The best crypto exchanges in the UK offer low fees, strong security, and simple ways to buy and sell digital assets with pounds sterling.

This guide compares the top FCA-regulated platforms in 2026, outlining their costs, tools, and features in clear, practical terms.

It helps UK beginners and active traders choose a safe, reliable exchange that fits their needs.

Key takeaway: What’s the best crypto exchange in the UK?

The best crypto exchanges in the UK are eToro, Coinbase, and Bitpanda. These platforms stand out for strong FCA oversight, clear fees, secure account protection, and simple GBP deposits, making them the most reliable choices for beginners and everyday investors.

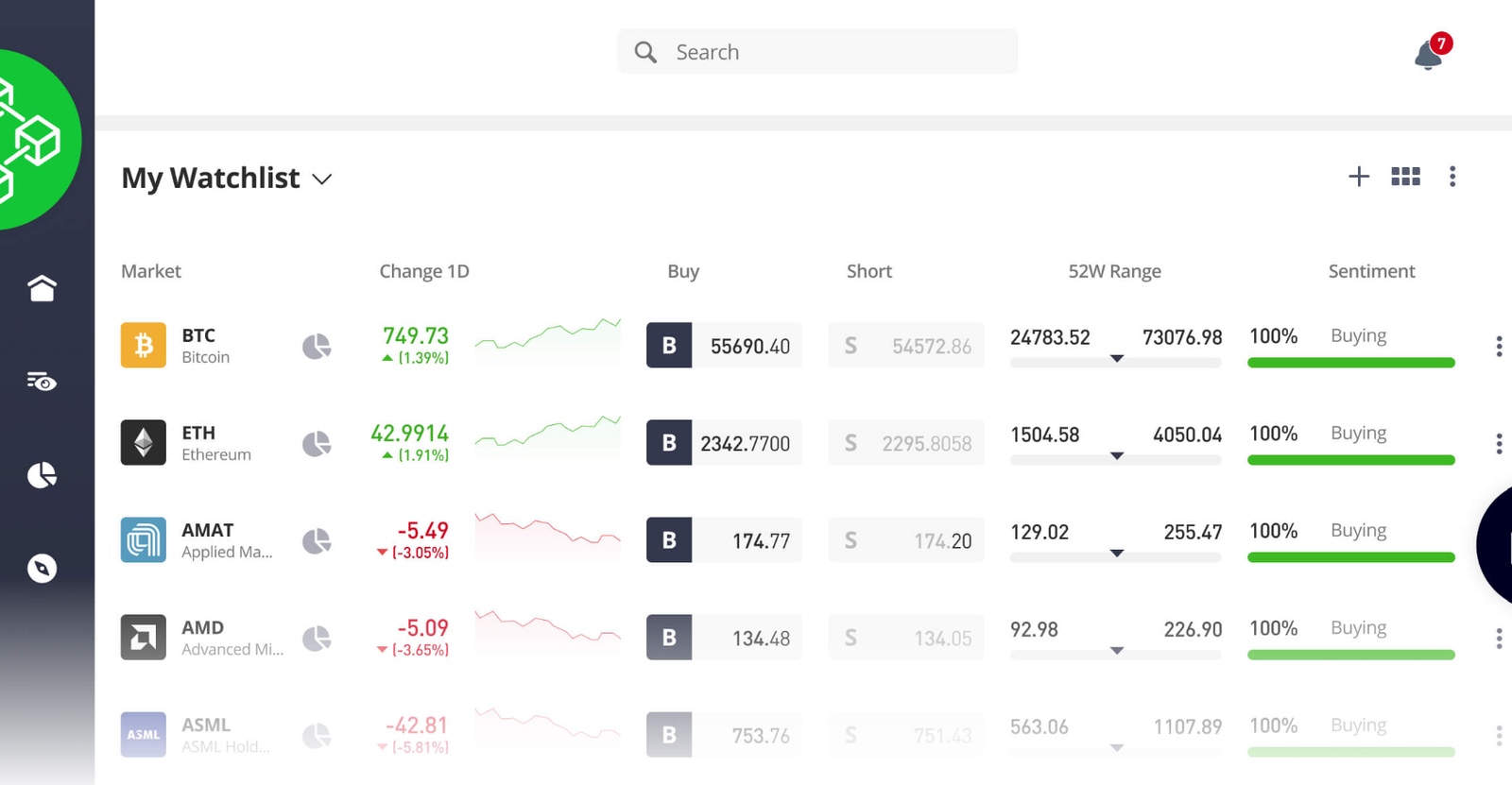

Best UK crypto exchanges compared

| Rank | Exchange | Number of cryptos | Beginner score | Fees | GBP deposit methods |

|---|---|---|---|---|---|

| 1 | eToro | 100 plus | 5.0 | ~1 percent + market spread | Bank transfer, debit card, Faster Payments, eToro Money |

| 2 | Coinbase | 250 plus | 4.8 | ~0.5 percent spread + 1.5–4 percent | Bank transfer, debit card, PayPal |

| 3 | Bitpanda | 600 plus | 4.4 | 0.99 percent to ~2.49 percent | Bank transfer, debit card, PayPal, Apple Pay |

| 4 | Crypto.com | 400 plus | 4.2 | 0.40 percent maker taker (lower with volume) | Bank transfer (FPS), debit card, PayPal, Apple Pay |

| 5 | Uphold | 250 plus | 4.0 | 0.8–1.5 percent spread | Bank transfer, debit card, Apple Pay, Google Pay |

Top 5 crypto exchanges and what they are best for

- eToro – Best for beginners and simple crypto investing

- Coinbase – Best for ease of use and fast GBP deposits

- Bitpanda – Best for widest crypto selection in the UK

- Crypto.com – Best for all in one crypto app and rewards

- Uphold – Best for multi asset trading across crypto and fiat

UK crypto exchange reviews

Below is a closer look at the top UK crypto exchanges, with concise reviews to help you compare their fees, features, and overall reliability.

