounding to work on market growth as well as reinvested income, although this comes with higher risk.

Cash savings with UK authorised providers are FSCS protected up to £85,000 per person per provider, but investing is not FSCS protected against market losses, and values can fall as well as rise.

Why reinvesting income is key

Reinvesting dividends or interest is what turns basic growth into compound growth. Many funds and ETFs automatically reinvest income, making this process simple for beginners.

This approach is common for:

- Long-term investing goals

- Retirement planning

- Stocks and Shares ISAs

Taking income instead of reinvesting slows compounding, which is why many investors focus on growth in earlier years and income later on.

How time reduces risk when compounding

Compounding works best over longer periods. Investing for at least five years gives markets time to recover from downturns and allows growth to accumulate. Short-term investing limits the benefits of compounding and increases risk.

Key risks beginners should understand

- Returns are not guaranteed

- Market values can go down as well as up

- You could get back less than you invest

- Compounding does not remove risk, it rewards time

This is why beginners should only invest money they do not need in the short term and should build an emergency fund first.

Key takeaway for new investors

Compound growth rewards patience, consistency, and reinvestment. For beginners, starting early, investing regularly, and reinvesting income can have a far greater impact on long-term outcomes than trying to time markets or chase short-term gains.

What is the best way to invest for the long term in the UK?

The best way to invest for the long term in the UK is to invest regularly into diversified funds or ETFs, held inside tax efficient wrappers such as a Stocks and Shares ISA or pension, and remain invested for at least five years. Long term investing focuses on growth, managing risk through diversification, and allowing compound growth to work over time.

Start with a long term mindset

Long term investing is not about short term market movements or quick returns. It is about staying invested through market ups and downs and giving investments time to recover and grow. In the UK, long term investing is typically defined as five years or more, with many goals extending across decades.

Key principles of long term investing include:

- Investing money you do not need in the short term

- Accepting that values will rise and fall

- Avoiding emotional decisions during market volatility

- Focusing on consistency rather than timing

Investments can fall as well as rise, and you could get back less than you invest.

Why long term investing beats saving alone

Cash savings protect your balance, but not its spending power over time. While savings held with UK authorised providers benefit from FSCS protection up to £85,000 per person per provider, returns often struggle to keep pace with rising prices. Long term investing involves risk, but it gives money the opportunity to grow faster than inflation over multi year periods.

As a result, many UK investors use a combination of cash for emergencies and short term needs, and investments for long term goals such as retirement or financial independence.

Use diversification to manage risk

Diversification reduces risk by spreading money across different assets, regions, and sectors. Rather than relying on the performance of a single company or market, diversified investing helps smooth returns over time.

For most long term UK investors, diversification includes:

- Global equities rather than individual shares

- A mix of asset types such as shares and bonds

- Exposure across multiple countries and industries

Funds and ETFs are commonly used because they provide instant diversification and reduce the need for active decision making.

Focus on growth first, then income later

Long term investing usually prioritises capital growth, particularly in earlier years. Growth comes from rising asset values and reinvested income.

There are two main long term investment approaches:

- Growth investing, which aims to increase the value of investments over time

- Income investing, which aims to generate regular payments

Many investors combine both approaches. Reinvesting income supports compound growth, which can significantly improve long term outcomes.

Let compound growth work over time

Compound growth occurs when returns are reinvested and then generate further growth. Over long periods, compounding can contribute more to final outcomes than the amount originally invested.

This is why starting early, investing regularly, and staying invested for longer periods are central to long term investing strategies.

Use tax efficient accounts wherever possible

Tax efficiency plays a major role in long term investing outcomes. Using tax wrappers helps reduce the impact of tax without increasing risk.

