Buying cryptocurrency in the UK starts with choosing a secure, FCA-registered platform, setting up an account, and funding it with pounds (GBP) using a bank transfer or debit card.

This guide explains each step in simple terms and helps UK beginners understand fees, safety, and the basics of building a responsible crypto portfolio.

What are the steps to buy cryptocurrency in the UK?

Buying crypto in the UK involves five simple steps: choose a FCA-registered exchange, open and verify your account, deposit GBP with a bank transfer or debit card, place your first buy order, and store your assets securely.

Below are the quick steps:

- Choose a compliant UK platform: Pick an FCA-registered exchange with clear fees and strong security

- Create and verify your account: Sign up and complete KYC identity checks

- Add funds in pounds: Deposit GBP via bank transfer, Faster Payments, or debit card

- Place your crypto order: Select the coin, choose order type, enter amount, and confirm

- Store your crypto securely: Use a secure wallet for long-term holdings

What must beginners know about crypto before investing in the UK?

You should know that crypto is high risk, volatile, and not FSCS protected, so only invest what you can afford to lose. Understand fees, security practices, UK regulations, and the importance of choosing an FCA-registered exchange before buying your first coin.

Volatility and risk

Crypto prices can swing sharply. Avoid short term decisions and never invest money needed for essential expenses.

No FSCS protection

Crypto holdings are not covered by the Financial Services Compensation Scheme (FSCS). If a provider fails, funds cannot be recovered.

Use FCA-registered platforms

Choose exchanges that are FCA-registered for cryptoasset activities, which indicates stronger compliance and safer operating standards.

Understand all fees

Review trading fees, spreads, deposit costs, and withdrawal charges. High fees reduce overall returns.

Secure your assets

Use strong passwords, two factor authentication, and consider moving long term holdings to a private wallet for added security.

Know the tax rules

HMRC treats crypto as capital gains, so profits may be taxable. Keep accurate records of all transactions.

Step-by-step guide to buying crypto in the UK

Buying crypto in the UK involves choosing a FCA-registered exchange, completing identity checks, funding your account with GBP, placing your first order, and securing your assets in a safe wallet.

The detailed steps below explain the full process clearly for beginners.

Step 1: Choose an FCA-registered crypto platform

Start by selecting a platform that is FCA-registered for cryptoasset activities, which signals stronger compliance with UK rules.

Review the exchange’s fees, available assets, payment methods, security features, and customer support.

Look for platforms offering:

- Clear deposit and withdrawal fees.

- UK payment options such as Faster Payments and bank transfer.

- High security standards including cold storage and two factor authentication.

- A simple, mobile-friendly crypto app for beginners. A good platform choice sets the foundation for safe and cost-effective investing.