1. eToro – Best for beginners and simple crypto investing

Should you use eToro for cryptocurrency investing?

Yes, eToro is a beginner friendly, regulated option for UK investors who want a simple way to buy crypto, learn from other traders, and trade multiple assets in one app. Its crypto fees are higher than some rivals, but the social and copy trading tools make it ideal for beginners and casual investors.

Key info: eToro crypto exchange at a glance

| Feature | eToro UK crypto details |

|---|---|

| Regulation (UK) | FCA registered for certain services, follows UK crypto rules |

| Safety | Cold storage, 2FA, SOC 1 & SOC 2 reports |

| Minimum deposit (UK) | From $50 (or equivalent in GBP) via bank transfer |

| Trading fee on crypto | 1% crypto trading fee, included in the spread |

| GBP deposit fee | Around 0.5% GBP deposit fee plus FX conversion to USD |

| Withdrawal fee | Flat $5 withdrawal fee |

| Inactivity fee | $10 per month after 12 months of inactivity |

| Crypto selection | Around 100+ cryptocurrencies |

| Other assets | Stocks, ETFs, CFDs, Smart Portfolios, copy trading |

| Platforms | Web platform and fully featured iOS and Android apps |

| Best for | Beginners and casual investors, copy trading fans |

Is this platform safe and properly regulated in the UK?

Yes. eToro is registered with the FCA for certain services and follows UK AML and marketing rules, with cold storage and 2FA for extra protection. Crypto is still not FSCS protected, so users remain exposed to market and platform risks.

What fees, spreads, and trading costs does this platform charge?

eToro charges around a 1 percent crypto trading fee, built into the spread, plus a 0.5 percent GBP deposit fee and FX conversion because accounts are in USD. There is also a $5 withdrawal fee and a $10 inactivity fee after 12 months with no activity, which makes it less attractive for very active or ultra cost focused traders.

Which coins and features does this platform offer?

eToro offers 100+ major cryptocurrencies, covering the main coins most UK investors want. Its strengths are CopyTrader, Smart Portfolios, staking on a few crypto assets, and the ability to trade stocks and ETFs from the same account.

How easy is this platform to use on desktop and mobile?

The platform is very beginner friendly, with a clean web dashboard, simple order tickets, and clear portfolio views. The mobile app mirrors this experience, adds price alerts and biometric login, and includes a demo account so users can practise before risking real money.

How fast and flexible are the GBP deposit and withdrawal options?

UK users can fund via bank transfer and debit card, with deposits usually arriving quickly and a minimum deposit from $50. Withdrawals to bank accounts are reliable but can take a few business days and always incur the $5 fee plus FX.

Who is this platform best for?

eToro suits UK beginners and casual investors who want a simple, regulated way to buy crypto and follow experienced traders. Cost sensitive or advanced traders who want very low fees, deep order books, and full self custody may prefer a specialist exchange.

Read the complete eToro review here.