Common UK long term investment wrappers include:

- Stocks and Shares ISAs, which shelter returns from UK income and capital gains tax

- Pensions and SIPPs, which offer tax relief on contributions and tax efficient growth

- Junior ISAs, which allow long term investing for children

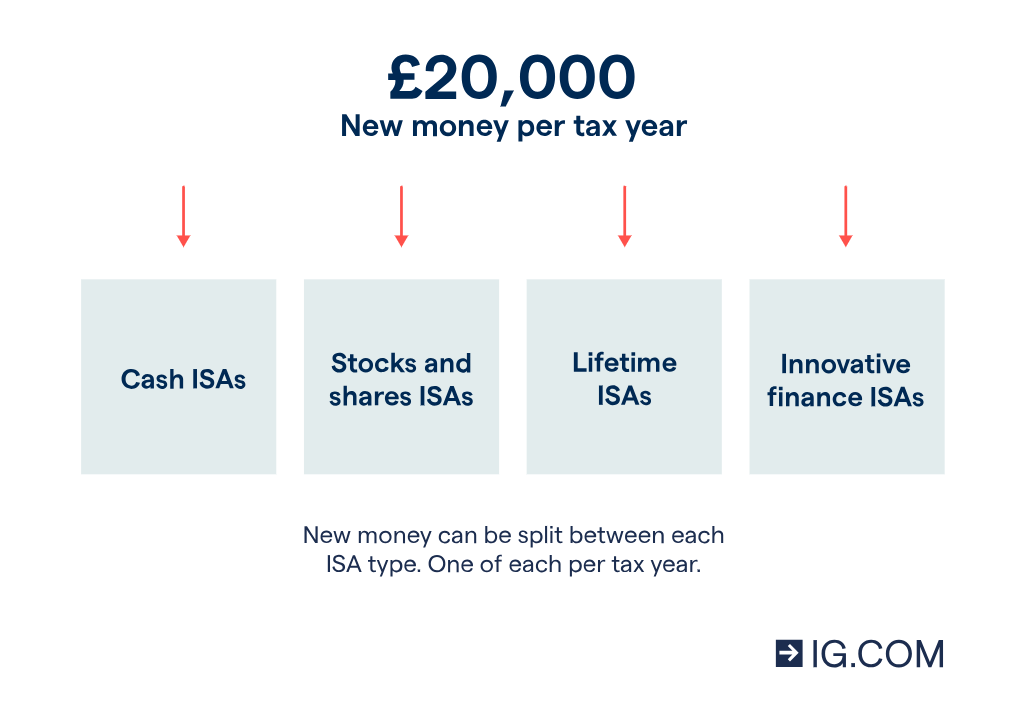

The annual ISA allowance is £20,000 per person, and unused allowances cannot be carried forward.

Invest regularly to reduce timing risk

Regular investing spreads money across time rather than committing a single lump sum. This helps reduce the risk of investing just before market downturns and encourages disciplined behaviour.

Benefits of regular investing include:

- Smoother market entry points

- Reduced emotional decision making

- Accessibility with smaller monthly amounts

Many UK investors start with modest monthly contributions and increase them as confidence and income grow.

Keep costs low and avoid overcomplication

Investment fees reduce returns, particularly over long periods. Long term investors generally benefit from:

- Low cost funds and ETFs

- Simple, diversified portfolios

- Limited trading activity

Keeping costs low helps more of your returns stay invested and compound over time.

A simple long term investing framework

A practical long term investing approach for UK investors is:

- Build an emergency fund in cash

- Define long term goals of five years or more

- Invest regularly into diversified funds or ETFs

- Use ISAs or pensions for tax efficiency

- Review investments periodically rather than frequently

Key takeaway

The best way to invest for the long term in the UK is to invest consistently, diversify widely, keep costs low, and remain invested through market ups and downs using tax efficient accounts. This approach does not remove risk, but it gives long term investors the best chance of growing wealth responsibly over time.

How can beginners invest in a tax efficient way in the UK?

Beginners can invest tax efficiently in the UK by using government approved tax wrappers such as ISAs and pensions, which shelter investments from income tax and capital gains tax. Using these accounts does not reduce investment risk, but it helps more of any returns stay invested over time.

Tax efficiency matters because taxes can significantly reduce long term outcomes, especially when investments grow or generate income.