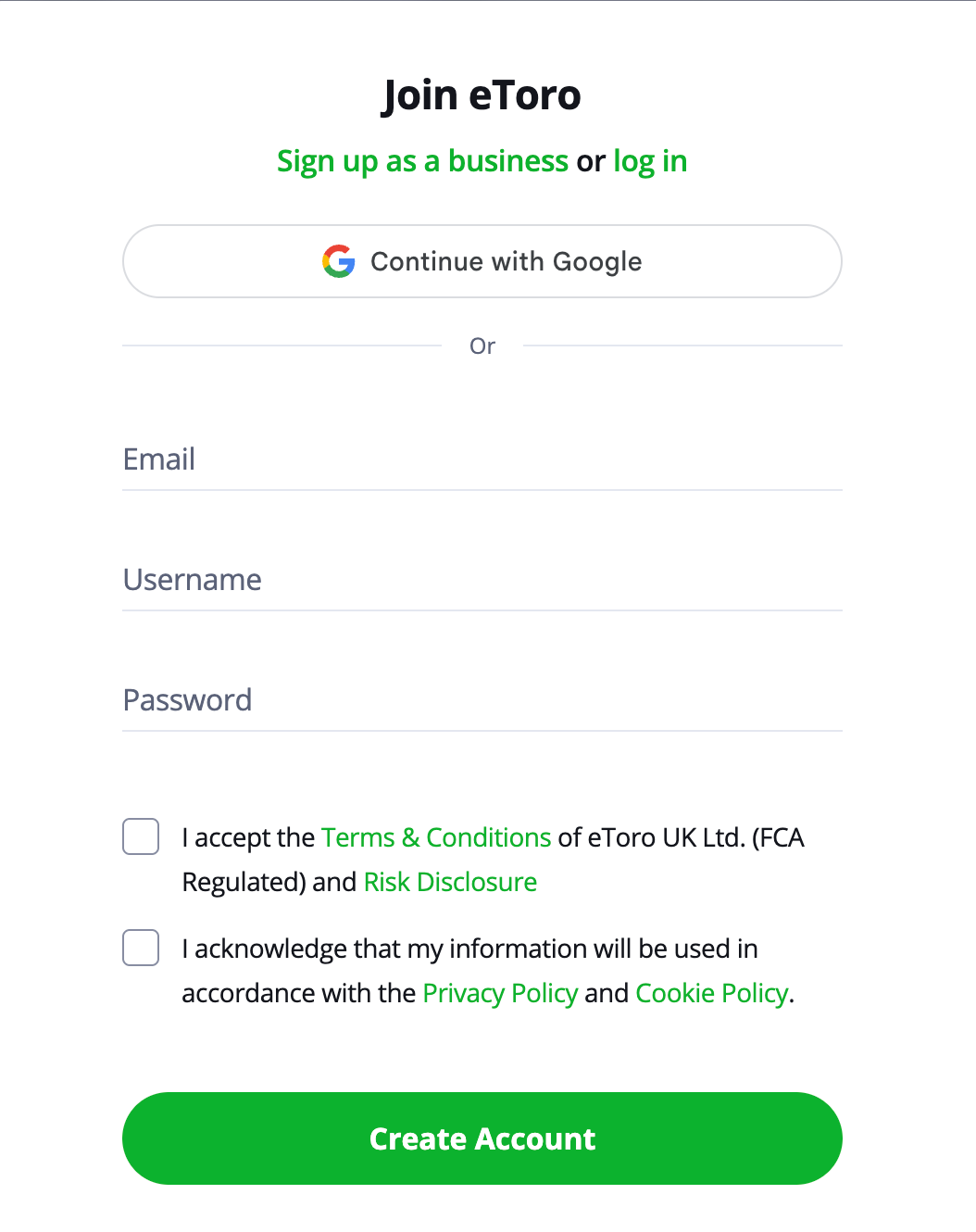

Step 2: Create your account

Register using your email address, password, and personal details. Choose a strong, unique password and store it safely. Enable two factor authentication immediately for added protection.

This reduces the risk of account breaches and protects your funds from unauthorised access. Most platforms offer quick sign up flows that take just a few minutes.

Step 3: Complete identity verification

All UK exchanges must verify users under KYC and AML rules. Upload your passport or driving licence and a proof of address such as a bank statement or utility bill.

Verification helps protect users by preventing fraud and ensures compliance with UK regulations. Processing times vary, but most platforms approve accounts within minutes. Keep your documents ready to avoid delays.