Pros and cons of using eToro for crypto

Pros

- FCA registered and aligned with UK rules

- Very beginner friendly on web and mobile

- CopyTrader and social trading tools

- Smart Portfolios for easy diversification

- Single account for crypto, stocks, and ETFs

- Demo account for risk free practice

Cons

- Around 1 percent crypto fee is higher than some rivals

- $5 withdrawal fee plus FX charges on GBP flows

- Assets are held on platform unless moved to a wallet

- Withdrawals can take several business days

- Limited appeal for very advanced, low fee traders

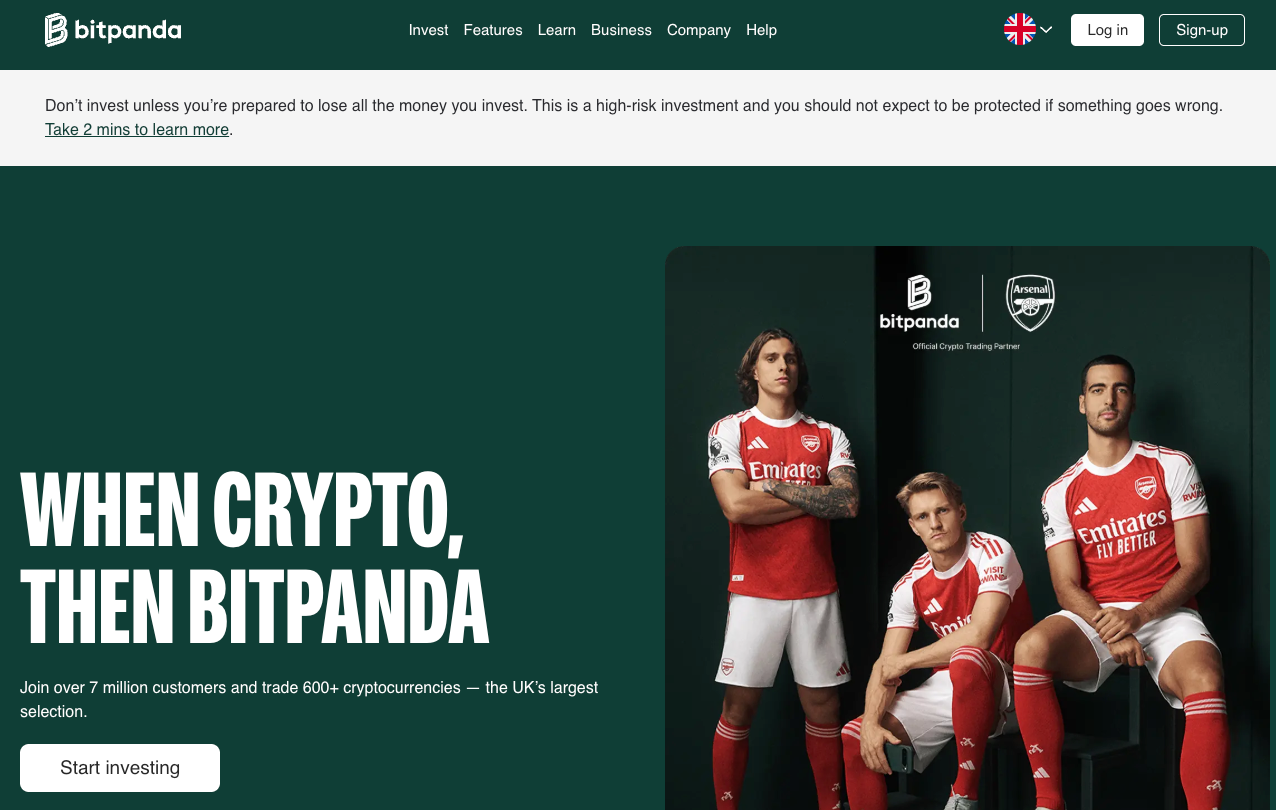

2. Bitpanda – Best for widest crypto selection in the UK

Should you use Bitpanda for cryptocurrency investing?

Yes, Bitpanda is a strong choice for UK investors who want a simple way to buy and hold a wide range of cryptocurrencies. It stands out for its huge coin selection, fee-free deposits and withdrawals, and beginner-friendly app, although crypto trading spreads can be higher than some rivals.

Key info: Bitpanda crypto broker at a glance

| Feature | Bitpanda UK crypto details |

|---|---|

| Regulation (UK) | FCA registered for cryptoasset services (not fully regulated) |

| Safety | Cold storage, 2FA, ISO 27001 / 27018 standards, no major hacks |

| Minimum trade | From £1 |

| Trading fee on crypto | From 0.99% up to around 2.49% per trade |

| Deposit fees | No Bitpanda deposit fees (network / bank charges may apply) |

| Withdrawal fees | No Bitpanda withdrawal fees (network fees on crypto only) |

| Crypto selection | 600+ cryptocurrencies plus crypto indices |

| Staking | Staking on 50+ coins, with weekly auto compounded rewards |

| Other features | Crypto indices, limit orders, Spotlight, price alerts |

| Platforms | Web platform and full iOS / Android apps |

| Best for | UK users wanting broad coin choice and long term holding |

Is this platform safe and properly regulated in the UK?

Bitpanda is registered with the FCA to provide cryptoasset services in the UK, which means it follows UK AML and conduct rules but crypto itself remains largely unregulated. Security is strong, with cold wallet storage, multi factor authentication, and ISO certified data handling, and there have been no major reported hacks.

What fees, spreads, and trading costs does this platform charge?

Bitpanda charges a clear trading premium that starts from 0.99 percent, rising to around 2.49 percent on some coins. There are no deposit or withdrawal fees from Bitpanda itself, and no inactivity fees, which suits investors who move money in and out occasionally rather than trading many times a day.

Which coins and features does this platform offer?

UK users can access over 600 cryptocurrencies, along with crypto indices that bundle coins into ready-made baskets. Extra tools include staking on 50-plus crypto assets, a Spotlight section for new projects, and limit orders, giving plenty of flexibility for both casual buyers and more engaged crypto users.

How easy is this platform to use on desktop and mobile?

Bitpanda has a very simple web interface that lets users track portfolios, check prices, and place trades without much learning curve. The mobile crypto app is highly rated for design and performance, giving a smooth way to buy, sell, stake, and monitor positions on the go.

How fast and flexible are the GBP deposit and withdrawal options?

Deposits and withdrawals are straightforward, with support for bank transfer, debit card, PayPal, and Apple Pay for UK users. Funds can usually be added quickly, there are no platform fees for moving money in or out, and crypto withdrawals only incur standard blockchain network charges.

Who is this platform best for?

Bitpanda is best for UK investors who care about coin choice and simplicity more than the absolute lowest crypto trading fee. It suits beginners and long-term holders who want to build a diversified crypto portfolio from small amounts, while very active traders who need advanced tools and ultra-tight spreads may look elsewhere.

Read the complete Bitpanda review here.