Stocks and Shares ISAs

A Stocks and Shares ISA allows beginners to invest in shares, funds, and ETFs without paying UK income tax or capital gains tax on returns. It is one of the simplest and most flexible tax efficient options available.

Key points beginners should know:

- Annual allowance of £20,000 per person

- No tax on dividends or capital gains

- Funds can usually be accessed at any time

- Suitable for medium to long term investing

Stocks and Shares ISAs are commonly used for long term goals such as building wealth or supplementing retirement savings. Investments inside an ISA can fall as well as rise, and returns are not guaranteed.

Lifetime ISAs

A Lifetime ISA is designed to help younger investors save tax efficiently for a first home or retirement, with an added government bonus. It offers strong incentives but has stricter rules.

Key features:

- Available to UK residents aged 18 to 39

- Contribute up to £4,000 per year

- Government adds a 25% bonus, up to £1,000 annually

- Can be held as cash or stocks and shares

Lifetime ISAs can be used to:

- Buy a first home up to the price limit

- Save for retirement after age 60

Withdrawals for other reasons usually trigger a penalty, so this option is best suited to clearly defined long term goals.

Pensions and SIPPs

Pensions are one of the most tax efficient ways for beginners to invest for retirement due to tax relief on contributions and tax efficient growth. A SIPP offers more control than a standard workplace pension.

Why pensions are tax efficient:

- Contributions receive tax relief, boosting invested amounts

- Investments grow largely free of UK income and capital gains tax

- Employer contributions may apply in workplace schemes

Key considerations:

- Money is usually locked away until later life

- Withdrawals are taxed under pension rules

- Investment risk still applies

For beginners, contributing to a workplace pension, especially where employers match contributions, is often the most efficient starting point.

Junior ISAs

A Junior ISA allows parents or guardians to invest tax efficiently on behalf of a child, with all returns sheltered from tax. The account belongs to the child and becomes accessible at age 18.

Key details:

- Annual allowance of £9,000

- Available as cash or stocks and shares

- No income or capital gains tax on returns

- Funds cannot be accessed until adulthood

Junior Stocks and Shares ISAs are often used for long term investing, such as supporting education costs or giving children a financial head start.

Getting started and understanding the risks

Tax efficiency does not remove investment risk, and beginners should understand the basics before investing. Returns are never guaranteed, and you could receive back less than you invest.

A simple framework for beginners:

- Build an emergency fund of three to six months of essential expenses

- Decide whether the goal is growth, income, or both

- Choose a suitable tax wrapper such as an ISA or pension

- Invest small amounts first and increase gradually

- Commit to a time horizon of at least five years

Key takeaway for beginners

The most tax efficient way for beginners to invest in the UK is to use ISAs and pensions appropriate to their goals, while accepting that all investing involves risk. Choosing the right wrapper early can significantly improve long term outcomes without increasing exposure to the markets.

How should beginners invest based on their age or life stage?

Beginners should invest differently depending on their age, income stability, and time horizon, because these factors affect risk tolerance, investment goals, and suitable account types. In the UK, younger investors can usually take more risk for growth, while older investors tend to prioritise stability, income, and capital preservation.

There is no single “correct” portfolio by age, but life stage provides a practical framework for decision making.

Investing in your 20s and 30s

Beginners in their 20s and 30s typically benefit from focusing on long-term growth, using diversified investments and tax efficient accounts such as Stocks and Shares ISAs and pensions. Time is the biggest advantage at this stage, as longer horizons reduce the impact of short-term market volatility.

Common priorities at this stage include:

- Building long-term wealth

- Starting retirement savings early

- Balancing investing with housing and lifestyle costs

Typical investment approach:

- Greater exposure to growth assets such as global equity funds or ETFs

- Regular monthly investing rather than lump sums

- Early pension contributions to benefit from compound growth and employer matching

Although risk tolerance is usually higher, an emergency fund of three to six months of essential expenses should still come first.