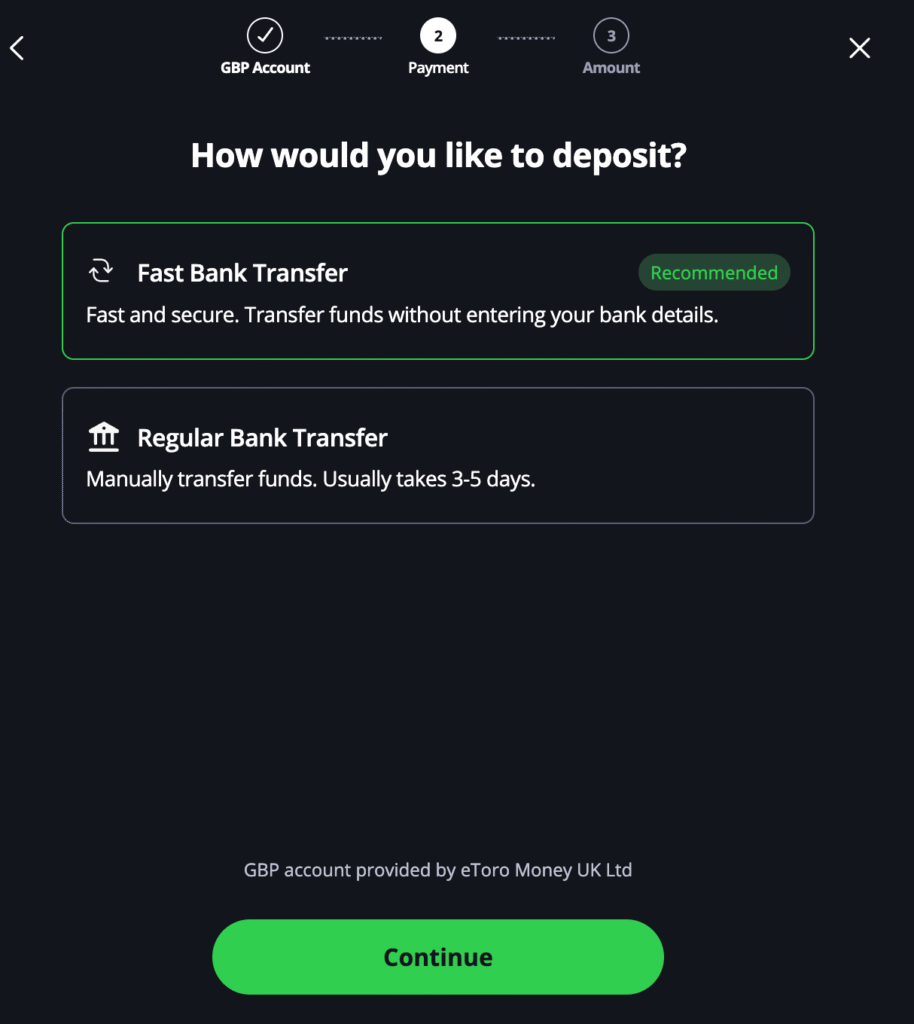

Step 4: Deposit pounds

Add GBP to your account before placing an order. Most UK platforms accept the following payment types:

- Bank transfer / Faster Payments: Usually free and processed quickly.

- Debit card: Instant deposits but often higher fees.

- E-wallets: Sometimes available but less common. Be aware of deposit limits and minimum amounts. Using bank transfers is generally the most cost-effective option for beginners and frequent traders.