Pros and cons of using Bitpanda for crypto

Pros

- 600+ cryptocurrencies and crypto indices

- No deposit or withdrawal fees from Bitpanda

- Start trading from just £1

- Clean, beginner friendly web and mobile apps

- Simple staking on 50+ crypto assets with auto-compounding

- Transparent fee display before each trade

Cons

- Trading premiums can reach around 2.49 percent on some crypto assets

- Fewer advanced charting tools than pro trading platforms

- Limited non crypto products for UK users compared with EU offering

- Customer support can be slower during busy market periods

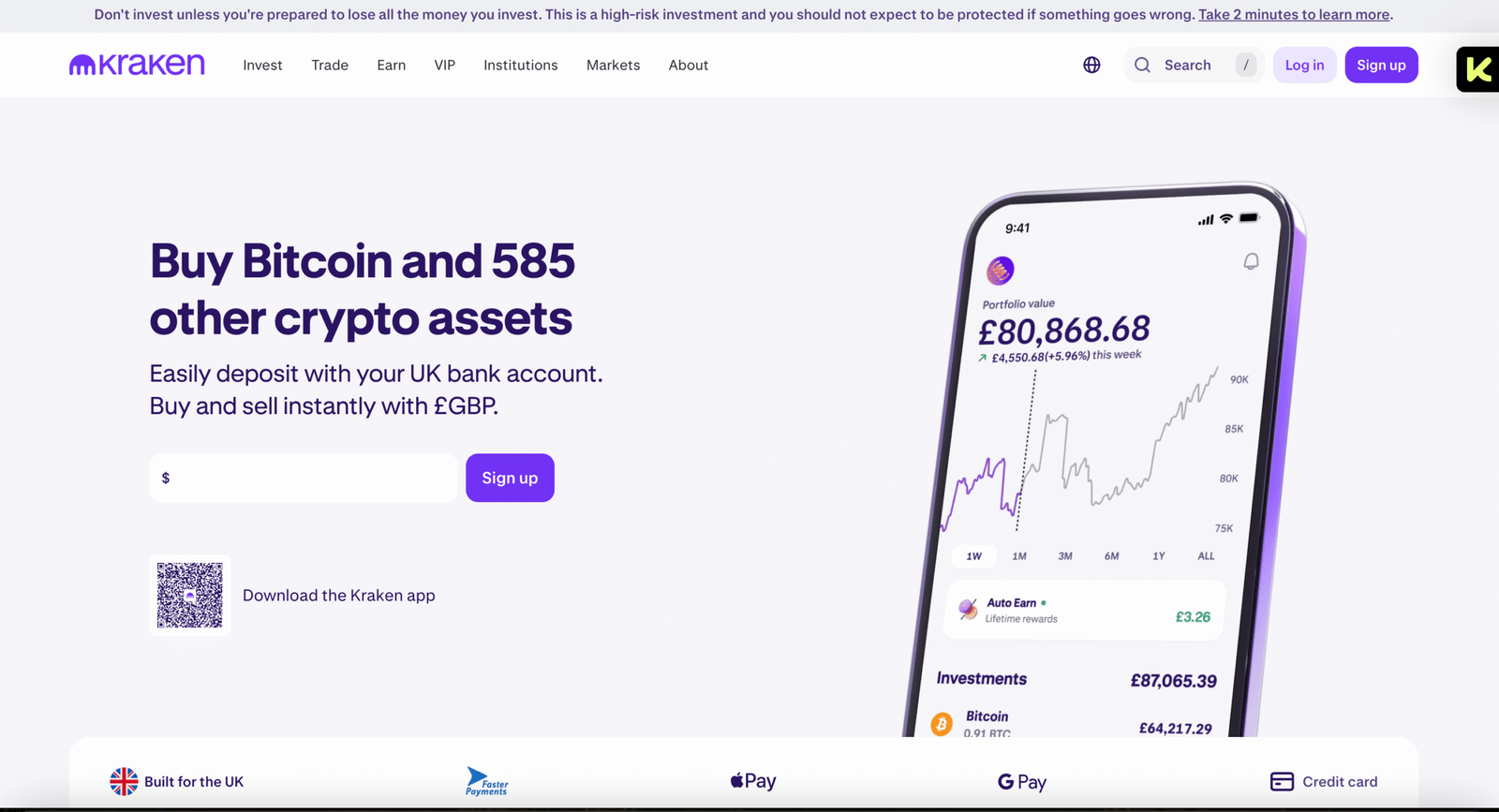

3. Kraken – Best for security focused active traders

Should you use Kraken for cryptocurrency investing?

Yes, Kraken is a strong option for UK investors who prioritise security, regulation, and competitive fees on higher volume trades. It offers FCA registration, Proof-of-Reserves audits, and deep liquidity, although the interface and Pro tools can feel more complex than beginner-only apps.

Key info: Kraken crypto broker at a glance

| Feature | Kraken UK crypto details |

|---|---|

| Regulation (UK) | FCA registered via Payward Ltd for cryptoasset activities |

| Safety | Cold storage, 2FA, ISO/IEC 27001, Proof-of-Reserves, no confirmed fund losses |

| Minimum trade | From £1 via UK bank transfer |

| Trading fee on crypto | Standard: ~1% + spread • Pro: 0.25% maker / 0.40% taker (entry tier) |

| Deposit fees | UK bank transfer typically free; card / PayPal fees vary by provider |

| Withdrawal fees | Varies by method; usually low for GBP bank transfer |

| Crypto selection | 490+ cryptocurrencies, including majors, altcoins, and niche tokens |

| Staking | Staking available on selected assets for yield-focused investors |

| Other features | Kraken vs Kraken Pro interfaces, advanced charts, order types, Proof-of-Reserves |

| Platforms | Web platform plus full iOS / Android apps (Standard and Pro) |

| Best for | Security-conscious UK users and active traders using Kraken Pro |

Is this platform safe and properly regulated in the UK?

Kraken is widely regarded as one of the safer choices, combining FCA registration in the UK with strong global security standards. Most client assets are held in offline cold storage, accounts support two factor authentication, and the platform undergoes ISO/IEC 27001 certification and regular Proof-of-Reserves checks so users can verify that client balances are fully backed.

What fees, spreads, and trading costs does this platform charge?

Kraken’s Standard buy/sell interface charges around 1 percent per trade plus a spread, which is convenient but more expensive for frequent crypto trading. Kraken Pro uses a maker-taker structure starting at 0.25 percent maker / 0.40 percent taker, with fees dropping as 30-day trading volume increases, making it more attractive for active or higher volume users.

Which coins and features does this platform offer?

UK investors can access over 490 cryptocurrencies, covering major coins like BTC and ETH, a wide range of altcoins, and specialist tokens. Features include spot trading, advanced order types on Kraken Pro, staking on selected crypto assets, and detailed portfolio and market data, with listings managed conservatively under tight compliance and reporting standards.

How easy is this platform to use on desktop and mobile?

The standard Kraken interface is designed to be clean and guided, helping newer users deposit, buy, and sell without too much friction. Kraken Pro offers a more advanced layout with order books, depth charts, and technical tools for experienced traders; it is powerful once learned, but can feel more complex than beginner-focused apps.

How fast and flexible are the GBP deposit and withdrawal options?

Kraken supports UK bank transfers with GBP, which are usually low cost and relatively quick for both deposits and withdrawals. Card and PayPal options are also available for added flexibility, but these methods may carry higher third party processing fees, so many regular traders prefer bank transfers for funding and cashing out.

Who is this platform best for?