Investing in your 40s and 50s

In your 40s and 50s, investing often shifts toward balancing growth with stability, while increasing focus on retirement planning and tax efficiency. Time horizons are shorter than in early adulthood, so managing risk becomes more important.

Key considerations include:

- Reviewing pension contributions and projected retirement income

- Reducing reliance on high-risk or concentrated investments

- Using ISAs and pensions strategically to manage future tax

Typical investment approach:

- Continued growth investing, but with broader diversification

- Gradually increasing exposure to lower volatility assets such as bonds

- Making full use of annual ISA allowances where possible

This stage is often the highest earning period, making tax efficient investing especially valuable.

Investing in your 60s and retirement

In your 60s and during retirement, investing usually focuses on preserving capital, generating income, and managing withdrawals sustainably. Growth still matters, but protecting money already built becomes a priority.

Common goals include:

- Creating reliable income alongside pensions

- Protecting savings from excessive market swings

- Managing tax efficiently during withdrawals

Typical investment approach:

- More conservative asset allocation, though not all growth assets are removed

- Using income-focused funds, bonds, or dividend strategies

- Planning withdrawals carefully to avoid selling investments during market downturns

Many retirees keep part of their portfolio invested for growth to help offset inflation over long retirements.

Why age matters, but flexibility matters more

Age provides guidance, but personal circumstances are more important than fixed rules. Health, income security, spending needs, and attitude to risk should always shape decisions more than age alone.

Across all life stages, beginners should remember:

- Investments can fall as well as rise

- Returns are not guaranteed

- Diversification and time reduce risk, but do not remove it

- Reviewing investments periodically is more effective than reacting to short-term market movements

Key takeaway for beginners

The best way to invest at any age is to match risk and investment choices to your time horizon and financial goals. Younger investors can usually focus on growth, mid-life investors balance growth and stability, and retirees prioritise income and capital preservation, while still keeping some exposure to growth where appropriate.

What are the best short term investment options in the UK?

The best short term investment options in the UK prioritise capital protection, liquidity, and predictable returns over high growth. For most beginners, “short term” means money needed within one to five years, where preserving value matters more than maximising returns.

Short term investing still involves risk, and unlike long term investing, there is less time to recover from market downturns.

High yield savings accounts

High yield savings accounts are one of the safest short term options for UK investors who need easy access to their money. These accounts offer variable interest and are protected by the FSCS up to £85,000 per person per provider.

Best for:

- Emergency funds

- Short term goals under two years

- Investors who cannot risk capital loss

Key trade off:

- Returns may struggle to keep pace with inflation

Fixed rate savings and notice accounts

Fixed rate and notice accounts offer higher certainty by locking money away for a set period in exchange for a guaranteed rate. They are also FSCS protected, making them suitable for short term planning where access timing is predictable.

Best for:

- Known expenses in 6 to 36 months

- Investors who do not need instant access

Key trade off:

- Early withdrawals may not be allowed or may incur penalties

Premium Bonds

Premium Bonds provide capital security backed by the UK government, with returns paid through monthly prize draws rather than interest. While returns are not guaranteed, your original investment does not fall in value.

Best for:

- Very cautious investors

- Parking cash short term with upside potential

Key trade off:

- No guaranteed return and winnings vary significantly

Short term bond funds and gilts

Short term bond funds and UK gilts can offer modest income with lower volatility than shares, but they are not risk free. Prices can still fluctuate due to interest rate changes.

Best for:

- One to five year horizons

- Investors comfortable with small price movements

Key trade off:

- Capital is not FSCS protected

- Returns are typically lower than equities

Stocks and shares for short term goals

Stocks and shares are generally not suitable for short term investing due to volatility, even though they offer higher return potential. Market downturns can lead to losses at the point money is needed.