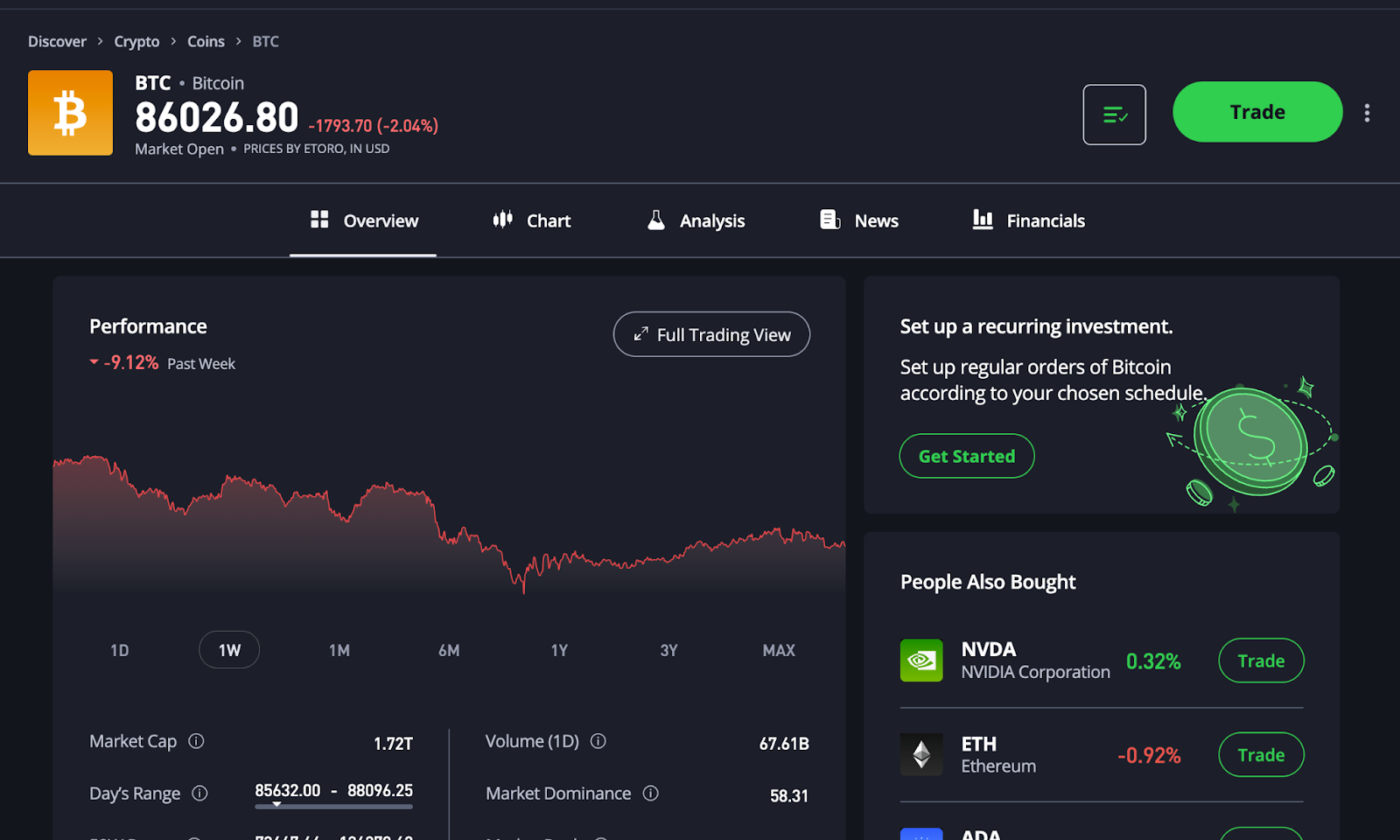

Step 5: Choose the cryptocurrency you want to buy

Browse the asset list on your platform and choose a coin that matches your goals. Bitcoin and Ethereum are the most widely supported and offer high liquidity.

Always check:

- The coin’s market volatility.

- Liquidity and daily trading volume.

- Platform specific trading fees and spreads.

- Whether the asset is suitable for long term holding or short term trading.

Take time to understand what you are buying before placing your order.

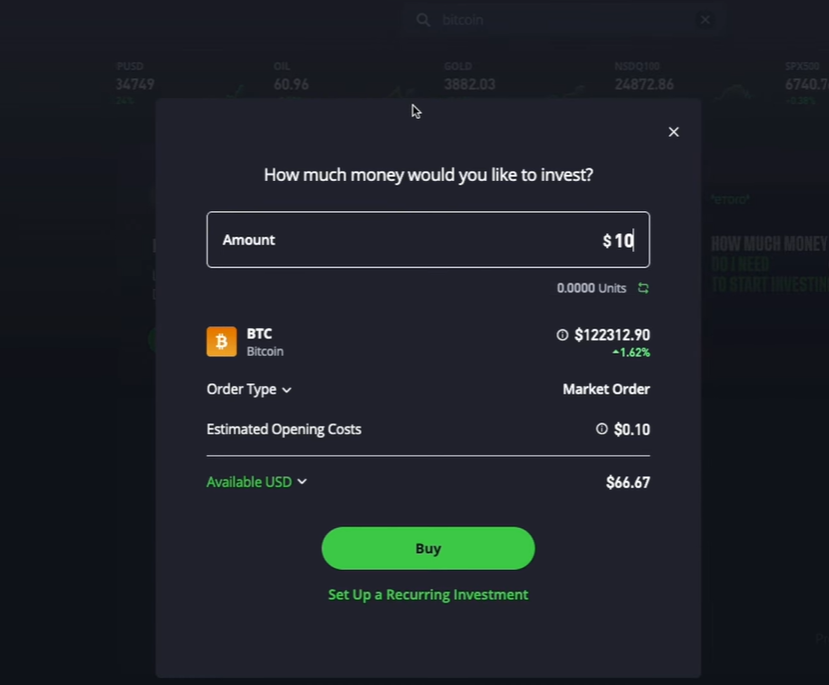

Step 6: Place your order

Tap Buy, select the cryptocurrency, and choose your order type:

- Market order: Buys immediately at the current price. Best for simplicity.

- Limit order: Lets you set a specific buy price. Useful for active traders.

Enter the amount in GBP or crypto and review the fees before confirming. Once placed, your order executes according to the market conditions. Always double-check the amount and asset before submitting.

Step 7: Review your transaction

After the order completes, review the details in your transaction history. Check the execution price, trading fee, total cost, and final amount received.

Saving this information helps you track performance and simplifies HMRC tax reporting later. Most platforms let you export statements or download full reports.

Step 8: Store your crypto securely

Decide how you want to store your assets:

- Exchange wallet: Best for beginners and short term trades. Offers convenience but leaves control with the platform.