Kraken is best suited to security-focused UK investors and active traders who want deep markets, robust regulation, and lower Pro-tier fees rather than a purely beginner-style interface. Casual users who only make occasional, small trades may find the Standard fees higher than some rivals, while highly fee-sensitive beginners might prefer a simpler, flat-fee app.

Read the complete Kraken review here.

Pros and cons of using Kraken for crypto

Pros

- FCA registered with a long operating history since 2011

- Strong security: cold storage, ISO certification, Proof-of-Reserves audits

- Competitive fees on Kraken Pro with volume-based discounts

- 490+ cryptocurrencies including major, alt, and niche tokens

- Choice of standard interface and advanced Kraken Pro tools

Cons

- Standard instant buy fees of ~1 percent plus spread are relatively high

- Interface and Pro features can be challenging for complete beginners

- No FSCS protection on crypto assets

- Card and PayPal deposits may incur higher costs than bank transfers

- Not every token is available to UK retail clients due to local rules

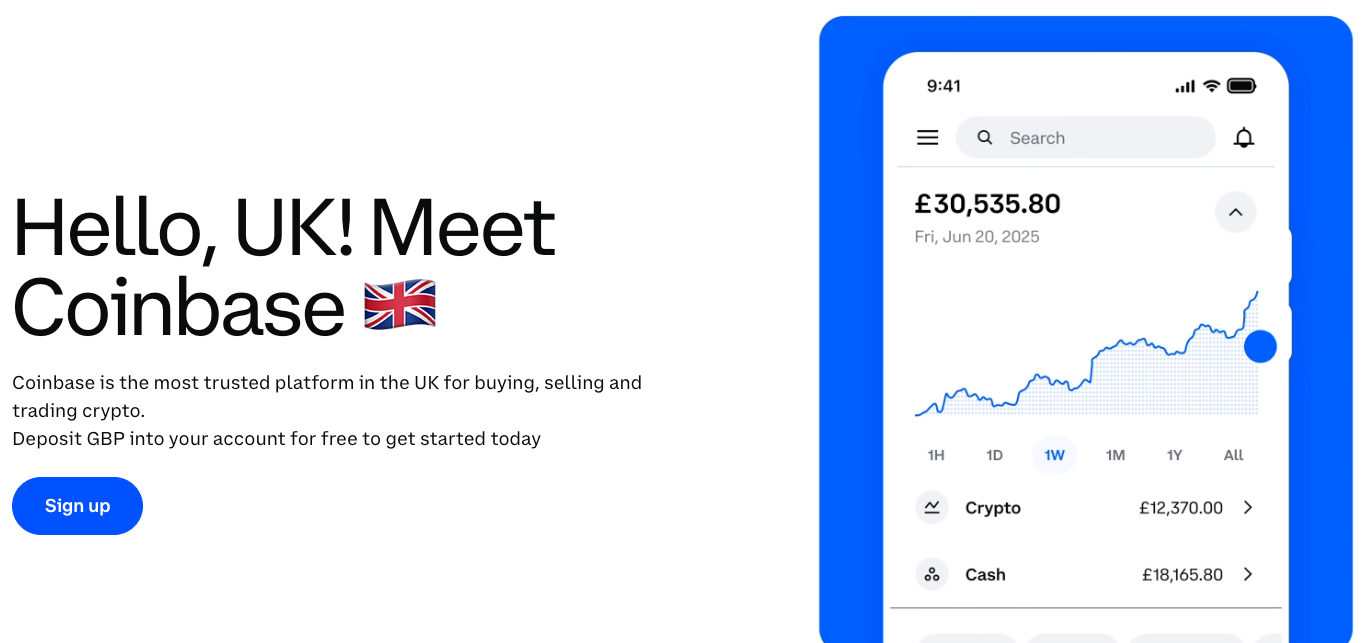

4. Coinbase – Best for ease of use and fast GBP deposits

Should you use Coinbase for cryptocurrency investing?

Yes, Coinbase is one of the easiest and most beginner friendly crypto platforms for UK users. It offers fast GBP deposits, a clean interface, strong US and UK regulatory oversight, and access to more than 250 cryptocurrencies. Fees are higher than competitors, but most casual investors value its simplicity and security.

Key info: Coinbase crypto exchange at a glance

| Feature | Coinbase UK crypto details |

|---|---|

| Regulation (UK) | FCA registered (via UK entity) under Money Laundering Regulations |

| Safety | 98 percent cold storage, 2FA, device checks, insurance for breaches, never hacked |

| Minimum trade | From £2 |

| Trading fee on crypto | ~0.5 percent spread + 1.5 to 4 percent transaction fee on standard buys |

| Deposit fees | Free GBP deposits via Faster Payments |

| Withdrawal fees | Bank withdrawals generally free; crypto withdrawals incur network fees |

| Crypto selection | 250+ cryptocurrencies with regular new listings |

| Staking | Staking available on selected coins (e.g., ETH, SOL, ADA) |

| Other features | Coinbase Advanced, Learn & Earn, instant withdrawals, price alerts |

| Platforms | Web platform, iOS and Android apps, Coinbase Advanced |

| Best for | Beginners and casual users wanting the simplest crypto experience |

Is this platform safe and properly regulated in the UK?

Coinbase is FCA registered for cryptoasset activities and follows strict security standards, including 98 percent cold storage, 2FA for all accounts, and device verification. As a publicly listed US company, it undergoes extensive financial oversight. User crypto is not FSCS protected, but Coinbase carries crime insurance for certain platform breaches.

What fees, spreads, and trading costs does this platform charge?

Coinbase charges a spread of around 0.5 percent, plus a 1.5 to 4 percent fee depending on payment method and purchase amount. These costs are shown at checkout and can be higher than many UK competitors. Coinbase Advanced offers lower maker taker fees starting at 0.6 to 1.2 percent, better suited to active users.

Which coins and features does this platform offer?