Best for:

- Flexible goals with no fixed deadline

Key trade off:

- High short term risk

- Capital values can fall sharply

Key risks beginners should understand

Short term investing reduces time to recover from losses, making risk management more important than return chasing. Before investing short term, beginners should ensure:

- Emergency cash is already in place

- Money will not be needed urgently

- The product matches the time horizon

Key takeaway

For short term goals, UK beginners are usually best served by FSCS protected savings, fixed rate products, or low risk government backed options. Investing in higher risk assets is generally more suitable for long term goals where time reduces volatility risk.

How can beginners invest in property in the UK with little money?

Beginners can invest in UK property with little money by using indirect property investments such as REITs, property funds, and property crowdfunding rather than buying a physical property outright. These options reduce upfront costs, remove the need for a mortgage, and allow investors to start with small amounts.

Direct property ownership usually requires a large deposit, stamp duty, and ongoing costs, making it inaccessible for many beginners.

What does “investing in property” actually mean?

Property investing means putting money into real estate with the aim of earning income, capital growth, or both. This can be done either by owning property directly or by investing through financial products linked to property assets.

For beginners with limited capital, indirect property investing is usually more realistic and lower effort.

Investing through REITs

REITs allow beginners to invest in property portfolios by buying shares in companies that own income producing real estate. These typically include commercial buildings, residential blocks, warehouses, or healthcare property.

Key features:

- Traded like shares on the stock market

- Pay regular income from rental profits

- Can be bought inside a Stocks and Shares ISA

- No large upfront investment required

Risks to understand:

- Share prices can fall

- Income is not guaranteed

- Property values can decline during downturns

REITs are one of the simplest ways to gain property exposure with small amounts of money.

Property funds and investment trusts

Property funds pool investor money to buy and manage a range of properties, offering diversification without direct ownership. These funds may focus on commercial, residential, or mixed property assets.

Pros:

- Diversification across many properties

- Professional management

- Accessible to beginners

Cons:

- Some funds can restrict withdrawals during periods of market stress

- Values can fall as well as rise

Property funds are often used as part of a wider diversified investment portfolio rather than a standalone solution.

Property crowdfunding

Property crowdfunding allows beginners to invest small amounts into specific property projects or portfolios alongside other investors. Returns may come from rental income, development profits, or both.

Typical characteristics:

- Lower minimum investments than buying property directly

- Access to individual projects

- Returns depend on project performance

Risks to consider:

- Capital may be locked in for several years

- Projects can be delayed or underperform

- Investments are not FSCS protected

Crowdfunding is higher risk than REITs and is better suited to investors who understand the project structure.

Why buying property directly is difficult with little money

Buying a physical property usually requires a large deposit, mortgage approval, and ongoing costs, which makes it challenging for beginners with limited capital.

Common barriers include:

- Deposit requirements of 5% to 25%

- Stamp duty and legal fees

- Maintenance, void periods, and repairs

- Interest rate and tenant risk

For most beginners, indirect property investing offers exposure without these responsibilities.

Getting started and understanding the risks

Property investments can fall in value, and income is never guaranteed. Before investing, beginners should ensure:

- An emergency fund of three to six months of expenses is in place

- Investments are aligned with a five year or longer time horizon

- Property exposure does not dominate the entire portfolio

Key takeaway for beginners

The easiest way for beginners to invest in UK property with little money is through REITs, property funds, or crowdfunding rather than buying property directly. These options reduce upfront costs, simplify management, and allow gradual exposure while accepting that all property investing involves risk.

How do you actually start investing step by step in the UK?

To start investing in the UK, beginners should first build a financial safety net, choose the right type of account, select suitable investments, and then review progress periodically rather than reacting to short term market movements. This step by step approach helps reduce mistakes and manage risk from the outset.

Investing always involves risk, and you could get back less than you invest.

Step 1: Build an emergency fund

Before investing, beginners should build an emergency fund covering three to six months of essential expenses in an easy access savings account. This protects you from needing to sell investments at a loss if unexpected costs arise.

Key points:

- Keep emergency money separate from investments

- Use FSCS protected savings accounts up to £85,000 per person per provider

- Only invest money you will not need in the short term

An emergency fund is the foundation of investing, not an alternative to it.