- Private wallet: A hardware or software wallet where you control your own keys. Best for long term security and larger holdings. Enable all security options such as 2FA, withdrawal whitelists, and anti phishing codes. Remember that crypto is not FSCS protected, so personal security is essential.

Step 9: Track performance and stay informed

Monitor the value of your holdings, market movements, and updates from trusted UK financial sources. Crypto markets are highly volatile, so avoid reacting emotionally to price changes.

Set clear goals, review your portfolio periodically, and continue learning about the technology and risks.

Step 10: Understand your tax obligations

In the UK, HMRC treats most crypto activity as capital gains. You may owe tax when you sell, swap, or spend crypto.

Keep detailed records of:

- Dates of purchases and sales.

- Amount of crypto bought or sold.

- GBP values at the time of each transaction.

- Fees paid to the exchange. Accurate records help you avoid errors and simplify your annual tax return. Using crypto tax software or platform exports can make record-keeping easier.

Is it legal to buy crypto in the UK?

Yes, it is legal to buy cryptocurrency in the UK as long as you use a compliant provider and complete standard identity checks.

Crypto is now formally recognised as a type of personal property in UK law, and exchanges and custodians are being brought into the Financial Services and Markets Act (FSMA) framework under FCA supervision.

What is the legal status of cryptocurrency in the UK?

Crypto is treated as a lawful but high risk investment, not as legal tender. The Property (Digital Assets etc) Act 2025 introduced a new statutory category of personal property specifically for digital assets such as cryptocurrencies and NFTs. This provides clearer ownership rights and improves legal protection for UK users.

What does the new Property Act change?

Before the Act, UK courts recognised crypto as property on a case by case basis. The new law confirms this in statute and clarifies that digital assets can be owned, transferred, and recovered in insolvency, fraud, and theft cases. It gives consumers stronger legal certainty around ownership and recovery of assets.

How are UK crypto platforms regulated?

Crypto exchanges and custodians must be FCA registered for cryptoasset activities and comply with anti money laundering and counter terrorist financing rules. Under FSMA 2023, the government is expanding regulation to cover trading, custody, issuance, and stablecoin payments, aiming to align crypto activities with traditional financial services standards.

What is allowed and what is restricted?

UK residents may legally buy, sell, and hold cryptocurrency using approved platforms. However, the FCA restricts riskier instruments such as crypto derivatives for retail users and enforces strict rules on promotions, credit card use, and misleading advertising. These measures are designed to reduce consumer harm in a high risk market.

What protections and risks should UK buyers know about?

Crypto is not FSCS protected, so losses cannot be recovered if a platform fails. HMRC treats most crypto gains as taxable, meaning users must track transactions carefully. Investors should use FCA supervised firms, enable strong security features, and only invest money they can afford to lose.

Do you have to pay taxes on crypto in the UK?

Yes, most UK crypto investors must pay Capital Gains Tax (CGT) on profits when they sell, swap, or spend cryptocurrency.

HMRC treats crypto as a taxable asset, so gains, staking rewards, airdrops, and mining income may all create taxable events that need to be reported.

How crypto is taxed

HMRC considers cryptocurrency a chargeable asset, similar to shares.

You may owe CGT when you:

- Sell crypto for GBP

- Swap one coin for another

- Spend crypto on goods or services

- Gift crypto (except to a spouse)

Income based tax

Some crypto earnings are taxed as income, including:

- Staking rewards

- Airdrops received in exchange for services

- Mining rewards: These are added to your annual income and taxed at your standard rate.

Annual allowance

You can use your annual CGT allowance to reduce taxable gains. Gains above this threshold must be reported through a Self Assessment tax return.

Record keeping

Investors must keep detailed records of dates, amounts, GBP values, and fees for every transaction. Accurate reporting helps avoid penalties and makes it easier to calculate your tax owed each year.

What is not taxed

Buying and holding crypto is not taxable until you dispose of it. Transfers between your own wallets are also not taxable events.

How to choose between crypto exchanges and wallets

Exchanges make buying and selling easy, while crypto wallets offer stronger long term security.

Beginners usually start with a crypto exchange and later move holdings to a private wallet once they understand how keys and backups work.

Exchanges

Best for quick trades, deposits, withdrawals, and portfolio management.

Private wallets

Best for holding assets securely, as you control your keys. Suitable for larger balances.

Which platforms should UK investors use to buy and trade crypto?