UK users can access 250+ cryptocurrencies, with support for popular assets and emerging altcoins. Features include crypto staking, crypto to crypto swaps, price alerts, Learn & Earn, and Coinbase Advanced for users who want deeper charting and more order types. It also supports GBP trading pairs to avoid conversion fees.

How easy is this platform to use on desktop and mobile?

Coinbase is designed for beginners, with a clean dashboard showing balances, price charts, and simple buy and sell buttons. Switching to Coinbase Advanced adds candlestick charts, order books, and limit orders for more experienced traders. The mobile app mirrors the website and is among the smoothest crypto apps in the UK.

How fast and flexible are the GBP deposit and withdrawal options?

UK users can deposit pounds instantly via Faster Payments with no fees. Debit card purchases settle instantly but cost more. Withdrawals to a UK bank account typically take 1 to 3 working days, while crypto withdrawals process in minutes once confirmed with 2FA. Coinbase does not currently support instant GBP card withdrawals.

Who is this platform best for?

Coinbase suits UK beginners and casual investors who want fast GBP deposits, strong regulation, and a straightforward way to buy their first crypto. It works well for users trading occasionally, while active traders may prefer lower-cost platforms such as Kraken or UK exchanges offering tight maker-taker fees.

Read the complete Coinbase review here.

Pros and cons of using Coinbase for crypto

Pros

- Very beginner friendly interface

- 250+ cryptocurrencies

- Free instant GBP deposits via Faster Payment

- Strong US and UK regulatory oversight

- Staking available on selected crypto assets

- Learn & Earn rewards for new users

- Smooth and reliable mobile app

Cons

- Fees of 1.5 to 4 percent are higher than most competitors

- Fee structure can be confusing

- No FSCS protection

- Support can be slow to reach

- No demo trading

5. Crypto.com – Best for all in one crypto app experience

Should you use Crypto.com for cryptocurrency investing?

Yes, Crypto.com is a strong option for UK users who want an all-in-one crypto platform that combines buying, trading, staking, spending, and earning in a single app. It offers a wide range of coins, competitive trading fees, a popular crypto Visa card, and FCA authorisation, although customer support and navigation can sometimes feel less polished than rivals.

Key info: Crypto.com at a glance

| Feature | Crypto.com UK details |

|---|---|

| Regulation (UK) | FCA authorised as an Electronic Money Institution |

| Safety | Cold storage for all customer funds, multi factor authentication, Zero Trust security architecture, no major breaches |

| Minimum trade | From £20 via ACH or £2 equivalent on card purchases |

| Trading fee on crypto | Maker taker model from 0.40 percent for low volume traders, dropping to 0.04 percent for high volume users |

| Deposit fees | Free GBP deposits via Faster Payments |

| Withdrawal fees | GBP bank withdrawals charged at £1.90 per transaction |

| Crypto selection | Over 400 cryptocurrencies supported |

| Staking | Crypto Earn on 40 plus assets, higher rewards for CRO staking |

| Other features | Crypto.com Visa card, Crypto Pay, NFT marketplace, DeFi wallet, CRO token rewards |

| Platforms | Mobile app first (iOS and Android), web trading for the exchange |

| Best for | UK users wanting an all in one crypto ecosystem with spending, staking, and rewards |

Is this platform safe and properly regulated in the UK?

Crypto.com holds FCA authorisation as an Electronic Money Institution, giving it a stronger regulatory footing than many crypto-only exchanges. It applies a Zero Trust, Defence in Depth security model, stores customer crypto in cold storage, and uses multi-factor authentication, passkeys, and device protections. No major security breaches have been publicly reported.

What fees, spreads, and trading costs does this platform charge?

GBP deposits are free via Faster Payments, while withdrawals incur a £1.90 fee.

Crypto purchases using debit or credit cards incur a 2.99 percent fee, and crypto withdrawals carry standard blockchain network charges.

Which coins and features does this platform offer?

Crypto.com offers a large selection of 400 plus cryptocurrencies, along with staking through Crypto Earn, crypto to crypto swaps, an NFT marketplace, a DeFi wallet for self custody, and the popular metal Visa card that gives cashback in CRO. Users can also borrow against their crypto holdings and access spot, margin, and derivatives trading through the Crypto.com exchange.

How easy is this platform to use on desktop and mobile?

Crypto.com is built as an app first platform. The mobile app is clean, powerful, and includes every feature from buying and swapping crypto to using the Visa card and setting up staking. The desktop interface supports exchange trading with deeper tools, though beginners may find navigation less intuitive compared with Coinbase.

How fast and flexible are the GBP deposit and withdrawal options?

UK users can deposit pounds instantly via Faster Payments at no cost. Bank withdrawals take one to three working days and incur a fixed £1.90 fee. Debit and credit card top ups are supported, as well as PayPal and Apple Pay for Visa card funding. Crypto deposits clear after network confirmations.

Who is this platform best for?

Crypto.com suits UK users who want a complete crypto ecosystem in one place, including buying, staking, card spending, rewards, and advanced trading features. It is ideal for users who value versatility and rewards, while beginners needing simple education tools or users who prioritise top-tier customer support may prefer Coinbase or eToro.

Read the complete Crypto.com review here.

Pros and cons of using Crypto.com for crypto

Pros

- Over 400 cryptocurrencies available

- Free GBP deposits via Faster Payments

- Competitive maker taker fees

- Crypto.com Visa card with cashback rewards

- Large feature set including staking, borrowing, and NFTs

- Strong security systems

- 24/7 live chat support

Cons

- Customer support quality can vary

- App navigation can feel complex for beginners

- Debit and credit card fees are high

- CRO staking often required to unlock the best rewards

- No FSCS protection for crypto balances

What factors should you consider when choosing the right crypto exchange?

Choosing the right crypto exchange means comparing security, fees, payment methods, asset range, and whether you want a custodial, non custodial, or decentralised experience.