Step 2: Choose an account type

The next step is choosing the right account or wrapper, as this determines tax treatment rather than investment performance. In the UK, using tax efficient accounts can significantly improve long term outcomes.

Common beginner options include:

- Stocks and Shares ISA for flexible, tax free investing

- Workplace pension or SIPP for retirement investing with tax relief

- General Investment Account if ISA allowances are already used

The annual ISA allowance is £20,000, and unused allowance cannot be carried forward.

Step 3: Choose investments

Beginners should focus on simple, diversified investments rather than picking individual shares. This reduces risk and removes the need to predict which companies will perform best.

Common beginner friendly choices:

- Global equity funds or ETFs

- Multi asset funds that include shares and bonds

- Ready made portfolios matched to risk tolerance

Diversification helps manage risk, but it does not remove it. Investment values can fall as well as rise.

Step 4: Monitor and review

Once invested, beginners should monitor progress occasionally and review investments periodically, rather than making frequent changes. Long term investing rewards consistency more than activity.

Best practice:

- Review investments once or twice per year

- Rebalance if risk levels drift from original goals

- Avoid reacting to short term market news

Markets move daily, but long term plans should not.

Common mistakes beginners should avoid

Many beginner mistakes come from rushing or overcomplicating the process. Common pitfalls include:

- Investing without an emergency fund

- Taking more risk than comfortable

- Constantly switching investments

- Trying to time the market

A simple, disciplined approach is usually more effective.

Key takeaway for beginners

Starting to invest in the UK is about preparation, simplicity, and patience. Build a safety net, use tax efficient accounts, invest in diversified funds, and review calmly over time. This approach does not guarantee returns, but it gives beginners a structured and responsible starting point.

What fees and costs should beginners watch out for when investing?

Beginners should watch out for platform fees, fund charges, trading fees, and advice costs, as these reduce returns over time even when investments perform well. Fees are not always obvious, and small percentages can have a large impact on long term results.

Costs do not make an investment safer or riskier, but higher costs mean more of your money goes to providers rather than staying invested.

Platform fees

Platform fees are charges for using an investment platform to hold and manage your investments. These are usually charged as a percentage of your portfolio or as a fixed monthly or annual fee.

Common structures include:

- Percentage based fees, often around 0.15% to 0.45% per year

- Flat fees, which may suit larger portfolios

- Tiered pricing as balances increase

Percentage fees have a greater impact as your portfolio grows, so understanding how they scale is important.

Fund charges

Fund charges are ongoing costs taken directly from investment funds, reducing returns without appearing as a separate bill. These are usually shown as an ongoing charge figure.

What fund charges typically cover:

- Fund management and administration

- Legal and operating costs

- Custody and reporting

Lower cost funds and ETFs often have charges below 0.30%, while actively managed funds can be significantly higher. Lower fees do not guarantee better performance, but they reduce the drag on returns.

Trading fees

Trading fees apply when you buy or sell investments and can quickly add up if you trade frequently. These are usually fixed per trade or built into wider dealing costs.

Common examples include:

- Per trade charges for shares or ETFs

- Foreign exchange fees on non GBP investments

- Bid offer spreads built into prices

Frequent trading increases costs and risk, which is why long term investors tend to trade less.

Advice fees

Advice fees apply when you receive personalised financial recommendations from a regulated adviser. These fees vary widely depending on the service provided.

Typical advice costs may include:

- Initial setup or planning fees

- Ongoing percentage based management fees

- Hourly or one off consultation charges

Financial advice can be valuable, but beginners should ensure fees are clear and proportionate to the service received.

Why fees matter more over the long term

Fees compound in the opposite direction to investment returns. Even small annual charges can significantly reduce long term outcomes, especially over decades.

For beginners, keeping fees transparent and proportionate is often more important than chasing complex strategies.

Key takeaway for beginners

The most important investing costs to understand are platform fees, fund charges, trading fees, and advice costs. Keeping costs low and predictable helps more of your money remain invested, improving long term potential without increasing risk.