The best crypto exchanges for UK investors are those that are FCA-registered, support GBP deposits, offer clear fees, and provide strong security.

Popular options include eToro, Bitpanda, Kraken, Coinbase, and Crypto.com, each suited to different experience levels and trading needs.

eToro

Best for beginners who want a simple app with social investing tools. Supports GBP deposits, offers staking, and provides a wide range of major cryptocurrencies. Read the complete eToro review here.

Bitpanda

Best for everyday investors who want a secure, easy to use platform with a broad asset range, including crypto, metals, and stocks. Strong European compliance and transparent fees. Read the complete Bitpanda review here.

Kraken

Best for serious traders and those who value security. Offers advanced order types, low fees, deep liquidity, and strong security reputation. Suitable for both beginners and experienced users. Read the complete Kraken review here.

Coinbase

Best for ease of use and education. A simple interface, strong security, and excellent resources for newcomers. Ideal for first time buyers, though fees may be higher than some rivals. Read the complete Coinbase review here.

Crypto.com

Best for active mobile investors. Offers a large range of supported assets, staking rewards, crypto cards, and competitive trading fees through its app-first platform. Read the complete Crypto.com review here.

What types of cryptocurrency can UK beginners invest in?

UK beginners typically start with investing in Ethereum and Bitcoin, as these have strong liquidity, wide exchange support, and clear long-term use cases. Other cryptocurrencies are available, but they come with higher volatility, less regulatory clarity, and greater risk.

Common crypto categories

- Blue chip coins: Bitcoin and Ethereum. Suitable for beginners due to stability and liquidity.

- Stablecoins: GBP or USD backed tokens, though access may vary depending on FCA rules.

- Altcoins: Smaller projects offering higher risk and lower liquidity.

- Tokenised assets: Available on select platforms and useful for diversified investing.

These categories help beginners understand what each asset represents before choosing where to invest.

What’s the safest way to start investing in crypto?

The safest way for UK beginners to start investing is to use a FCA-registered exchange, enable strong security features, invest small amounts, and avoid leveraged or derivative products.

Taking time to learn the basics reduces common beginner mistakes.

Safety checklist

- Use 2FA on all accounts

- Set strong, unique passwords

- Avoid unsolicited crypto promotions

- Move long term holdings to a secure wallet

- Use UK compliant platforms only

What are the risks of investing in cryptocurrency?

Crypto carries high volatility, no Financial Services Compensation Scheme (FSCS) protection, and increased fraud risk, so beginners must approach the market cautiously. Only invest money you can afford to lose and avoid complex products until you have experience.

Key risks to understand

- Market swings: Prices can rise or fall sharply in minutes.

- Platform risk: If a platform fails or is hacked, losses are not protected.

- Scams and phishing: Fake apps, websites, and social media promotions are common.

- Unregulated assets: Some coins have little oversight, making due diligence essential.

FAQs

How to buy cryptocurrency in the UK with a debit card?

You can buy crypto with a debit card by signing up with a FCA-registered exchange, completing verification, selecting “Debit Card” at checkout, and confirming your purchase. Debit card deposits are instant but usually come with higher fees than bank transfers.

How to buy cryptocurrency in the UK for beginners?

Beginners should use a FCA-registered platform, verify their account, deposit GBP via bank transfer or debit card, and buy a well known coin such as Bitcoin or Ethereum. Start with small amounts, review fees, and store your crypto in a secure wallet.

How much should you invest in cryptocurrency as a beginner?

Beginners should only invest an amount they can afford to lose, typically a small percentage of their overall portfolio. Crypto is high risk and volatile, so most first time investors start with modest sums to learn safely before increasing exposure.

What payment methods can I use to buy crypto in the UK?

UK investors can buy crypto using bank transfer, Faster Payments, debit card, and in some cases e-wallets. Bank transfers generally offer the lowest fees, while debit cards provide the fastest purchase experience.

How should a beginner invest in crypto?

Beginners should stick to FCA-registered exchanges, start with established coins, invest small amounts, and enable strong security such as 2FA. Avoid leverage, derivatives, and complex altcoins until you have more experience and a clear investment strategy.

Is buying crypto the same as Bitcoin?

Buying crypto is not the same as buying Bitcoin. Bitcoin is just one cryptocurrency, while “crypto” refers to thousands of different digital assets. If you specifically want BTC, you must choose it when placing your order. See our guide on how to buy Bitcoin for a simple step-by-step walkthrough.