UK users should also look for FCA registration on fiat services, transparent pricing, strong user protections, and clear information about how funds are stored.

1. Security and trust

- FCA registration for any exchange offering GBP deposits or withdrawals.

- Proof of reserves or independent audits showing assets are fully backed.

- Strong security features such as 2FA, address whitelisting, and cold storage.

- A proven track record without major hacks or withdrawal issues.

2. Fees and trading costs

- Maker taker trading fees and any additional account charges.

- Spreads, which can vary significantly between UK exchanges.

- Withdrawal and network fees for transferring crypto off the platform.

- Hidden costs such as poor GBP conversion rates.

3. Payment methods

- Support for UK options like bank transfer, Faster Payments, and debit card.

- Deposit and withdrawal speed, which can range from minutes to days.

- Fees on card payments or instant purchases, which are often higher.

4. Asset range and trading features

- Number of supported coins and trading pairs.

- Availability of advanced order types, staking, earning tools, or futures.

- Access to Web3, DEX integrations, or non custodial wallets if needed.

5. Ease of use and user experience

- A clean, intuitive interface for beginners.

- Reliable mobile and desktop apps.

- Smooth verification, fast funding, and clear navigation.

6. Customer support

- Live chat, email, or helpdesk ticketing with reasonable response times.

- Helpful FAQs, guides, and onboarding instructions.

- A good reputation for resolving account and withdrawal problems.

7. Control of your assets

- Custodial exchanges offer convenience but hold your private keys.

- Non custodial platforms and DEXs offer full control and on chain transparency but require more technical skill and diligent security.

- Consider whether you prioritise simplicity or full self custody.

By weighing these factors, readers can choose a UK crypto exchange that aligns with their trading experience, risk tolerance, and long-term goals.

What is a cryptocurrency exchange and how does it work?

A cryptocurrency exchange is a platform where you can buy, sell, and trade digital assets like Bitcoin and Ethereum using fiat currency such as pounds sterling or other coins.

It matches buyers and sellers, shows live prices, and handles order execution, balances, and basic security on your behalf.

Most UK crypto exchanges use an order book, where users place buy and sell orders at different prices. Some offer instant “buy now” options at a quoted rate, which is simpler but often more expensive.

Good exchanges provide clear pricing, basic charts, and account protections such as two factor authentication and withdrawal controls.

What types of cryptocurrency exchanges can you use?

Investors can use three main types of crypto exchanges: custodial platforms, non-custodial brokers, and decentralised exchanges that run on smart contracts.

Each works differently, with a trade off between ease of use, control over your funds, security model, and the level of responsibility placed on the user.

- Custodial exchanges hold your assets for you and feel most like a traditional broker.

- Non-custodial services let you trade directly from your own wallet, often via a simple interface.

- Decentralised exchanges (DEXs) connect buyers and sellers through on-chain liquidity pools, removing a central operator but requiring more technical knowledge and careful wallet security.

What is a custodial crypto exchange?

A custodial crypto exchange is a platform that holds users’ funds and private keys on their behalf, similar to how a bank safeguards money.

You deposit crypto or fiat into an account, and the exchange manages storage, security, and transactions.

This makes crypto trading simpler but introduces counterparty risk if the platform is hacked or becomes insolvent.

What is a non-custodial crypto exchange?

A non custodial exchange is a crypto platform where you keep full control of your wallet and private keys while trading.

It never holds customer funds. Trades are executed directly from your crypto wallet through smart contracts, reducing counterparty risk but requiring strong personal security and no fund recovery if keys are lost.

What is a decentralised exchange (DEX)?

A decentralised exchange is a non custodial trading platform that uses smart contracts to let users trade crypto directly from their wallets.

A DEX has no central operator, no account creation, and does not hold customer funds. Prices and liquidity come from user supplied pools, and all transactions settle on chain for greater transparency and control.

How do you choose the right type of crypto exchange?

Choosing the right exchange depends on how much control, convenience, and security you want. Custodial exchanges suit beginners who need simple funding. Non custodial and decentralised exchanges suit users who prioritise ownership, privacy, and on chain trading but require more technical confidence.

Choose a custodial exchange if you want

- Simple onboarding with email and ID verification.

- Fiat payments such as bank transfer, Faster Payments, and debit card.

- An easy trading app with charts, portfolios, and customer support.

- No need to manage private keys or seed phrases.

- Beginner friendly trading with quick execution.

Choose a non custodial exchange if you want

- Full ownership of your private keys and crypto at all times.

- Higher privacy with no central account storing your funds.

- Direct wallet based trading with smart contract execution.

- Reduced counterparty risk but more personal responsibility.

- Better access to Web3 tools.

Choose a decentralised exchange (DEX) if you want

- Crypto to crypto swaps settled entirely on chain.

- Access to liquidity pools, token swaps, and DeFi features.

- Trading without an account, email, or verification.

- Maximum transparency but no fiat deposits or customer recovery options.

- The most control over how trades are executed.

Key questions to help you decide

- Do you need to buy crypto with pounds through bank transfer or card?

- Are you confident managing a seed phrase and wallet security?

- Do you want access to early stage tokens and DeFi tools?

- Is customer support important, or do you prefer full self custody?

Most beginners start with a custodial exchange for buying crypto, then transition to non custodial wallets or DEXs as they gain confidence and want more control.

How to use a cryptocurrency & Bitcoin exchange

1. Create and verify your account

- Sign up with your email and secure password.

- Complete identity verification to enable deposits and higher limits.

- Add two factor authentication for security.

2. Deposit funds

- Use UK friendly methods like bank transfer, Faster Payments, or debit card.

- Check deposit fees and expected processing times.

- Some UK exchanges also allow crypto deposits from an external wallet.

3. Choose the cryptocurrency you want to buy

- Browse supported crypto assets and trading pairs.

- Compare fees, spreads, and minimum purchase amounts.

- Use simple buy buttons or advanced trading views if preferred.