Are robo advisors and managed investing suitable for beginners?

Robo advisors and managed investing services are suitable for beginners who want a simple, hands off way to invest without choosing individual investments themselves. These services build and manage diversified portfolios based on your goals and risk tolerance, making them a practical starting point for many UK investors.

They do not remove investment risk, and returns are not guaranteed.

What is a robo advisor?

A robo advisor is an automated investment service that builds and manages a portfolio for you based on a short questionnaire. It uses algorithms rather than human advisers to allocate and rebalance investments over time.

Typical features include:

- Diversified portfolios of funds or ETFs

- Automatic rebalancing

- Risk profiling based on goals and time horizon

- Low minimum investment requirements

Robo advisors are regulated in the UK and usually offer Stocks and Shares ISAs, pensions, or general investment accounts.

What is managed investing?

Managed investing means professionals make investment decisions on your behalf, either fully or partially. This can include discretionary portfolio management or ready made portfolios run by investment teams.

Key characteristics:

- Portfolios managed by professionals

- Regular monitoring and rebalancing

- Less involvement required from the investor

Managed investing typically costs more than DIY investing but offers simplicity and structure.

Why beginners often choose robo advisors

Robo advisors reduce complexity, which helps beginners avoid common mistakes such as overtrading or poor diversification. They are designed for people who want to invest consistently without deep market knowledge.

Main benefits for beginners:

- No need to pick shares or funds

- Clear risk levels

- Automatic portfolio maintenance

- Lower emotional decision making

They are especially useful for beginners investing for the long term.

What are the downsides beginners should know?

Robo advisors and managed investing are convenient, but they come with trade offs. Beginners should understand the limitations before choosing this route.

Potential drawbacks include:

- Ongoing management fees on top of fund charges

- Less flexibility than DIY investing

- Limited control over individual holdings

- Performance will track markets rather than beat them

Fees vary by provider and can reduce long term returns if not monitored.

How do costs compare to DIY investing?

Managed investing usually costs more than choosing and holding your own funds, but less than full financial advice. Typical costs include:

- Platform or management fees

- Underlying fund charges

For beginners, paying slightly higher fees may be acceptable in exchange for simplicity and discipline.

Who should consider robo advisors or managed investing?

These services are best suited to beginners who value simplicity over control. They are often appropriate if:

- You are new to investing

- You want a hands off approach

- You plan to invest regularly for five years or more

- You are comfortable paying a fee for management

Beginners who enjoy learning and managing investments themselves may prefer DIY options over time.

Key takeaway for beginners

Robo advisors and managed investing are suitable for beginners who want a simple, structured, and low effort way to start investing in the UK. They do not eliminate risk, but they can help beginners invest consistently, diversify properly, and avoid common early mistakes.

What mistakes should beginners avoid when investing in the UK?

Beginners should avoid rushing in without preparation, taking on too much risk, ignoring fees, and reacting emotionally to short term market movements. Most investing mistakes are behavioural rather than technical, and they can significantly reduce long term outcomes.

Investing always involves risk, and mistakes are more damaging when they happen early.

Investing without an emergency fund

One of the most common beginner mistakes is investing before building an emergency fund. Without accessible cash, investors may be forced to sell investments at a loss when unexpected expenses arise.

Best practice:

- Hold three to six months of essential expenses in an easy access, FSCS protected savings account

- Keep emergency money separate from investments

Investments should never replace emergency savings.

Taking on too much risk too soon

Many beginners underestimate how uncomfortable market losses can feel in practice. Choosing investments that are too risky often leads to panic selling during downturns.

Warning signs include:

- Investing heavily in a single asset or sector

- Chasing high return claims

- Ignoring personal comfort with losses

Risk should match your time horizon and emotional tolerance, not just return expectations.

Trying to time the market

Trying to buy at the perfect moment or sell before a fall is a common mistake that usually reduces returns. Markets move unpredictably, even for professionals.