4. Place your order

- Enter the amount you want to buy in GBP or crypto.

- Choose between a market order for instant purchase or a limit order if you want a specific price.

- Review fees before confirming.

5. Store your crypto securely

- Keep assets on the exchange for convenience or move them to a non custodial wallet for full control.

- Understand that crypto held on UK exchanges is not FSCS protected.

- Always back up your seed phrase if you use a non custodial wallet.

6. Withdraw or trade when needed

- Sell crypto back to GBP when you want to cash out.

- Withdraw funds to your bank using supported methods.

- You can also trade between different cryptocurrencies if the exchange offers multiple pairs.

Top 10 crypto exchanges UK

- eToro – Best for beginners and simple crypto investments

- Coinbase – Best for ease of use and fast GBP deposits

- Bitpanda – Best for widest crypto selection

- Crypto.com – Best all in one crypto app with rewards

- Kraken – Best for security focused active traders

- Uphold – Best for multi asset trading across crypto and fiat

- Binance International – Best for advanced traders who want deep liquidity

- Gemini – Best for strong security and regulated environment

- Revolut – Best for casual users buying small amounts of crypto

- OKX – Best for low fees and powerful trading tools

Crypto tax and regulation in the UK

UK investors should factor in regulation and tax obligations when choosing a crypto exchange. Understanding how crypto is treated by HMRC and overseen by the Financial Conduct Authority helps reduce compliance risk and avoid unexpected tax bills later.

How is cryptocurrency regulated in the UK?

Cryptocurrency is legal in the UK but is regulated mainly for anti money laundering and consumer protection, not as a traditional investment. Crypto exchanges must register with the FCA and meet strict AML requirements, but crypto holdings are not protected by the Financial Services Compensation Scheme, meaning losses from hacks or platform failure are not covered.

Do you pay tax on crypto in the UK?

Yes. Most crypto activity is taxable, and HMRC treats cryptocurrency as a capital asset, not as money. This means capital gains tax usually applies when you sell, swap, or spend crypto, while some activities trigger income tax instead.

When does capital gains tax apply to crypto?

You may owe capital gains tax (CGT) when you:

- Sell crypto for GBP

- Swap one cryptocurrency for another

- Use crypto to buy goods or services

- Gift crypto to someone other than your spouse or civil partner

For the 2024 to 2025 tax year, the CGT allowance is £3,000. Gains above this are taxed at 10 percent for basic rate taxpayers and 20 percent for higher and additional rate taxpayers, based on total taxable income.

When does income tax apply to crypto?

Income tax usually applies when you receive crypto rather than dispose of it. This includes:

- Mining rewards

- Staking or yield rewards

- Crypto received as payment for work or services

The taxable amount is the GBP market value at the time of receipt, and it is taxed at your marginal income tax rate. In some cases, National Insurance contributions may also apply.

Record keeping and HMRC compliance

HMRC expects investors to keep detailed transaction records, including dates, amounts, GBP values, wallet addresses, and exchange statements. Penalties can apply for underreporting or failing to declare gains, and HMRC has increased its use of data sharing with UK and overseas crypto platforms to identify undeclared activity.

How we test cryptocurrency exchanges in the UK

UK crypto exchanges are assessed using a structured review process that scores each platform on security, fees, asset range, ease of use, payment methods, and customer support. Each category is rated from 1 to 5 using real account data, hands-on testing, and verification of key features.

We check FCA registration for UK-compliant services, review proof of reserves, compare crypto trading fees, test funding and withdrawals, and evaluate app performance across mobile and desktop.

This ensures every recommendation is accurate, independent, and suitable for UK crypto users.

For a full breakdown, see our detailed guide on How We Test.

Conclusion – which cryptocurrency exchange should I choose?

There is no single “best” crypto exchange for every UK investor, only the one that fits your budget, risk tolerance, and experience level.

For most beginners, eToro, Coinbase, and Bitpanda stand out due to FCA oversight on key services, clear fee structures, and simple GBP deposits.

Active or security focused traders may prefer platforms like Kraken or Crypto.com for deeper tools and lower maker taker fees.

Whatever you choose, start small, focus on security, and remember that crypto is high risk and not Financial Services Compensation Scheme (FSCS) protected.

FAQs

Which is the best crypto exchange in the UK?

The best overall crypto exchange in the UK is eToro, due to FCA oversight on key services, simple GBP deposits, strong security, and a beginner friendly interface. Coinbase and Bitpanda are also top choices for ease of use and asset range.

What is the best crypto exchange UK for low fees?

Kraken Pro and Crypto.com Exchange offer the lowest fees, with competitive maker taker pricing and tighter spreads than beginner-focused platforms.

What is the best crypto exchange to withdraw fiat UK?

Coinbase and Kraken are the best for withdrawing GBP, offering fast, low cost bank transfers through Faster Payments with clear withdrawal processes.

What is the best crypto trading platform for beginners?

eToro is the best for beginners due to its clean layout, simple buying process, social trading tools, and FCA-linked protections for fiat services.

What is the best cryptocurrency exchange for UK customers when it comes to cashing out your cryptocurrency to GBP?

Kraken is the strongest choice for cashing out to GBP, offering reliable withdrawals, low fees, and deep liquidity. Coinbase is a close alternative with fast bank payouts.

What is the safest crypto exchange UK?

Kraken is widely considered the safest, offering industry leading security, Proof-of-Reserves, ISO certification, and FCA registration. Coinbase is also highly trusted for UK users, with strong custody standards and a long regulatory track record.

What is the best crypto exchange for futures trading UK?

There is no FCA-regulated crypto exchange offering futures trading to UK retail investors, as the FCA bans crypto derivatives for retail users. Advanced traders who qualify as professional clients or use offshore platforms often choose Binance or OKX for deep liquidity and advanced futures tools, but these are not available to most UK retail users and carry higher regulatory and risk considerations.