Better alternatives:

- Invest regularly over time

- Focus on long term goals

- Accept that short term volatility is normal

Time in the market matters more than timing the market.

Overtrading and constant changes

Frequent buying and selling increases costs and emotional decision making. Trading fees, spreads, and tax implications can quietly erode returns.

Beginners should avoid:

- Reacting to daily market news

- Constantly switching funds

- Checking portfolios too often

Long term investing rewards patience and consistency.

Ignoring fees and costs

Small fees can have a large impact on returns over time, especially when compounded. Beginners often focus on performance and overlook costs.

Costs to watch include:

- Platform fees

- Fund ongoing charges

- Trading and foreign exchange fees

Lower costs do not guarantee better performance, but they reduce drag on returns.

Failing to use tax efficient accounts

Not using ISAs or pensions is a costly mistake for UK investors. These wrappers protect returns from UK income and capital gains tax.

Key points:

- ISA allowance is £20,000 per year

- Pension contributions may receive tax relief

- Unused ISA allowance cannot be carried forward

Tax efficiency improves outcomes without increasing risk.

Copying others without understanding

Following tips from friends, social media, or online forums without understanding the investment is risky. What suits one person may be inappropriate for another.

Before investing, beginners should understand:

- What the investment is

- How it makes money

- What could cause losses

If it cannot be explained clearly, it is usually best avoided.

Expecting guaranteed returns

No investment offers guaranteed returns, and anyone promising certainty should be treated with caution. Even lower risk investments can fall in value.

Important reminders:

- Past performance does not predict future results

- Capital is always at risk

- Higher returns usually mean higher risk

Managing expectations is part of investing responsibly.

Key takeaway for beginners

The biggest investing mistakes in the UK come from poor preparation, emotional decisions, and ignoring costs and risk. Beginners who build a safety net, invest simply, use tax efficient accounts, and stay patient are more likely to avoid these pitfalls over the long term.

FAQs

Is investing protected by the FSCS?

Most investments are not protected by the FSCS against market losses. FSCS protection usually applies only if an authorised firm fails, not if investments fall in value. Cash held with UK authorised banks is protected up to £85,000 per person per provider, but shares, funds, ETFs, and property investments can lose value.

Is investing legal in the UK?

Yes, investing is legal in the UK when done through FCA authorised firms and platforms. UK residents can legally invest in shares, funds, ETFs, bonds, property investments, ISAs, and pensions, provided the provider is regulated and the investments comply with UK law.

Do beginners pay tax on investments?

Beginners may pay tax on investments, but many do not if they use tax efficient accounts. Investments held in Stocks and Shares ISAs are free from UK income and capital gains tax. Pensions offer tax relief on contributions, but withdrawals are taxed under pension rules. Outside tax wrappers, tax may apply depending on gains and income.

Is investing better than saving long term?

Investing is generally better than saving for long term goals, but it involves higher risk. Savings offer stability and FSCS protection, while investing provides the potential to grow money faster than inflation over long periods. Many UK investors use savings for short term needs and investing for long term goals.

Where to invest money to get monthly income UK?

To get monthly income from investing in the UK, investors typically use income focused funds, REITs, bond funds, or managed income portfolios that pay regular distributions. These investments aim to generate income from dividends, rental payments, or interest, and can be held inside a Stocks and Shares ISA to reduce tax. Income is not guaranteed, and capital values can fall as well as rise, so monthly income investing is best suited to investors with a longer time horizon and some tolerance for risk.

How do investment apps work for beginners who want to invest regularly?

Investment apps let beginners invest small amounts on a regular schedule, often monthly, into funds or portfolios. Most apps automate deposits, reinvest income, and show performance in simple terms, making regular investing easier without needing constant involvement.

What should beginners look for in an investment platform in the UK?

Beginners should look for an FCA authorised investment platform with clear fees, simple tools, access to ISAs, and a good range of diversified funds or ETFs. Ease of use, strong customer support, and transparent pricing are usually more important than advanced features.